Poly Pulse #5: A new ATH of Daily active users, new Polygon-BSC Bridge, DAO Grants and more!

Learn how you can deploy your dApps on a the world’s first decentralized and open cloud.

Howey family!

Welcome to Poly Pulse - your guide to staying up to date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the past week, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or someone who wants to keep yourself updated, this newsletter is the best place to stay ahead of everyone.

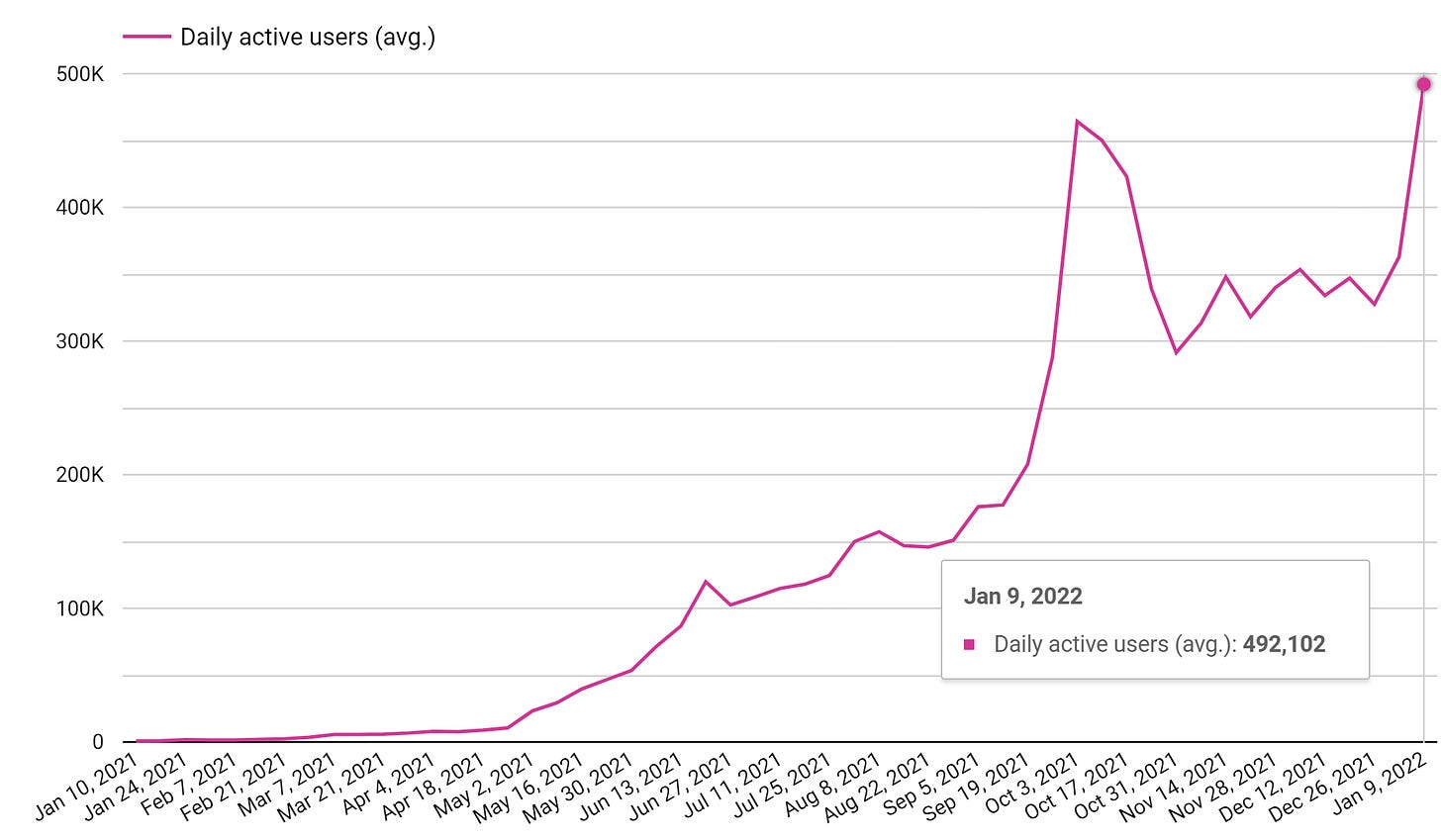

This week Polygon set ATH in active addresses. The Daily Active Users saw its biggest week-over-week gain since last Oct. Active addresses neared 500k a day. This is a 36% increase and a new all-time high!

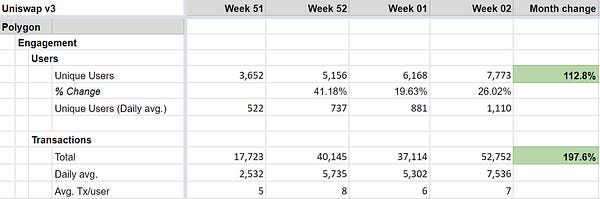

Another update was the gas fees saved by users doing transaction on Uniswap. The integration users have saved over $10 Million in gas fees vs Ethereum.

