🟪 PolyPulse #28 Polygon Avail Testnet goes live

Also, the latest updates from the Polygon Ecosystem!

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the fourth week of June 2022.

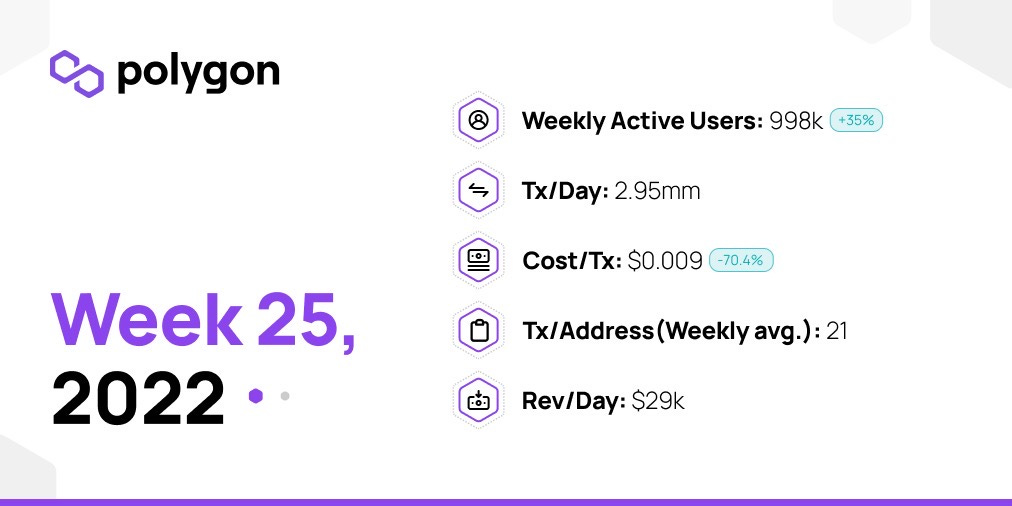

This week Polygon saw a massive surge in the weekly active users (WAU) with week-on-week growth of 35%, and the user count almost touched a million. 1inch (21k, +72%) recorded the maximum growth among DeFi projects in terms of the active users on-chain. The primary reason for this surge is the support from Coinbase for both deposits and withdrawals. With FUD (Fear, Uncertainty, Doubts) around CeFi’s collapse, users prefer to move their funds on-chain to save themselves from losing all their crypto holdings.

As it’s said in the crypto world, “ Not your keys, not your crypto.”

