DeFi Pulse Farmer #18

Catch up on a new week in DeFi as we recap the STABLE Act, Visa, the Farm of the week, the latest Governance updates, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

Amid another big week for DeFi, the ecosystem’s (TVL) reached a new all-time high not once but twice: first on Monday ($14.76B) and then again on Thursday ($14.8B). DeFi’s TVL has since declined to its current position of $14.56B, though that’s still a clear 10% increase from its $13.09B TVL at this point last Saturday!

It was a huge week for major DeFi headlines, too, with the main threads to watch having been 1) Visa’s embrace of USDC, 2) the awful STABLE Act, and 3) Yearn’s growing list of high-profile DeFi partnerships.

As for Visa, the multinational payments titan announced this week it was partnering with USDC issuer Circle to onboard Visa credit card issuers with support for USDC transactions. Considering Visa has a network of some 60 million merchants, this partnership could prove pivotal for the adoption of USDC and Ethereum in general going forward.

Yet on the same day, the Visa news was revealed, three U.S. legislators proposed a draft bill dubbed the STABLE Act. The rather draconian legislation would seek to regulate stablecoin issuers like banks in the U.S. to, as they put it, prevent these providers from taking advantage of and discriminating against users. That’s rich! Nevermind the fact that the whole Ethereum ecosystem centers around providing an open alternative financial system to anyone, I guess …

The scary part? The bill’s language and its proponents’ comments on social media since have betrayed that its authors and backers have no idea how Ethereum and major stablecoin projects actually work. Worse yet, the bill’s language is broad enough that it could pave the way to coming after people who run Ethereum nodes. The legislation has no path forward for now though it does suggest more ill-conceived draft bills are coming.

Lastly and on the brighter side, Yearn’s growing list of DeFi partnerships this week has really been something to behold. In recent days we’ve seen the team behind the popular yield aggregator lock down major new collaborations with Cover Protocol, Akropolis, and SushiSwap. As such, we’re seeing a young Yearn project adeptly positioning itself to become a true DeFi powerhouse for years to come.

Zooming in on top DeFi tokens, some of this week’s best-performing assets included SUSHI (+49%), PERP (+30%), AAVE (+45%), and COMP (+30%). We also saw the DeFi Pulse Index (DPI) rise 19% to +$108 over the last 7 days.

Thank you to our sponsors DEXTF, an asset management protocol that makes managing and investing assets easier, and Vesper, an upcoming platform for professional DeFi products, starting with set-and-forget pools for HODL'ing and growing your assets.

Accumulate and bundle yield generating assets with your favorite longs now on DEXTF, and sign up to Vesper to be among the first to try Vesper's incentivized beta.

Harvest +400% APY via Cover Protocol shield mining

Upstart insurance project Cover Protocol captured the hearts and minds in DeFi this week through its newfound collaboration with Yearn, a partnership that will see Cover become “the backstop coverage for the Yearn product suite, as well as for DeFi as a whole,” Yearn creator Andre Cronje noted. That’s big news, to be sure, yet this meld with Yearn is far from the only reason Cover’s really interesting right now!

Indeed, DeFi certainly needs more insurance solutions and Cover is rising to the challenge and relying on a bootstrapping-minded shield mining campaign to do so. The reason this campaign’s so intriguing, then, is because it’s something of a “win-win-win” situation: it’s good for yield farmers, it’s good for DeFi in general, and it’s good for Cover’s growth all at once.

Getting paid in COVER to shield DeFi

The Cover Protocol system revolves around the project’s fungible cover tokens.

In other words, for every 1 Dai deposited users receive two tokens, a CLAIM token, and a NOCLAIM token, which are maintained at a 1:1 basis with deposits. These tokens are minted by depositing collateral into one of Cover’s smart contracts and are tied to a particular protocol, e.g. Aave. If a claim payout is awarded through Cover’s claims process, then 1 CLAIM becomes ≈ 1 collateral (like 1 Dai) while the associated NOCLAIM token drops to 0. On the flip side, the opposite happens if a coverage period passes with no successful claims: 1 NOCLAIM becomes ≈ 1 collateral.

