👨🌾️ Farm up to 140% APR in Dopex L2 pastures & check out Vesper’s new Earn Pools!

Also, read about Optimistic Ethereum going public + more DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

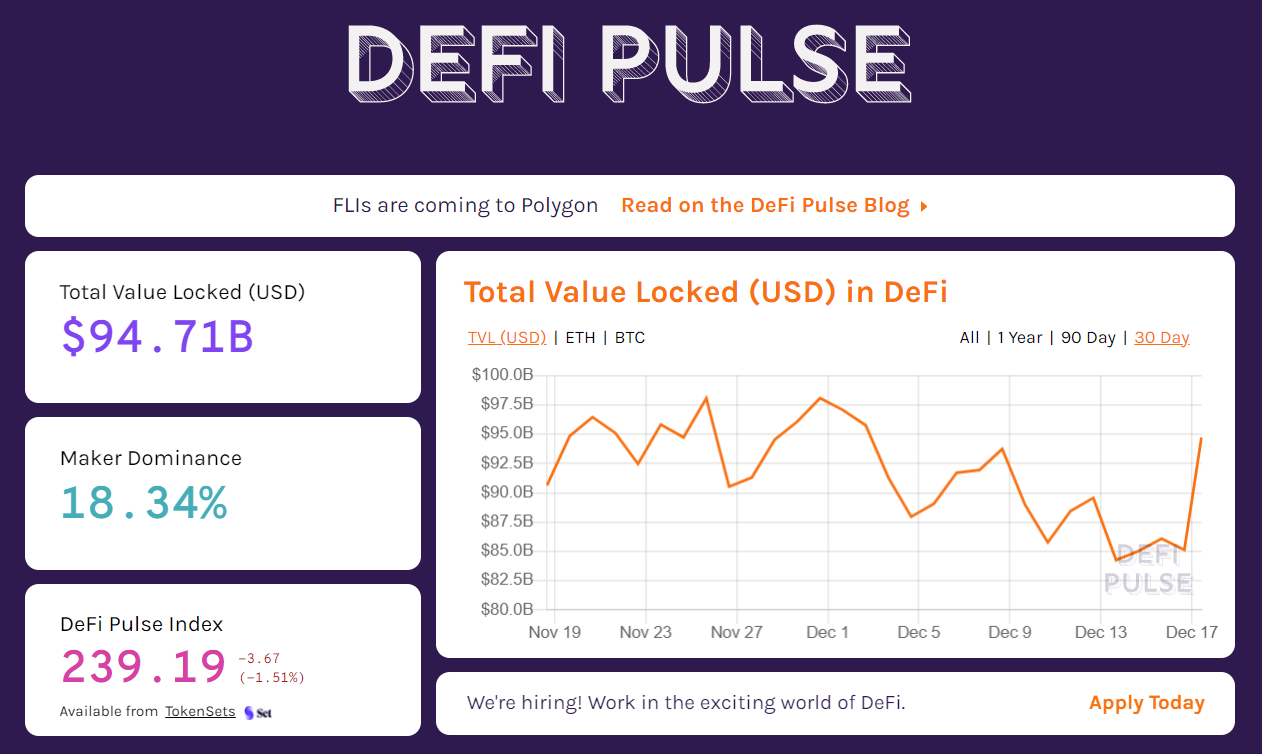

DeFi TVL rollercoaster continues — The total value locked (TVL) in Ethereum DeFi has been volatile lately. For example, this week the TVL dropped as low as $84B before climbing back to its current position of nearly $95B. For now, we’ll have to wait and see if we can return to +$100B and hold ground there or if we’ll break lower for the foreseeable future!

🎈 Optimistic Ethereum (OΞ) opens to the public — On Thursday, the Optimism team announced the opening of the OΞ L2 to public dapp deployments. Prior to this, Optimism mitigated early woes by enforcing an allowlist to launch on the scaling solution.

As such, DeFi and NFT projects can now permissionlessly deploy their smart contracts to OΞ just as they would on Ethereum. Moreover, since Optimism recently introduced EVM equivalence, dapps can deploy to OΞ in one-click fashion and enjoy all of the tooling and resources they love from Ethereum but on an L2!

The takeaway here, then? Expect to see the Optimism ecosystem blossom considerably in the months ahead as a growing number of dapps migrate over to access rapid and inexpensive transactions + EVM equivalence.

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 YFI (+51.4%)

📈 WNXM (+28.3%)

📈 CVX (+18.6%)

📈 CRV (+15%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $241.56, down 3.67% on the week.

Thank you to our sponsor Tempus Finance, a permissionless market for AMM-powered interest rate swaps.

Get the best of capital efficient fixed yields sourced from the most trusted DeFi protocols today with Tempus Finance!

🌾 Farm up to +140% APR in Dopex’s Arbitrum yield farms

Dopex is an options exchange on the Arbitrum L2 scaling solution. We’ve examined the project in a previous Alpha Tractor, but if you missed that here’s a quick refresher.

Fundamentally, Dopex relies on doTokens, which are modified Opyn tokens, and works both to optimize liquidity for options buyers and to minimize losses for options sellers.

