DeFi Pulse Farmer #25

Catch up on a new week in DeFi as we recap the Farm of the Week, the Conservative Farmer, the Governance Watcher, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

DeFi’s total value locked (TVL) hit a new all-time high of $25B on Wednesday. Amazing! What a milestone for the young DeFi arena. While the ecosystem’s TVL has since slid down some to $23.5B, optimism around the space has never been so widespread and palpable.

Major growth clearly lies ahead …

In the meantime, per individual TVLs the lending protocols Maker ($4.23B) and Aave ($3.22B) remain DeFi’s largest dapps. However, in recent days we saw Uniswap ($2.98B) overtake Compound ($2.88B) for 3rd place and Curve Finance ($2.26B) replace SushiSwap ($1.88B) in 5th place.

As for headlines, the biggest developments this week centered around the startings of DeFi’s wider migration to layer-two (L2) scaling solutions. For example, just a few days ago Nick Mudge created a bridge to the L2 Matic Network for Aave’s interest-bearing aTokens. Synthetic assets protocol Synthetix also just launched SNX staking on Optimism, another promising L2 system.

These projects are undoubtedly setting the tone early in 2021. Indeed, it’s only a matter of time until such integrations come to be the norm around DeFi as more and more people demand extremely affordable and extremely fast transactions.

Zooming out, the best-performing DeFi assets from the past week included PERP (+120%), ALPHA (+120%), CRV (+90%), MTA (+75%), and ROOK (+70%). We also saw the DeFI Pulse Index (DPI) climb 2.83% to $223.91.

Thank you to our sponsors DEXTF, an asset management protocol that makes managing and investing assets easier, and Basis Cash, a decentralized stablecoin with an algorithmic central bank.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF. Provide liquidity on Uniswap, and stake your tokens to participate in Basis Cash's incentivized program.

Farm Double-Digit Yields via Yearn V2 Vaults

Yearn is one of the most promising and productive yield aggregator projects in DeFi. That’s why more than a few people were waiting on the edges of their seats for the release of Yearn’s V2 Vaults, which finally kicked off last week.

An optimization of Yearn’s V1 system, these V2 Vaults can use multiple strategies at once (compared to V1’s one-at-a-time approach) and leverage. They also offer a better fee structure that’s focused on aligning incentives for users and the protocol alike.

These V2 Vaults are flexible, then, and are set to become a lucrative force to be reckoned with in DeFi going forward. So where to begin if you’re interested in getting started?

Out of the gate, Yearn has released three non-experimental V2 Vaults (USDC, DAI, and HEGIC respectively). Because these products launched only days ago, their inaugural harvest cycle hasn’t occurred yet and we won’t start getting a clearer picture of the actual yields generated until the first cycle is down.

However, that doesn’t mean we can’t roughly guesstimate here. In fact, Yearn developer Doug Molina noted earlier this week that the USDC V2 Vault fetched ~56% APY and the DAI V2 Vault fetched ~28% APY during preliminary tests, so these are certainly starting points.

If these V2 Vaults are the kinds of pastures you’re looking for, you can easily make a deposit through Yearn’s Vault dashboard itself or through front-end services like DeFi dashboards Zerion and Zapper.fi.

For the sake of straightforwardness, we’ll use the example of Yearn’s dashboard. Pick the farm you want to start with and then you can join like so:

Navigate to Yearn and connect your wallet.

Click on Yearn’s Vault dashboard.

Scroll down to your V2 Vault of choice and click on it.

Approve the transaction and make your desired deposit amount. You’ll receive an associated amount of Yearn’s V2 yield-bearing yvTokens (e.g yvDai, yvUSDC, yvHEGIC). These yvTokens track your share in the Vault’s underlying token pool.

Now you’re farming. If your Vault’s strategy performs successfully, these yvTokens will accrue in value and can be redeemed profitably later.

This is just one front-end to consider, though. The process of joining a Yearn V2 Vault through the aforementioned DeFi dashboards is quite similar to what’s described above, for instance.

Yearn is a highly respected and audited DeFi project, but you still shouldn’t farm through V2 Vaults until you’ve done your own research. Always farm responsibly, a little bit of caution can go a long way!

Kyber 3.0: Architecture Revamp, Dynamic MM, and KNC Migration Proposal

TLDR: The Kyber Network outlines its plans for the Kyber 3.0 upgrade, which among other things will transition the project from a single liquidity protocol into a hub of such protocols.GHST Token Live on Matic

TLDR: Aave’s Aavegotchi game hosts an incentivized liquidity migration event around its GHST governance token.Last Week for ibETH/ALPHA Trading Volume Mining on Uniswap Before Migrating to SushiSwap

TLDR: Alpha Homora prepares to migrate its ibETH/ALPHA pool to the SushiSwap AMM.The State of 1559

TLDR: Ethereum core dev Tim Beiko explains the current status of EIP-1559, an upgrade that will optimize how Ethereum fees are handled and pave the way to ETH becoming deflationary.Update on Saddle’s Launch

TLDR: New pegged-value token exchange Saddle releases an update noting how its team responded to some of the protocol’s early high-slippage transactions.dYdX - 2020 Review

TLDR: Decentralized derivatives project dYdX walks through its major growth metrics from last year.

