DeFi Pulse Farmer #8

Catch up on a new week in DeFi as we recap DeFi TVL ATH, tBTC, Optimism, the Farm of the week, and the Conservative Farmer.

Welcome to the eighth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, subscribe today.

If you already are a paid subscriber of the Alpha Tractor series and have not been included in the Alpha Tractor Discord channel yet, please fill in this form so we can onboard you.

Looking to catch up on the last two weeks? We’ve got you covered!

DeFi Recap

DeFi is on the rise again, with the ecosystem’s Total Value Locked (TVL) having surpassed the $10B milestone for the first time ever this week.

Among the most interesting threads in DeFi, this week was Maker’s acute return to being the arena’s largest protocol with a sector-leading TVL of $1.93B. Going into 2020 Maker was decisively DeFi’s king of the hill, but over the summer the project’s been flipped here and there by protocols like Compound, Curve, Aave, and most recently Uniswap.

Notably, with TVLs of $1.93B and $1.91B respectively, both Maker and Uniswap are now within striking distance of becoming the first DeFi protocols to secure $2B. Aave ($1.47B) and Curve ($1.32B) aren’t far from that mark either.

tBTC relaunched its trustless platform that allows users to use their BTC on the Ethereum network without relying on a custodian. After shutting down the alpha version back in May over a flaw, tBTC’s builders have hustled to right the project. With tBTC now back on the scene, it’ll be interesting to see where it settles as a trustless counterpart to the popular but more centralized WBTC token and how its impact will be in adding to the 114,889 of tokenized BTC on Ethereum.

As for token performances, some of the best performers over the last 7 days included SNX (+10% to $5.08), and CREAM (+10% to $78.54).

The pace of innovation in DeFi never slows down

While the market may be down, the pace of innovation in DeFi is not. During one of the calmest weeks in the past months, in which a large part of the public conversation switched to cover the DeFi drama and the coming of NFTs, protocols kept building. Optimism, a layer 2 solution for Ethereum, quietly launched its limited testnet with Synthetix as its first user, with Chainlink and Uniswap also early adopters.

Aave governance was released on mainnet with their first live API, and protocol politics kept developing in the public eye, with different groups looking to have a voice in Uniswap’s governance.

If one thing’s for sure, DeFi is still just getting started, and the coming weeks will bring massive innovations that we’re just beginning to see now.

Stories of the Week

Set Protocol Launches ETHUSD Yield Farm

TLDR: Automated token management project Set Protocol releases the ETH USD Yield Farm (USDAPY) set, which allows users to easily automate UNI yield farming.The YAM Rebase: Mechanism and Game Theory

TLDR: The Yam Finance team outlines the game theory behind serving as a liquidity provider in the new YAM/yUSD Uniswap pool.DefiDollar is now integrated with yVault

TLDR: Stablecoin index project DefiDollar integrates with yEarn’s yVault system, making it possible to mint DUSD via yUSD and yCRV.APY.Finance Raise $3.6 Million in Seed Funding

TLDR: Upstart yield farming aggregator APY.Finance raises $3.6 million in a seed funding round from investors like Arrington XRP Capital and Alameda Research.The shifting sands of DeFi

TLDR: Synthetix founder Kain Warwick discusses how Synthetix will be doubling down on tackling gas prices and supporting decentralized stablecoins for the foreseeable future.Stake SNX on Optimistic Ethereum L2 Testnet

TLDR: Synthetic and Optimism team up on the Optimistic Ethereum Testnet, an L2 scaling trial that will push optimistic rollups (ORUs) closer to DeFi’s mainstream.yEarn Vulnerability Disclosure 2020-09-25

TLDR: The yEarn team discovers and patches a potential vulnerability in certain yVaults in less than 30 minutes.New yEarn System Near

TLDR: yEarn creator Andre Cronje reveals the updated yEarn system will be L2 compatible and will incorporate elements from Aave, Chainlink, and Synthetix.

Governance Watcher

Aave introduces AIP1, a proposal to finalize the LEND to AAVE migration.

Compound executes an upgrade to the cUSDC interest rate model.

Want your company featured here? Fill out this link to get in touch!

Farm of the Week

Harvest up to 105% farming $PICKLE with sCRV

Pickle Finance is an interesting new project on the DeFi scene, and it’s offering a $PICKLE harvest campaign that’s aiming to be productive for DeFi as a whole.

Launched in early September, Pickle Finance is a no-frills yield farming project that wants to shift yield farming into being positive-sum by helping major stablecoins maintain their $1 USD pegs. The stablecoins Pickle Finance targets, for now, are DAI, USDC, USDT, and Synthetix’s sUSD.

