🚜Alpha Tractor

This is part of the Alpha Tractor series - giving you intel into the freshest yield for the most honest farmers only

THIS YIELD FARMING STRATEGY INVOLVES A PROTOCOL UNDERGOING AN AUDIT AND IS BUILT BY AN ANONYMOUS TEAM. USE THE INFORMATION BELOW AT YOUR OWN RISK. NEVER YIELD FARM WITH ASSETS YOU CAN’T AFFORD TO LOSE.

This is part of the Alpha Tractor series - giving you intel into the freshest yield for the most honest farmers only.

-By Edward Bush and Garrett Graham

Solidex, the convex lens for Solidly yields!

With all eyes on Andre Cronje’s new AMM Solidly, people are flocking to the new yield optimizer: Solidex. To understand Solidex, let’s begin by examining the protocol it is built on top of: Solidly.

Solidly, a Quick Run Down

Solidly is a new decentralized exchange (DEX) launched on Fantom by the notable DeFi architect Andre Cronje. Solidly is different from other DEXs as it incorporates the new and experimental concept of ve(3,3).

The “ve” stands for vote-escrowed, a concept taken from Curve Finance whereby CRV tokens can be locked by a user over different lengths of time to gain governance power over the protocol.

However, Solidly improves this aspect by representing the veSOLID tokens with non-fungible tokens (NFTs) instead, thus creating veNFTs. This small change allows user’s positions within Solidly to be used as collateral, traded and more. The final benefit of representing the ve locks as NFTs means a single address may hold multiple locks.

“(3,3)” on the other hand, is a game theory concept popularized by OlympusDAO Finance which states that neither player can do better by deviating from their strategy assuming other players remain constant in their strategies. In Solidly, the amount of SOLID tokens locked is inversely proportional to the emissions.

This means if 0% of the SOLID supply is locked then the weekly emissions will be at a maximum and vice versa. This reduces dilution as the more users there are that lock their tokens, the less emissions there will be. Moreover, ve lockers have their holdings increase proportionally to the weekly emission to ensure they are never diluted.

Another way in which Solidly is able to align emissions to incentives is by incentivizing the pools with the most fees (this does not mean highest in terms of gas) unlike how other AMMs incentivize liquidity. It does this by giving all trading fees of a particular pool to the veNFT holders who have voted for that pool.

This makes veNFT holders want to give emissions to the most traded pools, thus in turn aiding the liquidity of the pool. Additionally, this incentivizes fees for the protocol resulting in higher payouts for SOLID token lockers. The result of all these implementations means over time the protocol will self-optimize.

It’s worth noting that Solidly works in conjunction with other AMMs rather than as a competitor. The unique design of Solidly along with the integration of other AMMs, makes it ideal for extremely low trading fees, good liquidity, and minimal slippage on the most traded pairs.

Solidex: DeFi Lego for Solidly

Whoever controls the majority of the veNFTs is able to influence the pools that benefit them the most. One protocol has set out to gain as much governance power over Solidly as possible, Solidex.

Solidex Finance to Solidly works identically as Convex Finance does to Curve Finance. In essence, Solidex is able to gain governance power by offering their native token, SEX, as an additional incentive for staking SOLID with them as opposed to Solidly. One can stake and convert their SOLID tokens to SOLIDsex on Solidex, though the process is irreversible.

The staking rewards available from SOLIDsex will be higher than those of simply staking SOLID on Solidly. As Solidex accumulates more staked SOLID they gain more control over Solidly, thus allowing them to increase yields on the pools that benefit their users the most.

Users of Solidex can receive higher yields (via the SEX governance token bonus) than those simply found on Solidly. However, this of course comes with additional protocol risk.

Farming SOLID & SEX with BOO-xBOO LP tokens for ~140% APY

Before diving into this staking opportunity, note that Fantom requires its native FTM token to pay for gas instead of ETH. You can bridge FTM and other tokens like USDC to Fantom via the SpookySwap Bridge.

Also, you’ll need to have Fantom added to your browser wallet. You can use Chainlist to make this addition if you haven’t already.

💡Note: If you are having issues with the Fantom network, try switching RPCs to any of the ones listed here.

If you have your wallet ready to go, this is how you’d proceed:

You will need equal values of BOO and xBOO to provide liquidity with. To prepare, you can swap FTM for BOO on SpookySwap if you have none.

Next, you will have to head to “Stake BOO” on SpookySwap to stake half of your BOO and receive xBOO.

Connect your wallet;

Approve BOO and then stake it;

Click Display xBOO in wallet to display your xBOO balance in your wallet.

You should now have the BOO and xBOO required for farming. Next, provide liquidity to the BOO-xBOO pair on Solidex.

Connect your wallet;

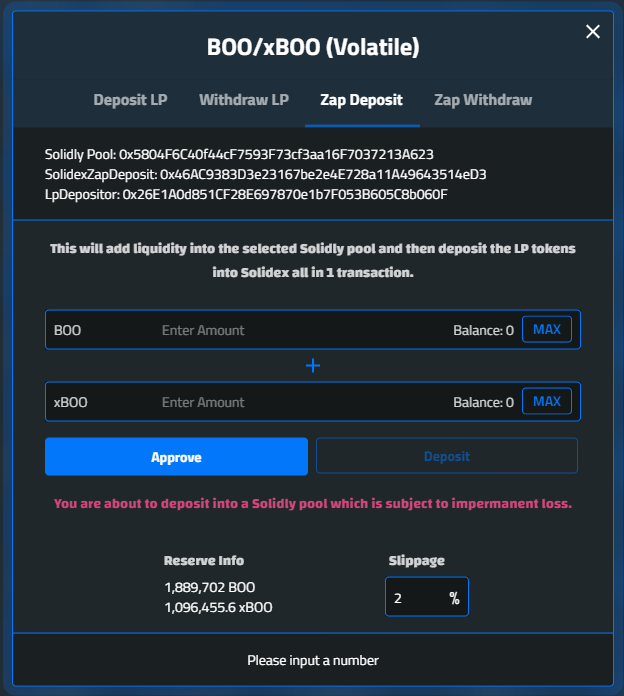

Click “Manage” on the correct pair (Boo-xBOO pair) and click “Zap Deposit.”;

This should provoke three transactions: the first for approvals, the second for depositing to create the LP token and the third for staking the LP token;

Input your desired deposit amounts;

Press “Approve” to grant approval to Solidex to trade the tokens and confirm it in your wallet;

Press “Deposit” and confirm the deposit in your wallet;

Now confirm the final transaction to stake your LP tokens;

You will automatically receive sAMM-BOO/xBOO liquidity provider tokens in your wallet once your staking process is complete;

Once it has been confirmed, you’ll automatically start earning SOLID and SEX rewards.

You can track your earnings through the Solidex Pools page and claim them at any time using the “Claim Earnings” button.

💡Tip: If you wish to reduce risk by only using Solidly, vfat tools has a button to claim multiple pools at once.

🚀 Boost your rewards: There are plenty of things you can do with your reward tokens outside of selling them. SEX can be locked within Solidex for over 2600% APR. SOLID can be converted to SOLIDsex and staked for 135% APR. You can provide liquidity for SOLIDsex-SOLID and SOLIDsex-SEX for 300% and 177% APRs respectively.

Solidex is currently undergoing an audit. This staking opportunity entails cross-protocol risks, market risks, impermanent loss risks, smart contract risks, and more. Treat this yield farm as experimental, and never deposit more money than you can afford to lose!

All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information (which does not account for specific goals or financial situations). Be careful and keep up the honest work!