🏹 Hold your keys

Also, read about yield farming, difficulty bomb delay and Vitalik’s thoughts on blockchain technology’s use cases beyond non-financial applications.

By now, you’ve probably heard about Three Arrows Capital insolvency rumors, right? These rumors have been going around for a time now, and I personally believe that their liquidation might be done already, or almost done.

If you’re a retail investor, my tip for you is: stay calm. Take this time to do a proper risk management analysis on your portfolio and, specially, risk management related to leverage (longs or shorts!). Don’t try to hit tops or bottoms, stay away from traders if this is not your 24/7 job.

But….buuuut….if you work for a DAO, a want a minute from your attention for this update on 3AC news:

Apparently, a few protocols that received investment from the hedge fund revealed that they’ve also received a proposal of treasury management services. Think this way: your emergency reserve money, the part of your portfolio that plays a strategic critical place in your risk management in case something happens, that will be the one responsible to keep your DAO running during the winter… you just handle it to someone else. What are you even doing in DeFi if your most critical reserve is being managed by a centralized entity? This is a practice kind of common in TradFi VC world where there is an extra value added by the venture company, but well, you know, it’s highly regulated.

From a New Mental Model for Defi Treasuries, by Hasu (strongly recommended), we’ve learned:

Native tokens are not assets (to be counted in the treasury);

Build a treasury that will last you 2-4 years even if the entire market collapses by 90% and stays there for some time;

DAO treasuries should understand their application-specific liabilities and hedge them.

DAO treasury management research and discussion will be brought to surface, and probably professional services and tools will arise….but for now I would recommend to keep control of your keys. - DeFinn

😳 Driving crypto and DeFi regulatory updates

NYC Mayor Eric Adams speaks out against PoW mining ban legislation

EU Nears agreement on crypto regulations, the report reveals.

Binance US faces court action for the sale of LUNA and TerraUSD

Russian Parliament to review Bill prohibiting crypto payments.

The Lithuanian government has approved a bill to tighten regulation of the cryptocurrency.

Ripple counsel slammed SEC for trying to bully, bulldoze, and bankrupt crypto

👀 Regardless of the regulatory chaos, Ripple CEO Brad Garlinghouse gave a high-five to Draymond Green. Isn't it awesome to see that his “calling is higher?”

🎯 The Sector Pulse

Crypto market sentiment trough Scalara’s indices.

📉 DeFi Pulse Index (DPI): $68.55 (-27.4%)

📈 Inverse ETH Flexible Leverage Index (iETH-FLI-P) - $196.15 (+35.21%)

👉 Also Read: What is the PONY stablecoin yield index??

👀 Latest News you shouldn’t miss:

Railgun v1.0 is live on ETH, BSC and Polygon.

Near becomes MetaMask compatible.

Ethereum price entered ‘oversold’ zone for the first time since November 2018.

Goldman Sachs executes its first trade of Ether-linked derivatives.

Have a big blockchain idea? You could get $100,000 to develop it.

Splyt and Binance partnered to offer ride hailing services and experiences within the Binance app.

JPMorgan wants to bring trillions of dollars of tokenized assets to DeFi.

Gitcoin grants R14 has begun, and is live until June 23.

The difficulty bomb is delayed for two months😳: What does it mean for “The Merge”?

The difficulty bomb is intended to reduce mining profitability in order to dissuade miners from participating in the long-awaited Merge. According to Ethereum core developer Tim Beiko in a Sunday tweet, the delay was set to two months to "be sure that we sanity check all the numbers before selecting an exact delay and deployment time."

While Ethereum developers have not given a definite date for the Ethereum Merge, key engineer Preston Van Loon indicated August. Delaying the difficulty bomb, on the other hand, may cause more Merge delays. However, the Merge could happen before August 2022, according to the latest EIP-5133 proposal. Moreover, Ben Edgington, another core developer, tweeted that "We say it won't delay the Merge. I sincerely hope not."

Okay, enough of the difficulty bomb delay stress! I hope that the following information will cool you down a bit 💧.

Stay tuned for further updates in the DeFi Pulse's upcoming newsletters.

Celsius pauses withdrawals: Is there any red flag here?

All withdrawals, swaps, and transfers between accounts have been halted by Celsius Network. As a result, users' funds are effectively frozen, despite the company's pledge that "acting in the best interests of our community is our first concern." Amidst the crypto market chaos, Alex Mahinsky tweeted not to create FUD. But, is there any red flag here?

Celsius has taken out a DAI loan with a current collateralization ratio of 195.93% and $545 million in locked WBTC as security. They have a liquidation price that is 26% lower than the current BTC price, and if they hit it without adding more collateral, their whole stake worth over $500 million will be liquidated on-chain. The worrying part is that Celsius has already added collateral to the loan many times in the last few days instead of repaying it.

Another is that, just before they ceased withdrawals, the company moved $320 million to FTX without disclosing it or giving the public advance notice. Perhaps more concerning is the fact that the corporation has been completely silent since the announcement when all of its users are concerned about their ability to access their funds.

