DeFi Pulse Farmer #36

Catch up on a new week in DeFi as we recap the Farm of the Week, the Conservative Farmer, the Governance Watcher, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

For the second week in a row, the DeFi ecosystem’s total value locked (TVL) climbed ~$5B, this time to reach the +$50B milestone for the first time ever! Next stop $100B, eh?

As for the TVLs of individual projects, things are looking interesting at the top of DeFi this week. Compound is the largest dapp at the moment, being the first protocol to surpass the TVL mark of $10B! After that, the biggest contenders presently are as follows:

Maker ($8.16B)

Uniswap ($5.92B)

Aave ($5.79B)

Curve ($4.78B)

Sushiswap ($4.38B)

Alas, the state of DeFi is strong and getting stronger all the while, especially if recent headlines are any indication. Big developments from this week included:

Aave’s founder Stani Kulechov proposed the Direct deposit DAI module — The D3M, if passed, would essentially let Maker directly lend Dai to Aave. This would support Dai’s peg and availability and offer Maker new revenue possibilities. “Makes AAVE like a commercial bank on top of MakerDAO's central bank,” as Dragonfly Capital’s Haseeb Qureshi noted.

The amount of ETH sitting on exchanges dropped below 19% — According to Santiment, we haven’t seen this metric hit this level since Dec. 2018. And, of course, the more ETH that’s sitting in peoples’ actual wallets, the more ETH can be productively put to use in DeFi.

Crypto exchange giant Coinbase joined the DeFi Alliance — It’s going to take all kinds of people and organizations to power the DeFi revolution into the future. Having a large and influential crypto-savvy company like Coinbase join the DeFi Alliance is a great ally that will make tangible differences in this collective DeFi effort.

So now you’re up to date on the news, but what about tokens? Some of the best-performing DeFi tokens this week included , RUNE (+40%), MIR (+38%), REP (+27%), YFI (+25%), and BZRX (+20%). The DeFi Pulse Index (DPI) declined 7% on the week and is currently trading at $435.25.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

Farm Between 105%-242% APY with Integral’s Incentivized Pools

There’s a new AMM in town, and it wants to eat all other exchanges’ lunches. That AMM is Integral.

What makes Integral so interesting, then, is how it leans into its “continuous vampire attack” style with its mirroring system.

What’s mirroring, you ask?

This technique is powered by an innovation Integral’s builders developed called the OrderBook AMM (OB-AMM). In short, what the OB-AMM does is allow Integral to mirror depth from other exchanges, e.g. 3x the depth of Binance’s spot market order books. What’s theirs is Integral’s accordingly, and the ensuing advantage is concentrated liquidity, or achieving extensive depth without needing equally extensive capital.

Eventually, Integral won’t have to rely on mirroring because the plan is the protocol will steadily and mightily accrue its own liquidity reserves.

But Rome wasn’t built in a day, and Integral’s success won’t be either. To kickstart the AMM’s early infrastructure and community, the protocol’s team is currently running an initial 12-week liquidity mining campaign via its ITGR governance and revenue token.

ITGR hasn’t been launched yet (that’s coming as soon as this month), but it’s possible to already start earning the token by providing liquidity to one of Integral’s incentivized pools. As things stand, these pools are as follows:

LINK-WETH (~181% APY currently)

USDT-WETH (~242% APY currently)

USDC-WETH (~240% APY currently)

DAI-WETH (~227% APY currently)

WBTC-WETH (105% APY currently)

Those APYs are quite attractive, to be sure, but before you run to grab your hardware wallet just know that the ITGR token will follow a 6-month vesting period. These aren’t farm-and-dump pools, rather they’re suited for farmers who believe in the long-term vision of Integral.

All that said, joining these pools is straightforward if you decide you are interested. Pick your pool, get the required tokens ready, and then follow these steps:

Navigate to Integral and connect your wallet.

Click on the right side of the AMM’s “Pool” button and then on the token pair you’re targeting.

Select how many tokens you want to deposit and press “Add Liquidity.”

Confirm the ensuing transaction, at which point you’ll receive Integral LP (liquidity provider) tokens. Now you’ll be farming ITGR!

Integral is interesting and has big backers, but it’s also young and isn’t battle-tested yet. Do your own research, and never deposit more money into any DeFi protocol than you can afford to lose. It’s not worth it losing the whole farm trying to chase a single harvest!

