DeFi Pulse Farmer #31

Catch up on a new week in DeFi as we recap the Farm of the Week, the Conservative Farmer, the Governance Watcher, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

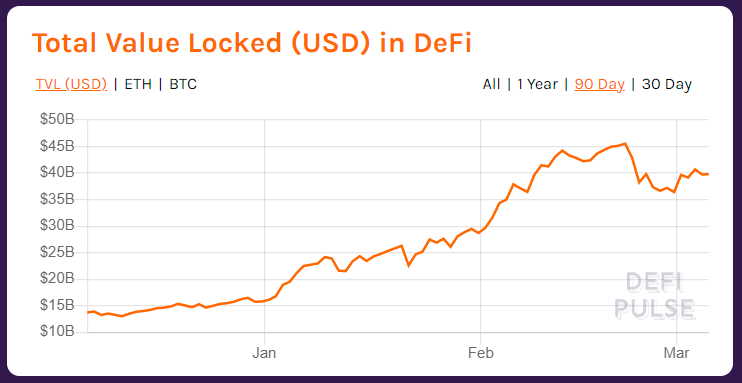

Things have cooled off a bit in DeFi this week, as the ecosystem’s total value locked (TVL) is currently hovering just under $40B — a drop of $5B from last week’s all-time TVL high of $45B to date.

Still, that $40B is impressive considering no one really knew about DeFi at this point one year ago. A lot has changed fast, and the pullback we’ve seen in recent days may be setting us up for DeFi’s next leg up. Is a $50B TVL just days away, then? Only time will tell, but these are exciting times to be watching.

The rebirth of the modern financial system happens in fits and bursts, right, that much is clear. We’re experiencing it firsthand currently.

Zooming in, there have been some interesting happenings among DeFi’s top dapps this week. For example, Maker’s back above a $6B TVL, Compound acutely flipped Aave for the 2nd-largest dapp position and the stablecoin exchange Curve at the $3.99B TVL mark. So even in something of a “down week,” DeFi’s stalwarts are looking strong.

As for individual DeFi tokens, we saw some strong performances this week. Top tokens on the week included RGT (+110%), BNT (+59%), ALPHA (+31%), KNC (+25%), BADGER (+8%). Additionally, the DeFi Pulse Index (DPI) is up 12% to $430.42 in the same span.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

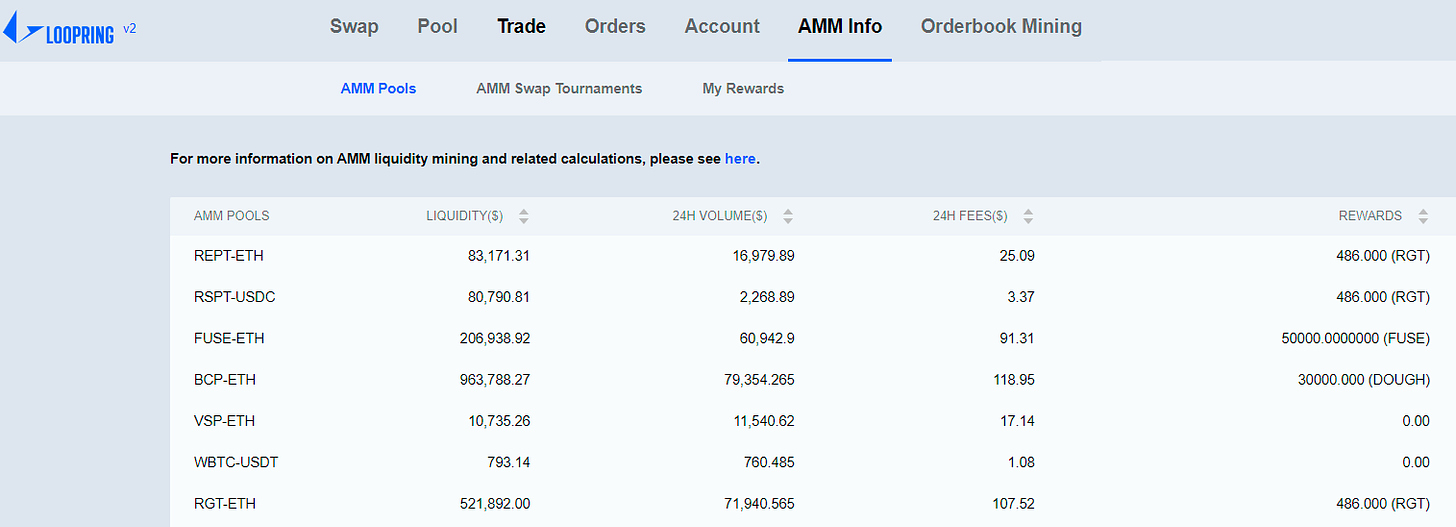

Farm up to 240% APY via Loopring’s L2 Liquidity Mining

Layer-two (L2) scaling is one of the biggest threads to watch in the Ethereum ecosystem in 2021. That’s why projects like Loopring who are running liquidity mining programs on L2 infrastructure are some of the most interesting yield farms right now.

So let’s get into the particulars. Loopring’s 3.0 L2 exchange is powered by ZK-Rollups, which are poised to be one of Ethereum’s most important scaling avenues over the next decade.

As such, Loopring’s ongoing L2 yield farms are giving Ethereum users the ability to serve as liquidity providers (LPs) and earn rewards for doing so while also serving as trailblazers for the masses of L2 users to come in the years ahead.

