DeFi Pulse Farmer #37

Catch up on a new week in DeFi as we recap dYdX L2 volume records, ETH annual supply decrease, the Farm of the Week, the Conservative Farmer, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

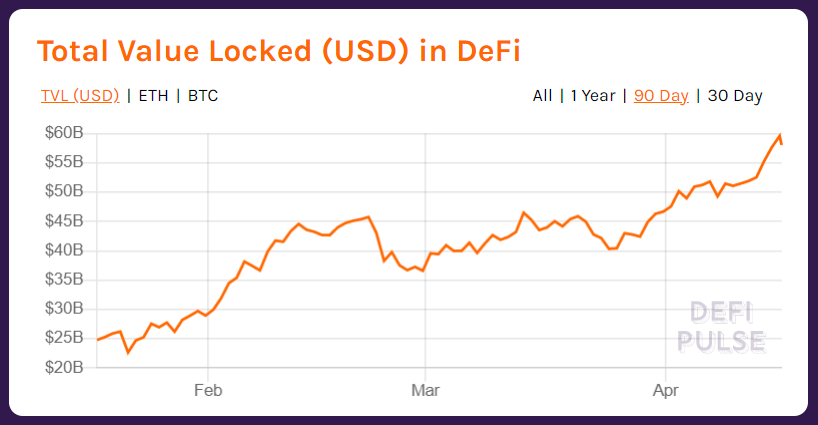

Since our last recap the cryptoeconomy returned to full-on bull mode, with crypto’s bellwethers like BTC and ETH hitting new all-time price highs and DeFi’s total value locked (TVL) surging some $8B to hit a new record of $59.27B on the week.

With that TVL surge, then, it was another strong week for DeFi’s top dapps. Among this upper echelon of projects, we saw the following TVL growth spurts since this time last week:

Compound ($10B ➡️ $11.2B)

Maker ($8.16B ➡️ $9.63B)

Aave ($5.79B ➡️ $6.41B)

Uniswap ($5.92B ➡️ $6.30B)

Curve ($4.78B ➡️ $5.61B)

So DeFi’s looking as great as ever, that much is clear. Moving on to the recent headlines of note, some of the biggest happenings in DeFi this week included:

BitMEX co-founder Arthur Hayes hails DeFi’s “bright future” in a new post — In the write-up, the exec uses price-to-revenue multiples analyses to demonstrate what could happen if more centralized trading activity moves to DeFi services. According to his math, the ETH price could hit over $400k USD if DeFi captures even just 10% of this centralized activity. It’s an astonishing about-face for Hayes, who’s previously blasted ETH for being a “shitcoin” and who’s now facing trial for allegedly skirting U.S. money-laundering laws at his centralized crypto derivatives exchange.

dYdX sets new layer two (L2) daily volume record — dYdX, a decentralized exchange that offers everything from spot to perpetuals trading, recently went live with StarkWare’s StarkEx scalability engine. Notably, then, dYdX’s activity on the ZK rollup side of things just hit over $36M within the span of 24 hours, a new daily record for rollup activity. Scaling has arrived, folks.

Justin Drake highlights ETH is veering toward annual supply decreases — Because they hail BTC as “sound money” for having a capped supply, Bitcoiners often jab ETH for being inflationary. Yet the implementation of EIP-1559 later this year will see ETH fee burns come into play, which can make ETH deflationary and put it on the path to becoming “ultra-sound money,” as Eth2 researcher Justin Drake likes to meme. Drake noted this week that with current Ethereum transaction fee levels, ETH would be approaching a ~2% annual supply decrease if EIP-1559 was already active!

Lastly, let’s quickly catch up with the best-performing assets in DeFi in recent days. The biggest token movers this week included RGT (+84%), MKR (+56), LQTY (+46%), ROOK (+35%), and FARM (+22%). In the same span, the DeFi Pulse Index (DPI) rose 26.69% to reach its current price of $502.30.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

Farm ~120% APR via Liquity’s Stability Pool

There’s a new decentralized stablecoin on the block, LUSD, and it comes to DeFi courtesy of upstart lending protocol Liquity.

First featured in our Alpha Tractor Series for premium subscribers, the Liquity project aims to tackle the pain point of interest payments in DeFi borrowing, as its system offers interest-free loans — yes, 0% interest — against ETH deposits.

In contrast, you can take the example of MakerDAO’s ETH-A Vault, which currently charges Dai borrowers a stability fee of 5.5%. So naturally, being able to draw out stablecoin loans with 0% interest is something new and interesting for DeFi, and that’s where the young Liquity project is looking to make a name for itself.

So you’re probably wondering how interest-free loans against ETH are possible. Liquity’s system accomplishes this feat partly through borrowers’ supplied ETH collateral and partly through what’s called the Stability Pool.

