Aave: The Global Liquidity Market

ChainLinkGod makes a case for why Aave is the global liquidity market and goes in-depth into what he thinks its fundamental value proposition is. This post is exclusive for Alpha Tracor subscribers.

This article is a part of a new series of opinion articles written by independent researchers that will be published in DeFi Pulse Farmer. The articles will first be shared with the Alpha Tractor subscribers, and will later be made accessible for free subscribers.

Aave: The Global Liquidity Market

Opinion article by ChainLinkGod.

When looking at the global economy today, it is undeniable that one of the most foundational components that underlies a large number of financial products is the ability to lend and borrow assets. Lending provides participants passive yield at a controlled level of risk (e.g. fixed income), while borrowers gain access to working capital for which they can do as they please (e.g. purchase a home). This is what is commonly referred to as a money market.

In the traditional financial system of today, money markets are operated by centralized middlemen who act as the facilitator of each interaction and hold custody of assets. In theory, while this reduces the friction of what would be basic P2P bartering, it introduces a new dynamic of risk of needing to trust the middlemen. These centralized middlemen have the ability to censor, strongarm, and effectively disrupt the ability for any participant to engage in financial activity. Such centralized middlemen have proven historically they have no ethical barriers against such activity.

What if there was a money market that didn’t require a centralized middleman, but instead interactions were facilitated by a credibly neutral decentralized protocol that could not censor or strongarm anyone and for which participants do not have to give up custody? Enter Aave.

Access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

Defining Aave

Built on the Ethereum blockchain, Aave is a set of programmable smart contracts that provides both humans and other smart contracts access to a permissionless source of on-chain liquidity. Like any good money market, Aave connects lenders who want to earn a passive income with borrowers who need to borrow working capital. Importantly, the enforcement of the market’s rules is not performed by a centralized entity, but instead, programmatic code which is governed by a decentralized community with financial skin in the game (AAVE token holders).

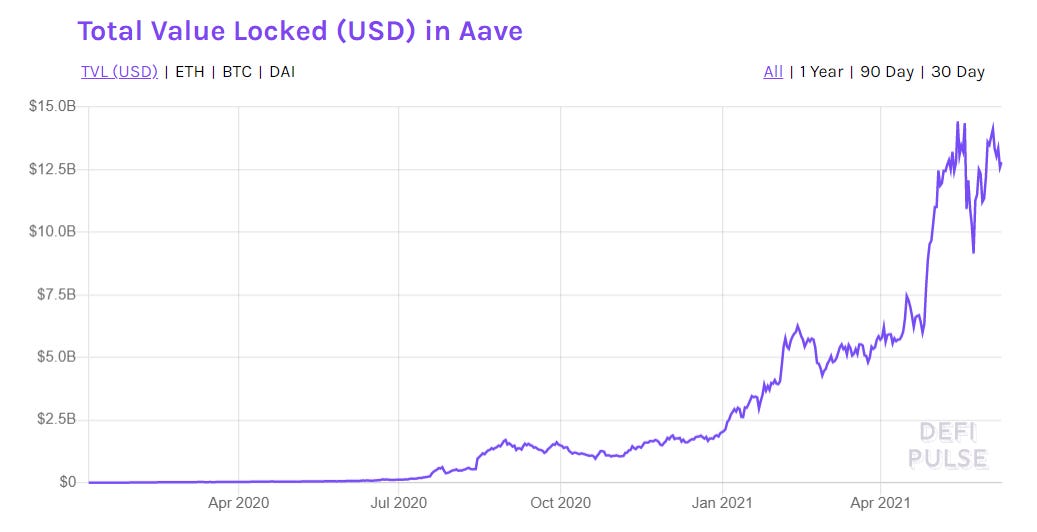

Since its launch in early 2020, the Aave protocol has grown exponentially to become not only the largest money market in the DeFi ecosystem but in fact the largest DeFi protocol by total value locked (as of writing). This growth has resulted in tens of billions of dollars in on-chain liquidity available to the public in a permissionless manner.

This growth has resulted in tens of billions of dollars in on-chain liquidity available to the public in a permissionless manner.

