DeFi Pulse Farmer #21

Catch up on a new week in DeFi as we recap 1inch's token airdrop, the Farm of the week, the Conservative Farmer, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

After hitting as high as $16B last week, DeFi’s TVL has since declined some 15% to its current position of $13.43B due to the DeFi Pulse's new Bitcoin at Work page, which now tracks Bitcoin locked in DeFi as a separate metric from DeFi TVL.

In any case, the round psychological milestone of $20B by year’s end now seems out of reach. Yet no matter how you slice it 2020 was indisputably a banner year of growth for the entire DeFi ecosystem, and the space’s current +$13B TVL is extremely impressive considering how that metric only crossed $1B for the first time back in February!

As for how the upper echelon of DeFi looks as we close out Q4, the five largest dapps right now are Maker ($2.61B TVL), Compound ($1.84B TVL), Aave ($1.64B TVL), Uniswap ($1.47B TVL), and Synthetix ($1.2B TVL). Looking ahead, it’ll be interesting to see how this top 5 looks at this point next year. Can the aforementioned projects consolidate their positions, or will new Defi protocols rise and challenge these veterans’ popularity?

We’ll have to wait and see. For now, the story that captured everyone’s attention this week was 1inch.exchange’s 1INCH token airdrop. Reminiscent of how Uniswap released UNI a few months ago, 1inch’s 1INCH distribution just rewarded the DEX aggregator’s past users in a big way. The project followed up the launch with a new liquidity mining campaign that’s offering some pretty attractive farms at the moment, too.

Lastly, let’s cover some of the top-performing DeFi assets from the past week, which included SNX (+38%), DODO (+27%), and KEEP (+5.4%). The DeFi Pulse Index (DPI) declined 4.1% to $105.9 in the same span.

Thank you to our sponsors DEXTF, an asset management protocol that makes managing and investing assets easier, and Vesper, an upcoming platform for professional DeFi products, starting with set-and-forget pools for HODL'ing and growing your assets.

Accumulate and bundle yield generating assets with your favorite longs now on DEXTF, and be among the first to try Vesper's incentivized beta.

Farm +95% APY in Alpha Homora’s ALPHA Pool

Launched by Alpha Finance Labs earlier this year, Alpha Homora is a first-of-its-kind DeFi protocol that lets users leverage their yield farming positions.

The protocol’s grand idea? Helping yield farmers maximize their returns efficiently and in a relatively safe fashion, which is great by us!

That said, Alpha Homora’s Uniswap ibETH/ALPHA pool is among the most interesting farms in DeFi right now. At the heart of a liquidity mining campaign running until Jan. 11th, 2021, this pool is notable because it offers liquidity providers (LPs) three separate income avenues.

What do I mean? First off, by serving as an ibETH/ALPHA LP you can earn Uniswap trading fees of course. Then there’s Alpha Homora’s ongoing liquidity mining campaign, which is seeing 3.5M ALPHA in rewards distributed to LPs between Dec. 12th and Jan. 11th.

Not bad! But what really makes this ALPHA pool interesting is its third income avenue, ibETH.

ibETH is the interest-bearing token given to Alpha Homora’s ETH lenders who supply the ETH underpinning the protocol’s Bank Reserve. As such, ibETH holders currently earn 8% APR from the interest paid by Alpha Homora’s borrowers. To reiterate, then, ibETH/ALPHA LPs earn trading fees, ALPHA rewards, and interest via ibETH.

If this sounds like the farm for you, then you can ready some ALPHA and ETH / or ibETH (Alpha Homora’s dashboard lets you enter the pool with either of the latter) and follow these steps to become an LP:

Navigate to Alpha Homora’s ALPHA Pools page.

Connect your wallet.

You’ll see two Uniswap ibETH/ALPHA widgets like in the image below. The one on the left accepts ETH deposits, and the one on the right accepts ibETH deposits. Select whichever one you prefer!

