DeFi Pulse Farmer #2

Catch up on a week for the DeFi history books as we recap YAM, BASED, CRV and more.

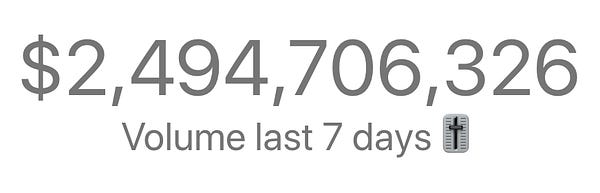

This was without a doubt the craziest week in yield farming yet. With billions in value flowing every which way, emotions flared as gas prices soared. Yield was made while sleep was lost.

Luckily, we covered it all thanks to our new Alpha Tractor Series series - giving you intel into the freshest yield for the most honest farmers only.

For those who missed it, subscribers were the first to hear about YAM, BASED and CRV with hand-tailored overviews delivered right to your inbox.

Each edition we’ll focus on two types of strategies. ‘Farm of the Week’ - a more sophisticated, risk-intensive tactic and ‘Conservative Farmer’ - for risk-averse traders looking to dip their toes into DeFi without as much potential risk.

These strategies and the Alpha Tractor Series will soon be hidden behind a paywall for serious farmers only. We’d like to make it clear that in order to see worthwhile returns from our strategies given current gas prices, we recommend getting started with a minimum of $10k.

Again - DeFi protocols are highly experimental and expose your assets to financial and protocol risks. Don’t invest more than you can afford to lose.

Before we dive in, we’d like to offer a quick word on risk

“Users are stress-testing financial products and protocols with massive sums of money, chasing returns. Not all products will pass the test; please exercise caution.”

Robert Leshner, Founder, Compound.

Thankfully, we’ve yet to see a major catastrophe in DeFi. This does not mean it will never happen and this does not mean you should blindly throw around money to unaudited (or even audited!) smart contracts.

When farming, please proceed with caution. We can not emphasize enough how new many of these opportunities are and the last thing we want is to give anyone the idea returns are *guaranteed* or without high levels of unforeseen risks. /rant

DeFi Recap

In the past week, Total Value Locked (TVL) surpassed the $5B mark for the first time and is now at its all-time high of $5.81B.

YAM launched and collapsed in just over 24 hours, attracting more than $400M while proving to be one of the most exhilarating experiments in governance coordination.

Curve’s $CRV contracts were deployed by an anonymous account causing TVL on the liquidity aggregator to spike 3X overnight.

Aave launched version two of their protocol featuring new lending use cases like credit delegation, gas optimizations, and governance parameters in preparation for their upcoming Aavenomics migration.

Balancer’s governance token - $BAL - was this week’s top gain with a 50% increase in price following it’s listing on Binance.

Most importantly, $ETH surpassed the $440 mark for the first time since 2018. We’ll let you do the math on how strong a signal this is.

Degen Coins - What’s the Point?

TEND, TACO, YAM, BASED, MEME - where does it end?

While the rise of meme-coins has been favorable to farmers thus far, the rush to mine the latest meme falls on a very slippery slope. Despite all the aforementioned meme coins putting a significant amount of attention into their token economics, let us not forget what got DeFi here in the first place.

Borderless access to new financial primitives is the premise which first caused DeFi to gain steam. If we are not careful, what was once a beautiful sector will quickly lose it’s legitimacy as something categorized as another ‘get rich quick scheme’.

DeFi truly is a real-life MMO game. Let’s do our best to make it one which everyone can (and wants to) play.

Stories of the Week

Curve releases it’s CRV Governance Token

TLDR: Curve liquidity providers now earn CRV for providing liquidity on the leading liquidity aggregator.Yam prepares to relaunch with a Yam2 migration

TLDR: The Yam team will work to relaunch YAM with bug patches which reward those who acted to #saveyam.1inch secures $2.8M in Funding

TLDR: 1inch teases its governance token with farming rewards on a handful of Mooniswap pools.bZx adds staking to the BZRX DAO

TLDR: Users can now stake BZRX via the DAO to earn protocol fees.Introducing APY Finance

TLDR: APY Finance announces Smart Yield Farming aggregator + farming for $APY governance token.Atomica Liquidation Markets Enhance Security, Boost Yield and Refine Gas Efficiency

TLDR: Atomica integrates Compound and adds COMP rewards for liquidity providers.HEGIC Token Announcement

TLDR: HEGIC announces governance token and farming rewards.Strike Protocol rebrands to Perpetual Protocol

TLDR: Decentralized perpetual swap protocol rebrands with new governance token - PERP.

Governance Watcher

Want your company featured here? Fill out this link to be the first DeFi Pulse Farmer sponsor!