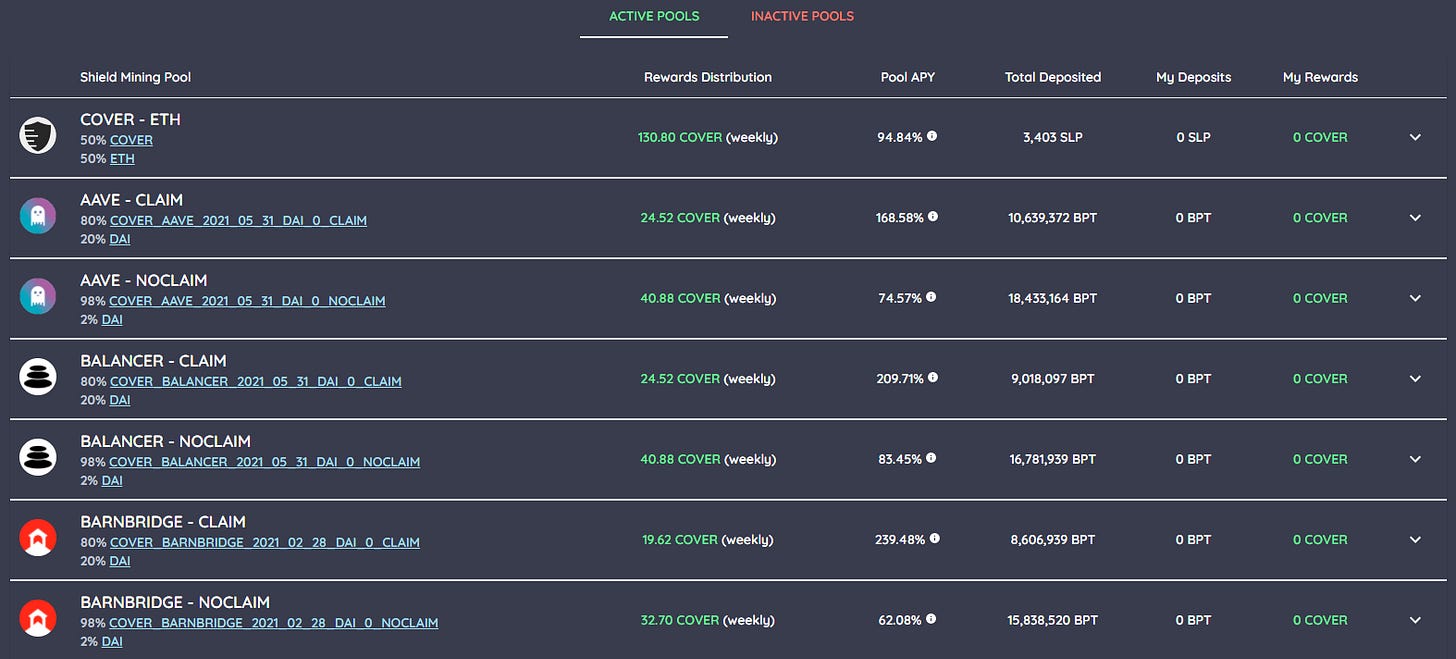

To make this coverage system liquid and efficient, Cover Protocol is incentivizing its CLAIM and NOCLAIM liquidity pools with COVER rewards, i.e. the project’s governance token.

To participate in any of these yield farms, you can follow these steps:

Mint CLAIM and NOCLAIM tokens by depositing collateral into Cover.

Have Dai on hand or acquire some, as you’ll need it for providing liquidity.

Navigate to Cover’s shield mining dashboard.

Click on your pool of choice, then click on the provided “Go to Balancer Pool” link.

Supply your CLAIM or NOCLAIM tokens and Dai into your chosen Balancer liquidity pool. Keep in mind: CLAIM pools rely on a CLAIM / DAI weighting of 80 / 20, while NOCLAIM pools use a NOCLAIM / DAI weighting of 98 / 2.

Take your Balancer Pool LP tokens, and stake them on Cover Protocol through the shield mining dashboard.

That’s it! You can claim your ensuing COVER rewards and withdraw your BPT whenever you want.

Some of these incentivized pools are pretty attractive right now, too. The highest-earning ones currently include:

CREAM - CLAIM (~429% APY)

HARVEST - CLAIM (~376% APY)

REN - CLAIM (~375% APY)

SUSHISWAP - CLAIM (274% APY)

Yet as always, farm responsibly and do your own research. Cover Protocol is a really interesting project and its shield mining campaign is currently going strong, but that doesn’t mean you should jump into any of its farms (or any yield farms in general) with more money than you can afford to lose. Farm smart, that’s the DeFi way!

The Aave Protocol V2

TLDR: Lending protocol Aave rolls out its optimized V2 system on the Ethereum mainnet.Understanding Cover Protocol

TLDR: Yearn creator Andre Cronje explains how DeFi insurance project Cover Protocol works in this excellent short primer.Bancor Progress Update: November 2020

TLDR: The Bancor team outlines recent major developments for the protocol, like the launch of Bancor v2.1.Opyn v2 Introduction + Bug Bounty

TLDR: The Opyn team explains the features of the coming Opyn v2 protocol, including its new European, cash-settled options.1inch announces stage 2 of liquidity mining campaign

TLDR: DEX aggregator project 1inch.exchange unveiled the second phase of its ongoing liquidity mining campaign.The Unintended(?) Consequences of the STABLE Act

TLDR: Crypto advocacy non-profit CoinCenter outlines precisely how the STABLE Act “could turn node operators into criminals.”Insurance Mining with DerivaDEX

TLDR: Derivatives trading protocol DerivaDEX launches its insurance mining program, which rewards users who stake deposits into the project’s insurance fund.Vesper’s Core Principles*

TLDR: Vesper introduces its four core principles: longevity, quality, trust, and community.

*This is part of our sponsored links series.

Thank you to our sponsors Injective Protocol, which offers a layer-2 DEX that is fully decentralized, and free of any gas fees, and TrueFi, the uncollateralized lending platform from the makers of TUSD.

Get early access to Injective Protocol’s testnet, and start earning competitive yields & farm at TrueFi.io today.

