PolyPulse: Learn how to Bridge to Polygon

Also, read more about how to bootstrap a blockchain on Polygon Edge.

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the second week of May 2022.

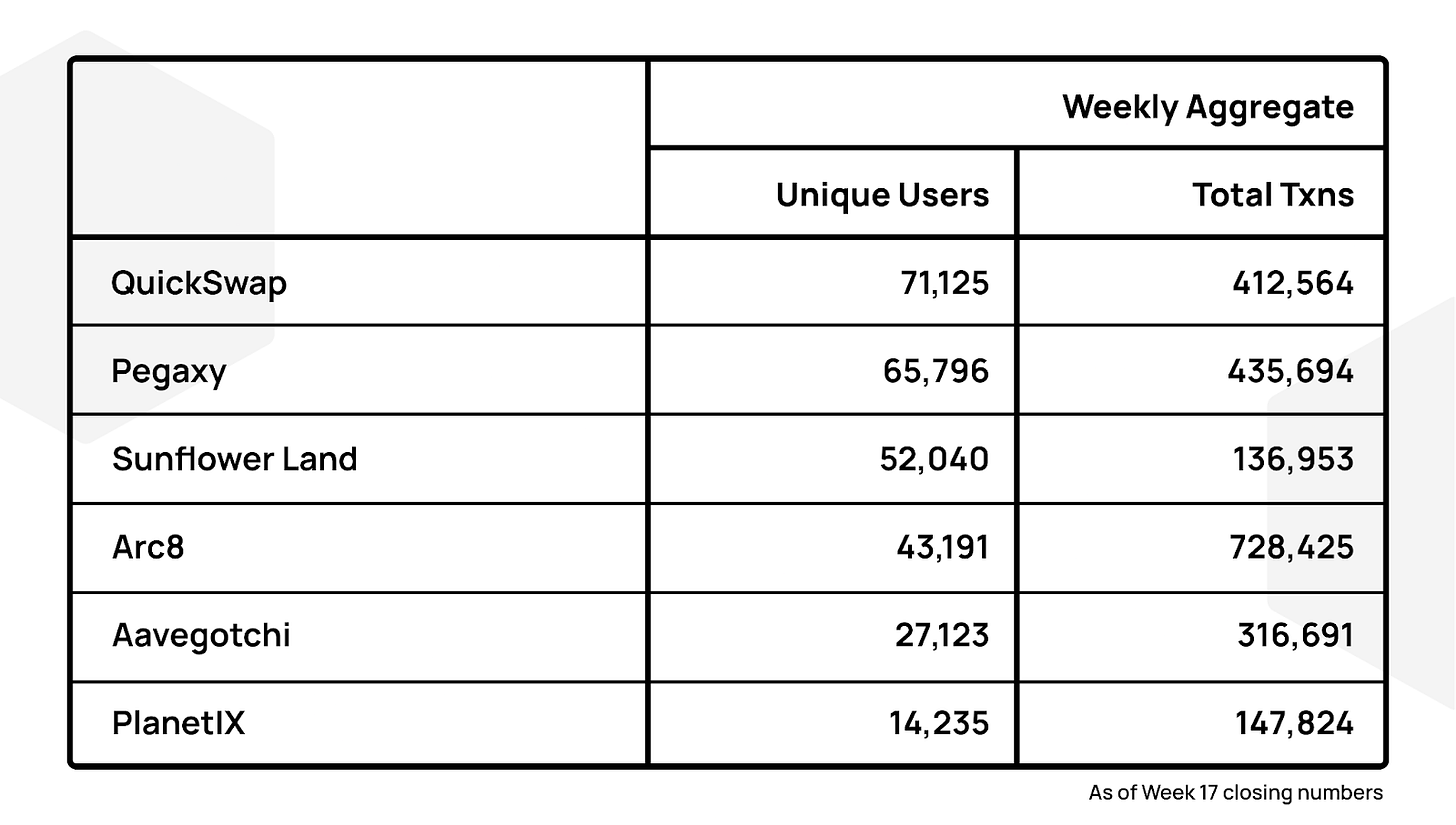

There hasn’t been much change in the number of Weekly Average Users on Polygon, even with the bear market kicking in.

The total on-chain transactions (per day) jumped to 3.48 million (7.3% rise). This growth was led by Arc8 (728k), Pegaxy (435k), Crazy defense heroes (224k), and Uniswap v3 (99k), amidst the increasing interest of the users in these dApps.

Gas Fee saved by using the Polygon network last week was $146.5 Million daily ($42 per Txn).

Also Read:

How to Bootstrap a blockchain With Polygon Edge

Polygon Edge is a customizable blockchain stack that enables devs to build and launch dedicated blockchain networks tailored to needs.

It offers solutions that allow fast and smooth scaling even in the case of extreme transaction load, enabling developers to build applications with millions of daily active users and manage tens of millions of transactions per day.

Diving into building a blockchain layer from scratch involves focusing on several key aspects:

Polygon Edge makes the process straightforward, so that teams can focus on what’s really important – their actual product.

Deploying Polygon Edge can be done in three steps:

Generating the private keys for each node.

Generating the genesis configuration.

Starting the node.

After all of the nodes are started, they will attempt to form a fully-meshed network and start producing blocks. For a deep down step-by-step guide you can check here.

How To Bridge 🌉

The current state of DeFi is highly fragmented. The liquidity, developers, and decentralized applications on web3 are split across L1s and L2s like Ethereum, Polygon, Binance, etc. Whether for the good or bad, it’s still too early to tell – there are conflicting arguments from both sides – but until then, it’s important to understand how to thrive in this cross-chain world of DeFi.

This article looks to answer some of the common questions: how to transfer assets between Ethereum and Polygon, and how to transfer assets between Binance and Polygon, amongst a few others. Read on!

Dystopia a ve(3.3) protocol launches on Polygon.

Stake USDC on Polygon and Earn upto 30% APR.

Meshswap crosses $600 Million in TVL in under a week.

Earn upto 40% APR on OliveDAO.

A KPI based vote mechanism that has been rolling eyes launches on Polygon.

Earn upto 8.6% APY on Stader (Liquid Staking Protocol) and use MaticX in other DeFi protocols to earn additional yields.

Will Polygon sustain the BEAR market?

This week was a difficult week in crypto markets as the prices of DeFi bluechip protocol tokens dropped even faster than Bitcoin and Ethereum. While most of the bluechips remained resilient, the loss of peg of Terra's stablecoin UST emphasized the need for more sustainable innovation in DeFi.

Additionally, we are seeing active institutional interest in creating protocols that deliver a sustainable yield and are easier for institutions to understand and use. Polygon's ecosystem features multiple Ethereum scalability solutions, 19k dApps and 325k daily active users and this has led institutions to choose Polygon as the platform for building many such protocols that will come online in late 2022 and 2023- Ajit Tripathi (Advisor to Polygon and Ex-AAVE).

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.