Farm of the Week

Harvest 473% APY using Curve’s sUSD Pool

As if it wasn’t obvious, Curve’s liquidity pools are currently netting the best returns in DeFi.

Thanks to the premise of entering with stablecoins, impermanent loss is mitigated by offering a sound return on liquidity (ROL) when farming DeFi’s hottest governance token.

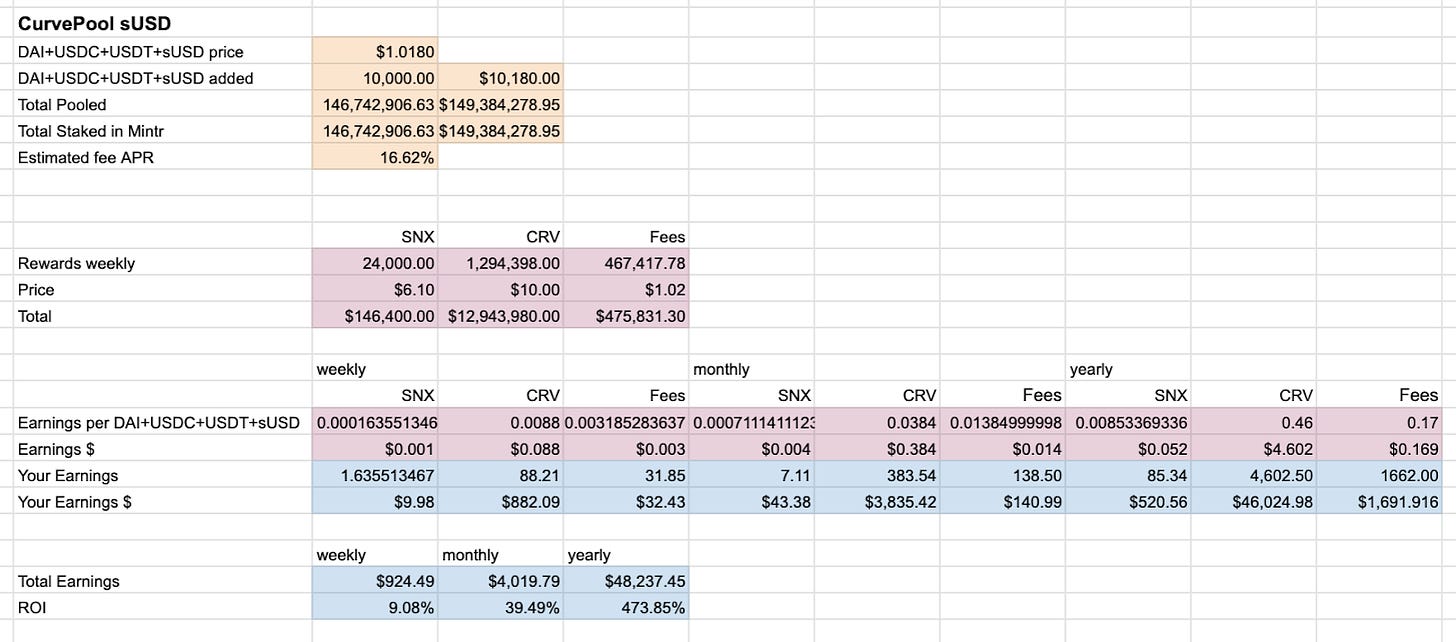

For this strategy, we want to highlight the added benefit of SNX rewards which come depositing into the sUSD Curve pool. Each week, Synthetix rewards 24,000 SNX to sUSD Curve LPs.

LP’s will need to provide liquidity to the sUSD pool and stake that position via a Curve Gauge to earn both CRV and SNX rewards. To do this, head over to the sUSD pool and deposit any mix of or 100% of any supported stablecoin in the basket (DAI, USDC, USDT, sUSDC). Here’s a look at how rewards break down at the time of writing.

It’s important to note that these yields won’t last long and that as CRV price drops, so do the subsequent rewards. This model does not take into account liquidity multipliers which can be earned by locking CRV and does not account for any early tokens which users may invest throughout farming.

