👨🌾️ Farm +70% APR via Synthetix’s new L2 pastures & try Yearn’s Fantom vaults!

Also, read about the recent Wonderland drama + more DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond!

If you want to access the full DeFi Pulse Farmer experience to receive emerging yield farming opportunities sent to you throughout the week, subscribe today!

🍇 DeFi TVL down, new look DeFi Pulse up — With macro conditions shaky and the Wonderland scandal recently bubbling to the surface, the total value locked (TVL) in Ethereum DeFi slid this week. Yet for the majority of projects here, it’s been business as usual. And speaking of biz, DeFi Pulse has some news to share: come through and check out our new branding and newly-madeover website! More updates are on the way, too 😉

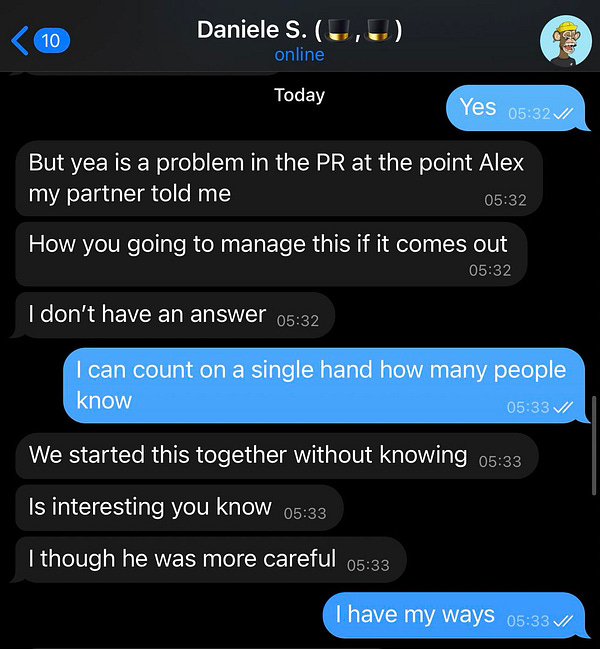

🐸 Driving DeFi news — Wonderland’s turmoil

Frog Nation — or the ecosystem of projects including Abracadabra, Popsicle Finance, and Wonderland — discovered a swamp monster within their own ranks this week.

Indeed, on Wednesday crypto investigator zachxbt.eth outed Wonderland co-founder 0xSifu as Michael Patryn, a serial scammer most famous for co-founding the Canadian crypto exchange QuadrigaCX that blew up in 2019 and lost traders millions of dollars.

The revelation plunged the Wonderland project into crisis, and now the protocol’s community has voted to remove Patryn from his prior treasury management role. Where Frog Nation goes from here remains unclear, but in the meantime the ecosystem’s tokens have been facing acute selloffs and more than a few frogs are feeling betrayed.

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 MPL (+28.81%)

📈 PUNK (+23.72%)

📈 BZRX (+17.42%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $175.94, down 14.8% on the week.

Related resources:

🌾 Farm +70% APR in the L2 WETH-SNX pool!

The future of yield farming is migrating to “layer two,” or L2, scaling solutions. You can see the beginnings of this migration today as “blue-chip” DeFi projects continue to pivot operations over to L2s.

A textbook example of this right now is Synthetix, which to date has gone all in on its deployment to Optimism, a powerful Ethereum scaling solution based on optimistic rollups technology.

The latest example of Synthetix’s L2 shift came this week when the protocol unveiled a one-month liquidity mining campaign that will distribute 50k SNX to SNX-WETH liquidity providers (LPs) on Optimism.

How to join this farm

If you haven’t already, add the Optimism network to your browser wallet; you can do so with just a few clicks at chainlist.org, look for “Optimistic Ethereum” and press “Connect.”

If you need to bridge SNX over to Optimism, consider the Optimism Gateway; if you’re just bridging ETH, Hop works well.

Use Uniswap V3 on Optimism to convert your ETH to WETH. You can also use an L2 DEX to pick up liquidity if you want, but beware of illiquidity in these early days.

Add SNX-WETH liquidity on a 1:1 basis via Sorbet Finance.

Head over to the SNX-WETH staking dashboard and approve the staking contract with a transaction.

Once that transaction’s done you can stake your Sorbet LP tokens, and after that you’ll instantly start racking up SNX rewards!

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose. This strategy could lose you money!

The Great Renaming

TLDR: The Ethereum Foundation officially moves on from using “Eth2” to describe Ethereum’s future form.Synthetix L222 Roadmap

TLDR: DeFi derivatives project Synthetix comprehensively outlines its development roadmap.Aave V3 is near

TLDR: The optimized Aave V3 protocol is now deployed across seven testnets.Not so smart contracts

TLDR: Yearn founder and developer Andre Cronje outlines his feelings over the recent Abracadabra drama.RON is live

TLDR: Axie Infinity releases RON, the native token of the Ronin sidechain, and begins a yearlong RON-WETH liquidity mining campaign on Katana.Michael Saylor visits UpOnly

TLDR: Microstrategy founder and CEO and bitcoin bull Michael Saylor appears on Cobie’s UpOnly podcast.

🚜 Farm +20% APR with Yearn’s new Fantom vaults!

If you’re not new to DeFi, chances are you’ve heard about the Yearn Vaults system. It’s legendary, in fact, and backed by some of the best minds in DeFi.

You put your money in, the vault programmatically gets to work, and then you automatically reap rewards over time. Performant and elegant really!

That said, to date Yearn’s mainly focused on Ethereum vaults, but lately the major DeFi protocol has been trying out vaults on Fantom. And since Fantom is compatible with the Ethereum Virtual Machine (EVM), it’s really easy to hop over and earn in these vaults if you want to.

Again, you can use chainlist.org to add Fantom to your wallet if you haven’t before, and Synapse is a Fantom bridge you can consider trying (previously an Alpha Tractor).

Once you’ve got funds over and have your tokens prepped, depositing is the same process as it takes on Ethereum. The best yielding opp right now is Fantom’s Curve Tricrypto pool, which is fetching +20% APR at the moment!

Balancer’s infrastructure is battle-tested and proven in DeFi at this point. However, never throw caution to the wind in DeFi. Only yield farm with money you can afford to lose!

ParaSwap considers a PSP threshold for opening up the DEX’s governance.

Wonderland votes on winding down its treasury and returning funds to community members.

Claiming and compounding your rewards in DeFi sometimes takes a bit of strategizing. Ditch the pen and paper, though, because developer OoTsun has created wenclaim.xyz. Input your deposit sum, your expected APR, and your costs, and boom! The site spits out your optimal claiming frequency.

What’s the grand takeaway from the Wonderland drama? 🤔

I think the main takeaway from this episode is to be really scrupulous when it comes to deciding 1) which DeFi projects you deposit to, and 2) how you size your deposits.

Because DeFi is so open, there are bad actors here. We have to do our best to avoid and resist these bad guys. Thus opting to use battle-tested protocols with proven leadership is good, safe, and smart all at once!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!