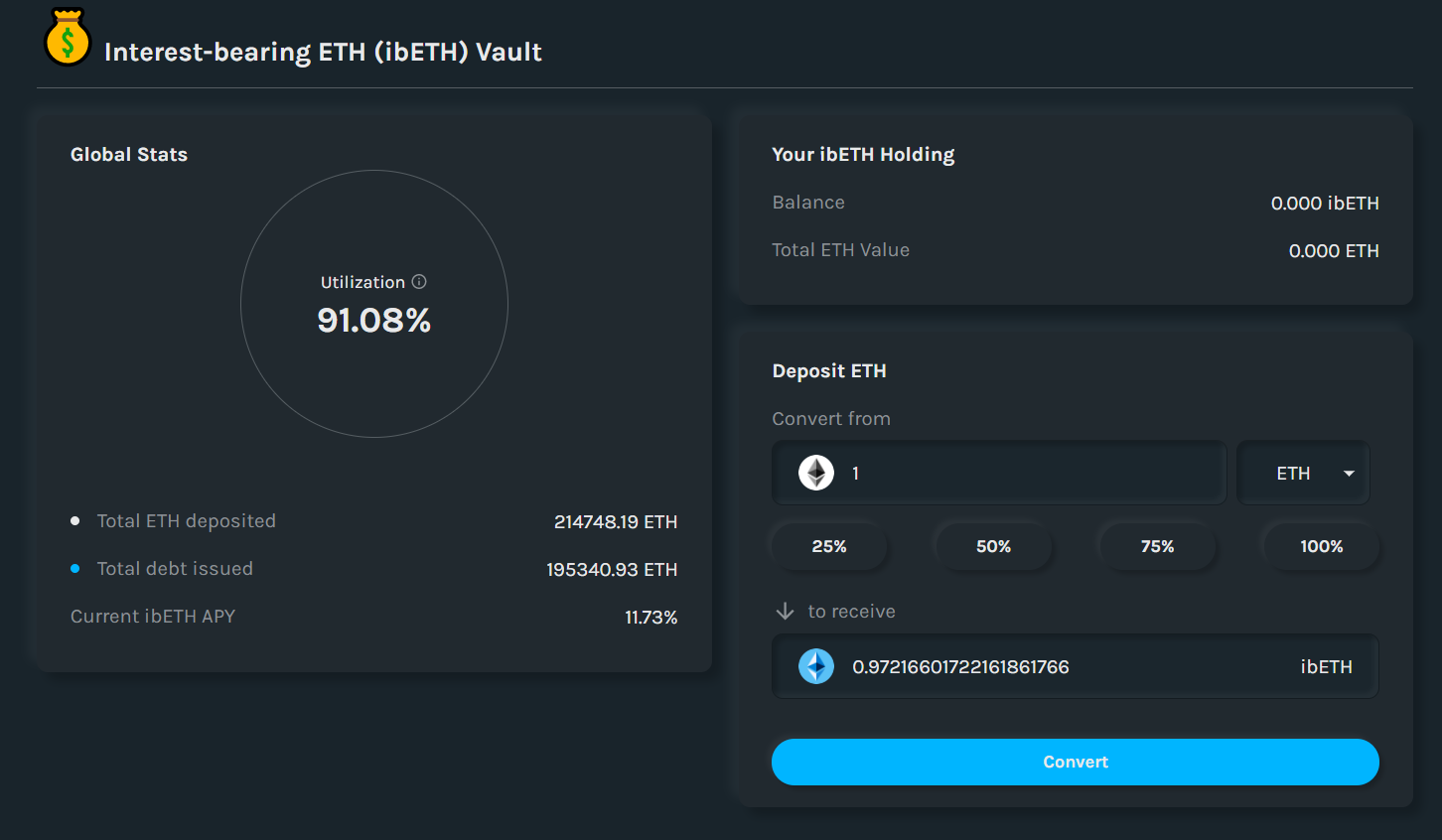

Farm ~12% Through Alpha Homora’s ibETH Vault

Supply APYs around ETH are typically pretty low in DeFi. For example, Compound’s ETH supply APY is just 0.13% right now, which obviously isn’t eye-popping yield.

That’s why we’re always on the hunt for places where you can keep the upside of holding ETH while also securing decent yields in relatively safe fashion. The good news is this week we’ve got precisely such an opportunity for you to consider, namely Alpha Homora’s ibETH Vault.

Alpha Homora is a leveraged yield farming protocol, and its interest-bearing ETH (ibETH) helps to incentivize liquidity to the project’s bank. Users deposit ETH and receive a proportional amount of ibETH, which accrues interest paid by Alpha Homora’s ETH borrowers. This interest is presently notching ibETH holders an 11.73% APY, which is fantastic for an ETH farm!

To join this farm, you’ll simply head over to Alpha Homora’s ibETH Vault page and convert however much ETH you’d like to ibETH. Once you confirm the conversion, your ibETH will automatically start earning you interest.

This farm is relatively safe but it’s not risk-free. Alpha Homora’s ETH lenders face the risk of accrued debt from underwater borrowers if liquidators don’t move fast enough, for example. Never invest more than you can afford to lose!

Yearn proposes to mint 6,666 YFI to fund future protocol development efforts.

Aave proposes adding support for 1inch’s 1INCH governance token.

Curve discusses how to distribute the fees it’s earning from cross-asset swaps via Synthetix.

This week’s Plow of the Week goes to DeFi Saver, a cool tool that’s widely known in the community but hasn’t been featured yet. DeFi Saver allows you to manage and automate your loans on Maker, Compound, and Aave, check it out if you haven’t already!

DeFi’s going strong. Yearn’s V2 Vaults are back, L2 integrations are popping off, the $25B TVL milestone was just notched, and many interesting yield farms are ongoing right now. It’s certainly a fruitful time to get involved, and fortunately, there’s something for everyone in DeFi!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!