DeFi Pulse Farmer #12

Catch up on a new week in DeFi as we recap DeFi TVL's all time high, PayPal, wBTC, the Farm of the Week, the Conservative Farmer and much more.

Welcome to the twelfth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, subscribe today.

Looking to catch up on the last two weeks? We’ve got you covered!

DeFi Recap

Things are heating up again in DeFi, as the ecosystem’s total value locked (TVL) is currently holding ground at $12.4 B, a new all-time high. That’s up from $11B at this time last week.

The TVL climb and recent surge of buy pressure around DeFi were in no small part influenced by PayPal’s announcement of cryptocurrency services for bitcoin, ether, and beyond on Wednesday. The high-profile mainstream embrace brought in a rapid influx of attention and optimism to Ethereum projects, which in turn translated to a week of growth for DeFi.

As for individual projects, top protocol Uniswap is closing in on the $3B mark with a current TVL of $2.64B. Following the reigning decentralized exchange is lending protocol Maker ($2.11B) and tokenized bitcoin project WBTC ($1.42B). With a new Bloomberg report suggesting PayPal may be targeting WBTC builders BitGo for an acquisition, it’ll certainly be interesting to see where WBTC’s TVL goes from here.

Then there’s DeFi’s tokens of the week. LINK is up 20% to $12.72, YFI climbed 13.2% to $15,187, and MKR gained 10.8% to $601.95. On the PayPal news WBTC and renBTC both rose 12% to $12,860.

Most importantly, ETH surpassed the $400 mark for the first time in the past 7 weeks!

Farm of the Week

Farm 13% APY from Uniwap’s ETH/WBTC Harvest

City upon a Hill? It’s more like the Farm upon a Hill where Uniswap’s ETH/WBTC pool is concerned.

That’s because this pool is undeniably the current king of the hill among yield farms -- not only because of its recent stats but also because of its unique central position within DeFi and in extension the wider crypto economy.

Source: CoinGecko

For starters, Uniswap’s ETH/WBTC pool is the largest farm in the land right now with ~$651M worth of assets presently locked in its contract. That makes this pool nearly $200M larger than DeFi’s second-largest farm, Uniswap’s ETH/USDC pair. Part of the reason for this size is many other yield farming projects are in the middle of routing their strategies through the attractive ETH/WBTC UNI farm while it’s still live.

Source: Dune Analytics

As for the centrality of this farm in DeFi and beyond, it boils down to the fact that this pool couldn’t be better positioned. It’s the jewel of Uniswap right now, DeFi’s top trading protocol, and it’s composed of the crypto economy’s two most coveted stores of value, ETH and BTC. This pool could boom accordingly if crypto rips into another massive bull run in the years ahead, and Uniswap ETH/WBTC LPs won’t miss out on the upside of ETH and BTC if these assets do rocket up.

Since Uniswap’s inaugural two-month UNI rewards campaign runs until November 18th, 2020, DeFi farmers still have almost a whole month left to farm UNI through the ETH/WBTC pool while the plowing’s still good. The pool’s APY is hovering just above 13% at the moment. For any farmers interested in joining in, you can add liquidity here.

Source: Uniswap

Lastly, remember to keep in mind the risks of serving as a Uniswap LP. The price of the UNI token can crash, the pool exposes your assets to impermanent loss, and yields can sink or gas prices can eat into profits. There’s also asset risk involved, like if the WBTC multisig were ever to be compromised. And there’s the chance, however remote, that Uniswap governance can be compromised toward malicious ends. Do your own research, try to fully understand the farm you’re interested in, and never plow with more money than you can afford to lose.

This week’s newsletter is sponsored by BARNBRIDGE, a fluctuation derivatives protocol for hedging yield sensitivity and market price.

Check out their cross-platform derivatives protocol here!

Stories of the Week

Our first single-asset PickleJar

TLDR: Pickle Finance introduces PickleJar 0.88, a system centered around DAI and leveraged COMP mining.Yield Protocol is Live

TLDR: Fixed-rate lending protocol Yield Protocol is now live on the Ethereum mainnet, premiering with its fyDai token.Week 8 Update: Welcome to the Good Life (Migration Complete)

TLDR: Harvest Finance updates its community on its recent massive on-chain migration, new vault strategies, and more.Why Optimism?

TLDR: Synthetix founder Kain Warwick explains why he believes Optimistic Ethereum will become a consensus scaling solution in the Ethereum ecosystem.Announcing $RGT: the long-term yield token

TLDR: Yield aggregator project Rari Protocol unveils its $RGT governance token, of which 87.5% will be distributed to the protocol’s depositors.tBTC Metapool is up

TLDR: Curve launches its tBTC Metapool, which lets traders efficiently swap among tBTC, WBTC, sBTC, and renBTC.New GUSD yEarn Vault

TLDR: Gemini’s stablecoin GUSD is imminently receiving its own dedicated yEarn Vault strategy.

The Conservative Farmer

Harvest up to 20% with mStable’s new pool in collaboration with Curve

mStable, the liquidity aggregator that offers lending on same-peg assets, has recently introduced a new meta-pool in collaboration with Curve: Curve mUSD/3POOL. The new pool can be entered by providing stable assets such as DAI, USDC, USDT, and mUSD, and is currently offering up to 20% APY, with very little exposure to impermanent loss.

10k MTA Rewards are allocated to this pool, so MTA yield is 12,7 %, CRV yield is at 5,84%, and fees are at 1,56%. You can check the details on the mUSD pool returns on Curve’s homepage.

Source: mStable

How to provide liquidity to mStable’s new Curve pool

Conservative farmers who wish to dive into this opportunity must make sure that they have any of the following stable coins: DAI, USDC, USDT, or mUSD.

