DeFi Pulse Farmer #14

Catch up on a new week in DeFi as we recap ETH2, TVL, the DPI, the Farm of the week, the Conservative Farmer, and much more.

Welcome to the fourteenth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, subscribe today.

Looking to catch up? We’ve got you covered!

If you prefer, you can read today’s edition directly on DeFi Pulse Farmer.

After DeFi saw its total value locked (TVL) shrink to $11B last week from $12.24B the week prior, the ecosystem rebounded back to the $12.46B mark over the last 7 days as the cryptoeconomy acutely heated up once more. Get ready for a new all-time high any time now!

The surge of recent optimism around DeFi came courtesy of renewed attention, with recent interest at least partly owed to the bitcoin price cracking $15,000 again, the ETH2 deposit contract being released, and risk-on assets in general seeing buy pressure amid the 2020 U.S. Election nearing a decisive conclusion.

As far as individual DeFi projects go, we now have five separate protocols that boast TVLs over $1B, namely Uniswap ($2.81B), Maker ($2.18B), WBTC ($1.9B), Compound ($1.28B), and Aave ($1.03B). The next project knocking on the doors of early DeFi’s $1B TVL club is the stablecoin exchange Curve, which currently has a TVL of $799M.

Zooming out, it was also a great few days for a range of DeFi tokens, with some of the best-performing tokens on the week being AAVE (+45%), FARM (39.6%), Alpha (+30%), and YFI (+27.8%). We also saw the DeFi Pulse Index (DPI) rise 16.281% to $75.54 since last Saturday.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier through their XTF token funds.

Check out their non-custodial asset management platform here!

dHEDGE is a rising decentralized asset management protocol that has big potential to become a mainstay in the DeFi ecosystem going forward.

That’s because the project, which is underpinned by Synthetix liquidity pools, makes it easy for investors of any size and experience level to invest in strategies from investment managers around the globe. These managers earn more fees the better their investment decisions are, so they’re incentivized to deliver investors superior strategies. As for users, they can automatically and trustlessly trade along, empowered the whole way thanks to dHEDGE’s non-custodial system.

With interest in the project on the rise, then, we’ll be taking a look dHEDGE’s incentivized Uniswap DHT/USDC pool as one of the more intriguing farm’s in DeFi right now.

Spotlight: DHT Liquidity Mining

dHEDGE’s governance token is DHT, and dHEDGE’s builders are using the token and an associated liquidity mining campaign as a means of bootstrapping the protocol’s ecosystem in its earliest days.

The main avenue for that bootstrapping is Uniswap’s DHT/USDC 50/50 pool, which began being incentivized with DHT rewards on September 21st. With an allocation of 500k DHT, the 10-week liquidity mining program still has a few weeks of runway left and is currently generating an impressive 110% APY for liquidity providers (LPs) via DHT rewards.

To harvest this DHT farm you’ll want to:

Supply your liquidity on Uniswap.

Stake your UNI V2 LP tokens on dHEDGE’s LP Rewards dashboard.

Claim your ensuing DHT as you please through the same dashboard.

That’s all it takes to start farming Uniswap’s DHT/USDC 50/50 pool! We think the opportunity is an interesting one at the very least, considering dHEDGE is a solid, audited project with strong VC-backing. But the pool does bring with it the risk of impermanent loss (IL), so please keep that in mind at all times.

Note: Alpha Tractor subscribers can also check out our previous Protocol Express featuring dHEDGE for more insights.

Indeed, always farm responsibly. Returns come on a rolling basis in DeFi so expect APYs to fluctuate. Do your own research, and never plow with more money than you can afford to lose!

Farmers can enhance this week’s farms with our sponsor Alpha Finance, which is focused on building out an ecosystem of cross-chain innovative and user-friendly DeFi products.

Just head to Alpha Homora, which allows yield farmers to take a leveraged position on their farms, liquidity providers to add liquidity on leverage, and ETH lenders to earn a higher interest on ETH lending. Don’t forget to check more new pools directly through their platform!

Announcing OUSD Staking Rewards on SnowSwap

TLDR: New automated-market maker SnowSwap introduces an OUSD staking pool that’s incentivized with $SNOW.Week 10 Update: New Vaults and More Bread for the People

TLDR: Yield aggregator project Harvest Finance opens up new YCRV and 3CRV vaults.yveCRV Vault is live

TLDR: yveCRV, a special new deposit-only yEarn Vault that boosts all yEarn’s Curve LP Vaults, launches.Keep3r Network: On-chain Oracle price feeds

TLDR: Keep3r Network creator Andre Cronje discusses why the project and yEarn-based systems have embraced UniQuote price feeds.Introducing 1inch v2

TLDR: Decentralized aggregator project 1inch.exchange unveils its v2 system, which has UI and routing optimizations.DeFi Pulse Index November Rebalance Complete

TLDR: The DeFi Pulse Index (DPI) undergoes its first trustless rebalance thanks to coordination between the Index Coop community and Set Labs.APY.Finance’s LBP Step-by-Step Guide

TLDR: APY.Finance demonstrates how to participate in the project’s Balancer Liquidity Bootstrapping Pool (LBP), which served as the APY token genesis event (TGE).DEXTF – Permissionless, Oracle-less Asset Management for Everyone*

TLDR: DEXTF is an asset management protocol that allows anyone to create, mint, and redeem XTF funds.Alpha Finance Lab’s Alpha Homora adds leveraged liquidity providing for new pools*

TLDR: Alpha Homora now offers leveraged yield farming for ETH/PICKLE and leveraged liquidity providing for AAVE, KP3R, LINK, MKR, REN, renBTC, SNX, and UNI.

*This is part of our sponsored links series.

