👩🌾️ Harvest Tokemak’s TOKE and catch up on Reflexer’s Rai/Dai Uniswap V3 farm!

Also, learn about the crypto push to please Washington D.C. & check out the stories of the week + the governance watcher! 👀

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

📈 DeFi TVL gains $6B — Ethereum DeFi continues its growth streak, as the total value locked (TVL) in the ecosystem has reached $98.69B. That’s a climb of $6B since this point last week; additionally, we’re now just a few billion away from the previous all-time high of $99.5B. It seems +$100B may soon be in the rearview mirror 🚜

🏛️ Crypto policy driving the news — As regulators are starting to take crypto more seriously, it’s time for DeFi projects to get proactive in kind. Uniswap Labs, the creators of Uniswap, did precisely that this week by hiring Hari Sevugan.

That’s because Sevugan, a former spokesperson for Barack Obama’s 2008 presidential campaign, is a veteran of Washington D.C. and will be able to help Uniswap capably engage with government officials. With Coinbase and FTX also making overtures to U.S. regulators in recent days, it’s clearer than ever that big DeFi-linked orgs have D.C. on the brain.

🟠 SEC approves bitcoin futures ETFs — America’s getting its first bitcoin exchange-traded funds now that the U.S. Securities and Exchange Commission (SEC) has greenlit the offerings. The move brings bitcoin that much further into the mainstream financial system and could bring major interest to crypto going forward.

💸 This week’s best-performing assets — Since last weekend, we’ve seen notable runs from the following top DeFi tokens:

📈 KEEP (+58.2%)

📈 ALCX (+50.3%)

📈 CVX (+48.4%)

📈 PERP (+32.4%)

📈 OHM (+26%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $352.75, a gain of 3.39% on the week!

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

🌾 Farm TOKE while you wait for Tokemak Reactor pastures!

Tokemak is a decentralized market making protocol.

Check out our Protocol Express on Tokemak from last week to get fully up to speed on the project. For starters, though, you can think of it as a grand in-progress liquidity hub for DeFi.

The ultimate goal for Tokemak, then? To democratize and make transparent liquidity provisioning, thus to ensure players beyond the biggest centralized entities can meaningfully participate as DeFi LPs.

Accordingly, at the heart of Tokemak is what’s known as token reactors. Every token that the Tokemak community approves gets its own bespoke reactor, which can then be used to provide “broadband liquidity” to projects across DeFi.

These reactors rely on liquidity directors (LDs) who vote with TOKE tokens to decide where a given reactor’s liquidity should be pointed to.

Tokemak’s first reactors are still in the process of coming online, but there are already TOKE farms available for your consideration!

