DeFi Pulse Farmer #23

Catch up on a new week in DeFi as we recap the Farm of the Week, the Conservative Farmer, the Governance Watcher, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

The DeFi ecosystem’s total value locked (TVL) is over $22B currently, more than $8B higher than it was just one week ago. Never has a $100B TVL and beyond seemed so realistic than it does today!

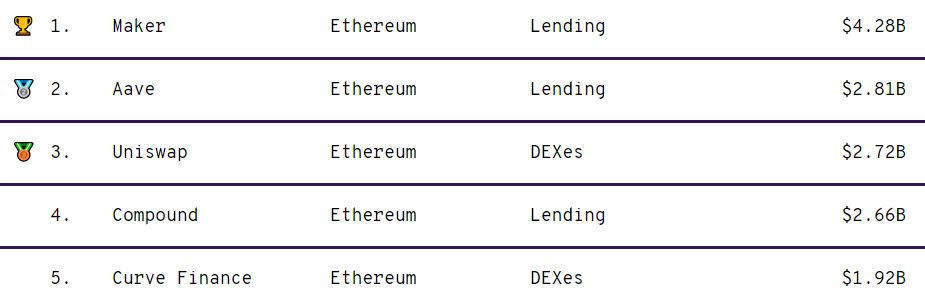

As for DeFi’s top projects this week we still have borrowing and lending protocol Maker leading the pack, and it’s notably the first protocol to break the $4B TVL milestone. Behind Maker are three projects on the cusp of breaking $3B: Aave at $2.81B, Uniswap at $2.72B, and Compound at $2.66B. The fifth-largest project right now is Curve, which is sitting at a $1.92B TVL.

Regarding headlines, the biggest news this week was arguably the ETH price trading above $1,200 USD for days in a row. This puts ETH within striking distance of its previous all-time high of +$1,430.

With the cryptoeconomy’s bullish winds recently, that price record could be breached sooner rather than later, too. Nothing’s guaranteed, but we’ll see!

Bitcoin’s now trading around the $40k mark, too, so BTC’s impressive price action alone could help to pull the ETH price up in the coming days. Add in the flurry of DeFi and NFT activity on Ethereum lately, and you’ve got a real bull case for ETH at the moment. Let’s watch how things shape up in the coming weeks!

Lastly, let’s take a look at this week’s top-performing DeFi assets, which included LRC (+120%), MKR (+117%), HEGIC (+100%), ALPHA (+95%), and YFI (+72%). The DeFi Pulse Index (DPI) also had a great week, climbing 79% to $181.60 in that span.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

Farm 90% APY via Loopring’s L2 Liquidity Mining

2020 was the year that DeFi first made a name for itself. 2021 will be the year that DeFi’s novel layer-two (L2) scaling solutions rise into the limelight, similarly.

That said, one of the earliest L2-focused projects of note around DeFi has been Loopring, an exchange and payments protocol underpinned by zkRollups.

Audited and non-custodial, Loopring’s extremely scalable technology is powered by zero-knowledge proofs that are used to batch and process transactions off-chain, which ensures gas and settlement costs stay very low for users.

One of Loopring’s key recent advancements has been the launch of Loopring Exchange v2, an automated market maker (AMM) that makes DeFi trading much faster and more affordable.

To bootstrap usage of this new exchange, the Loopring team is currently incentivizing liquidity providers (LPs) with an L2 liquidity mining campaign. Expect to see a lot more of these campaigns, too, as L2 solutions keep growing in prominence!

