👨🌾️ Farm +260% APR with AELIN/ETH staking & earn 15% on stables with Orion Saver!

Also, read about the recent Wormhole hack + more DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond!

If you want to access the full DeFi Pulse Farmer experience to receive emerging yield farming opportunities sent to you throughout the week, subscribe today!

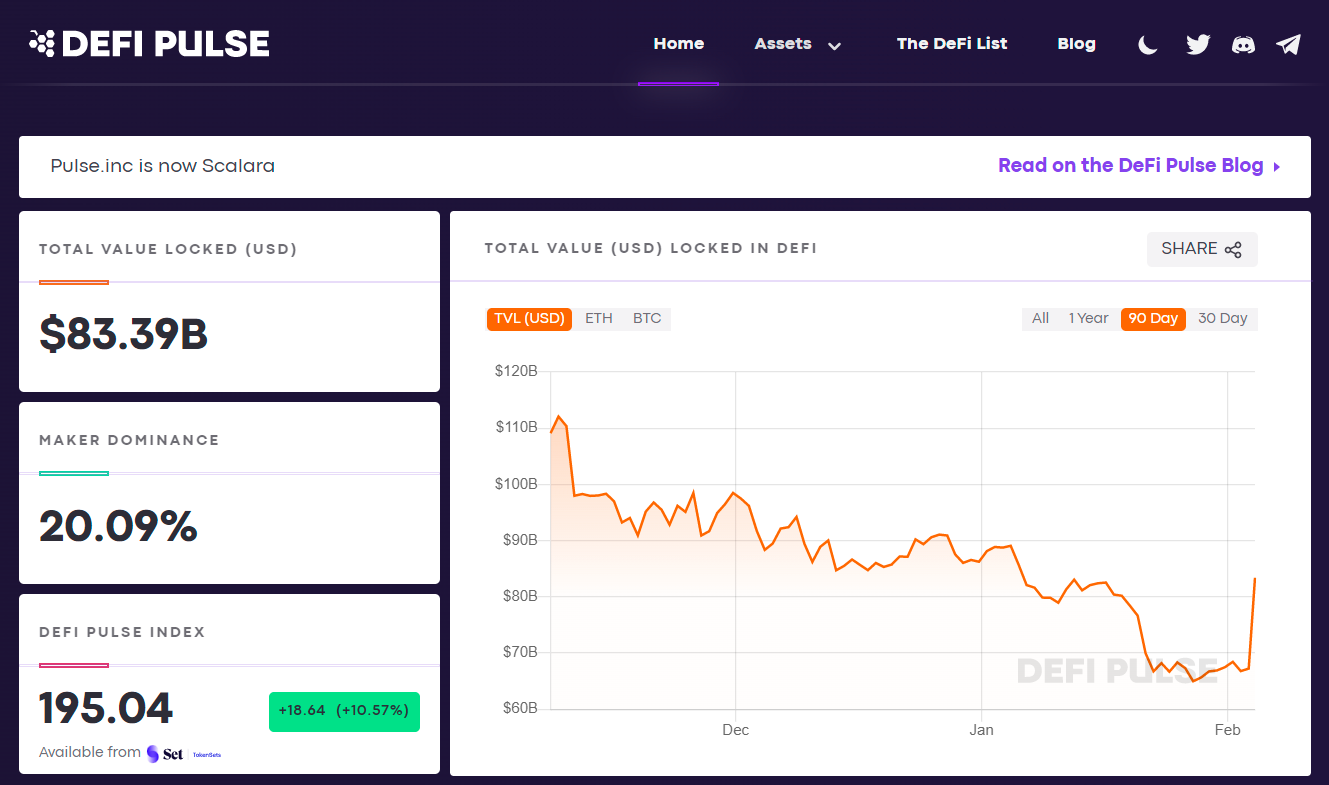

📈 DeFi TVL back on the rise — Since last weekend the total value locked (TVL) in Ethereum DeFi climbed from $77B to $83B. Whether this acute gust of strength continues into next week remains to be seen, yet the market action in recent days has knocked crypto bears down a peg for now!

