Poly Pulse #10: Earn upto 550% on Qi

Also, read about the bounty board and how it unleashes the community of Polygon contributors.

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the third week of February 2022, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or a knowledge seeker who wants to keep yourself updated, PolyPulse newsletter is the best place to stay ahead of everyone.

The past week has been an absolute positive for Polygon regarding the engagement parameters.

Polygon saw a rise of 6.36% with respect to Daily Active Users (DAU) compared to the previous week. There was also a rise in the daily transaction count by 7.84% and per day revenue by 40%, meaning that more users are transacting on chain and increase in revenue gives more sustainability to the ecosystem . The primary reason for this hike is stability regarding fees, which spiked when EIP-1559 was deployed on Polygon, and more protocols or DeFi enthusiasts chose Polygon to build their projects.

Build a web3 application using Polygon and Arweave

Polygon, Ethereum's internet of blockchains, and Arweave, a network built to provide scalable and economically sustainable permanent data storage, have joined hands to fund a bounty. They want to develop and allow users to deploy and interact with the Arweave network using MATIC quickly.

The solution will be open source, once built, so that anyone can spin up a version of the solution and begin to store specific data permanently from the Polygon ecosystem into the Arweave network. By tagging each piece of data and using the bundlr.network bundle technique on Arweave, the resulting dataset should also be queryable by any dApp's front-end using a GraphQL interface.

If you are interested in the solution and want to build it, you can check the below tweet for more details:

With the start of the Season 1, the DAO has been able to ramp up its operations and selected 13 applications from a pool of over 50 protocols which applied for the grants. The winners were:

Web3 Syndricate: A partnership of a few startups that unites several communities that are interested in WEB 3.0, NFT, and GameFi.

LIFE: A multi chain wallet with @username functionality.

Liquidity Finance: Liquidity Finance is a product focused DeFi ecosystem. Starting with LFISWAP, ISO (Initial Stake Offering) Launchpad and DAO, the products generated fees are shared to LFI token holders .

Chedda: A one-stop shop for NFTs.

International Media Nodes: A project to support media nodes in other language communities, translate as well as distribute content about blockchain technology, DeFi, the Metaverse, and Web 3.

Stream Chain: A platform leveraging smart contracts to manage "Machine as a Service" contracts in the manufacturing sector.

UnicusOne: A Web 3.0 as a Service (WaS) Platform for Metaverse, Gaming and NFT Economy.

Cask Protocol: A recurring payments protocol for web3.

Unchained Music: An equitable music distribution protocol that uses DeFi NFTs and liquidity providing to provide a no-loss solution to artists.

Datagen Project: Creation of a layer0 -layer1 infrastructure for cloud computing on demand for different applications, starting with cloud computing for search engines.

Madeium DAO: A Design DAO built to bring code to life through the lens of top talent working directly with their followers and peer network.

Beb.xyz: A platform building a social network of professionals, i.e the LinkedIn of web3.

Immutable Ecosystem: An App Store providing decentralized distribution and licensing.

What’s in here for the community?

This week the Polygon Ecosystem DAO has operationalized a bounty board to harness the power of the community and get the projects building on Polygon to provide the community a chance to contribute and earn rewards for the same.

If you are building on Polygon and want to apply for these grants, feel free to apply here.

Earn upto 550% on $Qi.

Strategy Diagram:

Below are the steps to execute the complete strategy:

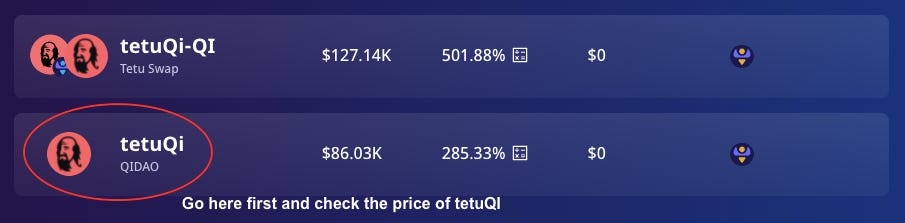

First go to the tetuQi section and check the price.

TetuQi is nothing but a wrapped version of eQI (vote escrow Qi) and is backed 1:1 with Qi that is permanently locked for 4 years. Hence, there are a few things to keep in mind.

Situation A: If the price of tetuQi < 1 Qi

In this case it makes no sense to mint tetuQi against the Qi you own as it would mint on a 1:1 ratio. Buying / Swapping Qi for tetuQi on TetuSwap is more profitable as 1 Qi would give you 1.01 tetuQi. The current price of tetuQi at the time of writing is 0.99Qi and hence one can buy rather than minting. Also, make sure to only swap 50% of your Qi for tetuQi as the strategy involves creation of a liquidity pair on Tetuswap.

