🟪 PolyPulse #29 DeFi and FinTech Crossover

Also, deep dive into Liquid Staking on Polygon.

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the last week of June and the first week of July 2022.

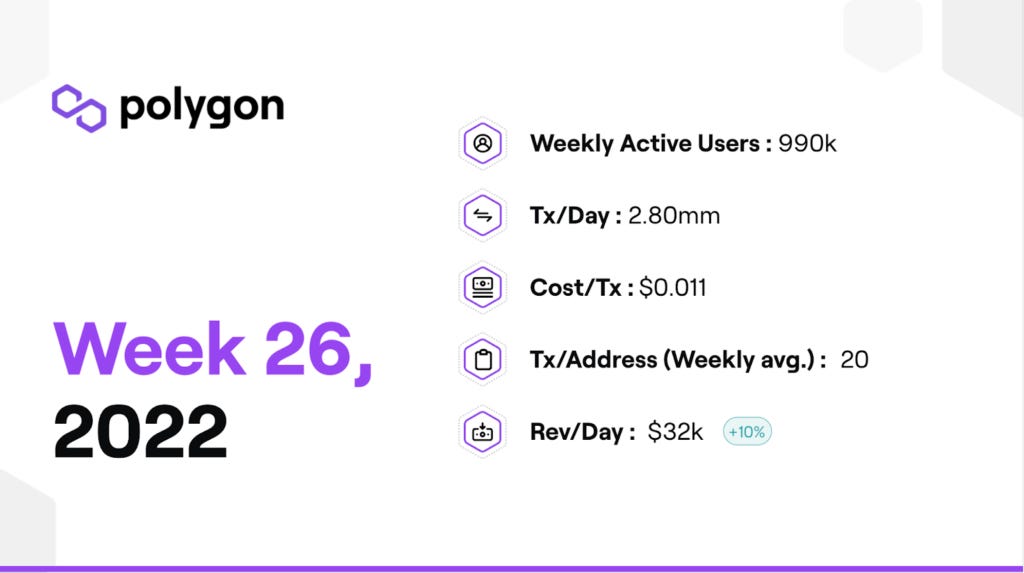

This week the Weekly Active Users (WAU) remained unchanged at 990k as compared to the previous week. An interesting fact about the proof-of-stake (PoS) chain is that at its peak, the chain processed 9,177,310 transactions on Wednesday, June 16, 2021.

