👩🌾 Exploring Boba Network’s USDC pool on cBridge!

Also, read about the US officials' discovery of Axie Infinity's $625M heist!

🦀 DeFi TVL remains steady — On April. 19th, 2022, the total value locked (TVL) in Ethereum DeFi projects was $76.8B according to DeFi Pulse, almost 0.9% higher than the value we saw a week ago.

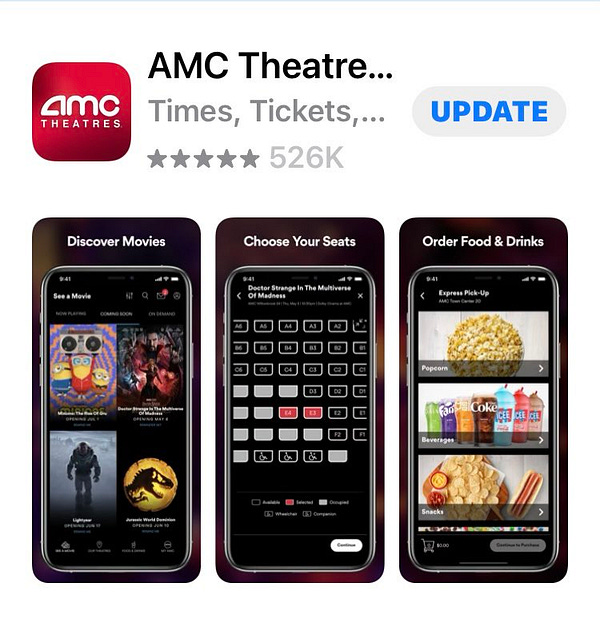

😳 Driving crypto news this week — AMC Theatres mobile app accepts Dogecoin, Shiba Inu and more; US officials tie North Korean Hacker Group to Axie's Ronin exploit

AMC Theatres CEO Adam Aron disclosed that the iOS and Android mobile apps now accept cryptocurrency payments thanks to a partnership with BitPay, a Bitcoin payment processor. AMC Theatres, a pro-crypto movie theatre operator in the United States, has updated its mobile app to accept Dogecoin (DOGE), Shibu Inu (SHIB), and other cryptocurrencies as payment.

According to US officials, North Korean state-backed hacker organization Lazarus has been linked to the recent loss of $625 million in cryptocurrencies from the Ronin Network. Elliptic and Chainalysis, both blockchain analysis organizations, have established that the US Treasury's wallet address is the same as the one used in the Ronin hack, from which the attackers stole 173,600 ether, or nearly $597 million, and $25.5 million in the stablecoin USDC.

💸 This week’s best-performing Ethereum DeFi tokens —

📈 Compound (COMP) +19.1%

📈 Synthetix Network Token (SNX) +17.8%

📈 REN (REN) +11.8%

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $175.63, an increase of 2.41% since Tuesday, April 12th.

👀Things you should keep an eye on:

Maker’s brand-new partnership with Maple Finance.

Compound’s reward adjustment proposal.

Cross-Consensus Messaging (XCM) coming to Polkadot

TLDR: The Cross-Consensus Messaging format, or XCM for short, is approaching its first production-ready release as the final Polkadot 1.0 version, complete with parachains draws close;Balancer.tools v2 beta launched

TLDR: The v2 beta of balancer.tools is now available! It has many valuable features, such as a $veBAL increase calculator. $veBAL boost calculator: helpful in determining how much $veBAL to lock to get a specific boost or which boost to expect for a particular configuration;Coinbase NFT beta marketplace is live

TLDR: Some waitlist subscribers have received access to test the brand-new platform. Although a few users agree on how clean and “Instagram like” the UX is, we probably didn’t need another comments section to throw hate around. We already have Twitter.

Andre is back…and calls for crypto regulation

TLDR: After slamming crypto culture in a recent comeback, Andre Cronje, founder of Yearn Finance, Keep3r and Solidly, is recruiting people to work on “regulated crypto”.Uniswap launches Swap Widget

TLDR: The Swap Widget helps developers access Uniswap’s swap capability with just one line of code, bringing this vision closer to reality. Swap Widget allows users to swap tokens in real time from anywhere on the internet.

