👨🌾 Farm up to ~150% APY with Netswap and put your stables to work on Avalanche!

Also, read about the new OpenSea regional restrictions & more DeFi updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond!

If you want to access the full DeFi Pulse Farmer experience to receive emerging yield farming opportunities sent to you throughout the week, subscribe today!

- Guneet Kaur, DeFinn

🦀 DeFi TVL crabs — On Mar. 07th, 2022, the total value locked (TVL) in Ethereum DeFi projects was $73.69B according to DeFi Pulse, basically the same value we saw a week ago.

😳 Driving crypto news this week — LUNA flipped Ether in terms of staked value, OpenSea restricts sanctioned individuals

There are currently 226,325 LUNA stakers, making it the second-most staked crypto asset, with more than four times the number of people staking ETH, with 54,768 stakers. LUNA is expected to yield over 6.98% in annual staking payouts, while ETH is expected to yield 4.81%. So, if you are looking for a passive income asset, you know which one to go for now!

Many OpenSea users like Iranian NFT artists "Bornosor" and "Khashayar Sharifaee" were blocked from using the platform in line with the U.S government's certain sanctions against the restricted countries.

But it’s always good to remember that this has nothing to do with Ethereum’s decentralization aspect:

💸 This week’s best-performing assets — Since Monday, Feb. 28th, we’ve seen notable week-over-week price rises from these DeFi tokens:

📈 UMA (UMA) +61.80%

📈 Kyber Network Crystal(KNC) +28.7%

📈 KeeperDAO(LUNA) +28.20%

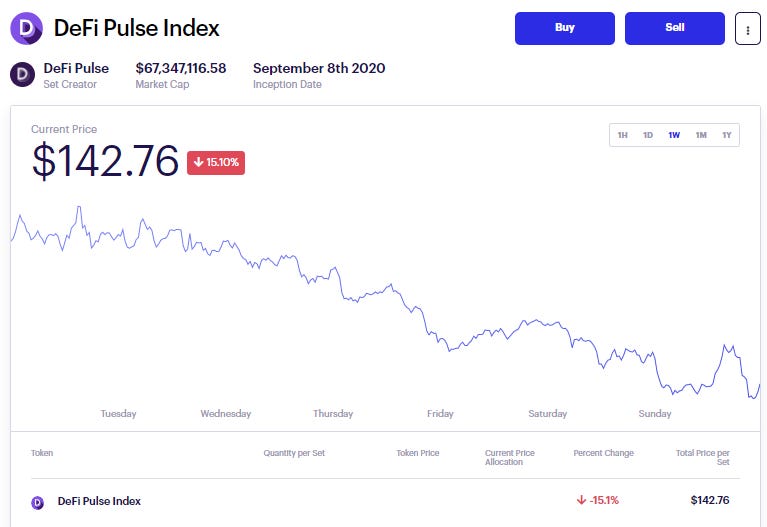

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $142.76, decreased by 15.10% since Saturday, Mon. 28th.

⁉️ Did you notice this edition went on a different day than usual?

🌾 Farm up to ~150% APY with Netswap!

Netswap is a decentralized exchange, specifically a fork of Uniswap V2, that operates on the Metis Andromeda network.

If you’re unfamiliar with Metis, it’s an optimistic rollup layer-two scaling solution that was forked from the Optimism L2 codebase.

As such, Netswap offers traders fast and low-cost transactions on Metis’s L2 infrastructure, and the project emphasizes community-driven development and the “fair and open distribution” of its native NETT token.

The NETT distribution began on Jan. 9th, 2022, and on Feb. 14th, 2022 the Netswap community activated a NETT emissions reduction. Yet, Netswap is still set to distribute +20,000 NETT per day to its incentivized liquidity pools until next year.

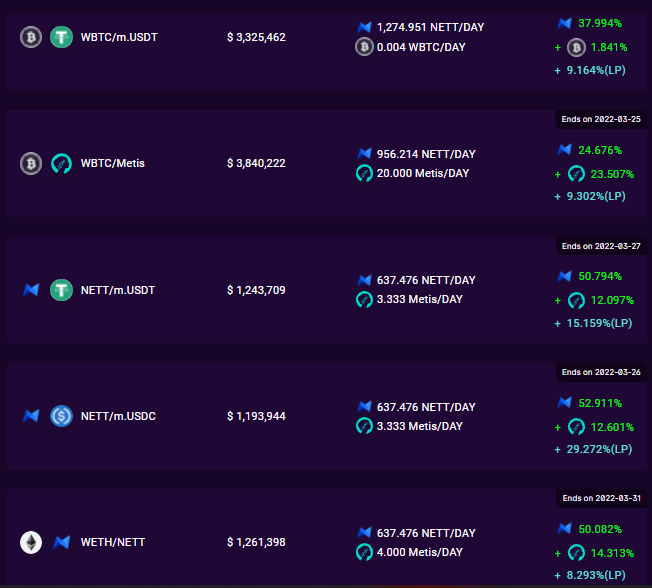

As you can see above, there are opportunities with higher impermanent loss risk but also highly incentivized as the WETH/NETT pool (which we’ll use as example below), or a more conservative but also with really attractive incentives as the WBTC/m.USDT pool.

How to join Netswap’s WETH-NETT LP Vault

Before diving into this LP token staking opportunity, note that Metis requires its native METIS token to pay for gas instead of ETH.