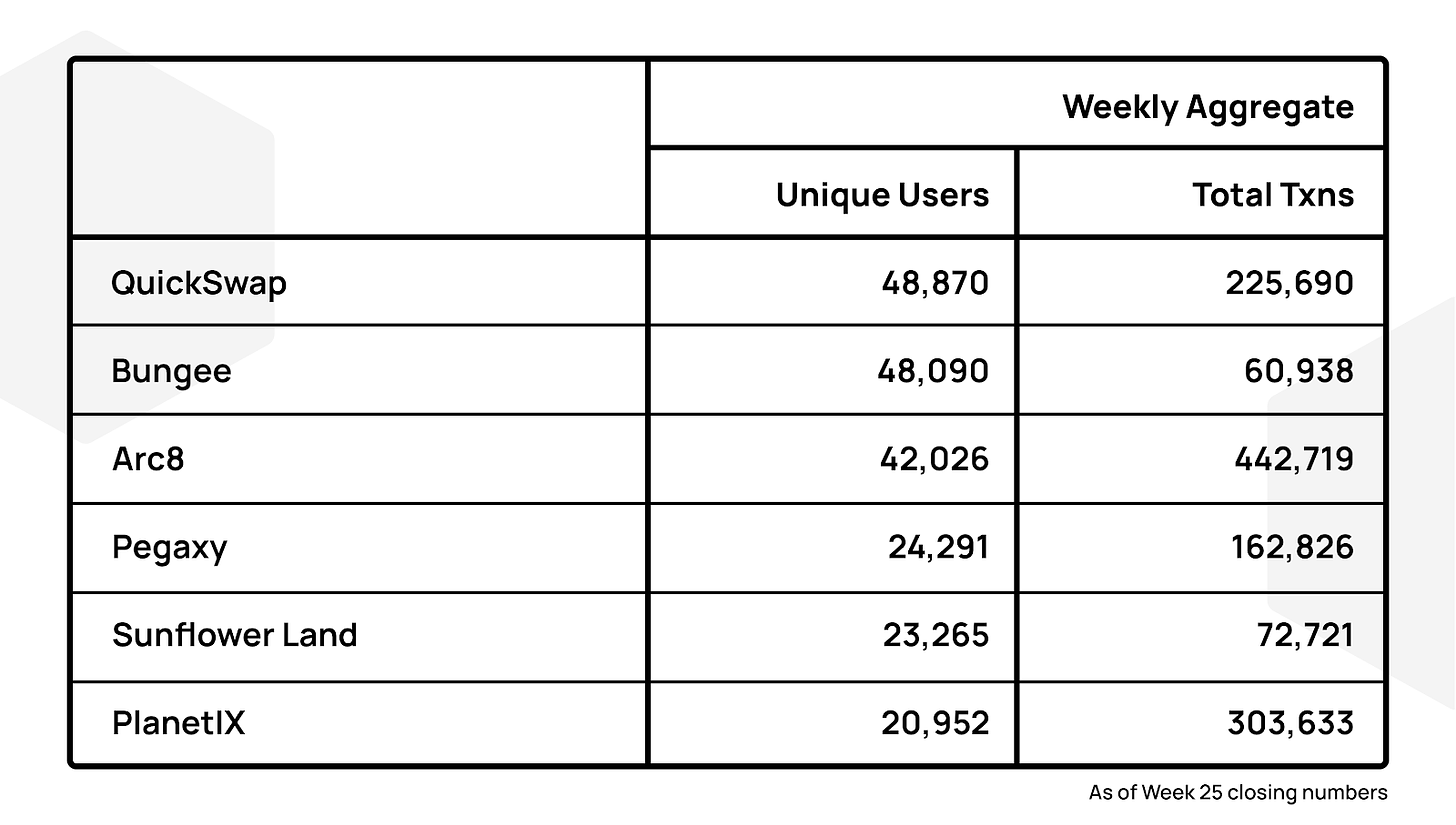

Quickswap remains the most engaging DeFi dApp on Polygon with approximately 225k total weekly transactions and 48k unique users.

Polygon Avail is live on Testnet, which promises to create a modular future enabling more scalability for the Web3 future

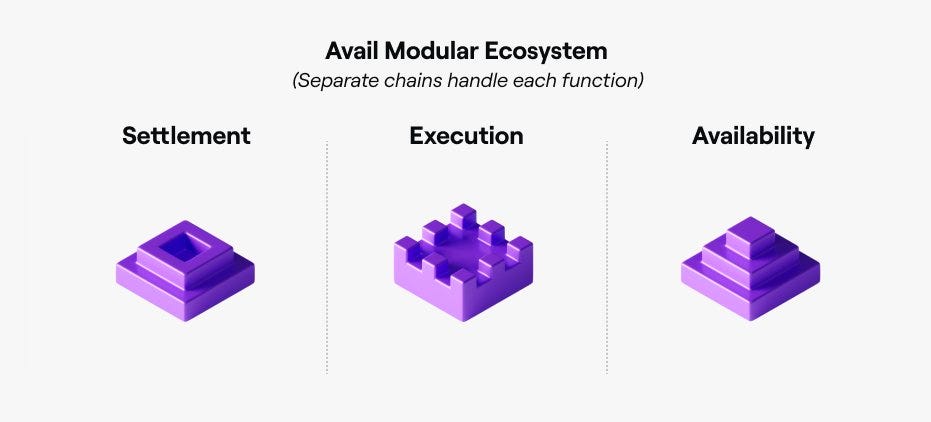

Currently, almost every blockchain performs following three functions:

Data availability: It refers to reaching a consensus on transaction orders and ensuring that transactions are available for verification.

Execution: This function runs transactions and determines state changes.

Settlement: This function ensures final verification and arbitration.

With Polygon Avail, Polygon wants to enable separate chains to handle each function.

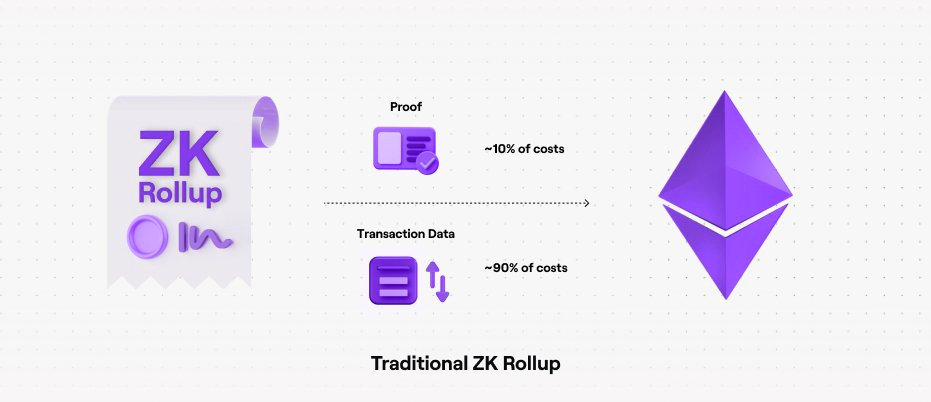

Currently, Layer 2’s reduce the costs of transactions and enhance the speed of execution by moving the execution layer off-chain. However, they still store the data on the primary blockchain.