Source: Alpha Homora

In the ensuing deposit screen, choose how much ALPHA and ETH/ibETH you want to allocate. Confirm the supply transaction, and then you’ll be farming away!

Alpha Homora is certainly an interesting project that’s brought something new to DeFi, but that doesn’t mean you should recklessly ape into this ibETH/ALPHA pool. Do your own research, and keep in mind the risks at hand like impermanent loss (IL) and accrued debts from underwater positions when it comes to ibETH.

NXM Hack Update

TLDR: Nexus Mutual founder Hugh Karp outlines how he was tricked into approving a transaction that gave a hacker 370k NXM tokens.Degenerative Finance: uGAS Explained

TLDR: The Yam Finance team explores Degenerative Finance, a product built in collaboration with UMA that serves as a synthetic gas futures token.Introducing COMBO Token

TLDR: Flash loan project Furucombo announces its COMBO governance and fee-sharing token.Ahead of the Curve #4

TLDR: The Curve team highlights major recent developments around the project, like the decentralized exchange’s freshly launched sETH pool.1inch Token Is Released

TLDR: DEX aggregator project 1inch.exhange launches its 1INCH governance token via a community airdrop.pNetwork Dawn - Introducing pNetwork Nodes

TLDR: Cross-chain DeFi composability protocol pNetwork unveils pNetwork Dawn, a network of node operators powering the project’s cross-chain infrastructure.Opium Token Economics

TLDR: Decentralized derivatives protocol Opium breaks down the ins and outs of its new $OPIUM governance token.Vesper incentivized beta launch*

TLDR: Vesper announces its beta launch and beginning of incentives campaign.

*This is part of our sponsored links series.

Farm Curve’s New Aave V2 aTokens Pool

You love to see when one respected protocol builds services around the infrastructure of another respected protocol. Curve gave us just such an example this week in unveiling its newest pool, which centers around Aave’s aTokens.

aTokens, of course, are Aave’s increasingly popular interest-bearing tokens that accrue interest straight to users’ wallets and in real-time. They’re easy to use, efficient, and more people are wanting to trade them. That’s where Curve’s new aTokens pool comes in.

The pool, initially composed of aDAI, aUSDC, and aUSDT, is a stablecoin pool so it doesn’t face IL risk. And since these three tokens are interest-bearing, LPs can earn trading fees via Curve and interest via Aave within the same farm. Nice! In the future, CRV rewards will likely be activated for the pool, too.

If you’re interested in joining this farm, start by navigating to Curve’s new aTokens pool deposit page. Then select what combination of aDAI, aUSDC, and aUSDT you’d like to supply and fire off a deposit transaction. That’s all it takes!

This pool is interesting and definitely on the safer side of things, but it’s also new and risks are inescapable in DeFi. Never treat any farm like its returns are guaranteed, and be sure to do your own research!

Maker voters formally approve adding AAVE and UNI-V2-DAI-ETH LP tokens as supported collateral types.

Aave proposes adding tBTC as a supported collateral type in the Aave V2 system.

Curve proposes creating a stETH/ETH pool for Lido staked ETH.

Yearn proposes a yvSNX Vault and asks for strategists to help in designing it.

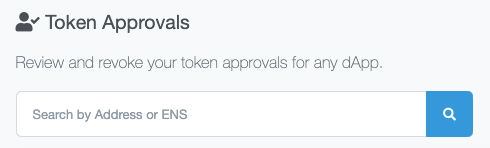

This week’s plow of the week goes to the new Etherscan feature: Token Approval Checker. The checker allows you to review and revoke your token approvals for any dApp!

After UNI, CRV, and now the 1INCH airdrop this week, it seems all but inevitable that retroactive token distributions will see much more adoption in 2021 and beyond. The grand question now, then, is what projects are next? High-profile teams that haven’t released tokens yet are obvious candidates, like MetaMask and Dharma. In the meantime, look for DeFi users to start experimenting far and wide to position themselves to reap future airdrops. The hunt is on!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!