On the one hand, Dopex optimizes liquidity by fostering Options pools and Volume Pools where liquidity providers (LPs) can earn via market making + DPX rewards. On the other hand, Dopex minimizes losses for underwriters with its rDPX rebate token, which options sellers earn when they incur losses on the protocol.

📌 Don’t miss our Alpha Tractors!

Not an Alpha Tractor subscriber? Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

How to earn in Dopex’s L2 farms

At the moment, Dopex is running a two-year liquidity mining campaign that’s distributing DPX and rDPX rewards to the protocol’s LPs on Arbitrum. The four farms available are:

DPX (single-token staking)

rDPX (single-token staking)

DPX-WETH (Sushi LP token staking)

rDPX-WETH (Sushi LP token staking)

If you’re interested in joining any of these pastures, you can use this Dopex guide to bridge your DPX, rDPX, or LP tokens from Ethereum to Arbitrum. Alternatively, you can acquire the tokens you want directly on Sushi’s Arbitrum deployment. Once you’re ready to proceed, you would follow these steps:

Go to https://app.dopex.io/farms.

Connect your wallet and connect to Arbitrum.

Next go to your farm of choice and click “Stake.”

Input the amount of tokens you want to stake and then select “Approve” to complete an approval tx. Once that’s done press “Deposit” and complete the supply tx, and voila! Now you’ll be earning DPX and rDPX rewards.

Note: the highest-yielding opp right now is the rDPX-WETH farm, which is currently fetching +140% APR for stakers. Also keep in mind that you can unstake through the same interface you staked through.

Dopex has been audited, but it’s also a young project and all young projects in DeFi should be approached first and foremost as experiments. That means do your own research, understand the risks, and never invest more money than you can afford to lose.

Auto Router V2

TLDR: Uniswap unveils a range of new features that will “improve pricing and optimize gas costs of swaps” for traders.Tornado Cash introduces arbitrary amounts & shielded transfers

TLDR: The Tornado privacy project presents the details of its new Tornado Cash Nova pool system.L2 Scaling is coming to Element

TLDR: Fixed-rates protocol Element Finance announces plans to deploy on the Aztec Network scaling solution.Say hello to Newt

TLDR: Aave announces Newt, the project’s new research and development arm.ConsenSys partners with Mastercard

TLDR: ConsenSys and Mastercard team up on ConsenSys Rollups, an enterprise-grade scaling solution for Ethereum Virtual Machine (EVM)-compatible blockchains.Balancer launches Boosted Pools to increase LP yields

TLDR: Balancer unveils its new Boosted Pools system, with Aave Boosted Pools being the first offerings.

🚜 Yield DPI with your DAI in Vesper Earn!

Vesper Finance just introduced Vesper Season Two, and at the heart of that rollout is the launch of Vesper Earn on the main Vesper app.

Vesper Earn does DeFi in a new way, namely via programmable yield. In other words, users can deposit one crypto into this system, like ETH, and earn yield in another crypto, like DAI.

This is an unprecedented yield format, and it opens up interesting possibilities for farmers. For example, you can deposit DAI to buy DPI daily without having to sell your underlying holdings!

Depicted above, the 5 inaugural Earn Pools are offering additional VSP rewards on top of their base earnings rates. These opportunities just launched, so expect these rates to fluctuate going forward, but they’re certainly worth taking a look currently.

If you’re interested in trying out these pools, head to the Vesper app and connect your wallet. Scroll down to your Earn Pool of choice, click “Deposit,” and input how many tokens you want to supply. You’ll press “Deposit” again and carry out 1) an approval tx and 2) a supply tx, and that’s it! Then you’ll be farming in style.

Vesper has been audited multiple times and is run by a public team. However, there are no ultimate guarantees in DeFi. Always do your own research, and never invest more money into any project than you can afford to lose.

Note: Although Vesper is our partner, the curation of the DeFi Pulse Farmer is conducted with editorial independence. These yield pastures were selected for this week’s Conservative Farmer because of their novelty.

The Fei-Rari Merger has officially entered the on-chain governance process.

Aave votes on integrating HAL, which is designed for building and tracking automated workflows.

Shopify announces an NFT beta program for its Plus merchants.

Adidas launched “Into the Metaverse,” a limited-edition NFT series.

Sudoswap releases a post-mortem on an incident with the EtherOrcs project.

NFT Charts is a platform for easily visualizing NFT trading data. The platform offers an “Overview” page for comparing metrics across a range of NFT projects; it also provides bespoke stat dashboards for individual collections, e.g. the Bored Ape Yacht Club.

What’s going to be big in DeFi next year ? 🤔

I’m guessing 2022 will be an even busier year for DeFi than 2021 was. Accordingly, some areas I’m expecting notable growth around include:

Old and new DEXes

Top yield aggregators (e.g. Yearn with its leading strategists)

L2 liquidity (spurred on by liquidity mining campaigns)

Fixed-rate protocols (like Notional Finance, Element Finance, etc.)

And more!

Ultimately, though, there’s no telling how next year will precisely unfold. Some of the advances that are to come may totally surprise us, at least from where we’re standing now!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!