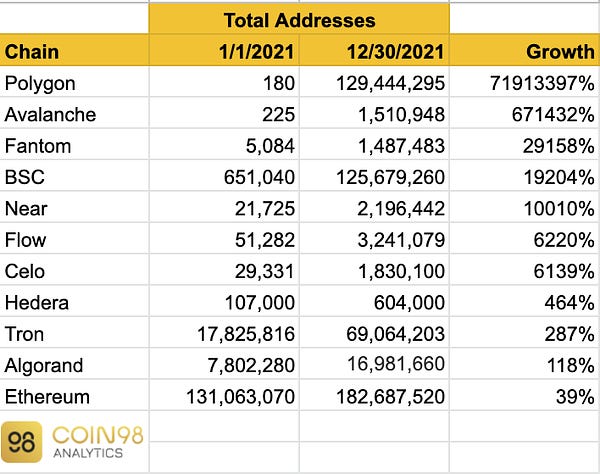

Poly Pulse #3: A YoY 71,913,397% growth in Total Addresses on Polygon

Polygon is now the most productive smart contract chain in terms of DeFi revenue relative to TVL.

Howey family!

Welcome to Poly Pulse - your guide to staying up to date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the past week, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or someone who wants to keep yourself updated, this newsletter is the best place to stay ahead of everyone.

As Polygon closes the year 2021, it boasts of having almost 130 Million addresses compared to just 180 addresses when the year began.

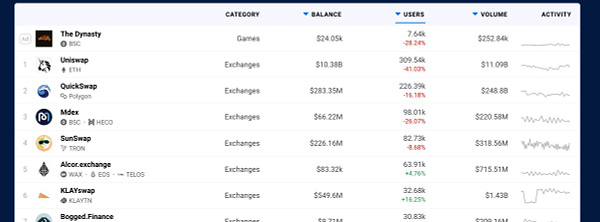

Quickswap, the biggest DEX on Polygon, became the most used Decentralised Exchange after Uniswap in DeFi, having over 226k users over the last 30 days, clearly demonstrating the formidable ecosystem of the chain.

These are a clear indication of the growth and user adoption of Polygon. Where it goes from here is something that the year 2022 will unravel.

Miner Extractable Value (MEV) is a blockchain-wide problem. Transactions are broadcasted to the memory pools on public blockchains, and miners pick these transactions to be included in the block. Till the time miners pick these transactions, everyone has visibility of pending transactions and can outbid using priority gas auctions over every last bit of profit, e.g., front-running opportunities. These opportunities are also known as Sandwich attacks.

To quote an example of how a sandwich attack happens, let's assume:

A wants to buy a Token A on a Decentralised Exchange (DEX) that uses an automated market maker (AMM) model.

A miner who sees A's transaction can create two of its transactions, which it inserts before and after A's transaction ("sandwiching," aka its namesake).

The miner's first transaction buys Token A, which pushes up the price for A's transaction, and then the third transaction is the miner's transaction to sell Token A (now at a higher price) at a profit.

Automata, a privacy middleware, has been solving the issue with their solution XATA and Conveyor. They have also launched a $20Million Ecosystem Incentive Program and partnered with Polygon to support those projects fostering fair innovation with a dedicated Polygon Track.

You can check out the details in the below tweet.

The previous week, Polygon Ecosystem DAO gave grants to four more projects which include:

MaticMike: A 100% on-chain generative NFT on Polygon with an Ethereum Bridge;

PolygonMe: A composable identity system on Polygon Network;

PolygonPunks: The premier PFP NFT on Polygon and,

PrismNetwork: A Universal DeFi Servicing Hub and Multi-Chain Launchpad.

The grants are milestone-based and will be released based on the performance of the projects. If you plan to build on Polygon or currently are on Polygon, you can also apply for a grant to the DAO via their application form.

Along with the grants, the Polygon Ecosystem DAO is gearing up for a DApp Council, a new governance, and incentive model and an upcoming Bounty Board, which will constitute various tasks and jobs in the polygon Ecosystem. Completing these bounties will ensure rewards to the contributors. Stay tuned as it all takes shape.