How to yield farm TOKE

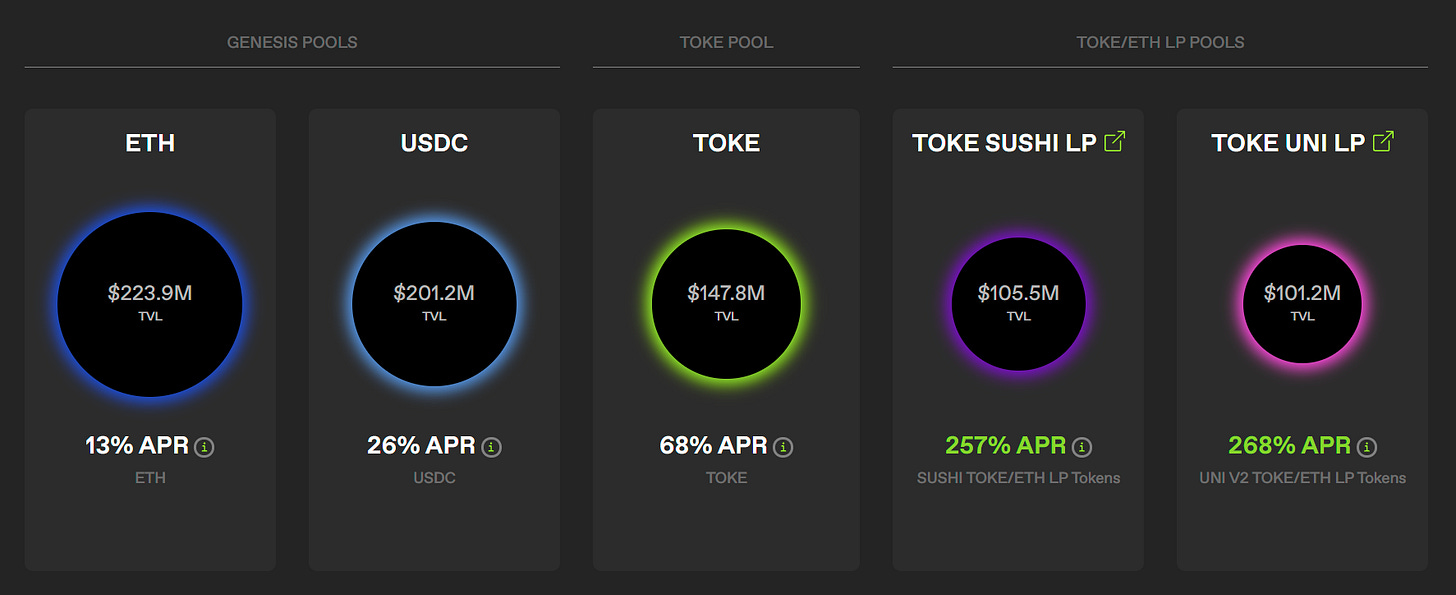

Ahead of the launch of token reactors, you have five potential TOKE farms to choose from.

Three of these are simple staking pools (for ETH, USDC, and TOKE respectively) in which you deposit the required asset and can then start farming TOKE.

For these opportunities, you know the drill: head to Tokemak, connect your wallet, approve Tokemak, and then deposit how much ETH, USDC, or TOKE you’d like to. Voila.

It’s the other two opportunities — Sushiswap’s TOKE/ETH pool and Uniswap V2’s TOKE/ETH pool — that are a bit more risky and complicated.

That’s because for these pastures you have to first provide liquidity to the designated pool, and then you have to stake your ensuing LP tokens. LPing with TOKE has non-trivial risks of impermanent loss due to the voting dynamics around TOKE, so just keep that in mind!

Tokemak has been audited, but audits aren’t full-proof. Approach Tokemak as an experiment where your deposits will be at risk, and only try participating after you’ve done your own research. Lastly, never yield farm with more money than you can afford to lose!

Do you want to dive more into Yield Farming opportunities? Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

UniSync: a Uniswap V2 port on the zkEVM

TLDR: Matter Labs deploys Uniswap V2 on zkEVM, marking the first time a full application has been implemented on an EMV-compatible zk rollup.C.o.R.E. Stats at a Glance

TLDR: Tokemak breaks down the key stats around the project’s inaugural round of C.o.R.E. voting.volmex.finance v1 is live on Arbitrum!

TLDR: Volmex Finance announces the arrival of its V1 system on the Arbitrum One optimistic rollup.Indexed Attack Post-Mortem

TLDR: Indexed Finance details the key events surrounding the $16M hack the project faced this week.KyberDMM Launches Dynamic Trade Routing

TLDR: KyberDMM rolls out dynamic trade routing, which allows traders to source trades across multiple decentralized exchanges simultaneously.The Future of Ren

TLDR: Tokenization project Ren introduces Ren Labs, which will focus on building out a 3rd-party app ecosystem around the RenVM.Pods Finance is Live on Ethereum Mainnet!

TLDR: Previously only available on Polygon, the on-chain options protocol is now also available on mainnet.

🥒 DeFi Pulse Power Tool: Pickle Jars on Arbitrum 🥒

This week step your farming up a level - figuratively and literally - with our sponsor Pickle Finance. That’s because you can now make use of layer-two Pickle Jars on Arbitrum!

Pickle Finance is a yield aggregator whose Pickle Jars compound depositors’ returns via cross-protocol yield strategies. The idea is to automatically and passively reap interest from top DeFi opportunities. Head over to the Pickle Jars to start yield farming on an L2 today!

Disclosure: This section is part of our paid promotional Partners Program; We’ve partnered with Pickle Finance to help educate and inform the community about the yield aggregator. As always, we’re committed to providing the entire community with quality, objective information, and any opinions we express are our own.

🚜 Farm +120% APR with Reflexer’s Rai/Dai Uniswap V3 pool!

Is Rai the one true stablecoin? The token’s creators, the Reflexer team, passionately argue so.

That’s because Rai isn’t pegged to an external currency like the USD, which can inflate and deflate. Instead the Rai is stable unto itself, relying on just ETH collateral and on its own internal algorithm to maintain price stability instead of an external price peg.

So Rai is very decentralized and very stable. For Reflexer, the name of the game now is evolving the Rai into a bona fide world currency, and to do that they’ve got to ensure the token gets into as many peoples’ hands as possible.

Accordingly, Reflexer’s currently incentivizing the Uniswap V3 RAI/DAI liquidity pool with FLX, the project’s “ungovernance token,” to get more people to use Rai early on.

Note, this opportunity is comparatively riskier than most of our previous conservative farms because you have to mint Rai and then LP with it on Uniswap V3 to qualify for the +120% APR in FLX rewards right now. This minting puts you at risk of liquidation if the market goes south! With that warning in mind, here’s a full guide on joining this pool.

Reflexer’s smart contracts have been audited, but you can never be too safe in DeFi. Make sure you do your own research, and only farm with money you can afford to lose.