In short, this Stability Pool is a backstop for the solvency of the Liquity protocol. Users can deposit LUSD into the pool to service it, and it also steadily accumulates collateral from liquidated Troves, which are akin to Maker Vaults. Stability Providers (depositors into the pool) steadily earn a pro-rata share of the liquidated collateral in exchange for steadily ceding a pro-rata share of their supplied LUSD.

As you can imagine, then, maintaining this Stability Pool is central to maintaining Liquity itself. That’s why the project is incentivizing Stability Providers with LQTY rewards, LQTY being the native token of Liquity and which captures the value accrued to the protocol. Indeed, out of the gate Liquity has allocated no less than 32M of the total 100M LQTY supply to Stability Providers in order to readily bootstrap the centrally important Stability Pool.

If you’re interested in joining this yield farm, you’ll first need to acquire some LUSD for depositing. You’ll also want to keep in mind that the Liquity project doesn’t maintain any front-ends to its protocol, but rather leaves that work up to third-party teams. So you’ll have to find a front-end, of which there are already many to choose from. An easy one to navigate is lusd.eth.link, for example.

Once you’re actually ready to start harvesting LQTY, you can follow these steps:

Connect your wallet on your front-end of choice.

Navigate to the Stability Pool section of the site — on lusd.eth.link, you’ll find this section under the “Farm” tab.

Click on the “Deposit” button, input how much LUSD you’d like to supply, and then confirm the transaction.

At this point, you’ll start racking up LQTY rewards according to your share of the pool!

Right now, the Liquity Stability Pool is earning depositors around 120% APR in LQTY rewards, so this is certainly a compelling farm. Just keep in mind kickback rates when you’re searching for a front-end to deposit through, as some will be better than others. For instance, the lusd.eth.link kickback rate is 95%, meaning 5% of its depositors’ earnings are allocated to the site operator.

Liquity is a novel take on a decentralized stablecoin project, and DeFi certainly needs more of that. But Liquity also just arrived, so it’s not necessarily proven in the wild just yet. Never jump into any farm with more money than you can afford to lose, and always perform your own research, too.

UNI, Aave Markets now live

TLDR: Decentralized derivatives exchange dYdX adds support for AAVE and UNI perpetuals trading.Flashbots Transparency Report - March 2021

TLDR: Flashbots, a research and development organization centered around MEV, releases its latest transparency report, which finds that nearly 5.5k flashbot bundles landed on-chain last month.0x DAO is live!

TLDR: The 0x project launches 0x DAO, a decentralized autonomous organization to be governed by ZRX holders.Guide to Bancor Limit Orders

TLDR: The Bancor DEX launches support for limit order trades via KeeperDAO and 0xProtocol.Frontrunning Synthetix: a history

TLDR: Synthetic assets protocol Synthetix publishes a post detailing how the project has faced frontrunning in its early days.MEV… wat do?

TLDR: Noted software engineer Phil Daian publishes a post arguing how MEV isn’t theft, but rather a fundamental reality of cryptocurrency experiments that should be turned into a force for good in DeFi.

Farm 25% to 95% on your BTC with mStable’s fPools

Recently, pegged-assets protocol mStable launched its first feeder pools or fPools.

For market participants, these fPools are compelling because they’re multidimensional: LPs to these fPools earn swap fees and MTA rewards and can also earn further token rewards from DeFi projects if they choose to incentivize a given pool.

Moreover, these fPools are designed to experience minimal impermanent loss, so depositors can rest easy without having to seriously fear any IL blowouts. Earn yield relatively safely while helping bring liquidity to the mStable protocol, that’s the fPool way.

Two really attractive fPools right now are mStable’s first two BTC-centric fPools, the mBTC/tBTC pool and the mBTC/HBTC pool. Staking MTA boosts yields for these pools, so currently the former farm is fetching between 31% and 94% APY and the latter between 26% and 79% APY depending on whether you’re staking MTA and how much if so.

Even beyond staking those floor APYs are great yield opportunities as far as BTC in DeFi goes, so if you’re looking for new solid farms lately, these BTC fPools are worth consideration.

If you’re interested in joining, acquire an equivalent portion of mBTC and tBTC and/or HBTC. Then through the mStable fPools dashboard start by confirming the two necessary approval transactions. After that, the interface will ask if you want to deposit your LP tokens straight into the fAssets vault, which is how you’ll start earning MTA rewards. Select yes, confirm the transaction, and then you’ll be farming MTA in a relatively safe fashion.

These farms are certainly on the safer end of things in DeFi, but you can never let your guard down in this space. Farm responsibly: do your own research, and never invest more than you can afford to lose.

When a community built tool is good and gets updated regularly, that’s even better. So this weekend’s Plow of the Week goes to vfat.tools, which now supports more than 30 protocols. Go ahead and check out your farms from a single interface!

Have you ever wondered if DeFi’s biggest proponents are being conservative right now, that DeFi can grow so much bigger than any of us can imagine? That’s obviously still up in the air, but on the heels of an explosive week like the one we’ve just had, you do get the sense that we’ve got more than a fighting chance. Something to think about while you’re farming!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!