Situation B: If the price of tetuQi > 1 Qi

In this case it makes sense to mint tetuQi against the Qi you own as it is cheaper than buying it out would mint on a 1:1 ratio. Buying / Swapping Qi for tetuQi on TetuSwap is more profitable as 1 Qi would give you 1.01 tetuQi. The current price of tetuQi at the time of writing is 0.99Qi and hence one can buy rather than minting. Also, make sure to only deposit 50% of your Qi to mint tetuQi as the strategy involves creation of a liquidity pair on tetuswap.

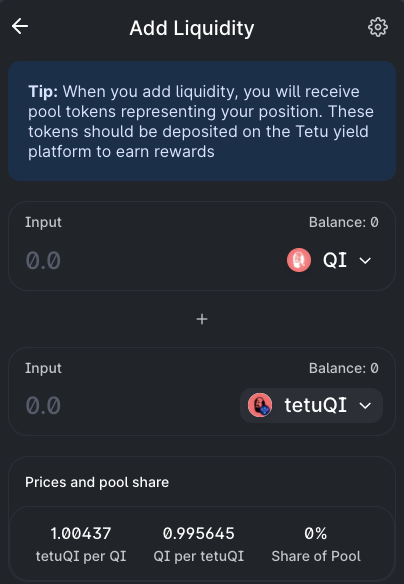

Now that you have both Qi and tetuQi in a 50:50 ratio, the next step is to provide liquidity on TetuSwap.

Upon providing liquidity, you will get a receipt token TLP_tetuQi_QI . Stake this LP in the farm to earn 550% in $TETU tokens (passive income). This APY comes with no risk of impermanent loss as both assets in the LP are essentially the same and move in the same direction.

After doing the above all you have to do is claim your TETU rewards and enjoy 550% farming your Qi.

A strategy shared by Yohaan.

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.

Tetu is attempting to be the Convex of the Qi Wars: Polygon native stablecoin protocol QiDao recently gave their token holders governance rights, to vote where the liquidity should reside. The tokens are known as eQi (escrowed Qi) holders. Following QIP047, a total of 0.65 Qi per block (around 187k Qi per week) was approved for distribution to vaults across all chains. By locking Qi for eQi, holders can receive boosted rewards and the ability to vote for the allocation of rewards to various collateral types. This allows eQi holders to move incentives for borrowing to the specific vaults of their choice.

Why does Tetu want to take part in the Qi Wars?

In December 2021, shortly before QIP047, Tetu provided the Polygon community with the innovative AAVE-MAI-Balancer Strategy (“AMB”). This “multi-strategy” automatically interconnects three protocols for the best yield farming techniques possible, earning rewards in AAVE, QiDao, and Balancer. All a user needs to do is deposit a single asset token into Tetu, such as MATIC, WBTC, WETH, or AAVE, and the strategy automatically does all the other work.

As a result, a good part of the profitability of this strategy was dependent on the Qi vault incentives for the four compounding aave vaults that TETU has built a strategy on top of, namely:

-> Compounding Aave;

-> Compounding Aave MATIC;

-> Compounding Aave WETH; and

-> Compounding Aave WBTC.

However, since the introduction of voting, rewards have moved out of 3 of the 4 AMB vaults, namely AAVE, wETH, and wBTC, as users have been voting for mooVAULTS on Fantom instead.Tetu decided to enter the Qi Wars by creating a liquid version of eQi called tetuQi, which would help boost the returns of the “AMB” vaults. Users can stake their Qi in return for tetuQi, meaning there is always a 1:1 ratio backing. Additionally, Tetu created a tetuQi-Qi LP pool on TetuSwap, incentivizing TETU tokens.

This creates further liquidity and allows for a zero impermanent loss LP opportunity and sufficient exit liquidity. This was the same vein that caused many CRV holders to stake for cvxCRV. It should incentivize many users to swap their Qi for eQi.

Tetu can get a more significant share of the vault rewards directed to the AMB vaults as their voting power increases due to the freshly acquired voting power, causing new users to deposit into the vaults and increasing the TVL. This is a win-win for both QiDao and Tetu as more Qi is locked out of circulation while the tetuQi holders benefit from getting exposure to liquid eQi. Ultimately, TETU wants dxTETU to act as a proxy for eQi, just like CVX is a proxy for veCRV.

Having the first-mover advantage, Tetu looks to have a significant advantage in the Qi Wars. If Tetu can create enough demand for tetuQi, they would have an excellent chance to gain a solid upper hand.

Earn 13% APY in USDC and an additional 12% in GOGO tokens.

Introducing a new approach to Data Discovery using RedStone with its unique approach of storing data on Arweave and delivering it to all EVM-compatible chains.

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of proveq. proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of proveq, and proveq is not responsible for the accuracy of the content on such third-party sites.

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!