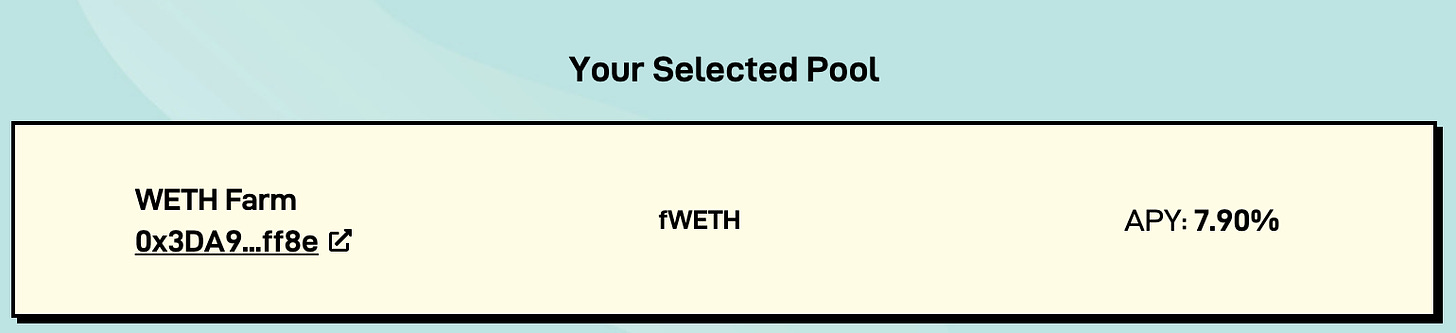

Farm 7.9% APY on Harvest’s ETH Pool

This week’s conservative farmer opportunity is, once more, an ETH pool, but this time featured on Harvest Finance, which automatically farms the highest yields in DeFi. The new WETH strategy is currently returning 7.9% APY, which is paid in FARM, Harvest’s reward token, and features no impermanent loss.

You can check more about Harvest’s WETH pool strategy in this blog post.

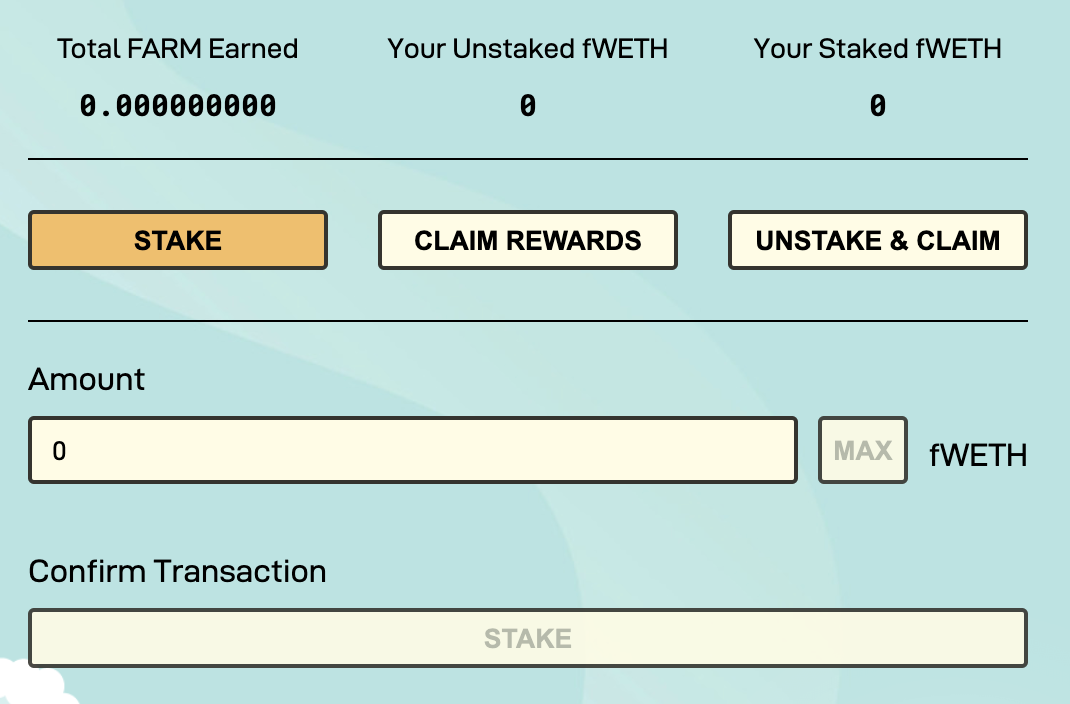

How to farm FARM with WETH on Harvest Finance

Farmers that want to take advantage of this opportunity first have to convert ETH to WETH, for example, on Balancer.

Once with WETH in their wallets, farmers have to head to Harvest’s WETH pool, select the amount of WETH they would like to stake, and click on “Stake”.

Source: Harvest Finance That’s it! Farmers will now start collecting FARM rewards, which they can claim at any time using the “Claim Rewards” button.

Balancer proposes distributing Batch #2 of Balancer Ecosystem Fund grants.

Maker adds an Executive Vote on adding YFI and BAL as supported collateral types.

yEarn discusses replacing the withdrawal fee with a management fee in v2 Vaults.

The Binance bToken team proposes creating a BBTC metapool on Curve.

This week’s plow of the week goes to Permanent Loss, a cool app that lets you calculate your risks of Impermanent Loss between multiple assets on custom weightings and timeframes.

With no doubts, this has been one of the most vital weeks in DeFi in the past month. TVL is about to cross its all-time high once more, most DeFi tokens are up, many of them more than 40%, the ETH 2 deposit contract is live, and the best teams in the space keep shipping every week. Remember, whether the market is up or down, one of the key metrics in the space is the pace of innovation at which tomorrow's financial infrastructure is being built. And the pace continues to be relentless.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!