To fight for these stablecoins’ pegs, Pickle Finance rewards more $PICKLE to below-peg stablecoin pools than above-peg stablecoin pools. This dynamic creates sell pressure for above-peg stablecoins and buy pressure for below-peg stablecoins.

To advance Pickle Finance even further, the project’s creators unveiled pVaults, which rely on flash loans to arbitrage among stablecoin opportunities, in turn pushing these tokens toward their pegs and providing returns for $PICKLE holders.

Within two weeks, pVaults have evolved into pJars, of which there are four right now.

Based on yEarn’s yVault tech, pJars allow users to:

Receive pAssets for pJar deposits.

Deploy these deposits into alpha-seeking strategies for yield opportunities.

Enjoy pAsset appreciation from returns being distributed back to pools.

Support Pickle Finance governance by incentivizing $PICKLE holders via fees.

Accordingly, this week’s Farm of the Week strategy involves sCRV

If interested in this harvest, farmers can:

Make a deposit into Curve’s sUSD v2 pool using Dai, USDC, USDT, or sUSD.

Deposit their ensuing sCRV tokens into pJar 0 on Pickle Finance.

Navigate to the psCRV deposit page and deposit their psCRV tokens.

At this point, they can harvest rewards whenever ready!

All that said, the most attractive part of Pickle Finance right now is being able to put your tokens to use into a pJar without losing any of your principal.

The Conservative Farmer

Harvest up to 65% with mStable

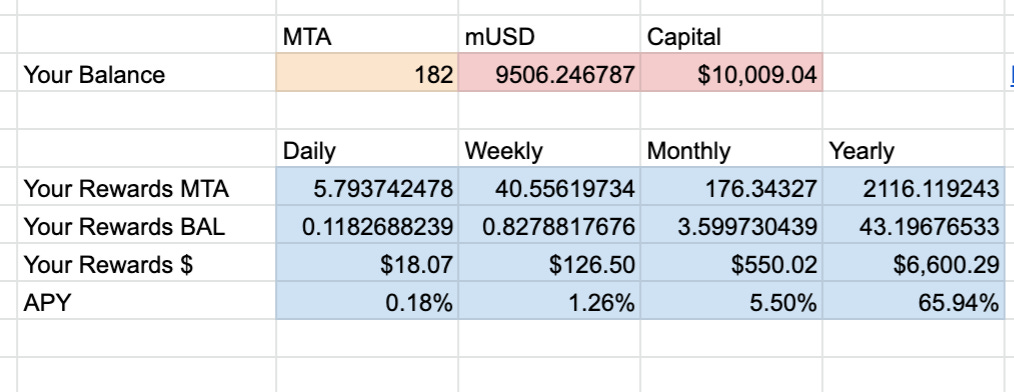

mStable, one of DeFi’s liquidity aggregators that offers lending on same-peg assets and yesterday released its Staking v1, has an attractive opportunity for farmers to obtain up to 65% by staking their stable coins.

Source: mStable Earn

How to invest in mStable Earn

Farmers that want to take advantage of this opportunity can join the 5%MTA-95%mUSD pool by adding mUSD, mStable’s native stablecoin, and MTA, mStable’s governance token. Or just one of the two tokens, as Balancer’s pool allows users to provide one-sided liquidity if preferred.

Farmers have to deposit USDT, USDC, TUSD, DAI, or a combination of any, to mint mUSD at a 1:1 ratio (alternatively, farmers can purchase mUSD on Balancer and Uniswap).

If farmers also wish to add MTA, they can purchase it at Balancer or Uniswap by using the links above.

Once farmers have their freshly minted mUSD, they first go to the 5%MTA-95%mUSD Balancer pool.

Source: Balancer

Click on the option Add Liquidity, select Multi Assets or Single Asset, depending on their preference, insert the amount they are willing to stake and click on Add Liquidity once more.

Source: Balancer

Farmers go to the Earn section on mStable, select the 5%MTA-95%mUSD, and stake their Balancer Pool tokens.

And that’s it! Farmers will start obtaining MTA and BAL rewards.Here you can see an example of estimated returns with a $10,000 investment

Plow of the Week

Do you have various positions across multiple pools and struggle to keep them all handy?

Liquidity Vision allows you to be on top of all of your Uniswap, Balancer, and Sushiwap pools from a single interface that will enable you to track your paid fees and net gains from a simple interface.

Alpha Leaker of the Week

Closing Thoughts

After several weeks in which the intensity on DeFi was at all-time highs, this weekend appears to be a good moment to take a break and recharge energies.

But beware, you never know when the next thing will drop ;)

Until next week, and keep up the honest work!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!