Degens Get BASED [Alpha Tractor]

Less than 24 hours after YAM, a new anon project - BASED - is drawing degen farmer's attention.

THIS STRATEGY IS BRAND NEW AND EXTREMELY RISKY. BASED IS UNAUDITED AND SHOULD BE APPROACHED KNOWING YOU MAY LOSE 100% OF YOUR FUNDS.

This is the second in the Alpha Tractor series - giving you intel into the freshest yield for the most honest farmers only.

What is BASED?

Pitched as “game theory for degenerates” BASED is exactly that - a highly volatile, rebase-oriented token earned through yield farming. It has no inherent value and is the epitome of meme-driven projects.

As stated on the website, Based features No VCs, no premine, and no founder’s fee. It’s the latest in a series of monetary experiments that rewards early adopters with high yields and teases game theory through supply rebases to shake out skeptics.

Like Ampleforth and YAM, BASED targets a $1 peg by contracting and expanding supply in events called “rebases” (hence the name BASED). It leverages Synthetix’s stablecoin - sUSD - as the primary target for stability.

“If the price difference between $sUSD and $BASED is more than 5% in either direction, this triggers a rebase event”

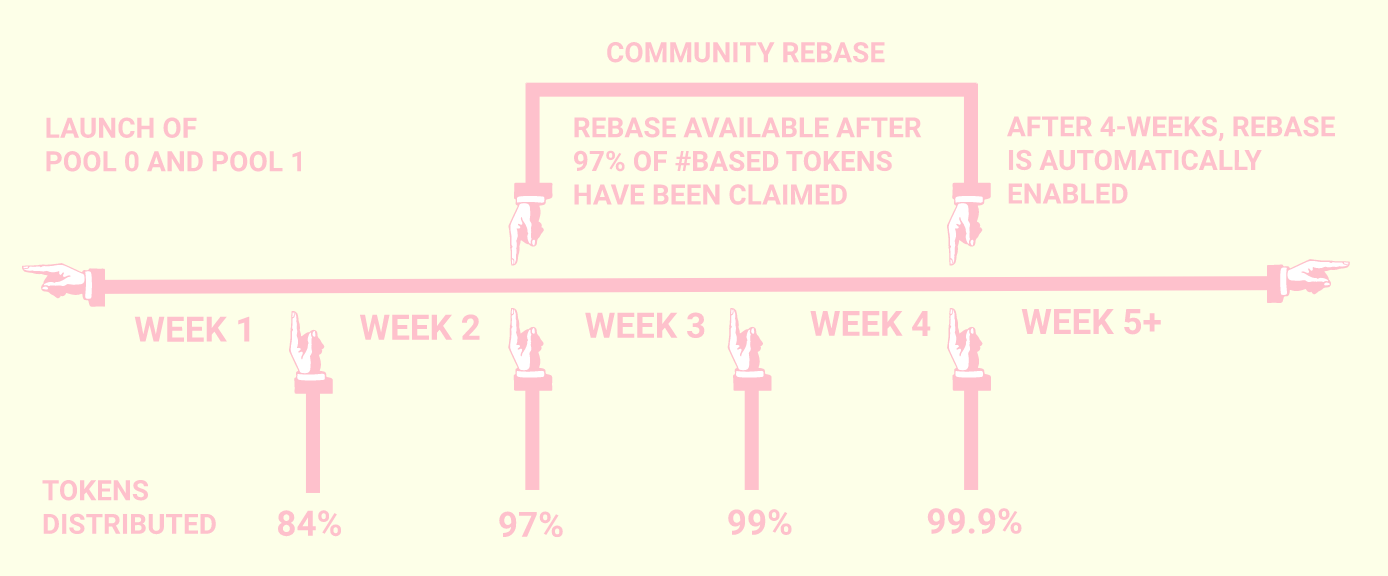

The difference in BASED’s distribution compared to YAM or AMPL is that a rebase will only occur after 97% of the supply has been claimed, making the initial yield farming window last a minimum of two weeks before the first supply adjustment event occurs.