🌌 Driving DeFi news — Wormhole bridge disaster averted

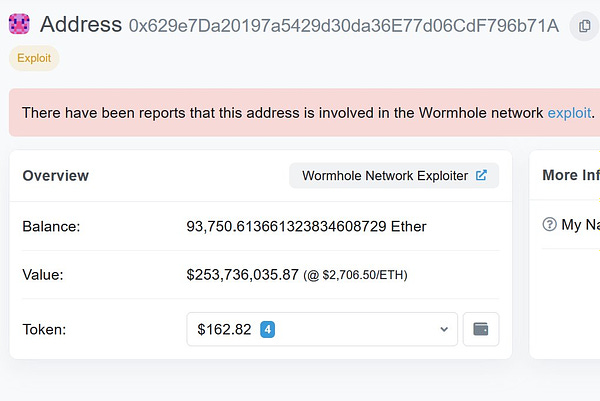

Wormhole, a cross-chain bridge protocol, suffered DeFi’s largest hack ever this week. Simply put, an attacker used a spoofing maneuver to print a trove of wrapped ETH on Solana. They then moved over 93k ETH back to Ethereum, a massive blackhat haul worth more than $320M USD.

This could’ve been disastrous. Many ETH holders on Solana would’ve been left with worthless unbacked tokens, which could have triggered wider shockwaves throughout the wider cryptoeconomy.

Fortunately for everyone, Jump Crypto — the incubators of Wormhole — put forth 120k ETH to backstop and make the bridge protocol whole. This prevented contagion effects from enveloping DeFi. But it feels like we’ve dodged a bullet here, or rather an artillery shell. It’s a stark reminder not to use cross-chain protocols willy-nilly in these early days.

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 TCR (+151%)

📈 LDO (+27%)

📈 MKR (+22%)

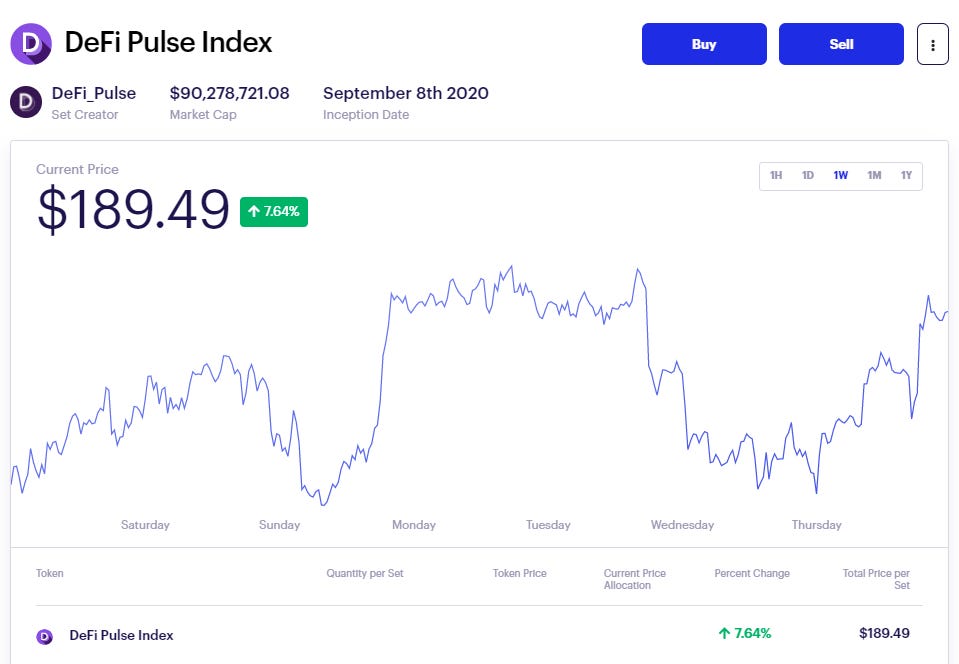

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $189.49, up 7.64% on the week.

More indices news: Pulse.inc, the meteorologists of the DeFi Pulse Index (DPI) and the FLI tokens, rebrands to Scalara!

Everything remains the same: DeFi Pulse Index and FLIs will still be maintained, and new indices are in the pipeline! Follow Scalara on Twitter to make sure you hear the news first hand.

Related resources:

🌾 Farm +260% APR with AELIN/ETH staking!

One month ago, we covered single-sided AELIN staking on the Optimism L2 for a Farm of the Week. Since then Aelin — a SPAC protocol — has notably deployed its Pool 2, an AELIN/ETH staking opp that relies on Gelato’s Sorbet Finance.

This yield farm is going brrrr with AELIN rewards right now! Yet it’s a little more involved than simple staking, as you’ll acquire LP tokens via Sorbet Finance first and only then stake back on Aelin.

How to join this farm

Make sure your browser wallet is connected to the Optimism L2. You can do so at chainlist.org with a couple clicks if you haven’t done so before.

You will need AELIN and WETH to LP with.

Currently, AELIN has only one liquid trading pair (AELIN-WETH) on Uniswap V3’s Optimism deployment.

