👨🌾️ Farm +1,000% APR via LooksRare & earn big on stables in the Fei DAO Fuse pool!

Also, read about the botched WTF token drop + DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond!

If you want to access the full DeFi Pulse Farmer experience to receive emerging yield farming opportunities sent to you throughout the week, subscribe today!

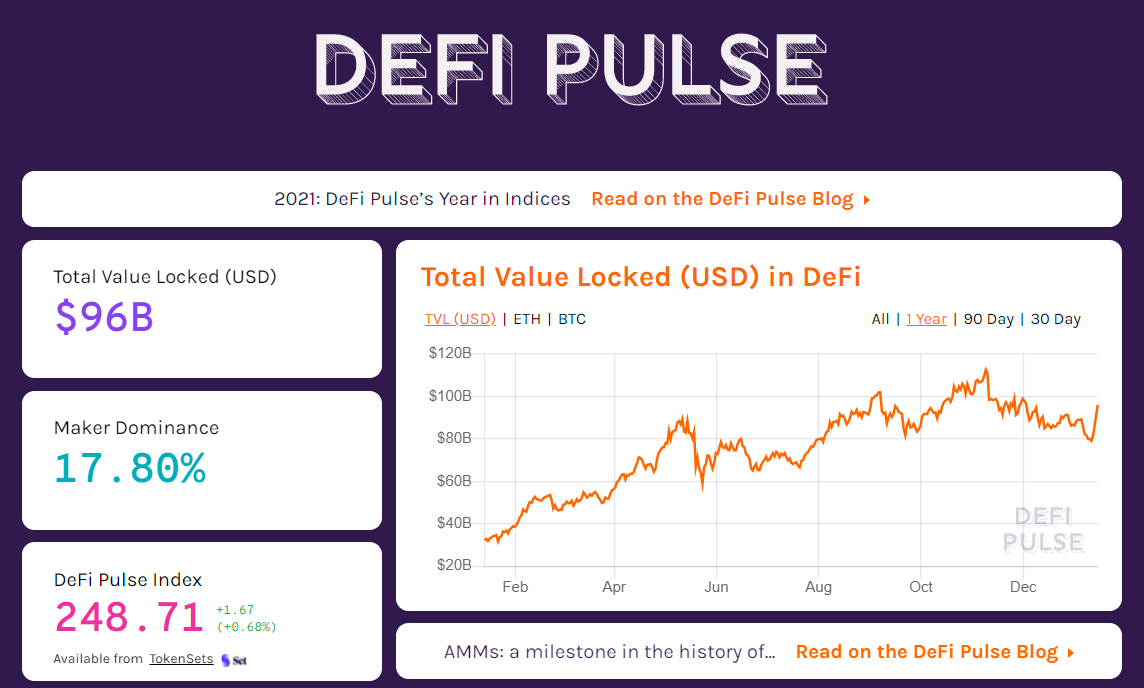

📈 DeFi TVL steadily climbs — The total value locked (TVL) in Ethereum DeFi gained $2B over the last week, having risen from ~$94B to $96B in that span. It ain’t much growth, but it is growth. And the ecosystem has notably been holding ground near $100B for months now!

❓ Driving DeFi news this week — WTF token drop debacle

Along with LOOKS (which we’ll cover in the Farm of the Week below) the other big token drop this week was the WTF release by crypto data site fees.wtf.

Yet, that release literally led to a big “what the…” moment. That’s because the fees.wtf team promptly launched an Uniswap pool around the token, albeit with a very small amount of liquidity. Like, wayyyy too small.

As bots immediately went to war around the illiquid pool, things got ugly fast. For example, during the initial trading frenzy one account purchased 0.00004 WTF for 42 ETH. RIP.

Trading around WTF’s now much more liquid. So this episode serves as a stark reminder that it’s best to wait a little bit after token drops before trying to make any major trades through liquidity pools!

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 AELIN (+182.4%)

📈 SCRT (+32%)

📈 NEAR (+31.3%)

📈 CVX (+19.4%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $250.43, down 3.01% on the week.

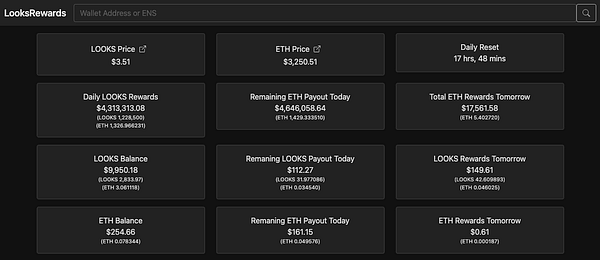

🌾 Farm +1k% APR via $LOOKS staking!