After ensuring they have stable assets in their wallets, farmers can head to the mStable's Curve mUSD/3POOL interface and approve spending each of the assets with which they choose to provide liquidity.

After approving the assets, farmers will select the amount they want to provide and click on "Add liquidity.” Alternatively, farmers can provide liquidity directly through Curve's mUSD pool interface and head to step 4.

Source: mStable

After depositing their assets, farmers will receive musd3CRV LP tokens, representing their proportional ownership of the pool. These tokens must be staked in order to start receiving rewards.

Farmers have to go to the “Deposit Stake” tab in mStable, select the amount they want to stake, and click on “Stake”.

Source: mStable

And that’s it! Farmers will now be receiving MTA & CRV rewards, which later can be claimed through the “Claim Rewards” tab in the same section of the web.

Remember that farmers can also boost up their CRV rewards on Curve by staking their CRV rewards through Curve's locker.

Lastly, the mStable pool is only one of the current Curve meta-pools available. Farmers can also check others such as the GUSD pool.

Governance Watcher

Curve proposes adding support for a (DUSD, [3Pool]) Metapool.

Dharma’s proposal to reduce Uniswap’s 3M UNI proposal threshold failed.

Aave seeks consensus on saving LEND tokens stuck in the LEND smart contract.

yEarn proposes the creation of yPools, riskier versions of yVaults.

Plow of the Week

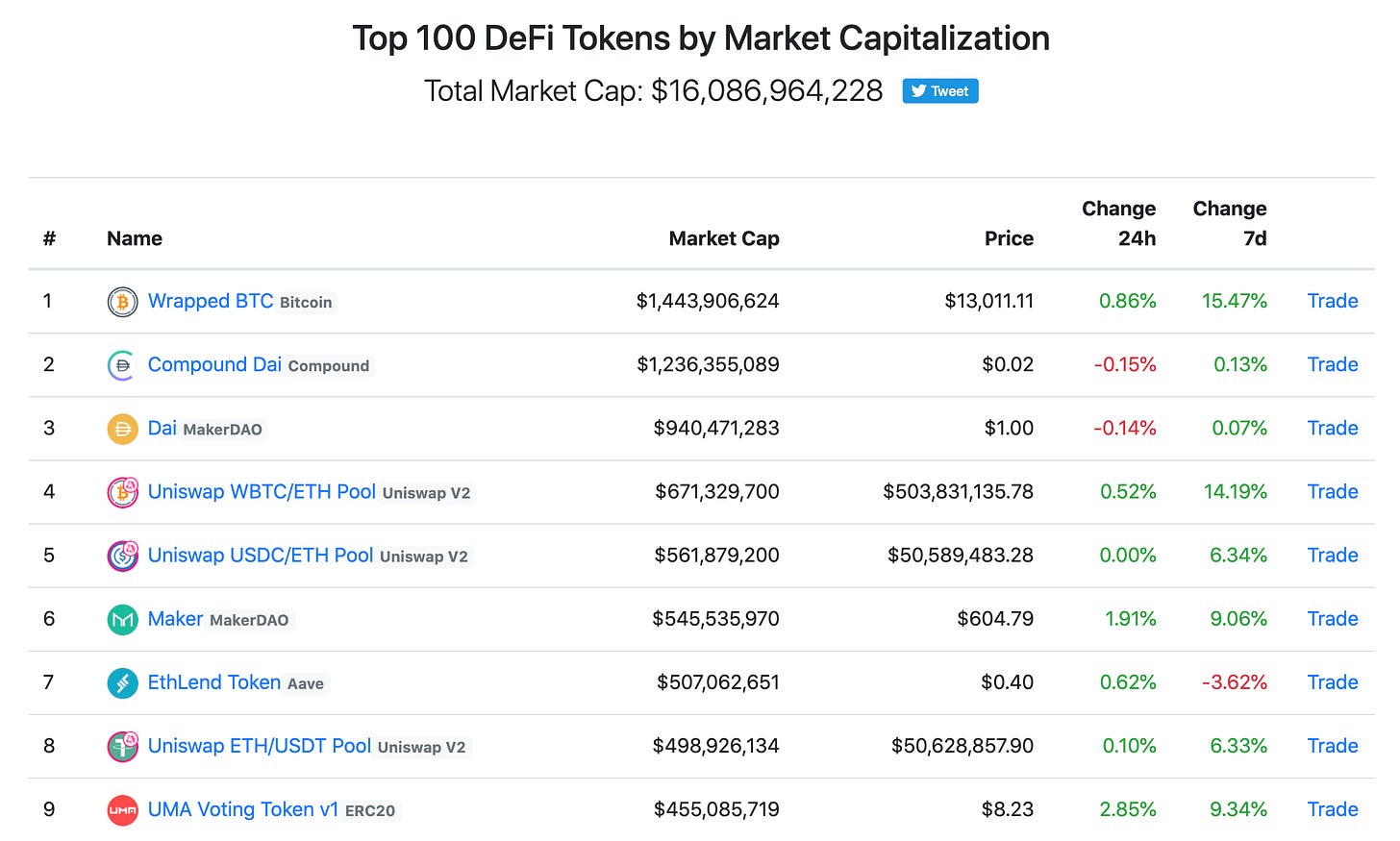

This week’s plow of the week goes to DeFi Market Cap. This is a simple leaderboard that displays the market cap of DeFi tokens and also includes LP tokens from various protocols, allowing farmers to track prices for both from a simple interface.

Alpha Leaker of the Week

Closing Thoughts

Even though returns across the Yield Farming space are down from the extraordinary and unsustainable 1000%’s APY that we saw during Q3, we shouldn't forget that farming provides exposure to distributed ownership across the financial infrastructure of tomorrow.

Until next week, enjoy your weekend!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!