MakerDAO signals support for adding stETH (Lido Staked ETH) as a new Vault type.

MakerDAO begins collaborating on a “Real-World Sandbox” project.

BarnBridge discusses using Olympus Pro to accumulate BOND/ETH liquidity.

Mainstream cloud gaming platform Steam is removing NFT games from its service.

NFT20 creators Very Nifty build CUDL Bridge to help players easily play Cudl Finance on Arbitrum.

NFTX kicks off a Fuse Pool with $4M worth of PUNK and NFTX tokens.

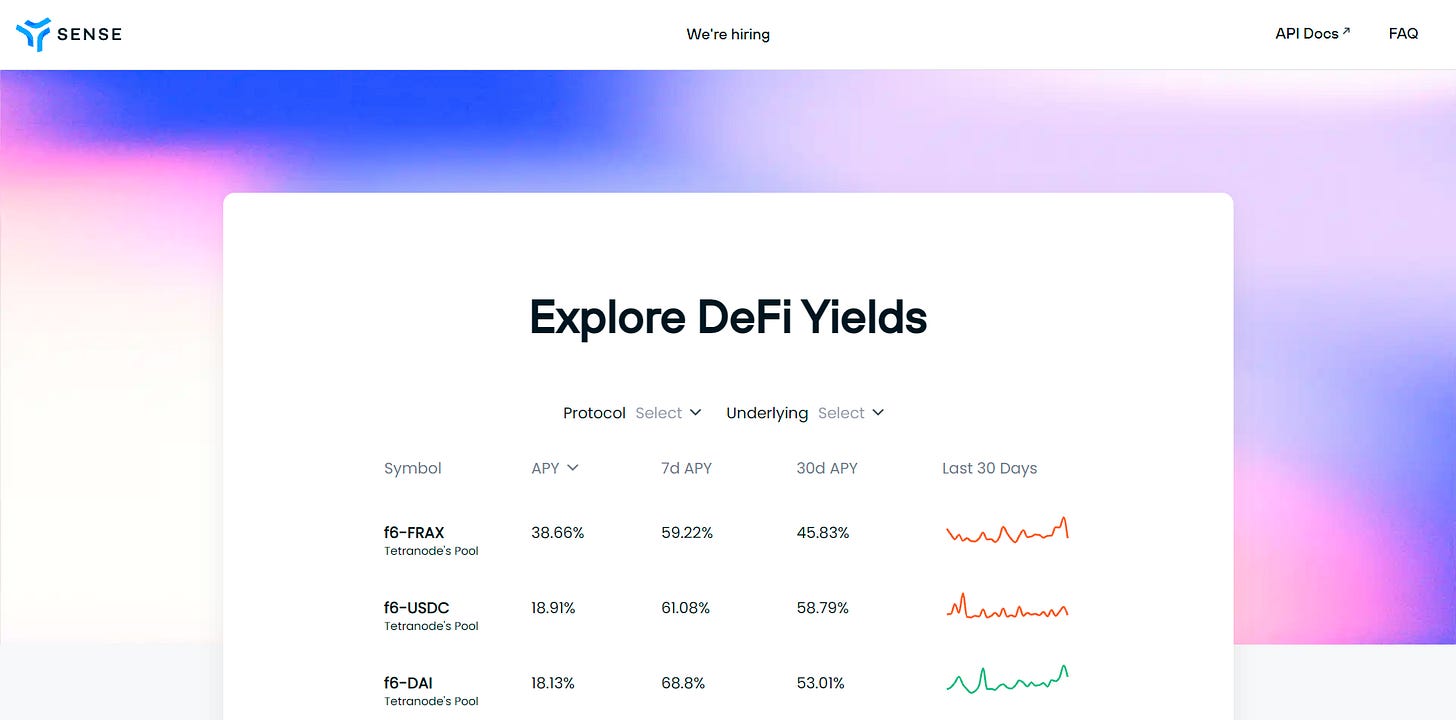

Hunting for yields in DeFi? Then it’s important to consider how yield opportunities have performed in the past, not just how they’re currently performing. Toward that end, a great tool is Sense Portal. Created by Sense Protocol, this hub lets you easily track DeFi yields as they change over time.

Is DeFi 2.0 a useful meme? 🤔

I think it’s a mixed bag; it can be good and bad!

At its best, the meme hails a new wave of promising DeFi projects. At its worst, it’s a loaded term used by competitors to suggest that veteran protocols have become outdated.

In zooming out, what I would stress is that every project in DeFi is best understood as an experiment that is continuously evolving. And there are things that will happen in the future that we can’t anticipate now, which in turn will cause further evolutions that we can’t anticipate yet.

That said, the verdict is still out for every protocol. It’s too early to fairly consider DeFi’s original dreamers as outdated. In a very real sense, their dreams have only just begun.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!