👩🌾️ Farm +320% APR on Dopex and 12% via the 1st Balancer MetaStable Pool!

Also, learn about samczsun’s latest major DeFi rescue, and check out the stories of the week + the governance watcher!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

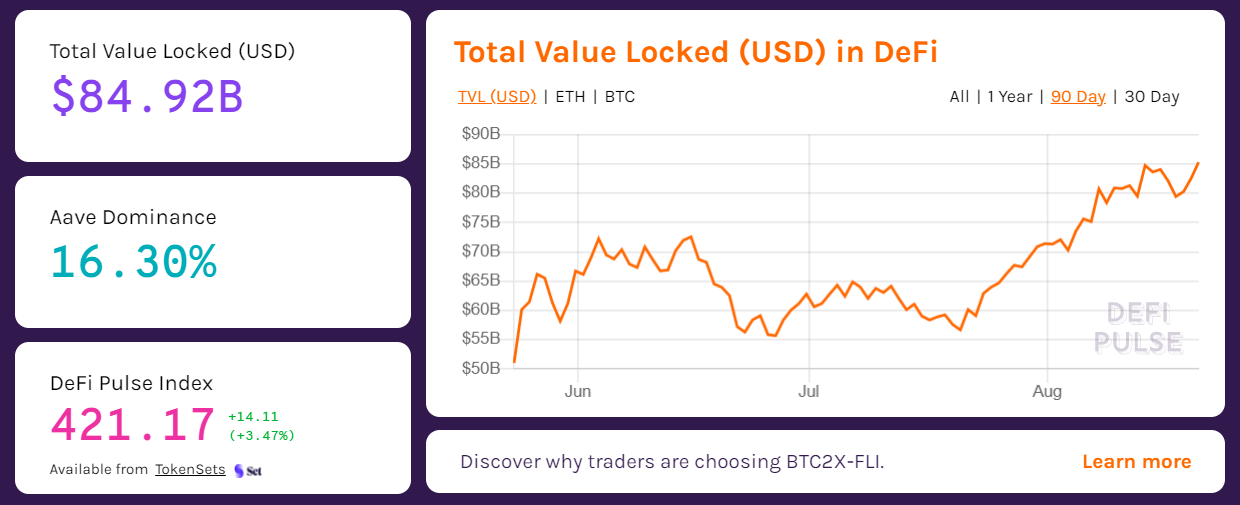

At $85B today, the total value locked (TVL) in decentralized finance apps continues to knock on the door of its previous ~$90B all-time record for the second week in a row.

Two takeaways here: the activity around DeFi is effectively as robust as we’ve ever seen it, and there’s an unmistakable acute growth trend unfolding as you can see in the TVL chart below 🚜

Not bad for a decentralized ecosystem that’s barely four years old, eh?.

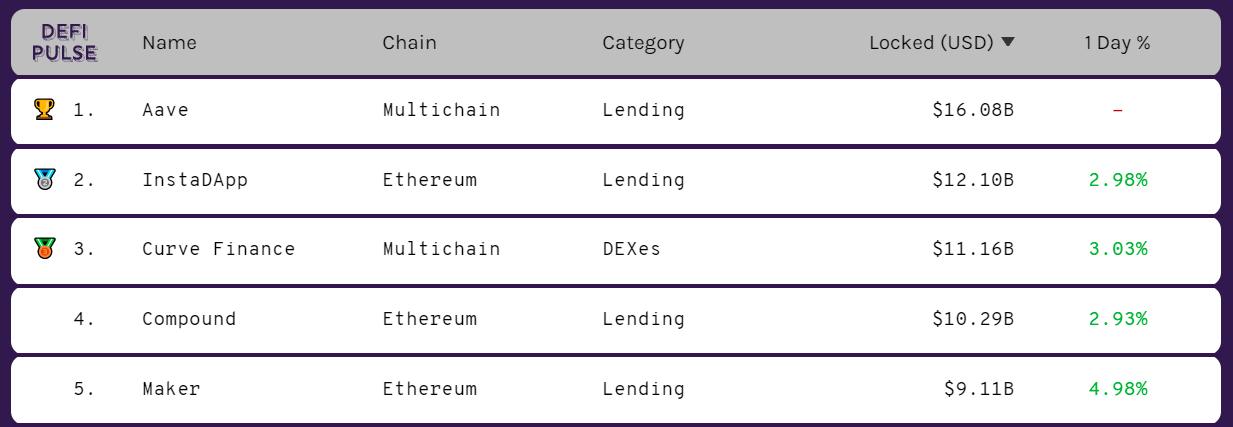

Anyways, zooming in at the top 5 dapps per TVL right now we find money market Aave ($16.08B) has a firm grip on 1st place, followed up for a much closer contest for 2nd and 3rd place among DeFi suite InstaDapp ($12.10B), exchange protocol Curve ($11.16B), money market Compound ($10.29B), and lending protocol Maker ($9.11B).

As for big news this week, it doesn’t get much bigger than samczsun’s latest DeFi rescue, one which the Paradigm research partner and whitehat auditor extraordinaire called “maybe the biggest whitehat rescue ever.”

To make a long story short, samczsun discovered a critical vulnerability within Sushi’s MISO token launchpad and then helped coordinate a quick rescue of $350M in funds that were ultimately hanging in the balance until that point.