The Conservative Farmer

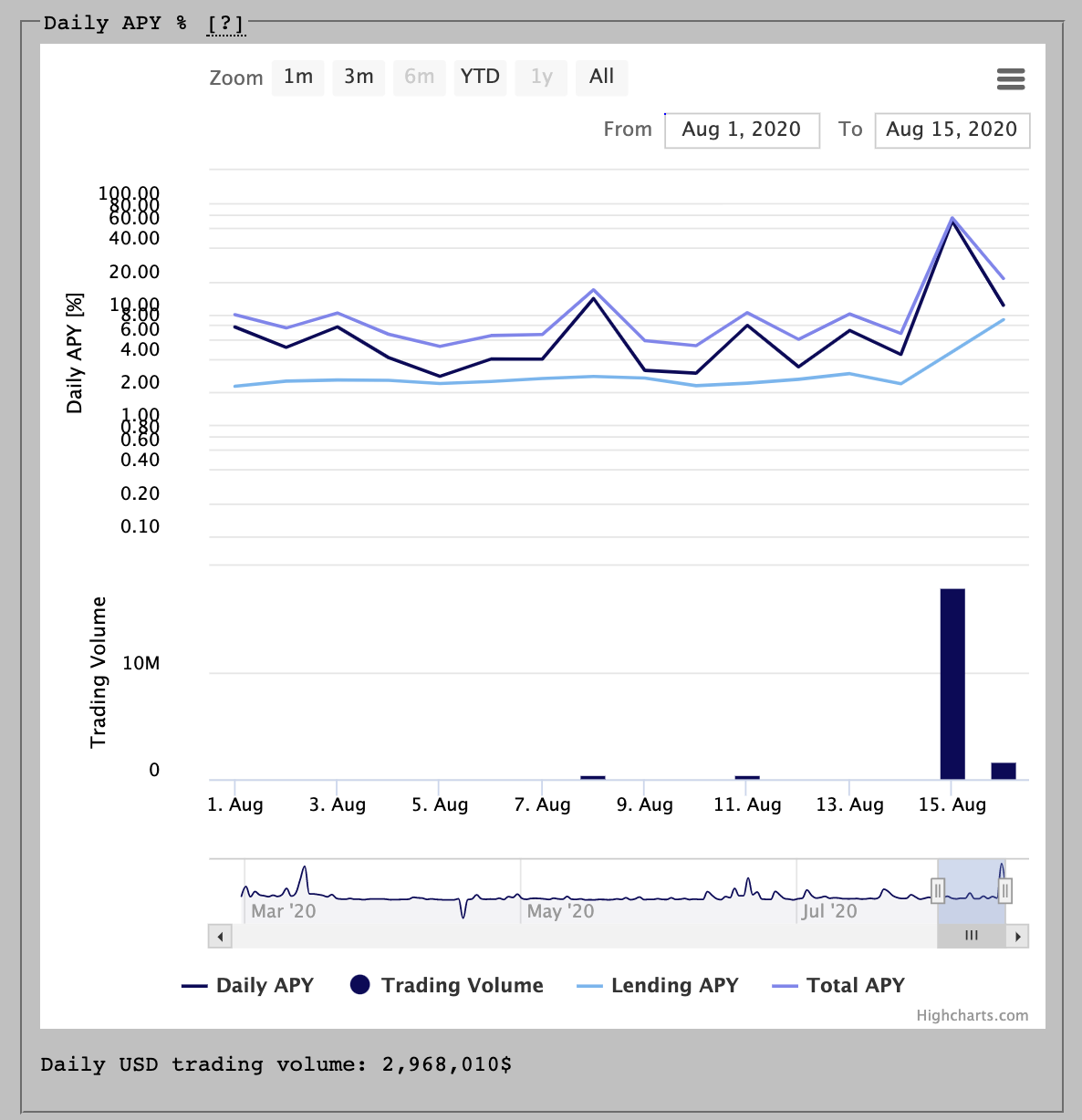

Harvest 20% on your stablecoins with Curve’s Compound pool

Curve’s DEX is built for efficient stablecoin trading. One of their first pools, Compound, allows farmers to obtain up to 20% APY when locking their DAI or USDC while offering the lowest degree of associated risk. This APY is *without* taking CRV rewards into account.

Image source: https://www.curve.fi/compound/stats

How to invest in Curve’s Compound pool

Curve’s Compound pool is accessible using DAI and USDC deposits which can be purchased on Uniswap or Balancer.

Farmers can deposit USDC or DAI to Curve’s Compound Pool.

BONUS: Stake the LP position via the Compound gauge for CRV rewards (extra risk + gas).

Curve’s Compound pool returns

When farmers deposit into the Compound pool, they receive Curve Compound LP tokens, representing their pool’s proportional ownership. Farmers get fees from all transactions on the pool plus extra income because their assets are supplied to the background’s Compound protocol.

We want to warn farmers that gas costs are at an all-time high. Getting in and out of this opportunity is likely to cost ~$100 in transaction fees alone.

Alpha Leaker of the Week

Closing Thoughts

This marks the second edition of DeFi Pulse Farmer.

As a resource best known for our Total Value Locked leaderboard, DeFi Pulse is excited to better demonstrate our adept knowledge on the latest trends in DeFi. We’re always looking to expand our contributor list and give you a chance to be featured in next week’s edition.

If you’ve got a strategy worth leaking, join the Concourse Discord and make some noise in the #defi-pulse-community channel. Those who are featured will receive a shoutout on Twitter with over 25k followers.

Until next week, keep up the honest work!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!