Poly Pulse #11: Stuck with bad UI/UX? Finity to the rescue.

Also learn about how to get IEO tickets for IndiGG on FTX!

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the last week of February 2022, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or a knowledge seeker who wants to keep yourself updated, PolyPulse newsletter is the best place to stay ahead of everyone.

When we did the network analysis of Polygon’s statistics last week the Daily Active Users (DAU) remained pretty much the same, however there was a significant decline in transactions and revenues. The divergence can be explained by looking into specific dApp data, where larger dApps such as Crazy Defense Heroes saw a dwindle of -11% in users, but -35% in transactions over the last 7 days. Similar trends were seen in protocols like Zed Run and Pegaxy where there was a decline in users as well as the total transactions on chain.

When we analyze the dApp activities and volume on DeX’s, Uniswap integration of Polygon is quickly finding its place concerning percentage volume of trades on the chain, while Sushi Swap seems to be losing its share over time.

QuickSwap, however, remains the top go-to DeX for the users on Polygon and still clocked the highest number of transactions on-chain.

Web3 adoption needs a new, more intuitive UX/UI experience.

The Cambrian explosion of decentralized applications (dApps) is a bullish sign for Web3 adoption. At the same time, teams under pressure to ship products often prioritize functionality over design and user experience. Let’s be blunt, many of the dApps can use better UI and UX. What this space needs is a design system built from scratch for Web3 applications.

Introducing, Finity -- a user-first interconnected system of design elements that allows teams to quickly prototype, launch and scale their products without compromising on aesthetics and usability. Finity offers tried-and-tested assets, elements, and templates with a focus on 3D design. Its visual library allows for elements to be used individually or with each other, in perfect harmony.

Polygon’s mission is to offer a wide range of secure, fast, affordable, and energy-efficient Ethereum scaling and infrastructure solutions for developers to build dApps. The organization is set to make dApps’ design more pleasing in hopes to bring millions of users to Web3.

With Finity, developers can easily customize styles and symbols, add their own elements and scale the designs, combine symbols to create multiple UI elements.

Cope, the team behind Finity, is a deep-tech studio that brings together design, nonfungible tokens (NFTs), decentralized autonomous organizations (DAOs), and Virtual Reality/ Augmented Reality (VR/AR) with a focus on Metaverse. Polygon and Cope are also joining hands with Brevan Howard, co-founder Alan Howard to create a moonshot factory for taking Web3 projects from an idea generation stage to product launch.

You can get started with Finity here.

Thank you to our sponsor Tally, the first DeFi wallet owned by its users.

Try Tally Swaps before the DAO launches!

The previous week, Polygon Ecosystem DAO approved six grants to various projects which include:

UnoFarm: A unique cross-chain autofarming solution with transparent automated strategies.

Manifest: A crypto native streetwear brand that leverages cutting edge DeFi economics, NFTs, and community led gamified DAO governance.

Thropic: A trusted service provider, Thropic helps nonprofits broaden their engagement with younger donors by offering a suite of cryptographically secure digital assets.

Another-1: AN1 is a one-stop shop to design, produce, crowdfund, and trade digital units of hype fashion backed by physical goods.

Skytale: A DeFi curated ledger to consolidate on-chain activities into one single view and to prevent fraud by flagging transactions and preparing critical data for tax reporting.

Flashback One: A leading NFT ticketing platform eliminating fraud and forgery in the ticketing industry while adding personal and monetary value to digital tickets.

OnChain TV: Live Twitter spaces, Twitch stream doing live content. We will be creating decentralized media content ( similar to rug radio) Holders will be part of space.

Papyrus: It is a web3-native, on-chain publishing and newsletter platform. Creators can publish content to Arweave, send newsletters to their audience (either via email, or via wallet address) and monetize by selling paid memberships that provide token-gated access to their best content.

The grants are milestone-based and will be released based on the performance of the projects. If you plan to build on Polygon or currently are on Polygon, you can also apply for a grant to the DAO via their application form.

Earn 10% of wETH with no Impermanent loss.

CelsiusX, the DeFi arm of Celsius, has been fully integrated with Polygon. It has also provided $100 million in seed liquidity pools to prevent slippage for the Polygon community. Together, CelsiusX, Polygon, and QuickSwap will provide $10 million in rewards to encourage liquidity providers (LPs) and stakers for the incentivized pairs mentioned below.

cxADA-cxETH

cxDOGE-cxETH

cxETH-ETH

These rewards will be paid out over the next 6 months and this would be a long term LP play for yield farmers on Polygon.

Out of all the pairs, the cxETH-ETH would not have any impermanent loss and is best suited for yield farmers who want a high yielding low risk strategy.