You can convert ETH to WETH on Uniswap as needed.

If you need to bridge funds over to Optimism, you can consider fast bridges like Hop and Synapse or the official Optimism Gateway.

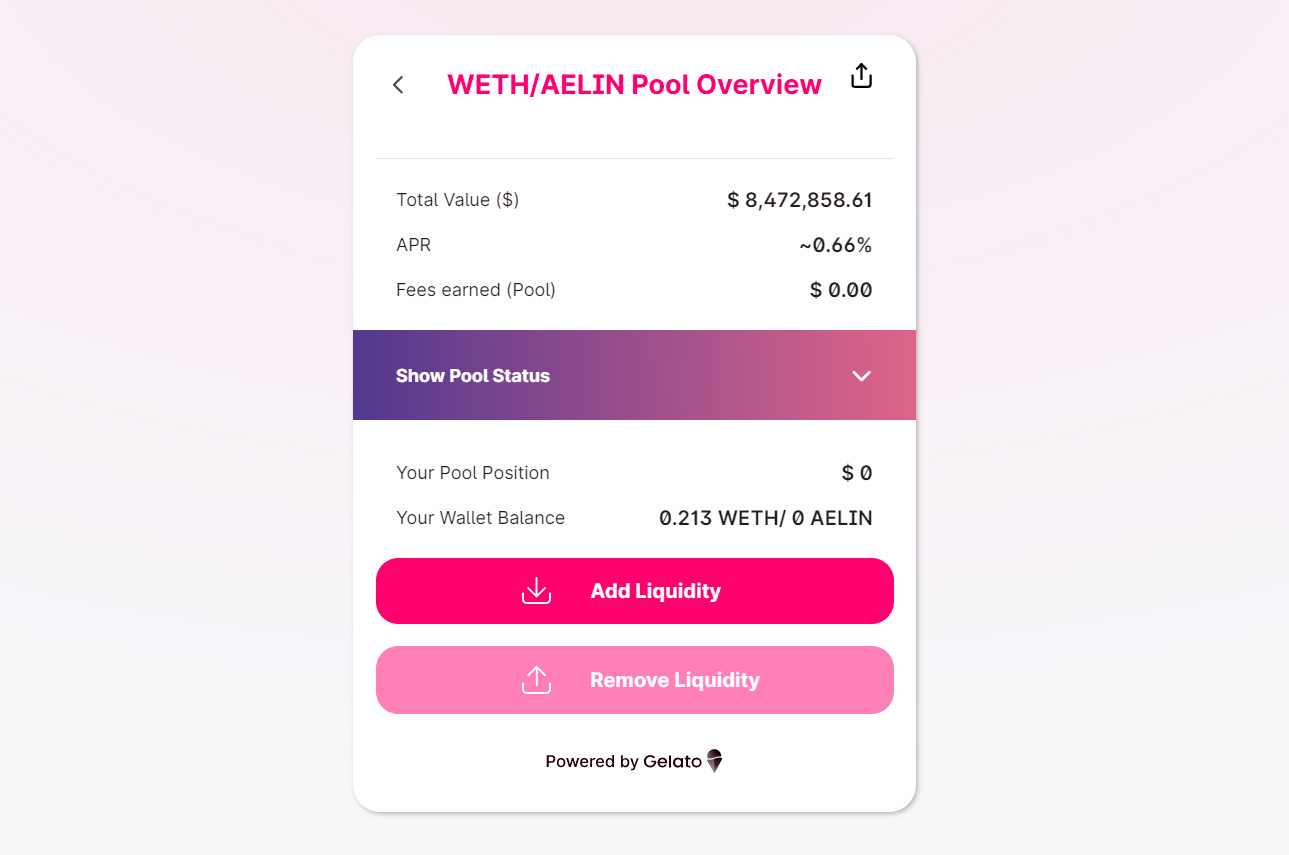

Once your tokens are prepped, head over to Sorbet Finance’s AELIN-WETH pool page. Input the amount of liquidity you want to supply and fire off a deposit transaction.

You’ll receive G-UNI LP tokens for your liquidity. Head to the Aelin staking dashboard, input the amount of G-UNI tokens you want to stake, and complete an approval transaction and then a final staking transaction.

That’s it! You can track and claim your accrued AELIN rewards through this same staking interface whenever you want.

Aelin has been audited, but this opp involves multiple projects and the risk of impermanent loss. You should approach this farm cautiously accordingly. Never invest with more money than you can afford to lose. Also, note staking yields can drop fast if many people join in short order.