🚜 Exploring Boba Network’s USDC pool on cBridge

cBridge’s USDC pool on Boba is an opportunity to partake in Boba Networks incentive program whilst putting your USDC to work! cBridge is a decentralized and non-custodial asset bridge built on top of the Celer Network. The bridge supports a range of blockchains and various layer-two scaling solutions. The bridge also has an extensive collection of pools for liquidity providers to participate in. To partake in this conservative farmer, users will have to bridge to Boba Network and swap their tokens for USDC on OolongSwap or another native Boba DEX.

Once a user has USDC on Boba, they may choose to stake them on cBridge by clicking on the “Liquidity” section of the cBridge website before navigating to the USDC token. Upon expansion, users will be able to see all the USDC pools and their respective networks. One must then head over to the Boba USDC pool where they will be able to add liquidity.

✅Advantages of the strategy:

The pool has a decent amount of Total Value Locked (TVL), so one can assume the yield will not drastically decrease from new pool entrants diluting farmers;

cBridge 2.0 has undergone multiple audits;

The pool being composed of a stablecoin prevents one from having correlated exposure to the overall market, so if the market has a bad week the pool will be unaffected. Additionally, USDC is one of the most trusted stablecoins.

❗ Risks to keep an eye on:

If USDC were to lose peg a user may lose a significant portion of their funds;

Since the farm is composed of a stablecoin, the yield is lower than what you could find in a riskier opportunity.

The pool’s rewards are in WAGMIV2 tokens due to an on-going incentive program from Boba Network; this program will end on April 30th, 2022. Users will have to redeem their WAGMIV2 tokens for BOBA on May 1st, 2022 (see here).

The pool’s rewards are in WAGMIV2 tokens which must be redeemed for BOBA tokens. This means a user’s rewards are subject to market volatility.

Interested in trying this opportunity? You could:

Setup Boba on your Metamask;

Bridge assets to Boba Network

Provide liquidity to the USDC pool on cBridge;

cBridge has been audited, but there are no ultimate guarantees in DeFi. So, always do your own research, and never invest more money into any project than you can afford to lose.

DEX Screener is a relatively new website that provides advanced charting, market-capitalization rankings, and other advanced trading features for several blockchains. A wealth of information is available when you sort different coins by volume, price change, liquidity, and market cap.

Here are some things to think about as we look forward to the DeFi Summer of 2022:

DeFi advocates have every reason to believe that in 2022, a 'DeFi summer' - a period of unprecedented market expansion – will occur as DeFi innovators finally succeed in drawing mainstream customers into the DeFi ecosystem. Here's how you can beat the heat of DeFi Summer 2022:

Due Diligence: The DeFi market provides nearly limitless chances for creative discovery and profit – yet, like any financial industry, it is not without risk. Therefore, investors should prioritize due diligence and avoid making judgments only based on article headlines or social media buzz. Reviewing a solution's whitepaper to learn more about its value-add and technical viability may be a beneficial first step.

Be prepared for regulatory changes: The SEC's allegations against Ripple to become regulated, the US Congress's stablecoin regulations, and the UK's plans to regulate some cryptocurrencies portray that law is on its way for the DeFi world. Those who intend to use it need to monitor legislative developments and alter their investment strategy accordingly.

Lower your transaction expenses in advance with layer two solutions: Investing in DeFi solutions necessitates funds/capital, but investors don't have to give up the farm to make trades. Innovative layer two platforms have been increasingly important in recent years in assisting investors in completing transactions swiftly and at a reasonable cost. -Guneet Kaur

All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information (which does not account for specific goals or financial situations) and links provided to third-party sites are for informational purposes. Such sites are not under the control of DeFi Pulse, so DeFi Pulse or the author are not responsible for the accuracy of the content on such third-party sites. Be careful and keep up the honest work!