You can bridge METIS and other tokens like ETH (which will specifically become wrapped ETH, or WETH, on Metis) to the Metis L2 using the official Metis Bridge. On the Ethereum “L1,” you can find METIS liquidity on Uniswap V3.

It should only take a few minutes for your tokens to bridge to Metis, but withdrawals can take up to seven days if you go through the official Metis Bridge. If you want to make quick withdrawals, e.g. METIS back to Ethereum, you can use a “fast bridge” like the Celer cBridge.

Also, you’ll need to have Metis added to your browser wallet (MetaMask could be a feasible option), so you can use Chainlist to add “Metis Andromeda Mainnet” if you haven’t already.

After you’ve bridged funds over and have your wallet ready to go, you could consider the following yield farming strategy:

Use Netswap’s Swap page to acquire your desired amount of WETH and NETT liquidity. You will have to connect your wallet and connect to Metis first.

Next, add your desired amount of liquidity through the WETH-NETT pair on Netswap’s Pool page.

After your deposit transaction completes, you will receive Netswap LP (NLP) tokens in your wallet.

Go to Netswap’s Farm page and click on the WETH-NETT option.

Press “Approve” and complete an approval transaction to let Netswap use your funds.

Once the approval transaction goes through, input the amount of NLP tokens you want to stake and press “Stake.”

After the staking transaction completes, you’ll automatically start accruing NETT and METIS rewards.

Keep in mind that you can unstake through the same UI you staked through and that you instantly collect your token rewards whenever you unstake. Afterwards you can unwind your LP position through the Netswap Pool page anytime.

Netswap has been audited. However, this L2 DeFi staking opportunity entails market risks, impermanent loss risks, smart contract risks, and more. Treat this yield farm as experimental, and never deposit more money than you can afford to lose.

Thank you to our sponsor Tally, the first DeFi wallet owned by its users.

Try Tally Swaps before the DAO launches!

Ukraine has canceled the 'Airdrop' of cryptocurrency rewards in exchange for donations

TLDR: So far, more than $33 million has been raised in cryptocurrency donations. To fund the military, the country will shortly issue nonfungible tokens;Andre Cronje and Anton Nell to retire from crypto development; TLDR: Founders of Yearn Finance, Solidly, Keep3r and other protocols, Cronje and Nell announce the end of their public contribution to crypto space;

Ethereum's flywheel is knowledge

TLDR: Ethereum will fund $750,000 to explore various domain areas related to the Ethereum blockchain;ZKTech grants in GR13

TLDR: The ZKTech side round of GR13 will be held on gitcoin.co/grants and will be open to all grantees who meet the criteria;Lido Finance staking for Polygon is here

TLDR: Stake your MATIC with Lido to earn stMATIC tokens, which can be exchanged, transferred, and utilized throughout the Polygon DeFi ecosystem.

🚜 Earn 29% with Curve’s aTriCrypto on Beefy Finance

Put the strongest slice of your crypto portfolio to work with Curve + Beefy Finance!

Curve’s triCrypto pools are probably the first choice of many experienced (and long-term bulls) yield farms in DeFi. Through these pools, liquidity providers will be investing equally in ETH, BTC and stables (DAI, USDC and USDT).

To help minimize the impermanent loss risk and give an extra boost to this portfolio, Beefy Finance, a decentralized, multichain yield optimizer, is offering an attractive APY on top of your aTriCrypto LP on Avalanche.

Interested in trying this opportunity? You could:

Setup Avalanche on your Metamask;

Provide liquidity to aTriCrypto pool on Curve;

Stake your LP on Beefy Finance

Beefy Finance has been audited, but there are no ultimate guarantees in DeFi. Always do your own research, and never invest more money into any project than you can afford to lose.

Aave: ARC Add support for CVX

Sushi: Samurai v2 [Implementation]

Uniswap: Consensus Check - Should Uniswap governance contribute funding to the Nomic Foundation?

Spookyswap: Increase Spookyswap trading fee to 0.25%

Spookyswap: Prop-017 - DAO Funding Request, CEX, Market Maker

Portfolio diversification helps investors protect themselves against large movements in the cryptocurrency market by offsetting exposure to a single holding. But, doing so is such a hassle. Isn't it?

DeBank, DeFi dashboard, is such a relief to the hodlers, by which they can track their DeFi portfolio, with data and analytics for decentralized lending protocols, margin trading platforms, stablecoins, and DEXes. In addition, DeFi investors can manage their assets across 19 different blockchain networks, including Ethereum, Chronos, Polygon, and HECO.

Will DeFi Summer come back?

NFTs have undoubtedly gotten the most interest in the crypto sector in 2021.

While some market observers predicted their increase in popularity and adopted NFTs some time ago, most of us were caught off guard by their rapid adoption among traditional and crypto-native players.

Even the burgeoning DeFi industry was eclipsed by the craze for apes, punks, and rocks.

However, I believe that DeFi will resurface this year, experiencing a second “DeFi summer” as it did in 2020, mainly for two reasons:

in a sideways or adverse market condition, yield opportunities are likely to be more sought after; and

the establishment of a compliant version of DeFi, which I will refer to as CDeFi

- Guneet Kaur.

All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information (which does not account for specific goals or financial situations) and links provided to third-party sites are for informational purposes. Such sites are not under the control of DeFi Pulse, so DeFi Pulse or the author are not responsible for the accuracy of the content on such third-party sites. Be careful and keep up the honest work!