👩🌾️ Farm Ribbon’s new Aave Covered Call vault and check out Tetranode’s Locker on Fuse!

Also, learn about the Aave V3 system + DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

📈 DeFi TVL climbs +$4B — Since dipping to $101B last Saturday, the total value locked in Ethereum DeFi has acutely surged and is currently hovering over $105.6B. Not bad! This show of strength comes as Ethereum, DeFi, and NFTs continue to make inroads to the mainstream like never before.

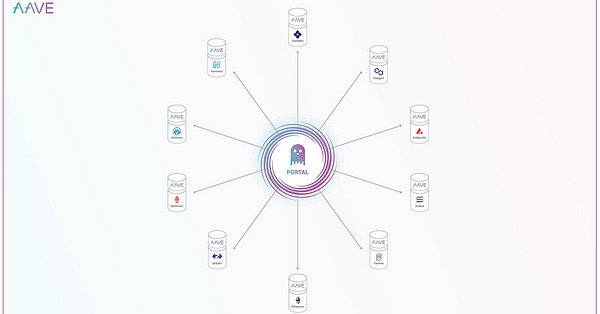

👻 Aave intros V3 — The biggest news in DeFi this week was the Aave community’s next-gen Aave V3 proposal. If approved, the system would turn the decentralized lending giant into an all-in-one, L2-centric liquidity protocol the likes of which DeFi hasn’t seen before.

Specifically, Aave V3 aims to provide three powerful new mechanisms. They are:

Portal: a cross-chain bridging system for easily moving DeFi tokens across whatever chains you please.

eMode: a feature for efficiently maximizing the borrowing power you have against your own collateral.

Isolate Mode: a system for supporting newer and thus riskier assets by using debt ceilings to limit borrowing.

As for what comes next, now Aave will hold “a community vote via Snapshot regarding a potential deployment.” Stay tuned!

💸 This week’s best-performing assets — Since last weekend, we’ve seen notable runs from the following top DeFi tokens:

📈 LRC (+152%)

📈 DDX (+34%)

📈 WNXM (+27%)

📈 MKR (+24%)

📈 ZRX (+23%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $363.56, up 7.43% on the week!

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

🌾 Farm Ribbon Finance’s new Aave Covered Calls vault!

Ribbon Finance is a protocol for crypto-structured products.

These DeFi-native products operate according to unique automated investment strategies, with the goal being to optimize yields while minimizing risks for investors.

Zooming in, Ribbon’s initial products have been Theta Vaults. Simply put, these vaults earn investors money by putting users’ deposits to work in automated options selling strategies.

The first of these Theta Vaults have centered around ETH put selling strategies and ETH or WBTC covered call strategies. That’s why Ribbon made waves this week in launching its first Theta Vault around a DeFi token, which was AAVE!

📌 Don’t miss DeFi Pulse’s previous Ribbon guide:

Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

How to farm with the T-AAVE-C vault

Have some AAVE you’re interested in deploying for potentially high yields? Ribbon’s latest Theta Vault is certainly one passive, relatively easy option to consider.

Before proceeding, let’s get you up to speed. Here’s how you would go about using Ribbon’s new Aave Covered Calls vault:

To start, you’d go to Ribbon’s T-AAVE-C dashboard and then connect your wallet.

Then press the provided “Approve Aave” button and complete the transaction with your wallet. Doing so will allow Ribbon to use your Aave. (At the time of writing, the cost of this tx was ~$35 worth of ETH).

The approval transaction may take a few minutes to process. Once that’s done, input the amount of AAVE you’d like to deposit and press “Preview Deposit.”

A prompt will pop up showing your proposed position. If everything looks correct, press “Deposit Now” and confirm the transaction with your wallet. (At the time of writing, the cost of this tx was ~$140 worth of ETH).

With that completed, the vault will start auto-farming with your deposited AAVE! Then later you’ll handle withdrawals as needed through the vault dashboard’s Withdraw interface.

As for what’s actually happening under the hood here, Ribbon takes the AAVE deposits and uses them to mint European AAVE call options via Opyn. Ribbon thus sells these options through Gnosis batch auctions, and the earnings from these sales create yield for depositors. That’s the tl;dr, at least!

