👩🌾️ Farm 4-digit APRs on Gro Protocol & check out Curve’s ETH/alETH factory pool!

Also, learn about the RBN airdrop drama & check out the stories of the week + the governance watcher!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

📈 DeFi TVL gains +$6B again — For the second week in a row, DeFi’s total value locked (TVL) rose by over $6B. Indeed, the ecosystem’s TVL climbed from $80B to $86B last week, while this week it went from $86B to $92.8B.

DeFi’s in an acute activity upswing, then, as a growing number of people have been looking for new opportunities to put their crypto to work in dapps 🚜

🎀 RBN airdrop drama driving the news — Crypto-structured products protocol Ribbon Finance airdropped RBN tokens to its users back in the spring. On Wednesday the tokens unlocked, at which point drama ensued.

Why? Blockchain sleuths discovered an analyst with Divergence Ventures — which counts Ribbon among its portfolio investments — conducted a sybil attack of sorts against the RBN distribution. They did so by creating dozens upon dozens of wallets and then used them to interact with Ribbon’s Vaults.

To add insult to injury, the analyst quickly sold millions of dollars worth of RBN for ETH. Divergence has since apologized and returned ETH to the Ribbon DAO treasury, which is good. In the very least, the episode is a wake up call to major crypto stakeholders to never lose sight of ethics.

💸 This week’s best-performing assets — Since last weekend, we’ve seen notable runs from the following top DeFi tokens:

📈 BADGER (+30.2%)

📈 CVX (+21.9%)

📈 OHM (+19.4%)

📈 FXS (+19.3%)

📈 NXM (+18.3%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $337.05, a modest gain of 0.54% on the week!

💻 It’s Hackathon time! $2.5M in prizes to make crypto mobile 📱

Celo platform is calling out all shadowy super coders, designers and thinkers to help make DeFi mobile, accessible, affordable & open! 🌍

Sign-up today for Celo’s Mobile Hackathon and have the opportunity to win from a prize pool of $2.5M! Categories include DeFi, Low-carbon solutions, NFTs, infrastructure and interoperability. Let’s make crypto mobile!

The Celo platform is proof-of-stake, EVM-compatible, open source, and governed by CELO asset owners.

Disclosure: This section is part of our paid promotional Drops Program; We’ve partnered with Celo to help bootstrap their Hackathon. As always, we’re committed to providing the entire community with quality, objective information, and any opinions we express are our own.

🌾 Farm 4-digit APYs on Gro Protocol!

Gro Protocol is a new “yield optimizer for stables.”

This means Gro aggregates yields, trying to earn stablecoin depositors optimized returns from around DeFi. Moreover, Gro has a bespoke Risk Balancer system it uses to tranche DeFi yields and risks into senior and junior sides.

The Risk Balancer is what makes Gro go ‘round. Why? It serves as the foundational engine that powers Gro’s initial flagship products: the PWRD stablecoin and the Vault.

In short, PWRD provides users with in-built yield + deposit protection, and the Vault offers riskier, leveraged returns -- check out our recent Alpha Tractor on Gro for the full scoop on how these products work!

