👩🌾️ Farm ~2,000% APY on CompliFi’s Polygon pastures and check out next-gen Hop yields!

Also, learn about the SEC’s investigation of Uniswap Labs, and check out the stories of the week + the governance watcher!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

📈 DeFi flirts with ~$100B TVL achievement! — At the start of the year, we predicted in this column that the total value locked in Ethereum’s decentralized finance ecosystem would hit $100B at some point in 2021. With DeFi’s TVL surging from $82B to +$98B since last weekend, our community is on the cusp of that major milestone and can break through it any day. Time to set our sights higher now, right. When $1T? 😎

🦄 SEC Uniswap investigation dominating DeFi headlines — Right now one of the most intriguing stories in DeFi is the SEC’s investigation of Uniswap Labs, a development that was first reported by The Wall Street Journal yesterday. In its report, The Journal noted SEC attorneys were currently “looking for more information on how investors use Uniswap and the manner in which it is marketed.”

Of course, SEC Chairman Gary Gensler has been pivoting his agency’s attention to DeFi matters in recent weeks, so the Commission’s interest in learning more about the team behind the space’s most popular DEX isn’t surprising. Additionally, these sorts of fact-finding missions are routine for the SEC and don’t inherently indicate or allege that any wrongdoing has taken place.

Whatever happens, it is the first time we’ve learned of the SEC turning its gaze to a contemporary DeFi powerhouse. This reality has caused some nervousness and more than a few people to rally to Uniswap’s side. For now, though, what happens next remains to be seen!

💸 This week’s best-performing assets — Since last weekend, we’ve seen strong runs from the following top DeFi tokens:

📈 RGT (+54.4%)

📈 INDEX (+49%)

📈 ETH2X-FLI (+38.5%)

📈 DDX (+36.9%)

📈 REN (+34.3%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is currently trading at $418.32, marking a 5.77% climb on the week. That’s what happens when DeFi adds +$15B to its TVL in just seven days!

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today..

