DeFi Pulse Farmer #10

Catch up on a new week in DeFi as we recap Aave migration, the Governance Watcher, the Farm of the week, and the Conservative Farmer.

Welcome to the tenth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, subscribe today.

If you already are a paid subscriber of the Alpha Tractor series and have not been included in the Alpha Tractor Discord channel yet, please fill in this form so we can onboard you.

Looking to catch up on the last two weeks? We’ve got you covered!

DeFi Recap

DeFi slightly shrunk this week, with the ecosystem’s total value locked (TVL) sliding to $10.78B from the $10.9B TVL notched this time last Saturday.

Uniswap, which became the first protocol to hit a $2B TVL last week, saw its TVL reach a new all-time high of $2.38B this Monday and then again on Saturday to $2.53B. From that perch, the decentralized exchange is acutely holding firm as the space’s largest application. The runner-ups, reigning lending protocols Maker, and Aave, currently boast TVLs of $1.92B and $1.16B, respectively.

Aave’s new LEND to AAVE token migration started picking up speed, which turned it to one of the more significant recent threads in DeFi. Devised as part of the new Aavenomics, AAVE paves the way to truly decentralized governance and can be staked in exchange for AAVE rewards to insure the protocol. The conversion period is indefinite, but more than 40% of the LEND supply has already been migrated in one week.

As for token performances, a handful of DeFi assets just had strong 7-day runs including UMA (27.8% to $9.86), HEGIC (25.8% to $0.129), BNT (15.2% to $1.14), and LINK (15% to $10.59).

Stories of the Week

Curve + zkSync L2

TLDR: zkSync creators Matter Labs unveil Zinc Alef, a zkSync smart contracts testnet, with stablecoin exchange Curve as the network’s first dApp.yUSD has been boosted

TLDR: The yUSD Vault deposits its generated yCRV back into Curve, engaging “boosted” returns via more CRV being generated from the yVault.Rari Capital x Synthetix

TLDR: Rari Capital integrates with Synthetix so it can deposit funds into sUSD through Aave.An experimental $LINKUSD pool is now live

TLDR: Curve deploys this special pool in a bid to correct the $LINKUSD token to its peg.Aragon and Balancer take Snapshot to the next level

TLDR: Aragon Association and Balancer Labs plan to contribute code and bounties to token holder polling project Snapshot.Alpha Homora

TLDR: Alpha Finance releases Alpha Homora, a Harry Potter-themed protocol for leveraged yield farming.INDEX Liquidity Mining is Now Live

TLDR: New crypto indexes project Index Cooperative launch its INDEX liquidity mining campaign.

Governance Watcher

Compound proposes a new interest rate model for the cUNI token.

Compound introduces proposal to set ETH & USDC collateral factor to 85%.

yEarn proposes a redesign of yEarn Vaults to optimize their flexibility and reliability.

Maker introduces a governance poll on adding an ETH-B Vault type.

Aave polls its community on adding support for AAVE, UNI, and GUSD.

Want your company featured here? Fill out this link to get in touch!

Farm of the Week

Farm 123% APY by Staking FARM in Harvest Finance

Get your DeFi plows ready, farmers, because this week we’re working one of the ecosystem’s most interesting rising farms: Harvest Finance.

Launched on Sept. 1st, 2020, Harvest Finance is a yield aggregator protocol that lets users automatically farm the highest yields in DeFi. So while yield farming used to be manual, inconvenient, and inefficient, Harvest Finance is a slick farmer’s farm that makes netting these attractive DeFi yields both easy and passive.

At the heart of the project are its interest-bearing fTokens (e.g. fDAI, fUSDC, fWBTC), which work like yEarn’s yTokens.

Farm on the FARM staking pool

FARM, which will ultimately have a max supply of 690,420, is the governance token of Harvest Finance and is being rewarded to early stakeholders via yield farming to bootstrap the protocol.

If interested in staking FARM, then, farmers want to:

Buy FARM on Uniswap or farm the token by serving as an LP/staking fTokens (please follow the steps below the image to find out how to farm on Harvest Finance ).

Navigate to Harvest Finance’s FARM pool.

Select the amount of FARM you want to stake and confirm the transaction.

Sit back and earn FARM for a current APY of ~123%.

Source: Harvest Finance

Farming FARM on Harvest Finance

Farmers go to the Farm section on Harvest Finance and deposit any of the available tokens, including DAI, USDC, & WBTC, or UNI V2 LP tokens from pools like ETH-DAI & ETH-USDC. After depositing their assets, farmers will receive interest-bearing fTokens in exchange.

Source: Harvest.Finance

After obtaining the interest-bearing fTokens, farmers go to the Earn section on Harvest.Finance and stake their tokens in the corresponding pool, and start receiving FARM rewards.

Source: Harvest.finance

Also, farmers who already have FARM tokens, can join the FARM-USDC Uniswap pool and stake their LP tokens in the UNI-FARM pool on Harvest.Finance and get up to 369% APY. Please be aware that these pools are extra risky and will expose your assets to impermanent loss.

Please remember that, if you’re farming FARM as an LP to stake the tokens later, you will face risks like impermanent loss and beyond. Never plow with more than you can afford to lose.