How to yield farm GRO

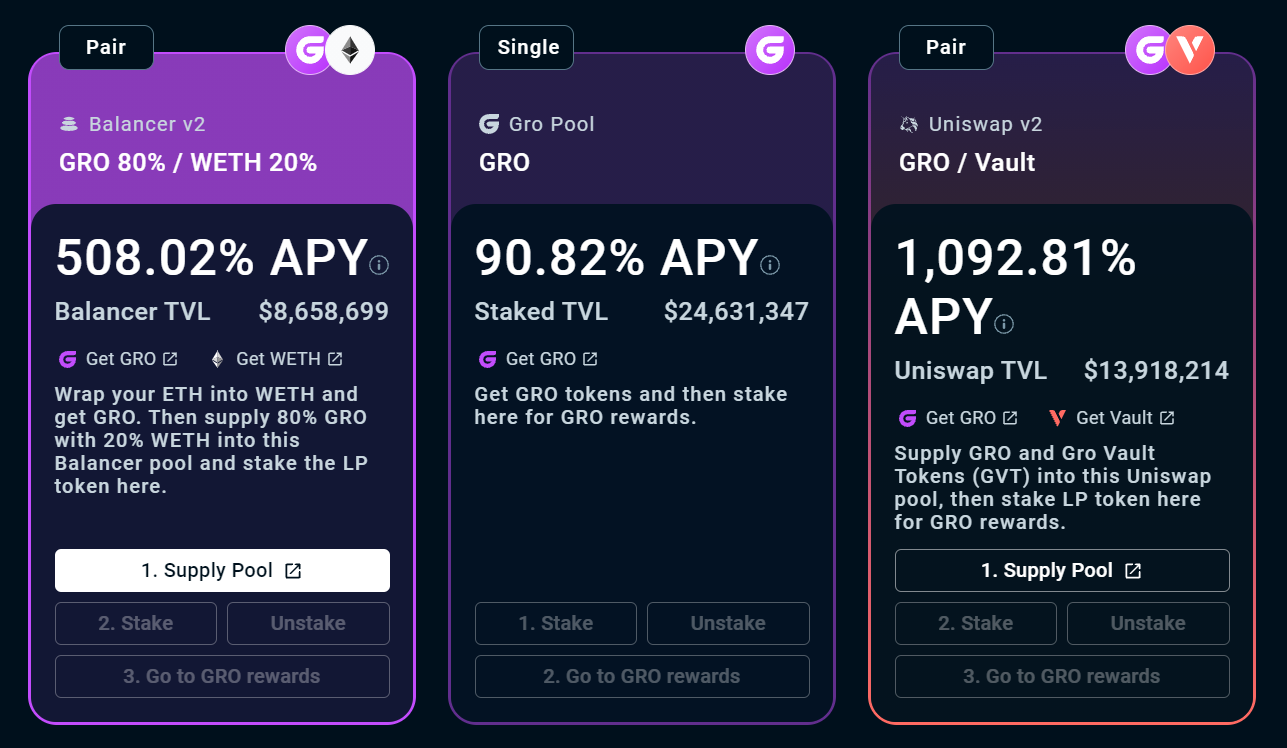

Gro Protocol started a liquidity mining program for its GRO token on Oct. 1st. Over the first month of the campaign, 2M GRO (or 2% of the total supply) will be distributed to Gro users. The incentivized pools are as follows:

GRO staking pool

Vault staking pool

GRO/WETH 80/20 Balancer pool

GRO/Vault Uniswap V2 pool

GRO/USDC Uniswap V2 pool

PWRD-3CRV Curve metapool

For either of the staking pools, you’d just need GRO or Vault tokens depending on which pool you’re interested in. Then you’d simply deposit them through the provided dashboards, at which point let the GRO farming begin!

The four remaining pools are LP token staking pools. Head to the Pools page (it gives you the option to acquire the underlying tokens if you still need to) and the interface will walk you through the supply, staking, unstaking and GRO rewards processes. The highest yields right now are in the GRO/Vault Uniswap V2 pool, which is generating 1,092% APY presently!

Gro Protocol is a young DeFi project. It’s not as battle-tested as other DeFi projects you may have interacted with. Treat it like an experiment where your money is at risk in various ways. That said, never yield farm with more money than you can afford to lose.

Altair Mainnet Announcement

TLDR: The Ethereum dev community announces that the Altair beacon chain upgrade will go live on Oct. 27th.Layer 1 Wind Down

TLDR: Decentralized derivatives exchange dYdX announces that its L1 spot and margin trading services will enter Close Only mode on Nov. 1st.Alchemix Roadmap

TLDR: Self-repaying loans project Alchemix unveils its updated roadmap, which details the protocols “short to mid term development plans.”StarkNet Alpha Is Coming to Mainnet

TLDR: L2 scaling group StarkWare announces that their StarkNet scalability solution is launching its mainnet before November.Dai’s USDC backing drops below 50%

TLDR: MakerDAO’s Dai stablecoin is now less than 50% backed by USDC once again. The downward shift comes after some people have raised concerns in recent months about Dai becoming too reliant on USDC.Increasing Min Gas Price to 30 Gwei

TLDR: In a bid to mitigate spam transactions, Polygon developers have raised the Polygon sidechain’s minimum gas price to 30 gwei.