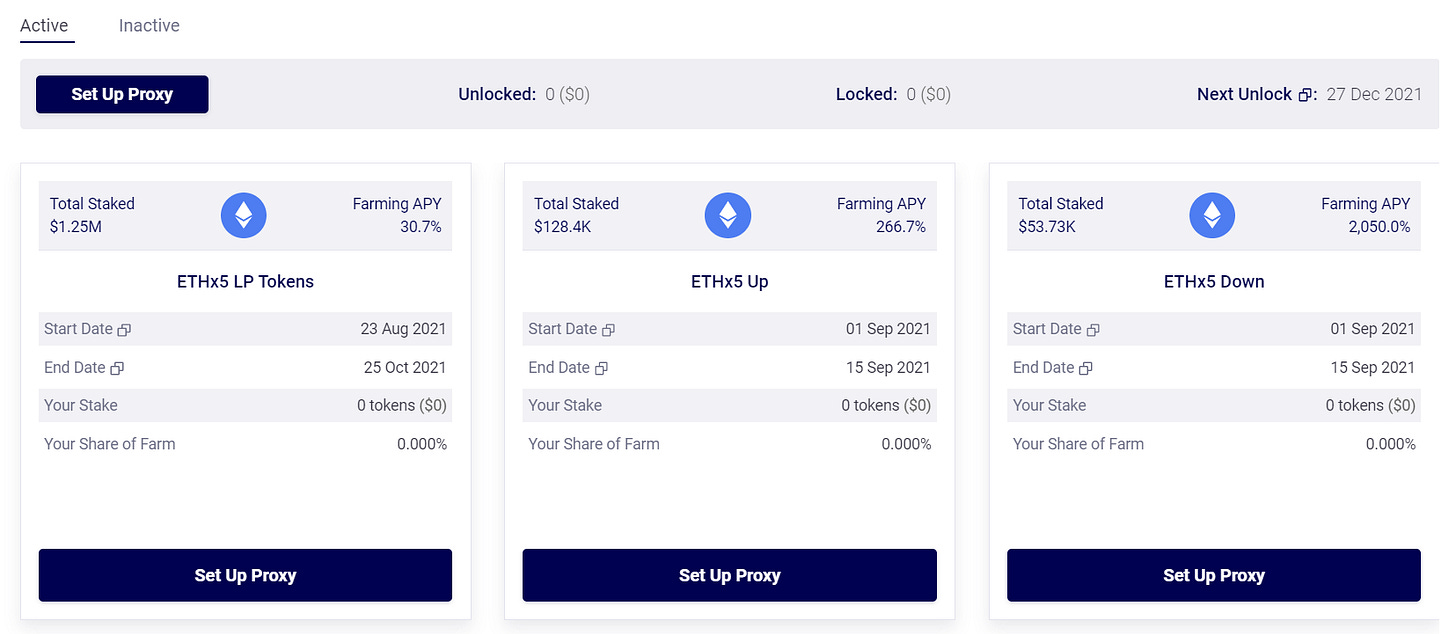

🌾 Yield farm +2,050% via CompliFi’s Polygon pastures!

CompliFi is a synthetic risk factory for DeFi.

That’s the technical way of explaining the protocol, but you can more simply understand the project as offering a Uniswap-like UX to traders and liquidity providers of decentralized derivatives tokens.

Toward this end, CompliFi relies on a bespoke automated market maker system to complement its synthetic derivatives issuance system.

The result is a dualistic protocol whose derivatives are fully collateralized and whose users don’t have to worry about defaults, margin calls, or liquidations because as we explained in our recent Alpha Tractor on CompliFi:

Your winnings are always covered ✅

Your buy-in price is the limit of your exposure ✅

And no margin calls = no possibility of liquidations ✅

Today, CompliFi is live on two chains — Ethereum plus the Polygon sidechain — and has two types of products currently available: x5 leverage tokens and covered call options.

🌀 The leverage tokens come as “long-short” token pairs and are presently offered around AAVE, COMP, LINK, MATIC, UNI, WBTC, and WETH.

➿ The covered call options let LPs earn money + trading fees when the calls succeed “in the money” or keep their collateral + earned trading fees if their calls conclude “out of the money.”

How to earn COMFI rewards & CompliFi fees

CompliFi recently launched the second wave of its “derivatives farming” program centered around distributing COMFI, the project’s governance token.

If you’re interested in participating in this program, you’ll first have to acquire LP tokens (corresponding to CompliFi’s leverage tokens or covered call options) and thereafter stake them. As I detailed in the aforementioned Alpha Tractor, the process works like this:

You’d need to have some USDC available on Polygon, where these yield farms are live. Bridge tokens over if necessary!

Now you’d go to the CompliFi front-end and click the Set Up Proxy button, and complete the creation transaction. This will let the protocol facilitate AMM and issuance activities atomically on your behalf.

Next step is to acquire some CompliFi derivatives. One option is to navigate to CompliFi’s Trade dashboard and buy Up and Down derivative tokens.

Your other acquisition avenue would be to head over to CompliFi’s Investment Pools hub and deposit USDC to mint derivatives, which are automatically supplied to the protocol’s bespoke AMM and thus converted to LP tokens.

Now you’d navigate to CompliFi’s Farm dashboard. Choose from the provided x5 derivatives farms (for purchasers) or the LP token farms (for minters).

To finish things up you’d complete an approval transaction to allow CompliFi to spend your funds and then a deposit transaction to start finally farming COMFI rewards!

Remember that CompliFi is still in a beta state, so make sure you understand the terms and conditions the project displays when you first arrive at its site! CompliFi has been audited, but all new DeFi protocols should be treated as experiments that you can lose money through. Only deposit funds into this project after doing your own research, and never do so with money you can’t afford to lose.