With more integrations and protocols preparing themselves to launch on Uniswap and the new Celsius integration, this is going to increase more.

The Akash Polygon-athon

Dubbed the Akash Polygon-athon, Akash has launched a new program specifically for dApps running on Polygon’s network. All developers in the Polygon ecosystem are now incentivized to migrate away from the traditional cloud providers and move their back-end and front-end services to the Akash Network.

Akash is offering 20 $AKT to any Polygon ecosystem project to cover the cost of hosting on Akash. If you are a developer, check out the Polygon Starter Kit to get started.

To put things in perspective, this covers roughly 2-3 months of hosting costs for an application with 4 cores, 16 GB RAM, and 1 GB of storage - OR - up to 20 microservices.

Akash will match bounties posted by Polygon projects - up to 100 $AKT. If a project offers a bounty of 100 $AKT or more, Akash will match the bounty with an additional 100 $AKT, and the person hired to the bounty will be awarded 200 $AKT.

Bounties by projects can be paid in any currency. Matching awards by Akash will be paid in $AKT.

Further, developers are encouraged to apply for up to $100,000 from the Akash Developer Grant Program, which will be welcoming projects running on Polygon. Support for Polygon dApps will be funded through a bounty hosted by Akash and Gitcoin. Visit the Akash Community Forum to learn how to apply for the program.

If you're an Ethereum Developer, you're already a Polygon developer. Leverage Polygon’s fast and secure txns for your dApp, get started here.

The previous week, Polygon Ecosystem DAO boosted its grant process to approve six grants to various projects which include:

AdLunam: An IDO platform.

Equalizer Finance: A scalable and multi-chain marketplace for flash loans.

Spect Network: A Decentralized Gig Economy for DAOs and the Sovereign Individual.

DAS.bit: Cross-chain Decentralized Account Systems.

Mystiko: A Zero Knowledge Proof On Cross-Chain Networks.

Meta Gamma Delta: Meta Gamma Delta is an inclusive and empowering society supporting women-led projects.

The grants are milestone-based and will be released based on the performance of the projects. If you plan to build on Polygon or currently are on Polygon, you can also apply for a grant to the DAO via their application form.

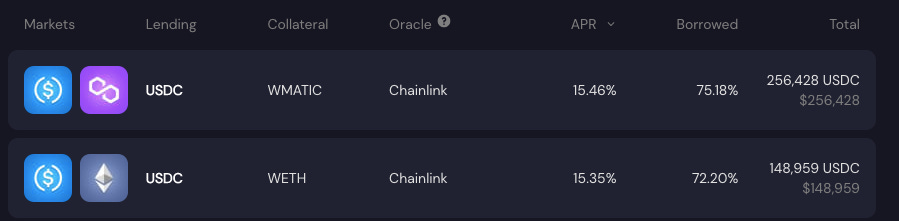

Earn ~15% on your $USDC using Kashi lending markets built on Bento Box

Kashi is a lending and margin trading platform, built on the BentoBox, that allows for anyone to create customized and gas-efficient markets for lending, borrowing, and collateralizing a variety of DeFi tokens, stable coins, and synthetic assets.

Step 1: Lend your USDC on Kashi.

When you will supply your tokens to Kashi, it will automatically send it to BentoBox which works its magic for the extra ~3% using idle funds.

A strategy by Yohaan John Neroth

Bridge BSC directly to the Polygon network in one click and ~5 minutes through the Ever Rise swap.

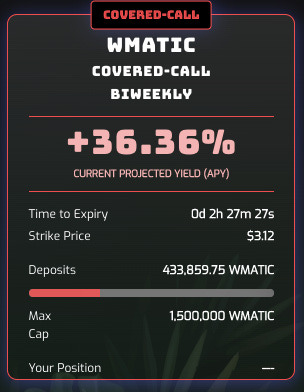

Are you an expert at options and complex structured products? If you are not, then Thetanuts have got you covered with their covered call and put strategy vaults. These vaults were designed with the everyday person in mind who does not have the tools or ability to take advantage of these strategies.

~36% APR on $MATIC is earned by selling covered call options. A covered call is when the vault holds a long position in an asset (here it is your $MATIC) and then sells call options on that same asset hence why it is "covered." The vault strategy makes sure that the strike price is out of the money to make sure you have a better chance of collecting the premium at expiry. The primary source of revenue from this strategy is from earning options premiums which are then re-invested for more $MATIC.

The risk of covered calls in $MATIC is missing out on MATIC appreciation in exchange for a consistent premium. If the value of the assets appreciates greatly (beyond the strike price), the vault strategy will only benefit up to the strike price, but no higher as a call was written.

Something new is coming very soon. Stay tuned!

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!