NFT marketplace LooksRare launched this week to much ado. Yet the platform did so without an audit and without a public GitHub repository, which are red flags safety-wise. Accordingly, approach cautiously and use the platform at your own risk until further notice!

That said, LooksRare has been at the center of major trading activity after only a handful of days, and its DeFi-inspired LOOKS yield farms are offering monster yields right now.

Decentralized OpenSea competitors are going to be a growing theme in 2022, as well, so let’s get you up to speed on this project so you can decide for yourself whether this seasonable opp is right for you at this time.

LooksRare 101

A growing number of NFT users are dissatisfied with OpenSea’s semi-centralized structure and mainstream IPO plans. They want something decentralized and that they can manage together as a community of users.

Here, cue in LooksRare.

LooksRare is a decentralized and permissionless NFT marketplace. Besides offering collection-wide NFT offers, the platform is mainly distinct from OpenSea in offering a native token, i.e. LOOKS, plus NFT trading rewards and classic DeFi yield farming opportunities.

Indeed, LooksRare does offer a LOOKS-ETH Uniswap LP token staking farm (yielding +600% APR currently), but the opp I want to hone in on today is LOOKS staking, i.e. single-sided deposits of LOOKS to LooksRare. This is because the platform is allocating its revenues to LOOKS stakers!

How to stake LOOKS

The LOOKS airdrop was based on how much NFT trading activity you’ve had in recent months. Note: a 10-day claim period started on Jan. 10th, but Trezor users are having problems claiming so this window will likely be extended.

As such if you haven’t been an active NFTer lately, you might not have any LOOKS to claim. Don’t let that stop you if you’re determined to stake, though; you can simply acquire your initial sum on a DEX like Uniswap.

Anyways, below I’ll walk you through how to stake LOOKS as if you were starting with the airdrop claims process. You would follow these steps:

Go to looksrare.org, go through the welcome prompts, and then connect your wallet. You’ll have to sign a transaction.

Back on the main page will be a “Check Now” button. You can press this to check your claim amount. However, you can only withdraw the sum if you first list an NFT for sale on LooksRare. Note, both listing and claiming will cost gas.

After you’ve listed at least one NFT for sale on the platform, click on the Rewards page and scroll down to the staking interface.

Input how much LOOKS you want to stake and then press “Stake.” You’ll need to complete an approval transaction to let LooksRare use your LOOKS and then fire off the final staking transaction.

Over time you can claim your LOOKS + WETH revenue rewards or unstake through this same interface whenever you want!

Again, I stress that this NFT marketplace is unaudited and without a public repo. If you choose to at all, use it at your own risk and only with money you can afford to lose.

Hopefully an audit and repo opening will occur soon, but in the meantime we’re on our own safety-wise. Also keep in mind that the APR of LOOKS staking and the LOOKS price can be very volatile, plus gas costs may make this opp unprofitable for some users. Please farm responsibly!

Gnosis Protocol turns CoW Protocol

TLDR: The Gnosis Protocol team, which built CowSwap, is rebranding to CoW Protocol.Our path towards full decentralization

TLDR: DeFi derivatives platform dYdX charts a path forward toward total decentralization.Introducing the Goldfinch Protocol token

TLDR: Decentralized credit platform Goldfinch launches its native GFI token.Set Protocol is live on Optimism

TLDR: DeFi structured products project Set Protocol is now open for use on the Optimism L2.Introducing Plonky2

TLDR: The Polygon Zero team unveils Plonky2, a zero-knowledge scaling innovation that’s 100x quicker than its comparable predecessors.

🚜 Farm +40% APR on stables with the Fei DAO Fuse pool!