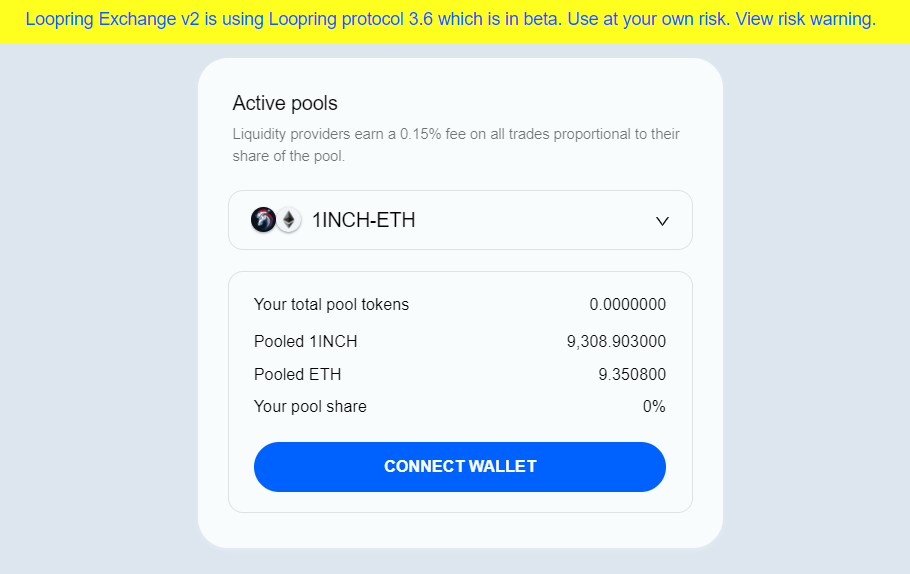

Farming LRC on L2

LRC is the native token of Loopring. Of the +1.3B LRC in existence, the project’s team allocated 1.2M LRC to reward the LPs of three Loopring Exchange v2 pools: LRC/ETH, ETH/USDT, and ETH/WBTC.

This means 400k LRC has been set aside for each pool as things stand, and these rewards are run across multiple 14-day cycles. After one cycle is done, another one can be approved and even be extended to add support for more pools.

All you’ll have to do to earn these LRC rewards is to provide liquidity to one of the three aforementioned pools. To do that, you’ll simply:

Navigate to the Loopring Exchange v2 Pool dashboard.

Connect your Ethereum wallet.

From the provided dropdown menu, select LRC/ETH, ETH/USDT, or ETH/WBTC.

Click on the deposit button and select the amount you’d like to supply.

Confirm the deposit transaction and you’ll be L2 mining!

As for tracking your farmed LRC, you’ll be able to watch your rewards grow daily in Loopring’s My Rewards page. Earned LRC will be sent to your L2 account at the end of every two-week liquidity mining cycle.

Another thing to keep in mind is that you can take your LRC rewards and stake them through Loopring’s staking portal. This will entitle you to a cut of the fees paid by any of the exchanges built atop Loopring’s protocol.

Remember, serving as an LP or staking your LRC comes with certain risks, like impermanent loss or the possibility of smart contract vulnerabilities. Always do your own research before you jump into any farm, and never plow with more money than you can afford to lose!

Collateralized Stable Yield Credit

TLDR: Yearn creator Andre Cronje unveils the 3rd iteration of Stable Credit, a credit line DeFi project that’s nearing its 2nd audit and thereafter launching.New COVER Token Launch

TLDR: DeFi insurance project Cover Protol launches its claims portal and details how users affected in its recent economic attack can claim new COVER tokens.Announcing Futureswap V2 Beta

TLDR: DeFi perpetuals project Futureswap explains the new features of its coming V2 system, like the FST governance token and the Oracle Relayer Network (ORN).Loopring to Launch AMM Liquidity Mining on L2

TLDR: To incentivize liquidity providers, Loopring launches a liquidity mining campaign on its layer-two Loopring Exchange v2 system.Alpha Homora V2 Is Coming to Town

TLDR: DeFi leverage protocol Alpha Homora announces its V2 upgrade will be rolled out in Jan. 2020.Umbrella Internal Alpha

TLDR: Yam Finance explains how it’s begun internally testing Umbrella protocol, a DeFi service for straightforward “factory-based” pool creations.