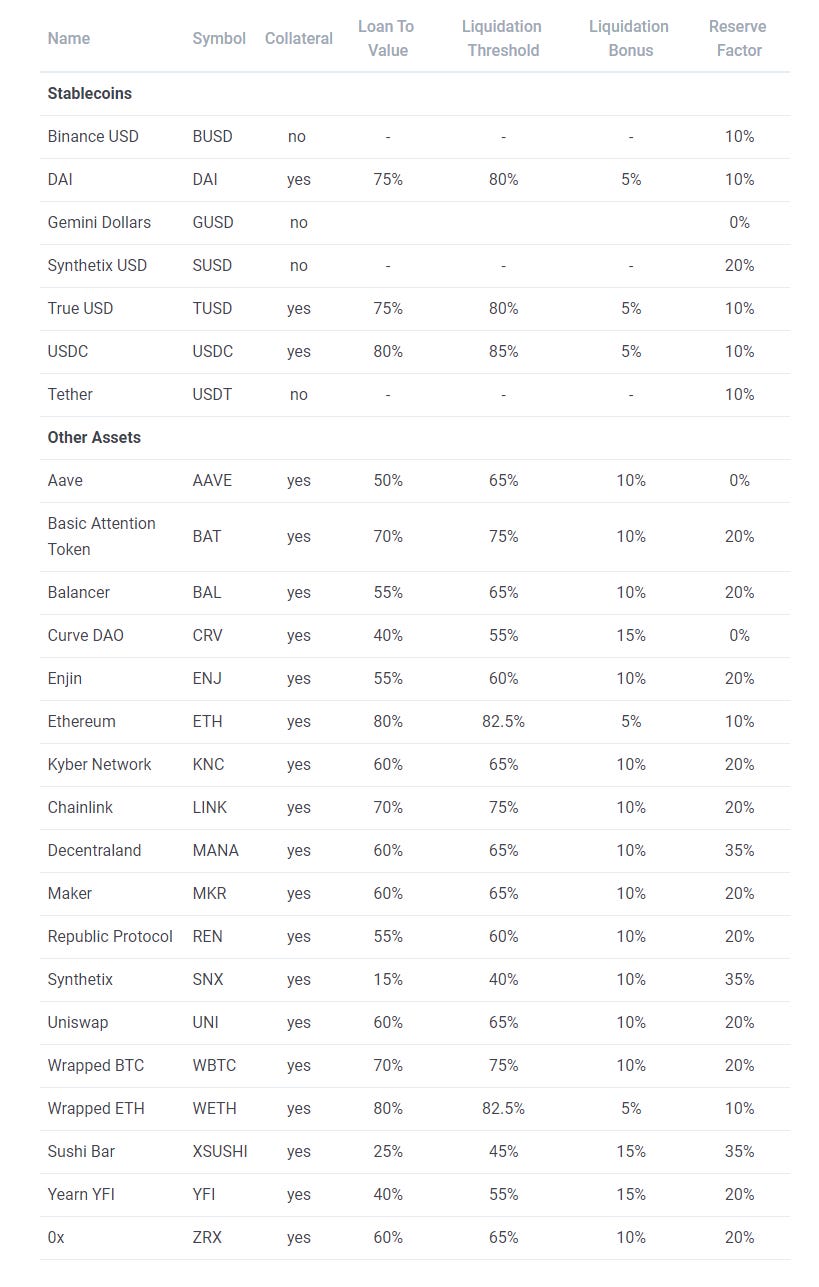

Supporting this growth is Aave’s support for the largest array of tokens, supporting 25+ different on-chain ERC20 tokens, including 7 different centralized and decentralized stablecoins.

It’s important to note Aave isn’t just a single money market but is actually an ecosystem of multiple money markets, each geared towards different types of lenders and borrowers.

The Aave v2 market on Ethereum provides the deepest liquidity for the widest array of tokens, the Aave AMM market allows liquidity providers on Uniswap to borrow against their AMM positions, the Aave Polygon market leverages a scalable layer 2 sidechain…

The Aave v2 market on Ethereum provides the deepest liquidity for the widest array of tokens, the Aave AMM market allows liquidity providers on Uniswap to borrow against their AMM positions, the Aave Polygon market leverages a scalable layer 2 sidechain to support financial activity with low transaction fees, and the upcoming Aave Pro market is geared towards institutions with KYC/AML support.

Each of these different markets generates yield from borrowers, where the majority is paid to lenders, while a portion is allocated towards the Aave DAO—the community of AAVE token holders who set the parameters of Aave markets and perform risk management. As a result, as more Aave markets get launched and more liquidity enters the system and borrowing increases, the revenue earned by the DAO increases, which can be paid back to AAVE token holders or reinvested into the ecosystem to further the adoption of the protocol globally.

Aave is one of the most trusted and widely used DeFi protocols and it comes down to two core reasons: security and innovation.

Security

With DeFi applications that directly manage user funds, security is of the utmost importance to prevent the loss of funds. With money markets, in particular, risk exists because the financial value of the collateral and borrowed debt is in constant flux due to the volatility of trading markets. To mitigate this risk, Aave requires loans to be overcollateralized, meaning the collateral is always worth more than the debt being borrowed. To maintain solvency, positions nearing under collateralization are liquidated (collateral is sold to pay back the debt), protecting lenders and keeping all positions well over 100% collateralized.

Because every crypto token on a money market has its own volatility profile, the level of collateralization at which liquidations occur must be defined independently for each token. In the Aave protocol, there is a Loan-To-Value (LTV) ratio, defining how value can be borrowed against the collateral, and a Liquidation Threshold, defining when positions are closed out. A lower volatility token with a large amount of liquidity can have a higher LTV, while a more volatile and less liquid token should have a lower LTV, to ensure unhealthy positions are liquidated.