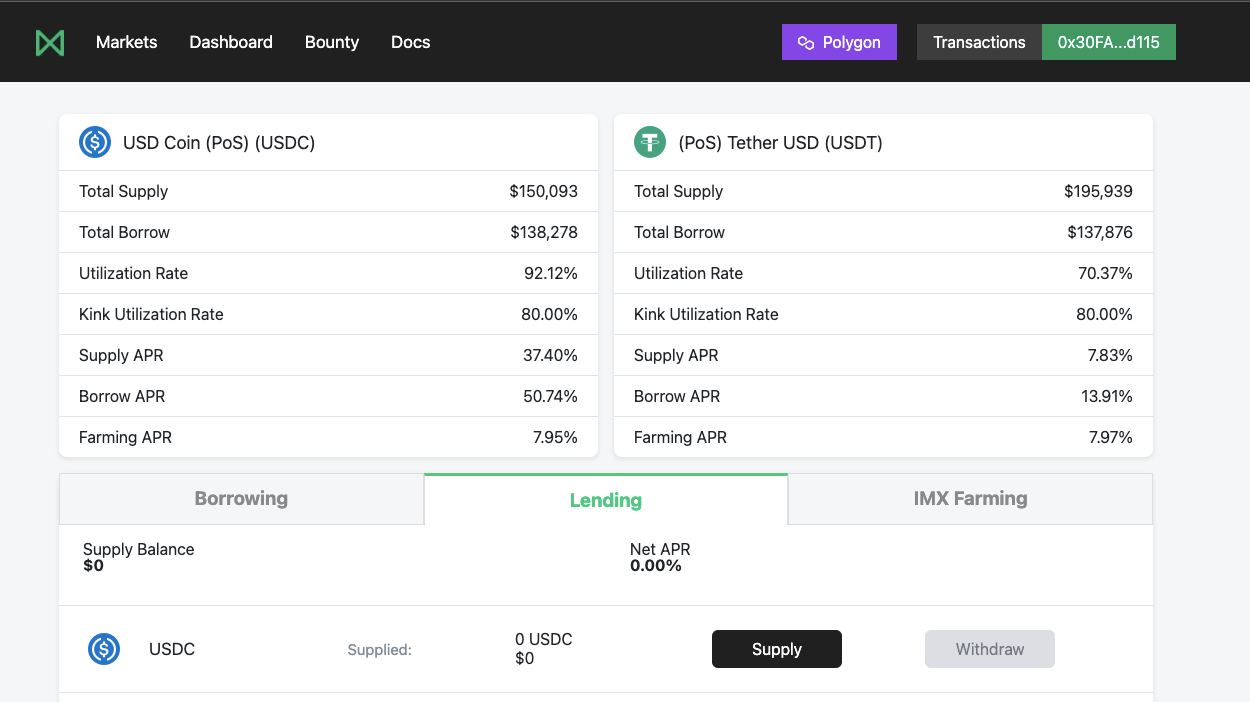

Supply your Stable Coins on Impermax Liquidity pools and earn up to 37%.

Step 1: Go to Impermax website and select the USDC/USDT pair on Quick Swap.

Step 2: Click on the USDC/USDT pair.

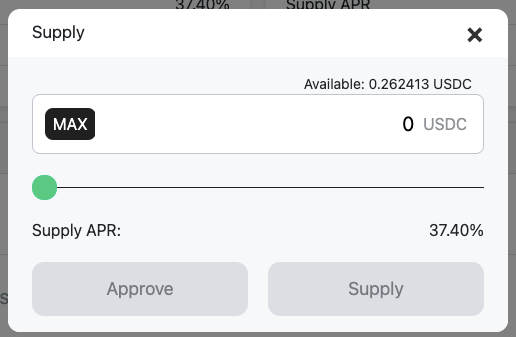

Step 3: Select USDC in the Lending Sector and select the quantity you want to supply. Do the same with the USDT token.

That’s it folks. Enjoy the cheesy returns.

Gains Network, a decentralized trading platform on Polygon, had added over 40 pairs in crypto to leverage trade at up to 150X leverage and zero percent funding fees.

Tetu is still offering lucrative returns on stable coins.

The DeFi ecosystem has been flourishing on Polygon and has one of the most extensive DEX user bases. Polygon protocols got 50% more efficient at converting those users (their capital) to revenue.

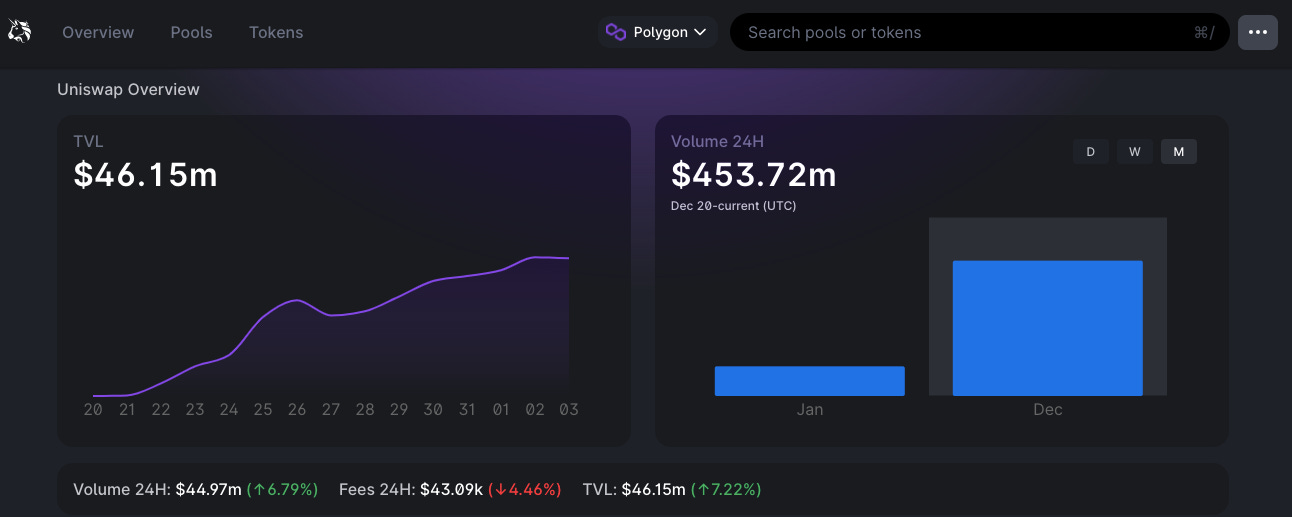

Regarding revenue efficiency, Polygon is now the most productive smart contract chain in terms of DeFi revenue relative to TVL. And that’s without a hyper-efficient DEX like Uniswap V3 (note DEXs drive 60% - 70% of the overall DeFi volume). With the recent Uniswap Integration, under two weeks Polygon has around $46 Million TVL locked and almost $0.5 Billion volume done already.

With new and better integrations developing every day, this newsletter will help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!