The Conservative Farmer

Farm up to 13% APY on Yearn Finance

Yearn Finance, the yield farming aggregator that uses the most optimal strategies to maximize returns and allows users to farm the best yields in an automated way, currently has one of the most attractive opportunities for conservative farmers in their Yearn Finance curve.fi/busd LP vault.

How to farm passively with yEarn

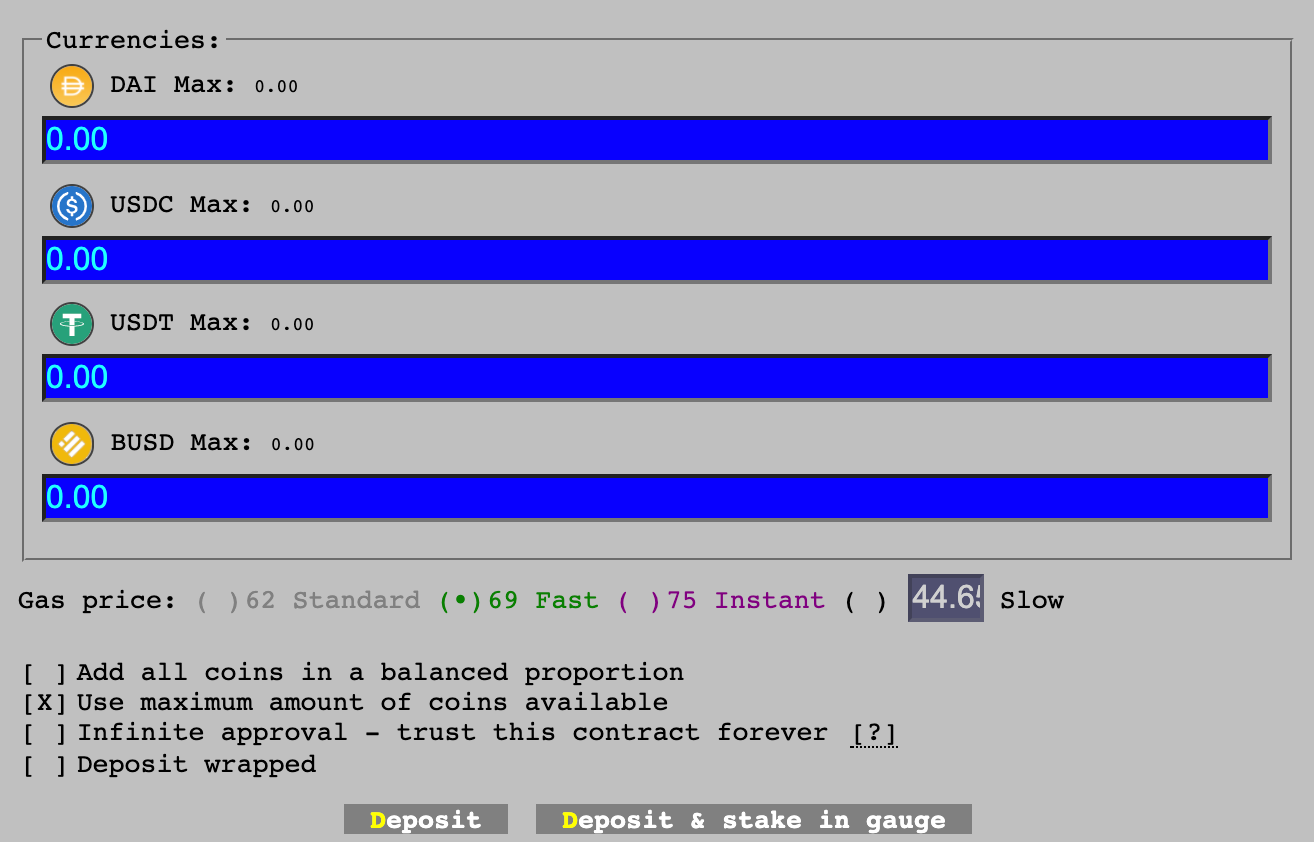

Farmers have to go to the Curve bUSD pool and deposit DAI, USDC, USDT, BUSD, or a combination of them and receive crvBUSD LP tokens in exchange (for this opportunity, farmers should not click “deposit and stake in Gauge”).

Source: curve.

Farmers then head to the Vault’s section on Yearn Finance’s website, click on the curve.fi/busd LP vault and deposit their assets.

Source:Yearn Finance.

From this point on Farmers will start receiving 13% APY on Yearn Finance at the time of writing!

Please be advised that staking in any of these pools has a minimum cost of $40. If you don't trust any of the basket assets on any pool, you should ignore that pool.

Plow of the Week

This week's plow of the week is yearn.party. This straightforward tool allows farmers to connect their wallets and instantly start tracking earnings received via any of the different options on Yearn Finance. If you're a conservative farmer or you're just taking advantage of any of the current opportunities on Yearn Finance, you should give it a try!

Alpha Leaker of the Week

Closing Thoughts

During a time of relative calmness in the DeFi market, teams benefit from less noise and can focus on building tomorrow's infrastructure. And have no doubt, we're still in the early days of DeFi!

Until next week, and have a good rest!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!