Setting these parameters is a balancing act between capital efficiency and protocol risk because if the parameters are too risk-on, the protocol could be at risk of insolvency during a time of market volatility. To properly set these parameters and mitigate this risk, Aave has a robust risk framework that lays out the parameters for each token.

In addition to setting proper parameters, money markets require a secure price oracle; the infrastructure that feeds financial market data into the protocol that is used to determine the maximum size of a loan and when positions should be liquidated. If a price oracle returns a manipulated value (e.g. saying Ether is $10M each), then the entire protocol could be drained of all its funds by a malicious entity (e.g. borrowing much more debt than your collateral is actually worth).

To mitigate this risk, Aave uses Chainlink Price Feeds and has been since day one. These Price Feeds are decentralized oracle networks that provide accurate and reliable exchange rates on every supported asset within the Aave protocol.

Chainlink Price Feeds consists of multiple independent oracle nodes that aggregate price data from multiple professional data aggregators who generate a volume-weighted average price for each asset…

Chainlink Price Feeds consists of multiple independent oracle nodes that aggregate price data from multiple professional data aggregators who generate a volume-weighted average price for each asset, tracking all centralized and decentralized exchanges, while discarding outliers and wash trading. This high-quality price data ensures users are never falsely liquidated and that the protocol does not become insolvent.

Because of the proper setting of market risk parameters, the use of Chainlink Price Feeds, and various other security measures, I consider Aave one of the most secure protocols in the entire DeFi ecosystem, giving it the most likelihood to continue its adoption globally.

Innovation

The DeFi ecosystem is ever-evolving. Projects that stagnate on growth are often abandoned for more agile projects which push the boundaries of what’s possible, often creating new financial primitives in the process. Aave is an example of such a second-generation DeFi protocol that superseded previous money market implementations through a large number of core innovations including:

Flash loans: Aave introduced the first uncollateralized loan solution in DeFi, allowing users to borrow capital without putting up any collateral, as long as the loan is paid back within the same transaction. If the loan is not paid back, then the entire transaction reverts, protecting lenders while earning them a higher yield. Since its release, the adoption of flash loans has also gone exponential.

Stable/variable rates: Borrowers can choose between a variable interest rate that changes according to market demand or a stable interest rate that is slightly higher than the current variable rate but provides a hedge against interest rates spiking. This provides users freedom of choice regarding the type of loan they want to open.

Delegated Credit: Lenders who wish to earn yield from their deposits can allocate their unused credit line to other users/protocols who pay a fee to borrow against the lender’s capital. This provides additional capital efficiency and higher yield while ensuring all positions on the protocol are always kept overcollateralized.

aTokens: All deposits onto Aave mint a tokenized representation called aTokens. This token acts as a 1:1 claim to the underlying deposited asset and grows in real-time as interest is accrued. As standard ERC20 tokens, aTokens can be deposited into other DeFi protocols such as Curve to earn additional yield through the power of composability.

Collateral/yield swaps: Any deposits onto Aave can be atomically swapped into any other token supported on the platform, even while outstanding loans are open. This allows lenders to switch to the highest-earning tokens and for borrowers to adjust the risk of their position.

Repay with collateral: Borrowers who are at risk of getting liquidated but don’t have outside capital to pay down their debt can use their existing deposited collateral to pay down the debt by swapping on a DEX and closing the position within the same transaction.

Much more

The speed of innovation of the Aave protocol is ever accelerating and likely to continue into the future as the protocol and the DeFi ecosystem continue to evolve as a whole.

Aave’s inherently agile nature ensures that regardless of the macro market dynamics of the DeFi ecosystem, the Aave community is capable of adding new functionalities and shifting focus as needed to provide users the greatest amount of utility.

Aave’s inherently agile nature ensures that regardless of the macro market dynamics of the DeFi ecosystem, the Aave community is capable of adding new functionalities and shifting focus as needed to provide users the greatest amount of utility. This constant evolution will continue to result in additional financial primitives that could have never existed in the traditional centralized financial system of today.

Ultimately, at the end of the day, Aave is a low-level protocol in the DeFi tech stack that provides the fundamental liquidity building blocks on which other protocols can build upon and create increasingly advanced financial products (e.g. Yearn). As DeFi continues to shift into the mainstream and capture global finance, the underlying infrastructure powering the ecosystem including Aave will be along for the ride. The direct growth of Aave leads to the direct increase of value capture of the native AAVE token. In my personal opinion, Aave is one of the greatest success stories of the DeFi ecosystem and will play a major role in the global economy of tomorrow.

Follow ChainLinkGod on Twitter: @ChainLinkGod 🔥🔥🔥 !

This article reflects the opinion of its author, who has received no compensation for it (other than from DeFi Pulse). All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information and does not account for specific goals or financial situations. Be careful and keep up the honest work!