So serving as a Loopring LP is something of an activist position, as you’re betting on the future of Ethereum and Ethereum L2 activity. Simultaneously, you can get paid pretty attractive rewards in Loopring’s LRC token for your services. If you’re interested in any of these farms, try these steps.

Navigate to the Loopring Exchange v2 Pool dashboard.

Connect your Ethereum wallet.

From the provided dropdown menu, select your desired pool and then approve and deposit the required amount of assets.

Confirm the deposit transaction, and then you’ll be mining yields on L2.

If you’re all-in on Ethereum, and Ethereum’s future roadmap is rollups-centric, then projects like Loopring are compelling going forward. We’ll have to see how things shake out, of course, Loopring’s definitely a project to have on the radar right now.

L2 is largely uncharted territory. Only make the L2 leap if you’ve done your research and you feel comfortable moving your assets away from the Ethereum main chain. Do your research, farm responsibly, and never farm with money you can’t afford to lose.

Introducing Gateway

TLDR: The Compound team introduces the mechanics of a COMP-governed Substrate blockchain that will allow for a cross-chain interest rate market.BarnBridge SMART Yield Specs Unveiled

TLDR: The BarnBridge team releases the specification of the SMART Yield system, which “allows users to tranche out the yield from the debt pools of other projects, such as Aave, Compound, Cream, or Yearn Finance.”Announcing BABL

TLDR: Community-led asset management protocol unveils its BABL governance token.Announcing Yearn Partners

TLDR: Yield aggregator project Yearn launches its Yearn Partners program, which creates something of a “white-label solution for yVaults.”UMA Airdrop Recipient Addresses

TLDR: The UMA Protocol project airdrops uTVL KPI Options to 5 different DeFi governance communities. These options incentivize holders to boost the underlyings project’s TVLs.

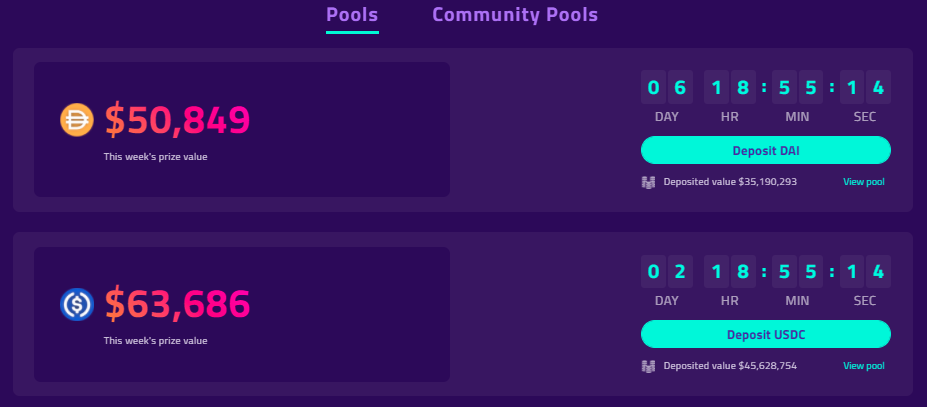

Farm 40% on stables with a chance to win big via PoolTogether!

There’s a smarter way to do lotteries, where no one loses but someone wins. Enter PoolTogether, the no-loss savings game built on Ethereum!

Simply put, you put your money in with others and the interest gained from everyone’s deposits creates the weekly prizes via DeFi lending. Beyond that, all underlying deposits can be withdrawn at any time, giving rise to PoolTogether’s “no-loss” moniker.

If you’re trying to show friends and family how powerful Ethereum can be in relatively safe fashion, then, PoolTogether’s no-loss lotto pools are one of your best bets. And better yet? The dapp just launched the POOL token to decentralize its governance, so right now you can get paid in POOL just to deposit your stablecoins into PoolTogether’s top prize pools, its DAI and USDC pools.

If you’re down with this farm, joining is simple, and you can earn up to 40% APY in POOL rewards right now for diving in. You just need to head over to PoolTogether’s deposit dashboard and pick which stablecoin pool you’d rather play, DAI or USDC. Approve your deposit, confirm it, and then you’ll be earning POOL while also having a shot at weekly lotto rewards, and you can withdraw your underlying deposit whenever you want.

PoolTogether’s been around for awhile and its structure is conservative and proven, so this is one of the safer yield farm opportunities you can find. But none of us are oblivious, in DeFi we all have to be on our toes at all times. You never know what could happen, and money can be lost per that knowledge gap. Just farm responsibly, do your own research, and never deposit more tokens than you can afford to lose.

The Balancer project votes whether to reimburse users’ gas fees in BAL tokens.

Compound updates the collateral parameters of its ZRX, BAT, and WBTC tokens.

Maker adds an Executive Vote to add Real World Asset 001 (RWA-001) as a supported collateral type.

The Uniswap community explores the possibility of adopting various L2 scaling solutions.

Have you ever wondered how many protocols you have granted access to for unlimited spending? Then Revoke, this week’s plow of the week is for you. Just type in your address to find out, and click revoke on the ones you want to eliminate!

‘Twas another promising week in DeFi, with some ups and some downs. And we come back and we trade and we farm some more. Because at the end of the day, we’re chasing alpha and there’s plenty of alpha to be had in this space right now while many outsiders remain clueless. It’s our time to shine, and we’re putting in the work to make our dreams a reality. Cheers to us.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!