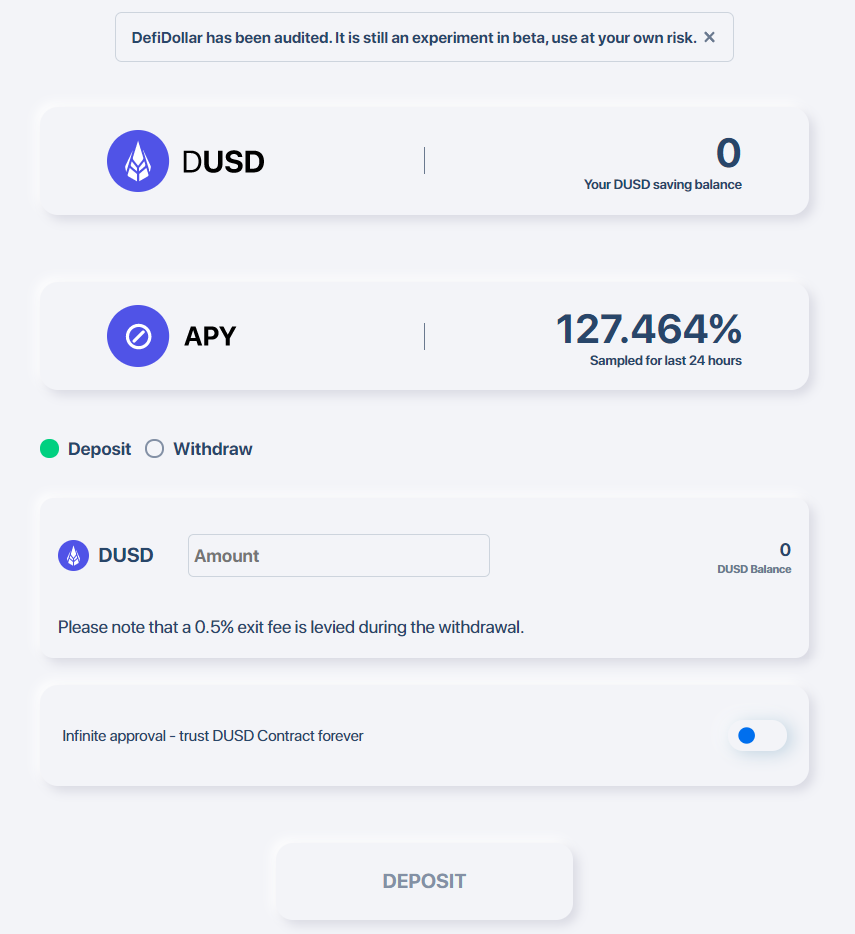

Farm ~125% through DefiDollar’s interest-bearing ibDUSD token.

What’s not to love about simple and low-risk farms, and the ibDUSD token from stablecoin index project DefiDollar certainly ticks both of these boxes. Launched last month as a “simple savings account” for DeFi, ibDUSD relies on multiple protocol integrations to generate yield for its holders.

That said, income generated from all existing DUSD accrues only to the DUSD staked in the ibUSD smart contract, so it’ll pay to be among the DUSD stakers (and thus ibDUSD holders) that are benefiting from the economic activity of the entire DUSD supply. As the DefiDollar project grows, then, the ibDUSD token becomes more lucrative in kind.

How to farm via ibDUSD

This farm is as straightforward as it comes, in that it just requires one step: depositing your DUSD into the ibDUSD smart contract through DefiDollar’s “Savings” dashboard.

Once you deposit however much DUSD you want into the contract you’ll receive an equivalent amount of interest-bearing ibDUSD in return, and this ibDUSD will steadily grow over time as yield continues to accrue to DUSD stakers.

While the yield you get through ibDUSD will naturally fluctuate, the novel DeFi savings instrument is currently generating +127% APY. That’s excellent for a low-risk yield farm and is definitely vastly more attractive than anything mainstream savings accounts could offer.

So with this farm, the gist is that it’s a straightforward and easy way to fetch some decent DeFi savings. DefiDollar has been audited, but you should still do your own research and remember that ultimately low-risk projects still entail risk. Farm shrewdly accordingly!

Maker signals approval for adding renBTC as a supported collateral type.

Curve proposes to start vesting funds to Curve’s Grant Council DAO multisig.

Yearn votes on whether to create a new YFI Governance Vault.

Bancor adds support for YFI and REN in its liquidity mining campaign.

Cream passes a proposal to list Dai as a supported collateral asset.

SushiSwap votes on whether it should add YFI to its treasury.

This week’s plow of the week goes to Yield Farming Tools, a simple tool that allows you to compare pools across various protocols by risk level, provider, and type of collateral!

DeFi’s rise toward the mainstream is accelerating, and with that comes growing pains like the proposal of the STABLE Act. But that’s to be expected, as the Ethereum ecosystem is nothing short of financial revolution that threatens the status quo. Of course, that’s going to rankle the powers-that-be now that Ethereum and DeFi are in the limelight like never before. So we’ll see what happens next but in the meantime happy farming!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!