🚜 Farm +200% APY in Alchemix’s alETH factory on Curve

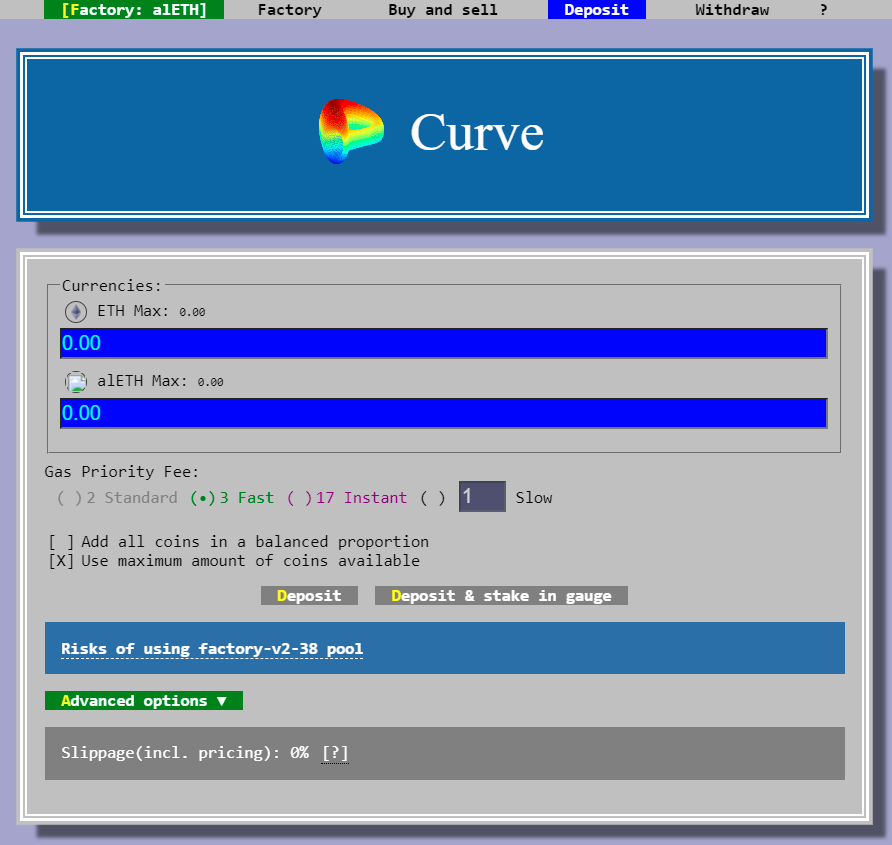

Decentralized exchange Curve teamed up with Yearn’s builders to create a pool factory system. These factory pools are “permissionless pools that anyone can deploy on Curve.”

That means Curve doesn’t vet these pools before they launch, so keep that in mind. Regardless, these factory pools are interesting because they offer young DeFi projects an avenue to readily support token liquidity. Some of these pools will even qualify for gauge allocations, so watch out for that!

As for a particular pool of interest, one we’re watching this week is the Alchemix community’s new alETH factory pool.

ETH/alETH depositors have been generating up to 213% APY in this pool recently. If you’re interested in farming these pastures, you’ll need some ETH or alETH of course. And to be safe remember to survey all the risks before you even consider starting!

Curve has been audited, and factory pools have been built by some of the brightest minds in DeFi. Even still, these pools should be treated as experiments with multiple layers of risk. Farm responsibly, never deposit more money than you can afford to lose.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

The Yearn community discusses what a YFI tokenomics revamp could look like.

The Alchemix community discusses creating an Alchemix Fuse Pool on Rari.

KeeperDAO introduces KIP-0, which defines a “simple format” for future KeeperDAO governance.

OlympusDAO votes on using the 45-day moving average for WETH price.

MakerDAO founder Rune Christensen proposes making Dai into “clean money” to fight climate change.

Ethereum Name Services unveils NFT avatar support for ENS domains.

New NFT marketplace Infinity is attempting a “vampire attack” on OpenSea.

Paradigm presents RICKS, a novel NFT fractionalization primitive.

The layer-two scaling era has arrived, so it’s important to have a bird’s-eye view of L2s to track where activity — and opportunities — are flowing in real time. In celebration of DeFi Pulse’s scaling week, we’re highlighting funnyking.eth’s L2 Gas Consumption dashboard on Dune Analytics accordingly!

What’s something people in DeFi may be sleeping on? 🤔

Just how big NFTs are going to be when it comes to bringing DeFi into the mainstream, I think!

NFTs can be used for just about anything, and not just art, collectibles, and games. We’ve seen how Uniswap started tracking LP positions as NFTs in Uniswap V3, for example, and that was just the beginning of the “financialization” of NFTs.

As such, major banks are now waking up to the possibilities at hand, and that could prove huge for DeFi going forward. Keep watching the DeFi x NFT intersection, then: it seems like big things are on the horizon!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!