BASED Numbers

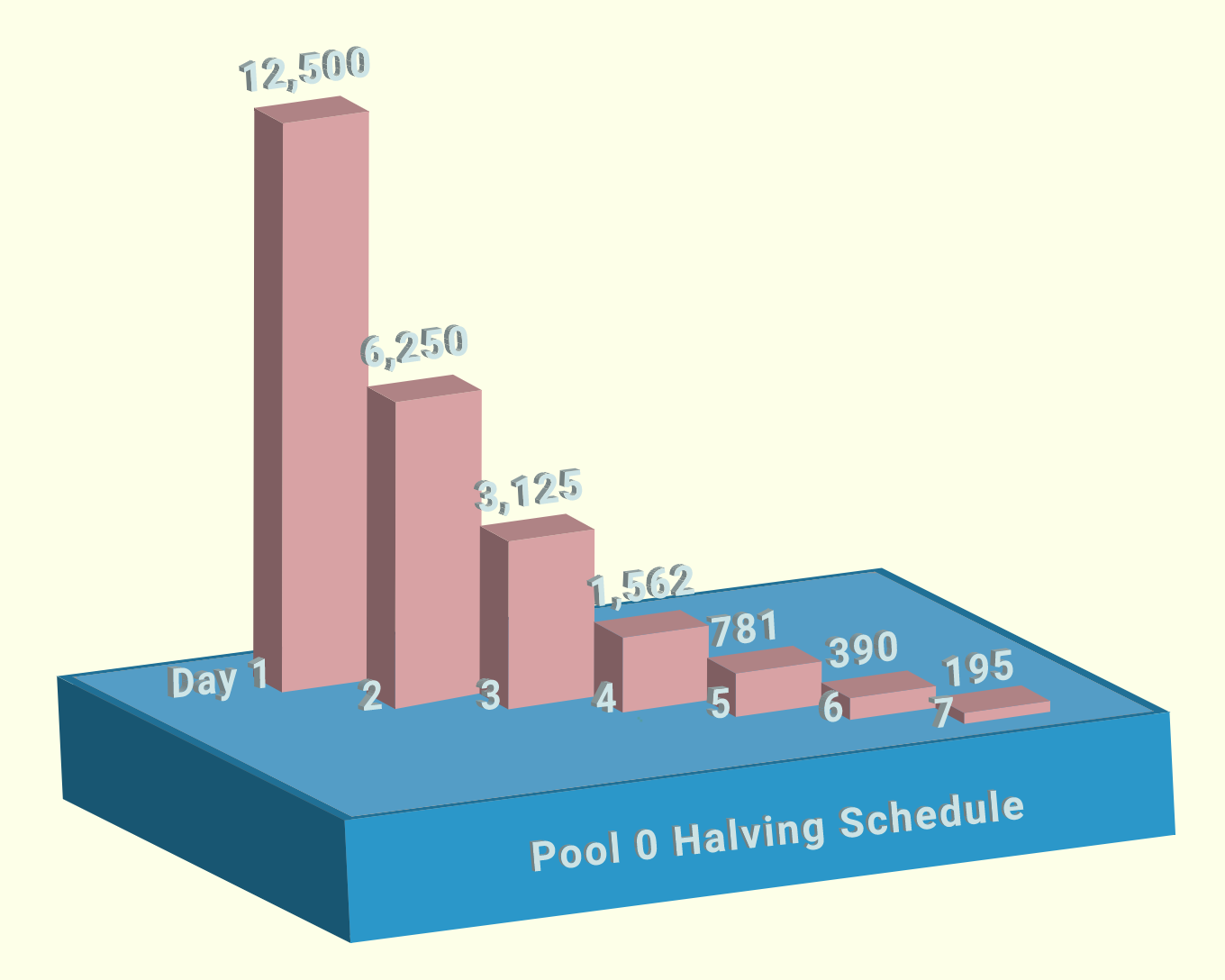

In total, there will be 100,000 BASED issued across two pools.

For Pool 0, farmers deposit Curve’s sUSD liquidity tokens (ysusdCRV) for a claim on 25,000 BASED which halves each day, starting with 12,5000 BASED on day one (today).

*In case you forgot, Curve LP’s will soon earn CRV upon the kickstart of liquidity mining in the very near future.

Pool 0 features a ~$12k deposit limit per account for the first 24 hours, meaning no one can flex their whaleness without creating multiple accounts and entering through them.

Next, a secondary liquidity pool (Pool 1) was launched for BASED liquidity mining.

Pool 1 will feature 75,000 BASED with rewards halving every 36 hours as opposed to 24 like Pool 0. BASED rewards are earned by contributing liquidity to the sUSD/BASED Uniswap pool and staking that position through the Based interface.

Once 97% of tokens have been distributed, the fun (or madness) begins.

Based Burns

Community members were quick to point out that the first deposit into BASED essentially acted as premine. The team (anons using GHOUL aliases) were quick to address this by burning the original tokens and revoking the access of admin keys.

While some suggested that the burn only happened because community members called it out, alas the first tokens were burned and farmers are flocking to get their hands on the latest degenerate token with over $7M staked at the time of writing.

Yesterday people were farming farm with the best. Today, people are farming with the based.

As always, please proceed with extreme caution. These are unaudited contracts which are pushing composability to it’s limits. Even DeFi experts have trouble digesting these opportunities and if you consider yourself to be a new user, we strongly avoid getting in over your head.