Do you want to dive more into Yield Farming opportunities? Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

Balancer Protocol Live on Arbitrum

TLDR: Balancer hails the launch of its first liquidity pools on Arbitrum’s layer-two (L2) scaling solution.Balancer Grants DAO Brings Indexed into Balancer’s Ecosystem

TLDR: The Balancer Grants DAO team approves an application from Indexed to migrate the protocol’s products into Balancer V2.MetaMask Surpasses 10 Million MAUs

TLDR: Popular non-custodial crypto wallet MetaMask announces it’s now servicing over 10 million monthly active users, or MAUs.Offchain Labs raises $120 million

TLDR: Offchain Labs, the team behind the newly-launched Arbitrum L2 solution, raises a Series B round and brings its company valuation to $1.2B.V2x Revisited

TLDR: Synthetix contextualizes a group of Synthetix Improvement Proposals (SIPs) that are being considered for inclusion in the protocol’s V2x system.Polygon Announces Polygon Grants Hackathon

TLDR: Ethereum scaling suite Polygon unveils an online hackathon program offering $100K in prizes for builders who try “early-stage ideas” atop Polygon.Welcome Trader

TLDR: Trader, an NFT exchange protocol built atop 0x, arrives and offers NFT trading with low gas costs and zero platform fees.

🚜 Farm 15% APR via Polygon USDC LP staking on Hop!

Ethereum’s scaling ecosystem is teeming lately with a growing range of reliable L2s and sidechains.

This is great for the long-term prospects of Ethereum, but the proliferation of these projects led to some early concerns that DeFi liquidity would become highly fragmented if solutions weren’t put in place to cross the divides among all these chains.

The good news? Hop, a protocol for trustlessly sending tokens among L1s and L2s, is one such solution that’s young but ascending rapidly. Notably, the project users send tokens across in cross-chain leaps, e.g. from Polygon to Optimism, in easy and quick fashion.

The “custom token” mentioned in the tweet above refers to a Hop token like hUSDC, which is for facilitating USDC liquidity across multiple chains at once. Right now LPs for Hop’s Polygon USDC pool (who deposited USDC and/or hUSDC) can earn 15% APR via WMATIC awards + trading fees for staking their LP tokens on Hop.

If you’re interested in trying out this farm of the future, make sure you’ve gotten the hang of using Polygon first and then if you get stuck on anything get the full scoop with Hop’s “Becoming a Liquidity Provider” FAQ 👩🌾️

Hop is a very promising project that should bring all of us yield farmers hope. At the same time new DeFi pastures always have unique risks, some of them perhaps unknown currently. Make sure that you err on the side of caution by never investing more money than you can afford to lose.

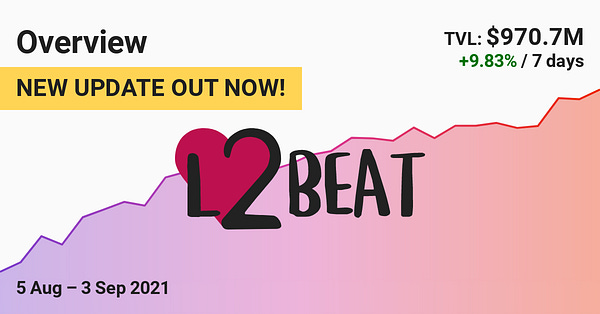

With the Arbitrum and Optimism mainnets now live Ethereum’s L2 scene is really starting to kick into high gear. That said, now’s a great time to consider checking out L2BEAT, an analytics dashboard that helps users easily track the market shares and risk levels of a range of L2s!

Can DeFi really go on to achieve a $1T TVL and beyond?

Absolutely ✅

We’re one-tenth of the way to that milestone already, and DeFi’s only just beginning! As such, it really isn’t far-fetched to forecast the ecosystem reaching its first trillion dollars’ worth of assets under management over the next few years.

Indeed, our impressive progress so far is making it seem increasingly inevitable that DeFi will continue to make deeper advances into the mainstream and thus into the everyday finances of billions of people.

That’s the ultimate DeFi mission, after all: to financially empower many with powerful “do it yourself” resources! ✊

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!