The episode’s remarkable for a number of reasons, but one is because it shows what’s best about DeFi: principled, open collaborations. One of Paradigm’s biggest portfolio positions is in Sushi’s competitor Uniswap, yet samczsun didn’t flinch at that reality upon identifying the vulnerability and thereafter helping the Sushi team fix it in short order. Class act!

Lastly, let’s finish up this recap by reviewing the best-performing DeFi tokens since this point last weekend. In that span, we saw strong runs from LDO (+27.6%), REN (+20.4%), CVX (+19%), FXS (+18.3%), and DODO (+17.5%), though the DeFi Pulse Index (DPI) slightly declined (-1.72%) and is now trading just above $416.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

Farm up to 321% APR via the first Dopex yield farms!

Decentralized options protocols come in all stripes these days, but most can’t offer yield farmers triple-digit APRs right now. One that can, though, is Dopex.

Dopex is an options protocol that’s eyeing the public launch of the Arbitrum layer-two (L2) scaling solution to really strut its stuff. That launch is just days away at this point, but Dopex has already launched some initial infrastructure on the Ethereum mainnet both for bootstrapping and for distributing the project’s DPX governance token.

Before diving further into DPX rewards, let’s briefly cover the basics of Dopex:

The protocol centers around optimizing liquidity for option writers/buyers while mitigating option writers’ losses.

As part of this liquidity system, Dopex offers Option pools for passive yield opportunities and Volume pools for facilitating advanced arbitrage opportunities.

Option writers’ losses are mitigated via payments of rDPX, a rebate token.

Dopex’s options are European-style, fully collateralized, and scheduled per daily, weekly and monthly expiries.

How to farm DPX

The Dopex team is currently running a liquidity mining program around three initial pools: single-sided DPX staking (17.7% APR), DPX/ETH Uniswap V2 LP token staking (219.3% APR), and rDPX/ETH Uniswap V2 LP token staking (321.45% APR).

If you’re keen on trying out any of these yield farms, supply DPX (and/or rDPX) and WETH to your Uniswap V2 pool of choice if you’re opting for one of Dopex’s two LP farms.

Then just navigate to the Dopex Farms page and stake your DPX or LP tokens through your selected interface. Remember, you’ll have to allow Dopex to spend your funds with an approval transaction before you fire off your final staking transaction!

Dopex has been audited, but it’s also a young project and all young projects in DeFi should be approached first and foremost as experiments. That means do your own research, understand the risks, and never invest more money than you can afford to lose.

Liquidity Mining Rewards v2

TLDR: Yearn Finance pioneer Andre Cronje in collaboration with Pods Finance and Sushi introduces a new liquidity mining model that centers around call options.QuickSwap Introduces Limit Orders

TLDR: Courtesy of Ethereum automation protocol Getlato, popular Polygon DEX QuickSwap integrates support for limit orders.Power Perpetuals

TLDR: Paradigm publishes a paper introducing power perpetuals, a new DeFi primitive offering “global options-like exposure without the need for either strikes or expiries.”dYdX Liquidity Staking Pool

TLDR: Derivatives protocol dYdX introduces its Liquidity Staking Pool, an incentive system that will help the protocol “compete with centralized exchanges.”‘Tis the Season for Listing

TLDR: AMM project Integral announces that ITGR token vesting will begin upon the token being listed on a leading exchange next month.Ondo Raises $4M

TLDR: The team behind upstart risk management protocol Ondo Finance raises $4M in an equity round led by Pantera Capital.Balancer Launches MetaStable Pools

TLDR: Balancer V2 now supports MetaStable Pools, which are “great for tokens with highly correlated, but not hard-pegged, prices.”

Earn 12% APR with Balancer’s ETH/wstETH pool

This week Balancer revealed support for MetaStable Pools, i.e. liquidity pools for highly-correlated assets that are “well suited to handle pegged tokens that gradually accumulate fees.”

To kick off this new release, Balancer unveiled a collaboration with Ethereum staking solution project Lido on an inaugural MetaStable Pool for wrapped Lido Staked ETH (wstETH) and wrapped ETH (WETH) 🎉

Notably, the liquidity pool is being incentivized with both BAL and LDO rewards and is presently fetching depositors nearly 12% APR, so this farm’s certainly not one to ignore.

The first reward distributions will take place on Aug. 24th, so if you want to start racking up these tokens early simply head over to the new MetaStable Pool and make a single-sided or two-token deposit. Then going forward you’ll simply claim your accrued rewards through the Balancer app whenever you please once they’re live!

Balancer V2 has been audited and built by a public team. However, just because Balancer is a blue-chip DeFi project doesn’t mean we should throw caution to the wind as users. Unlikely incidents can still happen, so never invest more money than you can afford to lose!

Do you want to dive more into Yield Farming opportunities? Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

The Aave community approves adding DPI as a supported collateral type to the Aave protocol.

The Aave community considers extending AAVE liquidity mining rewards.

The Curve community considers launching a deployment of Curve on the Harmony blockchain.

It won’t be long before a lot more of us are yield farming ETH via Eth2 staking. If you’re interested in modeling yield implications for Ethereum validators and ETH supply trajectories, consider checking out the simulator dashboards at ethmodel.io!

🏋♀️ The state of DeFi is strong and seemingly growing stronger all the while. Glance around the ecosystem right now and you’ll see amazing opportunities everywhere you look. Find where you want to make the most of your attention and resources and keep taking swings, albeit cautiously!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!