Meet Kuiper, a DeFi protocol for index tracking

TLDR: Kuiper is a new decentralized index tracking protocol that’s ideal for dynamic baskets.Fed releases new research on stablecoins

TLDR: The Federal Reserve, the central banking system of the U.S., publishes a new research report on the contemporary stablecoin ecosystem.MyCrypto is joining MetaMask

TLDR: Ethereum dev studio ConsenSys acquires online wallet service MyCrypto and is merging its efforts with MetaMask.What “shared security” means

TLDR: Vitalik Buterin publishes a write-up detailing how the shared security of layer-two (L2) scaling solutions offer unparalleled guarantees in the face of 51% attacks.

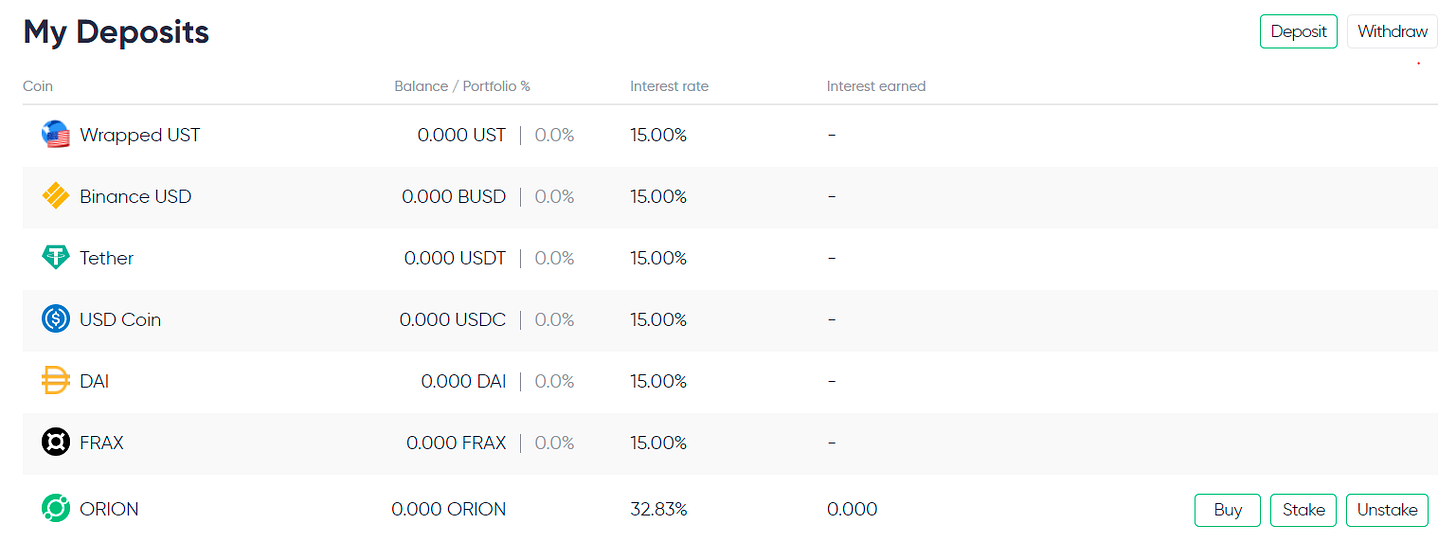

🚜 Farm 15% APY on stables with Orion Saver!