Kyber DMM beta is live

TLDR: On-chain liquidity protocol Kyber Network unveils its Kyber Dynamic Market Maker protocol, which boasts extreme capital efficiency.Liquity Goes Live on Ethereum Mainnet

TLDR: Decentralized borrowing protocol Liquity, which offers users 0% interest loans against their ETH, launches.Sushiswap x UMA: Announcing Call Options for xSUSHI

TLDR: The Sushiswap and UMA teams are collaborating on a call option token with a $25 strike price for xSUSHI, Sushiswap’s staking token.Instadapp Protocol and Governance

TLDR: DeFi middleware project Instadapp reveals plans for its governance rollout, which will center around the new INST token.Trade now on Layer 2

TLDR: Decentralized exchange dYdX now has cross-margined Perpetual products active on L2 courtesy of StarkWare.vBNT Burning is Live

TLDR: The Bancor AMM project deploys its Bancor Vortex Burner to the Ethereum mainnet.

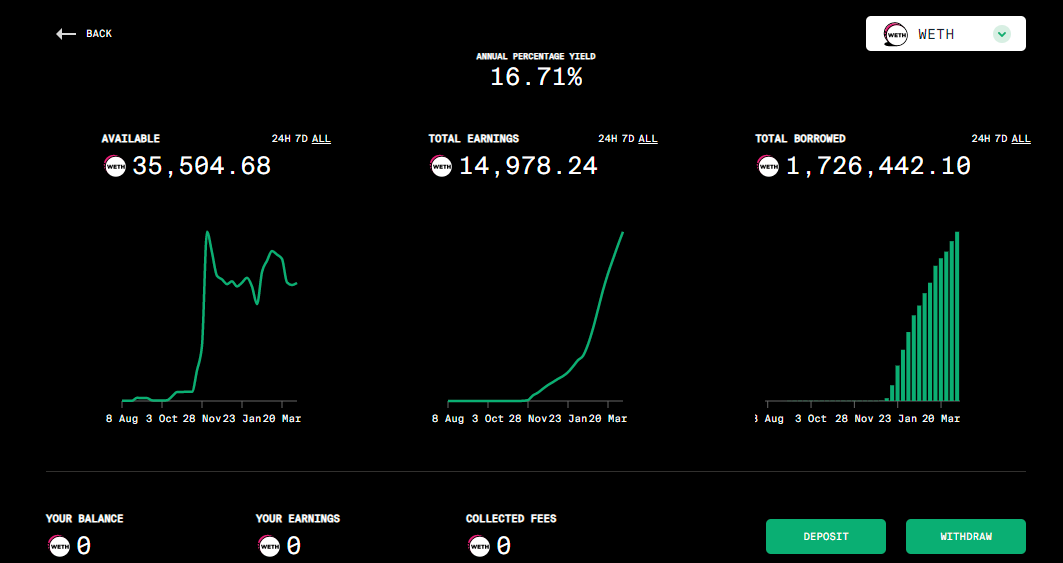

Farm 16.7% on your ETH with KeeperDAO

KeeperDAO is a game-theory protocol, in other words, it allows a range of stakeholders to pool and easily coordinate their participation around promising DeFi strategies.

As such, KeeperDAO’s great edge is its giant pool of amassed liquidity. The protocol can make use of this liquidity for revenue opportunities that individuals by themselves can’t achieve, so here we have a classic strength in numbers dynamic. Go together, get more, win-win, easy!

So that’s the bird’s-eye view of what KeeperDAO does. What actually helps the young protocol go ’round is ROOK, the project’s governance token, and one of the main ways to acquire ROOK currently is by providing liquidity to KeeperDAO.

All that said, we’re always on the lookout for sexy ETH farms, and KeeperDAO’s WETH pool is definitely a solid one to consider right now. It’s bringing in 16.7% APY at the moment, which is great by ETH yield standards.

If this sounds like the farm for you, you can head over to KeeperDAO’s WETH pool dashboard and connect your wallet. Then simply input how much wrapped ETH you’d like to supply, press “Deposit,” and confirm the ensuing transaction to start racking up ROOK rewards.

Keep in mind that you receive kTokens upon depositing funds to KeeperDAO. You’ll use these to redeem your underlying share in the liquidity pool whenever you please. Also, this may be a safe farm relatively speaking, but never throw caution to the wind in DeFi. Do your own research, and always farm responsibly.

Maker adds a Governance Poll on whether to increase the protocol’s System Surplus Buffer.

The Index Coop community proposes adding DPI as a collateral asset to Aave.

A Yearn community member proposes a new strategy for the WBTC v2 Vault.

This weekend’s Plow of the week goes to DeFi Simulation by Instadapp and Tenderly. The recently launched tool allows you to simulate your DeFi positions in a gas-free environment, topped with 100 ETH. Give it a try!

At the beginning of this year, we predicted that DeFi’s TVL would hit $100B at some point in 2021. We’re not halfway through the year yet, but DeFi’s TVL is halfway to that milestone. No one knows what happens from here, but you have to feel like our chances of hitting that $100B mark in the not-so-distant future have never been better! And while that milestone may ultimately be arbitrary, its implications are very real and consequential.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!