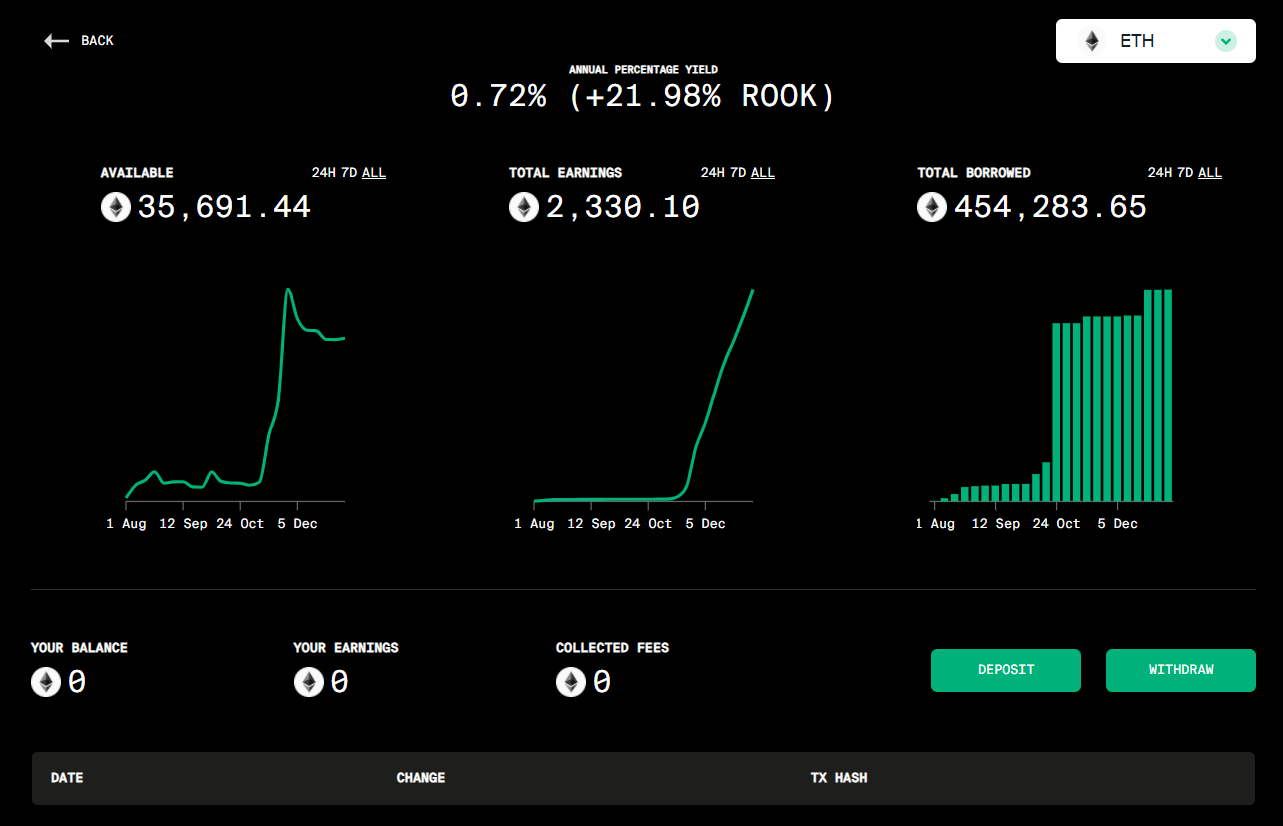

Farm Up to 50% APY via KeeperDAO

KeeperDAO is a really interesting protocol that’s centered around facilitating arbitrageurs, LPs, and beyond around DeFi. As the project grows and matures, then, so should DeFi.

KeeperDAO is also notable because it currently has some of the space’s most solid yield farms, seeing as how the project’s ETH pool, renBTC pool, and Stables pools have been bringing in steady yield for months now.

That’s what we like to hear! So for this edition of the Conservative Farmer we’re highlighting these farms, all of which have their own respective and yearly returns denominated in KeeperDAO’s native token, ROOK.

Right now, these returns look like so:

~23% APY for the ETH and WETH pool

~20% APY for the renBTC pool

~50% APY for the USDC pool

~49% APY for the DAI pool

If you’re interested in joining one of these farms, first navigate to KeeperDAO’s Pool dashboard and connect your wallet. Select the pool you’d like to supply to, and then make your deposit through the green deposit button on the lower right side of the dashboard. Once you do so, you’ll be farming ROOK!

Remember, you should always farm in a considerate and measured manner. Be sure to follow through with basic due diligence and research before you start farming through any project!

Compound votes on whether to change the COMP distribution parameters.

Sushiswap votes on adding 4 new core developers, or “Chefs.”

Sushiswap community introduces a proposal for Protocol v3: MIRIN.

Cream Finance votes on adding $1.39M in rescued liquidity to a new CREAM/USDC pool on Sushiswap.

This week’s Plow of the Week goes to Croco Finance, a really cool tool for Uniswap and Balancer farms that allows you to track your liquidity positions, compare strategies, and simulate how changes in token prices affect pool values!

2021 has seen DeFi get off to a hot start. Now, the grand question is: where does the early momentum go from here? Only time will tell, but in the meantime it’s certainly going to be fun to watch. Just remember to keep your head on straight if things do keep veering bullish from here, always farm responsibly, and take some profits every now and then!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!