🟪 PolyPulse #17 : BUIDL your PolyScore

Also, read more about $20M commitment of Polygon to Eliminate Carbon footprint in 2022

After dramatic increases over the past four weeks (Mid March to April beginning) , the active user count dropped in the second week of April. The primary reason for such a drop was reduced engagements in the gaming arena. However, there was a 20% week-over-week increase in transaction per user numbers. The Polygon developer ecosystem continues to lead the way with solid contract deployment and new developers.

Aavegotchi (+1008%), Quickswap (+51%), and Sunflower Farmers (+285%) saw tremendous growth in transaction numbers. Aavegotchi and Quickswap saw the increase due to newer deployments. Sunflower Farmers, a game that clogged the Polygon network due to bots taking over the game, has been re-deployed with improved features and security. Hence, the organic users seem to come back to play the game.

Another significant update to disclose is the gas fees saved by Polygon. The gas fee saved by using Polygon last week had been $53.55 Million daily ($17 per Txn). Imagine paying all these gas fees on Ethereum.

The major dApps to highlight this week based on unique users and total transactions are:

Polygon also partnered with KlimaDAO, a decentralized collective of environmentalists, developers, and entrepreneurs, widely recognized as the most high-profile proponent of facilitating the nascent on-chain carbon market. Polygon will purchase the credits via KlimaDAO's on-chain carbon market, Klima Infinity, and retire them using its offset aggregator decentralized app.

KilmaDAO will also analyze the Polygon network's energy footprint and support its emission management and mitigation strategy. The analysis will include emissions from staking node hardware, the energy consumption of staking operations, and contracts directly interacting with the Ethereum mainnet. Polygon has also commissioned the Crypto Carbon Ratings Institute (CCRI) to audit its carbon footprint.

This is part of a broader vision for sustainable development that includes the plan to achieve carbon-negative status in 2022. Polygon is also creating a climate offset vertically within its ecosystem. It has pledged $20 million to a series of community initiatives, including funding projects that utilize technology to combat climate change.

What if transacting on the Polygon chain could build your score and ultimately get you more benefits without doing anything else? Introducing Polygon Score (PolyScore), a composite score to attract and reward users for their activity on the Polygon PoS chain.

How is Polygon Score created?

Polygon Score comprises two metrics:

Engagement: Engagement is measured by the number of transactions one has done in the last two weeks on the Polygon PoS chain.

Retention: Number of weeks in the last ten weeks that you have engaged with Polygon!

Where can PolyScore be used?

If you are a dApp: You can use the documentation to learn more about using the PolyScore to reward the users who have high engagement on your dApp.

If you are a user: Many benefits are going to be available based on your on-chain score. Many dApps have started to integrate the score to enable the top users to earn more rewards.

How can you check your PolyScore?

You have to visit the website and log in with your wallet address to see the score.

The Polygon Village is finally live. What is in it for you? Read the information below to find out more.

Polygon DAO has announced the launch of Polygon Village, a full-stack ecosystem for developers to build and grow. Polygon DAO aims to decentralize, grow and innovate the Polygon community. As part of Polygon Village, projects building on Polygon will access all services and offerings ranging from hosting, audit services, infrastructure & API-related services, talent discovery, and much more.

Key components of the Polygon Village:

Welcome vouchers, and let its partners jumpstart their project.

Shared grants, when you have started your journey, receive grants and vouchers to accelerate your project further.

Village talks, Educational sessions, and Polygon will showcase projects from our ecosystem; projects that win a spot here will receive access to the alumni network and awards. Our goal is to support your project with external partners such as accelerators or VCs.

Bounty board, outsource your one-off tasks to our community members using our bounty board.

Job board, need to hire talent for your project? Leverage the reach of Polygon by mirroring your positions to our job board.

Learn more about Polygon Village and join the community in Polygon DAO. We want to build the future of web3 with you!

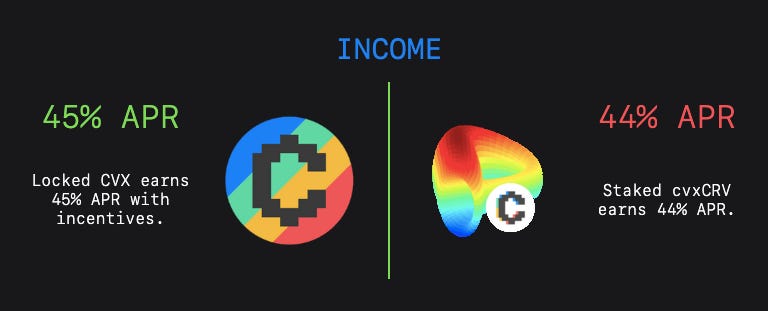

Exploring a ~46% APY strategy with CRV on Polygon

Users with smaller wallets are not able to participate in the curve wars due to the high cost of transactions on Ethereum for claiming cvxCRV staking rewards regularly and also long capital commitments involving locking CVX for 16 weeks and collecting fees and bribes.

However, it is possible to outperform both CVX and cvxCRV staking using CRV (~46%) as the principal asset on Polygon.

Disclaimer: Curve, 1Inch and QiDAO are audited. However, farming strategies entail protocol risks, market risks, smart contract risks, and more. Treat this strategy as experimental, and never deposit more money than you can afford to lose.

Summit DeFi, a Fantom primitive dApp just launched on Polygon with high APR’s.

2. First ever refinancing bridge between Aave and Polygon went live on Instadapp.

3. 3 Million worth of $MATIC LM in partnership with Polygon to drive more liquidity to Uniswap V3 via Arrakis goes live.

4. Gamma integrates with Polygon.

Does DeFi excite Wall Street yet?

This is a question that has been asked to me often, and honestly, the answer is No. Wall Street usually prefers to:

Make high-volume trades and need very deep liquidity.

Have a very high transaction speed.

Trade with spreads as low as ten basis points.

While DeFi has been able to go ahead and provide deep liquidity at some places, the other two parts are yet not solved. First, there are still reasonable amounts of slippage with high volume trades to discourage wall street from stepping foot here. Also, the transactional speeds are not as competitive as the stock and commodity exchanges. We probably will see them deploy massive volumes once we solve these issues.

- Aishwary Gupta

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.