Steps to deploy the strategy:

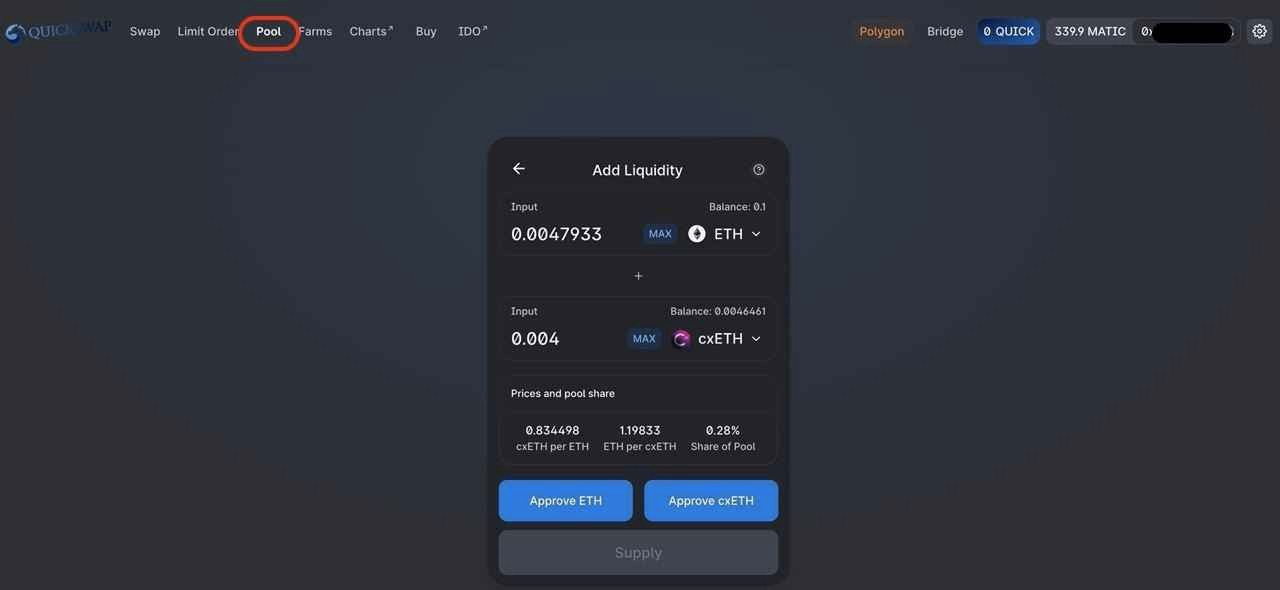

From QuickSwap’s user interface, select the Pool tab, and click on Add Liquidity.

In the new Add Liquidity window, select the cxETH-ETH pair.

Approve and deposit the LP pair.

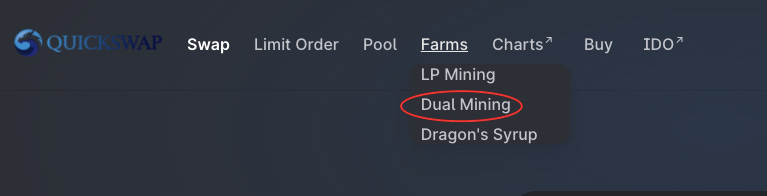

Now that you have supplied liquidity, you have to stake the LP in the Dual Mining Farm. Go to farms and select the Dual Mining option.

Find the cxETH-ETH Farm and stake your LP to earn $dQUICK and $wMATIC rewards. Compound the rewards daily or as often as you can for greater returns.

Brave Wallet is going to integrate Polygon Swap Functionality.

$cxETH had successfully passed QiDao’s governance process in QIP065. Soon, whenever the $cxETH vault is live. Users would be able to borrow $MAI against their $cxETH similar to how users can borrow $DAI against their $ETH on Ethereum to generate passive income.

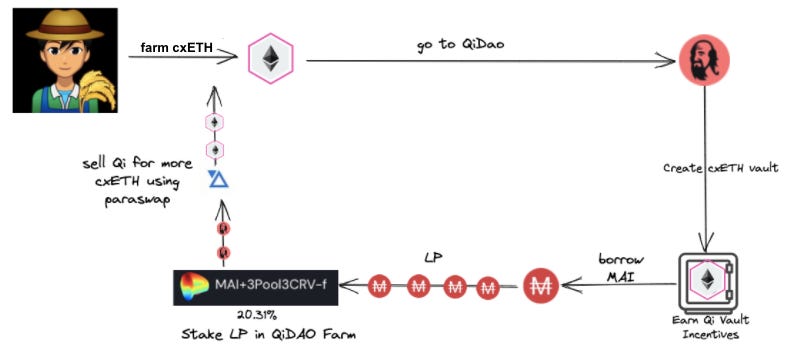

Here is a strategy that is easy to implement:

Steps to implement the strategy:

Create a vault in QiDao with cxETH . The minimum collateralization ratio that needs to be maintained is 130% of the borrowed amount in $MAI.

Borrow $MAI at a safe collateral ratio between 30% to 50%.

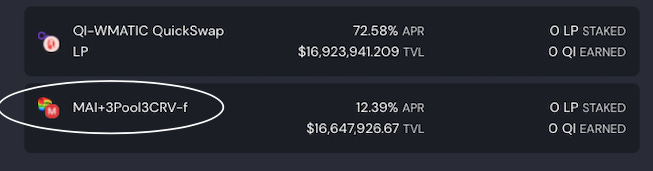

Supply the $MAI in the MAI-am3CRV pool on curve finance.

Go to the farm section of QiDao on their landing page.

Stake your LP in the farm. There is a 0.5% deposit fee to enter this farm.

Enjoy passive returns on your $cxETH. If the price of $cxETH falls below an LTV threshold that one is uncomfortable with, they can always repay part of the loan and borrow more when the markets are better.

3. A cross chain bridge revels itself.

Deposit $Matic and $YGG to win IndiGG IEO tickets on FTX.

Wirex now supports Polygon which enables more users to on-ramp into the Polygon network easily.

Watch a new episode of “Polygon All Stars” with SynFutures a Decentralized Derivatives Protocol.

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.