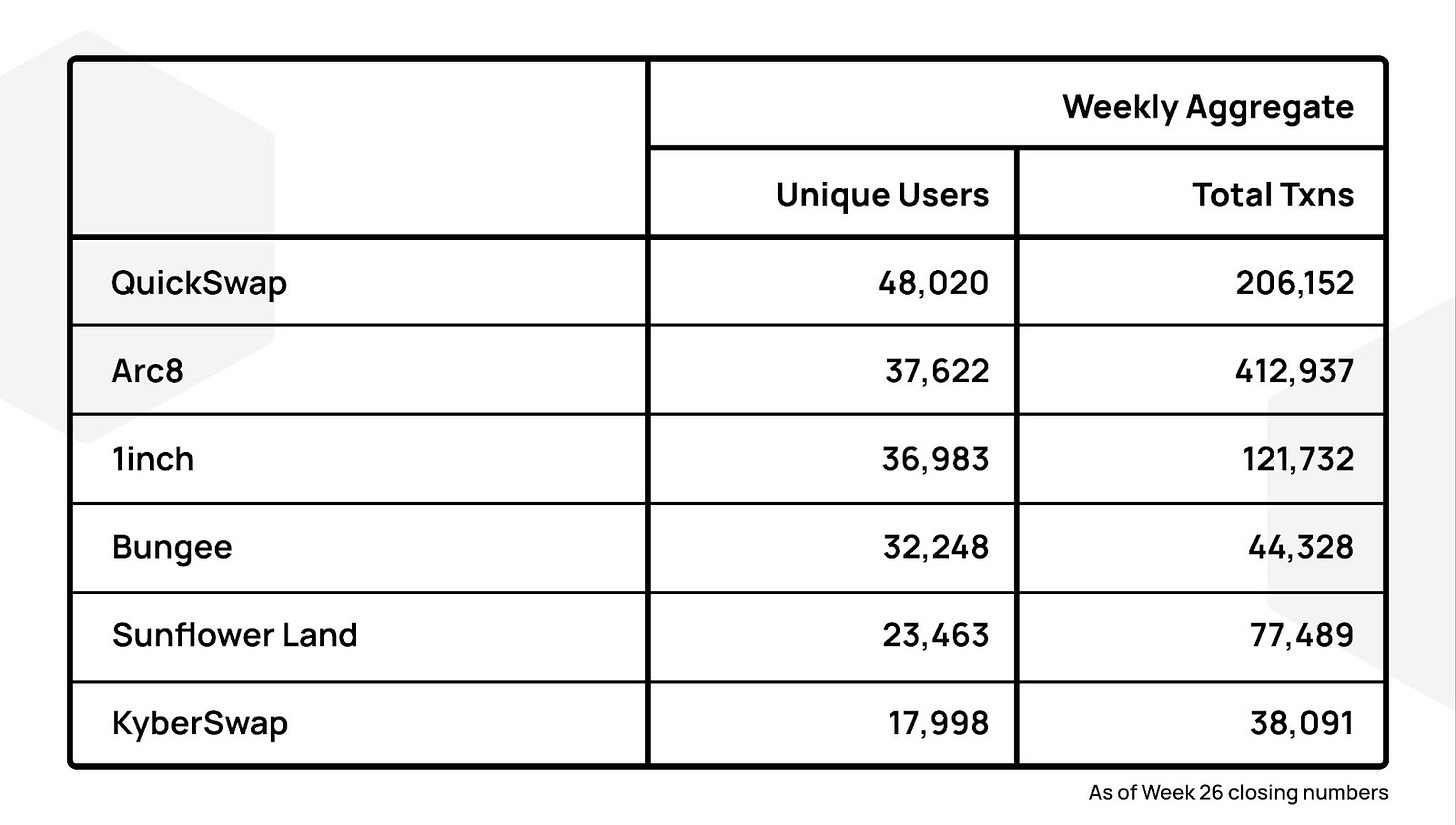

During this week, Good Ghosting (6.1k, ) and Slingshot (5.5k) entered the top 20 performing decentralized applications (dApps). 1inch climbed by 73%, reaching ~37k unique users, and secured the second spot in the list of top-performing dApps in the DeFi ecosystem. Uniswap v3 continued the upward trend with an 8% rise in its user base (17k) and transaction size reaching 111k.

Quickswap remains the most engaging DeFi dApp on Polygon, with approximately 206k weekly transactions and 48k unique users.

Also, deep dive into Liquid Staking on Polygon:

Why NeoBanks serve as the perfect gateway for DeFi on Polygon?