Ethereum crypto crash reason: Lido Staked ETH may cause a massive crypto crash

TLDR: In the last 48 hours, the price of Lido Staked Ethereum (stETH) has deviated dramatically from the price of Ethereum (ETH). However, the stETH token is designed to be a 1:1 peg to ETH in theory;Biggest Ether staking service has a centralization problem

TLDR: The concentration of more than 4 million Ether deposited through Lido, or 32 percent of the total amount staked in the token, raises warning flags. Critics claim that a single entity with a large amount of Ether could pose a security danger to the network;$500M of on-chain collateral will face liquidation if ETH falls

TLDR: On June 12th, Glassnode announced that on-chain HODLers in losses have dramatically climbed. According to parsec finance, approximately $500 million in on-chain collateral will be liquidated if ETH goes below $1,150. Also, if wBTC does not have more than $300 million in on-chain collateral, it will be liquidated;Vitalik Buterin: Where to use a blockchain in non-financial applications?

TLDR: Blockchains are just immensely easy for inexpensive and reliable data retrieval, with data retrieval remaining possible whether the application has two users or two million; Vitalik mentioned this technology as one of the use cases beyond non-financial applications.

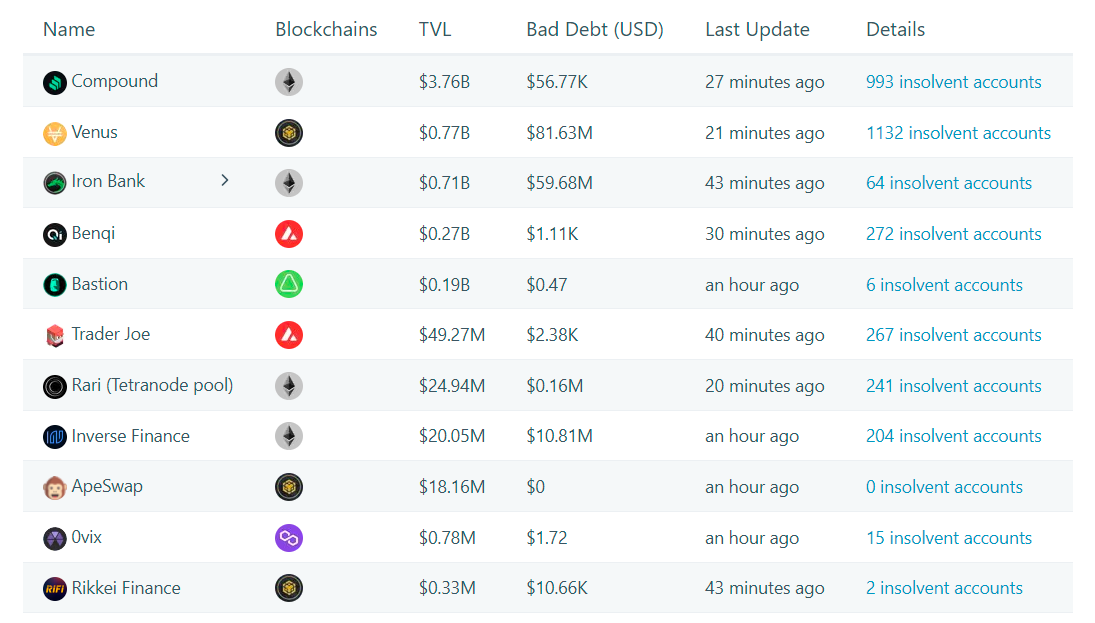

Risk DAO's bad debt dashboard checks all user debt and collateral regularly, and once user debt exceeds user collateral, it is added to the platform's overall bad debt (i.e. insolvent accounts). In addition, the dashboard keeps track of bad debt across all Compound protocols.

What is yield farming? A beginner’s guide to passive income in DeFi

Yield farming is a way for people to generate passive income by providing liquidity, i.e., cryptocurrency deposits, to DeFi liquidity pools or staking pools. In short, users lock up their money into a participating DeFi app, and in exchange for this service, the project automatically pays these “yield farmers” in crypto rewards over time.

Sounds exciting?

How to mentally survive a bear market

Remembering the “raison d'être” of the decentralized movement

Our world is witnessing an unprecedented period of uncertainty, and its foundations are shifting so fast that even the most “trusted” institutions we know are showing cracks under pressure. All those tensions have spilled over into global markets and naturally this has translated into even more volatility in the crypto space.

These are very difficult times to navigate, but without any doubt, it is during these times that the resiliency of open & decentralized systems we built over the last few years will emerge.

Let us not forget that we are here to build a fairer, more resilient and transparent digital economy where nobody gets left behind and let us all play our parts in getting there! - Nassim Ghorayeb (Partnerships @defipulse)

All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information (which does not account for specific goals or financial situations) and links provided to third-party sites are for informational purposes. Such sites are not under the control of DeFi Pulse, so DeFi Pulse or the author are not responsible for the accuracy of the content on such third-party sites. Be careful and keep up the honest work!