Note that this Theta Vault has a preliminary deposit cap of 15.5k AAVE, with the plan being to raise this cap over time. Also, Ribbon Finance is an interesting protocol but yield farm cautiously wherever you go. Never deposit more into any project than you can afford to lose. It’s completely possible for this Theta Vault to incur weekly losses, so beware!

Introducing Ribbon Treasury

TLDR: Ribbon Finance proposes a DAO treasury system in which projects could use covered calls to earn yields on their native assets.Report on Stablecoins

TLDR: A group of U.S. regulators call for stablecoin projects to be regulated as if they were traditional banking institutions.Maker releases DAI Direct Deposit Module (D3M)

TLDR: Maker unveils the D3M, a system that will offer Aave “privileged access to mint DAI.”C.R.E.A.M. Finance post-mortem

TLDR: The builders of C.R.E.A.M. detail the nuances of the flash loan exploit the protocol recently faced.Launching Micro Ether

TLDR: Pending regulatory review, CME Group plans to launch a Micro Ether futures product that will be sized at 1/10th of an ETH.ENS DAO: Call for Delegates

TLDR: The Ethereum Name Service announces plans to decentralize governance via an ENS token that will be airdropped to the service’s past users.

🥒 DeFi Pulse Power Tool: The New DILL 🥒

Ever wondered why many of the Jars on Pickle Finance present a range for their APYs? That’s because of the DILL token! Not only does DILL give holders voting power in Pickle plus claims on the protocol’s earnings, it’s also used to boost PICKLE rewards!

Indeed, Pickle users who vote lock their DILL can boost their PICKLE rewards up to 2.5x from their base levels! Pretty tasty, eh? To learn more, check out the Benefits of DILL guide and play with the DILL boost calculator on Pickle Finance!

Remember, Pickle Finance is a DeFi yield aggregator whose Pickle Jars compound depositors’ returns via cross-protocol yield strategies. The idea is to automatically and passively reap interest from top DeFi opportunities. Head over to the Pickle Jars to start yield farming on an L2 today!

Disclosure: This section is part of our paid promotional Partners Program; We’ve partnered with Pickle Finance to help educate and inform the community about the yield aggregator. As always, we’re committed to providing the entire community with quality, objective information, and any opinions we express are our own.

🚜 Farm +40% APY on USDC in Tetranode’s Locker!

Built by Rari Capital, Fuse is an open interest rate protocol for permissionless borrowing and lending.

Among the project’s most prolific and consistent pools yet has been Tetranode’s Locker, created by Ethereum DeFi’s most recognizable whale, Tetranode!

We turn your attention to this Fuse Pool now because it’s been fetching consistently high APYs for months, and that’s worth noting. In particular we currently like the risk/return profile here for USDC depositors, who are earning +40% APY at the moment.

To join, you’d connect your wallet on the pool page, click on the USDC option, and then input how much you want to supply. Select if you want to use this money as collateral, and then press “Confirm” and finish the transaction. Then you’d be in!

Make sure you understand the risks of using Fuse before participating in this yield farm. Also, never deposit more money than you can afford to lose into any pool or project.

Aave approves renewing Gauntlet’s Dynamic Risk Parameter engagement.

Compound does a temperature check on retro-distributing COMP to early protocol users.

Compound approves risk parameter updates for AAVE, LINK, MKR, SUSHI, USDC, and YFI.

Leading NFT game Axie Infinity launches Katana, its native DEX.

Are CryptoPunks like Picassos in the 1920s? Perhaps, says CNBC’s Kelly Evans.

CryptoPunks creators Larva Labs release custom-rigged 3D models for Meebits owners.

Check out this sneak peek of the Coinbase NFT marketplace onboarding flow.

CUDL Finance, an NFT project on Arbitrum, publishes its first community update.

Still a bit lost when it comes to the finer details of DeFi governance? Well look no further than The Guide to DeFi Governance by the Blockchain at Berkeley team. Inside, you’ll find one of the best overviews on the subject written yet!

What does Aave V3 bode for the future of DeFi? 🤔

In short, maturation.

DeFi’s come a very long way in a very short period of time, relatively speaking. Now the ecosystem’s early successes are translating faster and faster into better and stronger next-gen systems.

My point? DeFi’s dapps are growing up into robust services that are laying the groundwork for widespread crypto adoption. When we finally look around and everyone’s here, it’ll be in no small part because of things like Aave V3 that are being built in the here and now.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!