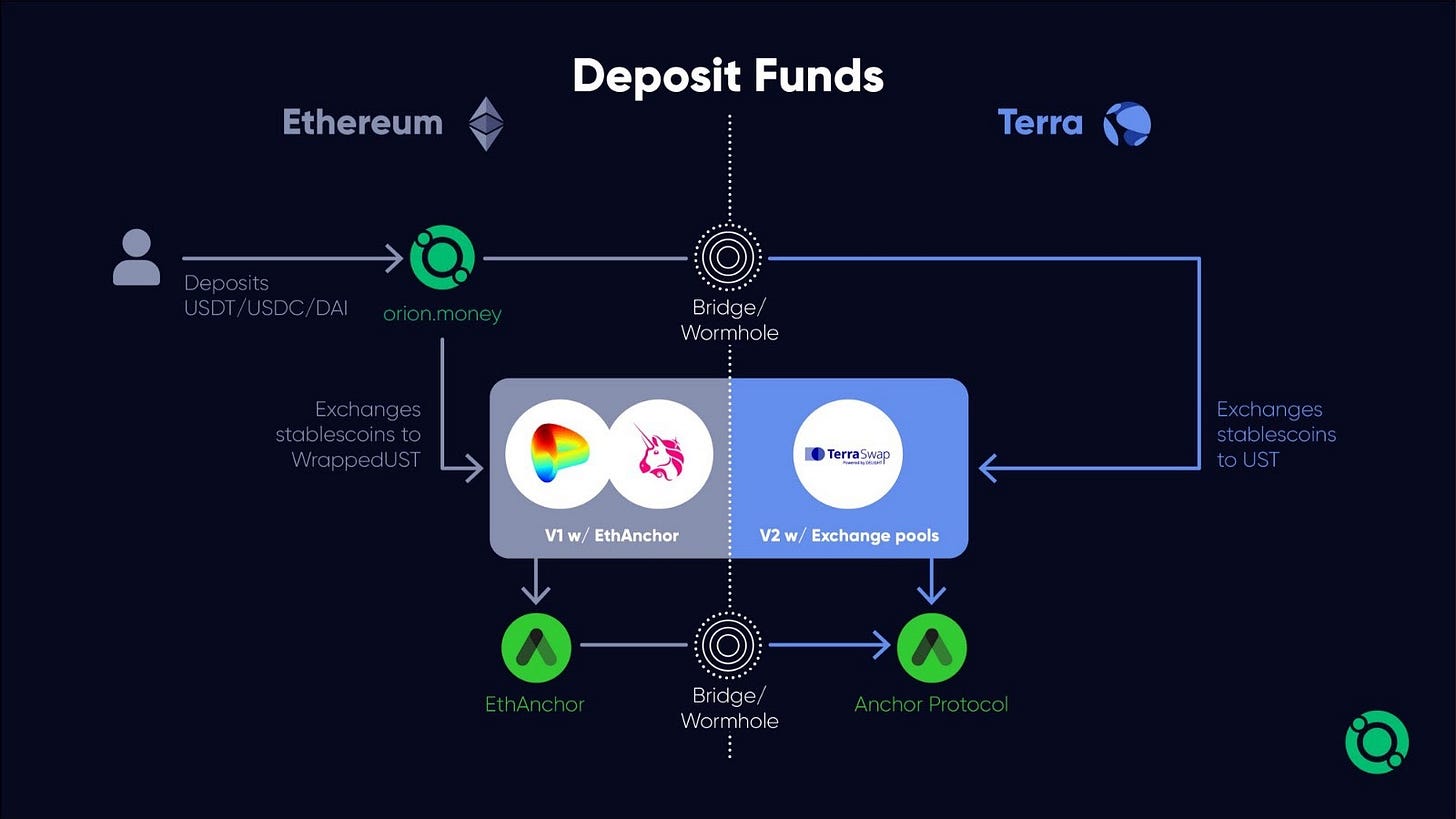

Orion Money is a cross-chain stablecoin bank, and Orion Saver is the project’s native stablecoin savings market.

This savings system works atop Anchor Protocol, the leading money market on the Terra blockchain, and is now available on Terra, Ethereum, Polygon, and Binance Smart Chain.

In short, users deposit in stables, which are then traded into wrapped UST, i.e. Terra’s native stablecoin. The yield comes from the ensuing UST ultimately being lent out to borrowers on Anchor.

There’s no need to chain hop to use Orion Saver, as you can deposit stables like USDC, USDT, or DAI into the Ethereum savings markets with a few clicks. Just keep in mind you can also use this dapp from Polygon, BSC, and Terra proper.

Orion Saver has been audited. However, UST peg risks and cross-chain market contagion possibilities can’t be ruled out. Never deposit funds you can’t afford to lose!

Maker announces a grant to explore KYC and AML compliance research.

1inch votes to add derivative aggregation to the 1inch Protocol.

Having trouble keeping up with all the many developments taking place around Ethereum’s scaling ecosystem right now? Not anymore! That’s because now we have L2.news, which aggregates top happenings from across the top scaling solutions today.

How’s DeFi faring one month into 2022? 🤔

Personally, I’ve been pleasantly surprised at how well DeFi’s been holding up lately in the face of choppy mainstream markets and toughening macro conditions.

We’re not out of the woods yet, of course, as more acute selloffs could be coming. Yet the DeFi ecosystem clearly has better infrastructure and better inertia than ever before, and it’s showing these days.

What I’m way more concerned about is the areas where we’re seeing self-inflicted damage. Stuff like the Wonderland scandal and 0xSifu filtering 1000s of ETH through Tornado.cash, or the Wormhole hack costing +$300M, is not doing us any favors.

DeFi can and will do better; yet the early growing pains are fierce at times.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!