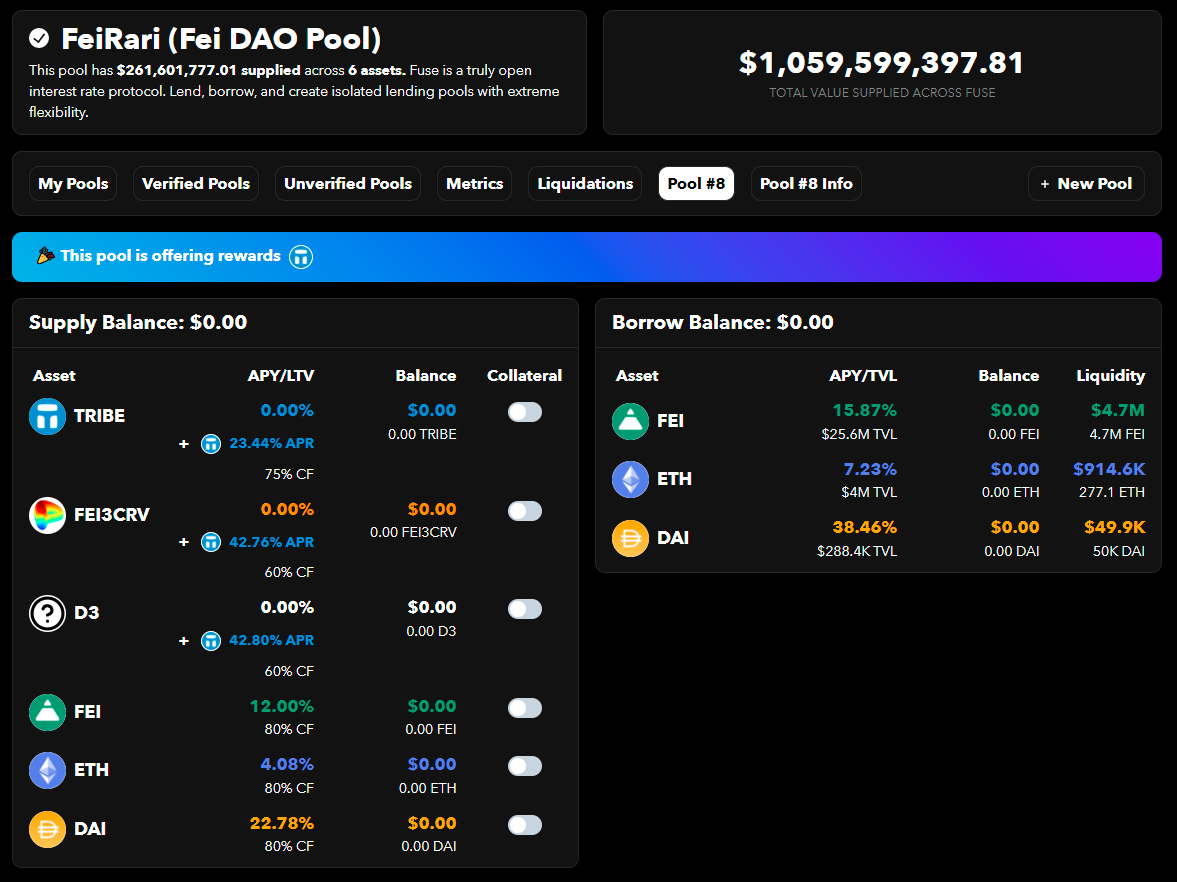

Originally built by Rari Capital prior to Rari’s recent merger with Fei Protocol, Fuse is an open interest rate protocol.

Fuse lets people borrow and lend any tokens they want in permissionless fashion, and this week we’ve been closely watching the protocol’s Fuse’s Fei DAO Pool, also known as Pool 8.

Specifically, right now we’re interested in the D3 collateral opp. As Alchemix founder Scoopy Trooples mentions in the tweet above, D3 is a Curve “Factory” liquidity pool composed of alUSD, FEI, and FRAX. At the moment, you can deposit LP tokens from this pool into Fuse to earn +40% APR in Fei TRIBE rewards.

If that sounds of any interest, you can pick up LP tokens from Curve and then deposit them into Pool 8. Just remember that these yields will fluctuate, so don’t expect +40% APR in perpetuity!

Fuse is essentially a fork of Compound Finance, and besides some edge cases it’s battle-proven so far. However, never throw caution to the wind in DeFi; only ever yield farm with money you can afford to lose!

Aave has votes in motion for launching Aave V3 on three L2s:

Aave is also voting on updating risk parameters for eight V2 assets.

Balancer votes to increase the flexibility of its liquidity mining program.

Rari Capital DAO votes to whitelist StakeWise as a Fuse pool creator.

Are you hopping through many EVM-compatible chains like never before, and want to start organizing your MetaMask wallet accordingly? Check out Chainlist, an expansive list of EVM networks that makes it easy to add new chains to your account.

Curve V2! 👀

Is the crypto bull market still on? 🤔

The DeFi ecosystem is bigger and more robust than it ever has been. Additionally, DeFi’s current TVL isn’t that far from its all-time high record. That’s pretty bullish to me! But if anything we’re in a crab market. Just keep calm, keep researching DeFi topics, and tend to your yield pastures. 2022’s off to a really solid start!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!