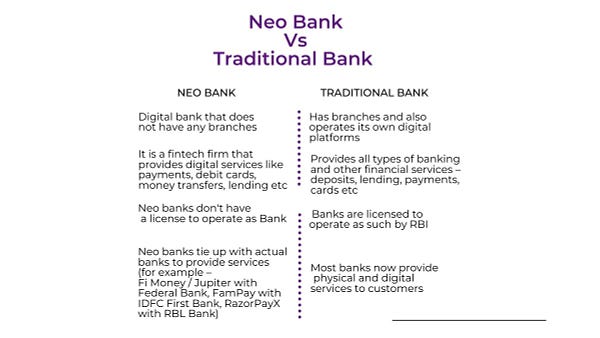

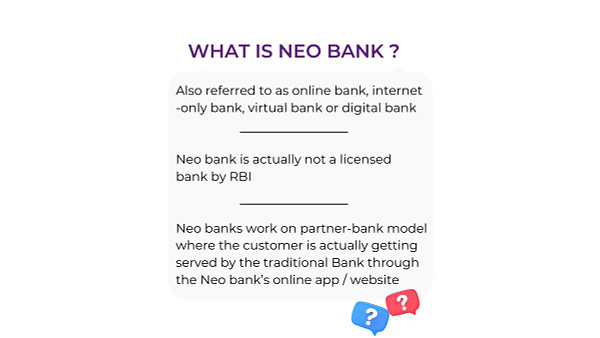

Conventional wisdom is that traditional finance (TradFi) and decentralized finance (DeFi) go together like vampires and garlic. This simply means that TradeFi & DeFi will coexist in the foreseeable future. Neobanks, or digital banks, are banks without brick-and-mortar branches, meaning they offer all their services online.

By their very nature, neobanks acquire and serve customers primarily through digital touchpoints such as mobile apps. They target the unbanked, younger individuals with lower incomes, and riskier credit scores. As a result, Neobanks tend to offer higher yields and operate under less stringent regulations.

The most important distinguishing characteristic is their freedom to experiment and the speed of innovation - the ability to launch features and develop partnerships to serve their customers at a pace no traditional bank can match. A useful mental model is to think of neobanks as the application layer of the banking system.

Bridge to Web3

Neobanks have the opportunity to bring average consumers to Web3 without massive overhead. As a licensed fintech with a know-your-customer (KYC) infrastructure, they can overcome the anonymity concerns of DeFi with dedicated portfolio teams managing the backend. Neobank product teams can also leverage the composability of DeFi protocols and combine various money legos into customized financial products built on Polygon. Additionally, Polygon is partnering with multiple neo-banks to enable this Web3 bridge to help fuel mass adoption.

The direct relationship with consumers and understanding of their behavioral patterns allows neobanks to create a much-needed feedback loop for further development of DeFi offerings that reflects consumer demand. Neobanks’ participation in the Web3 space can also encourage improvement in governance schemes, including industry-grade codes and self-regulatory tools. This is just one example of how Neobanks can act as the bridge between TradFi and DeFi. Going forward, it will be interesting to see how this space matures.

Bridge MAI to Polygon using Multichain at no cost for a month.

WOO Network’s multichain DEX is live on Polygon.

Robinhood integrates with Polygon to enable withdrawals and deposits.

Sikka Stablecoin testnet launched on Polygon.

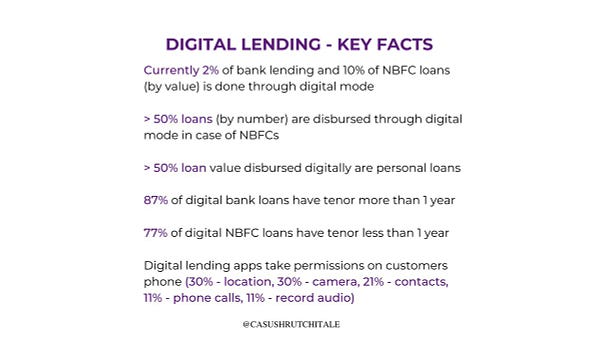

Can FinTech accelerate the growth of DeFi?

Even with the speed at which the products and innovations are happening, DeFi has still not been able to gear for mass adoption. In my opinion, certain things are missing:

A proper knowledge track to enable users to understand DeFi.

Poor UI/UX

Low-risk platforms

When we look at FinTech firms, they are under regulatory surveillance; customers do their KYC, and also their user interface is already accepted by the masses. This makes them the ideal place for DeFi integration. I believe the true DeFi potential can be unlocked by the established FinTech organizations, where on-chain activities would be the backend and FinTechs will serve as the front end.

What do you think about this? 💭 Feel free to connect with us on our Discord channel to discuss more!

-Aishwary Gupta (Community Lead at DeFi Pulse & Strategy and Marketing Lead at Polygon DeFi).

Disclaimer:

Information provided on this site is for general educational purposes and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.