With Polygon Avail, the users can store this data on Polygon Avail, post proof to primary blockchain like Ethereum and eliminate 80-95% of their costs.

To accelerate the widespread adoption of Web3, scalable blockchains are required to handle a high number of transactions. Moreover, the benefit of outsourcing the data availability function and supporting the needs of hundreds of blockchains at once is a massive thing. Therefore, as the Polygon Avail testnet unveils, we will closely monitor how it helps support blockchain's scalability and matures with time.

Here is a video that explains how Polygon Avail works:

https://blog.polygon.technology/wp-content/uploads/2022/05/FINAL-UPDATE-avail_1.mp4

To read more about Polygon Avail and its testnet, you can click here.

Are you still feeling the impacts of the current bear market? Then, just DAO it

Coinbase began supporting deposits and withdrawals on the Polygon Chain.

Sandbox deploys on Polygon.

Quickswap is partnering with Algebra Dex to deploy concentrated Liquidity.

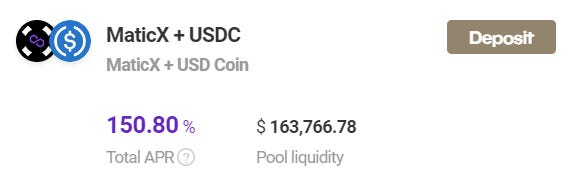

Farm upto 150% APY on Meshswap.

Polygon is kicking off its Lens community.

DeFi needs to raise standards

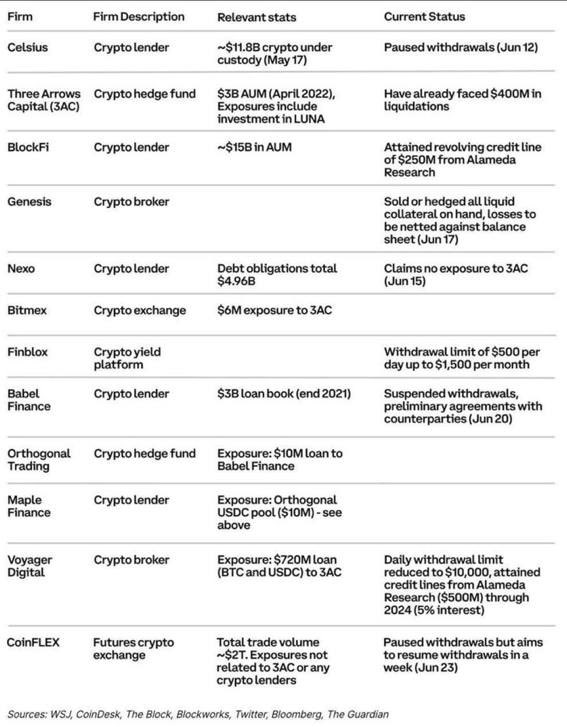

As we witness the turmoil in the Web3 world caused due to Celsius pausing withdrawals, 3AC being sued, and various centralized agencies going under threat due to their risk-averse decision-making, the situation highlights the need to improve DeFi. Therefore, giving out tokens to investors is no longer sufficient for DeFi ventures. Instead, projects' criteria need to be enhanced because DeFi is more than just a small subset of financial transactions.

A DeFi sector that cannot only survive but thrive in a bear market requires incentive-based tokenomics, oracle development, improved DeFi security, and more decentralization. We, at DeFi Pulse, are always committed to updating users about the current state of the DeFi space and how it can be improved further. So keep subscribed as we bring more insights to you.

Got something to say about DeFi or anything else? Contact us via our Discord channel

-Aishwary Gupta (Community Lead at DeFi Pulse & Strategy/Marketing Lead at Polygon DeFi).

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.

https://yieldfarmer.substack.com/p/-polypulse-28-polygon-avail-testnet?r=1g9cw0&s=r&utm_campaign=post&utm_medium=email