Poly Pulse #7: The last leg of Liquidity Mining worth $15 Million is going live on Polygon.

Also learn how to ship your own domain services on Polygon in less than 12 hours.

Howey family!

Welcome to Poly Pulse - your guide to staying up to date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the past week, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or someone who wants to keep yourself updated, this newsletter is the best place to stay ahead of everyone.

This week Polygon announced the last leg of Liquidity Mining worth $15 Million spread out over the next 6 months for the native dApps on Polygon.

The key measure, although not the sole one, is total value locked (TVL) as calculated based on a time-weighted average price (TWAP). Below is a preliminary list of parameters to determine how projects qualify for LM and the corresponding amounts.

Some important things to note:

Only protocol teams that have never received LM incentives from Polygon can apply.

TVL must stay above the specified TWAP for a period of 1 month to get the rewards.

All dAPPs that qualify can apply if the teams can provide a publicly-verifiable address (preferably a multi-sig) and a DeFiLlama link to track TVL.

The Polygon grants team has to approve the application before qualified teams can get the rewards.

Snapshots will be taken daily and weekly of DeFiLlama and the eligibility list will be updated on a weekly basis.

If at any point, the TVL goes below the given tier requirement, the team gets rewards of the lower tier.

If the one-month TWAP falls below $5M, rewards will be paused until the TVL comes back up.

Similarly, a protocol would qualify for higher rewards if TVL increases.

Check Polygon Ecosystem DAO forum for more upcoming details on how to apply.

Along with this, Polygon also announced LM for Uniswap V3 of $15 Million over a period of 12 Months.

Another key proposal which has been sent to Uniswap V3 is to reduce the fees to 0.01% from 0.05% for stablecoin liquidity pools on UniSwap v3. Currently there is a competition for stablecoin liquidity between UniSwap v3 and Curve. All of Curve’s pools have a trading fee set at 0.04%, including the Curve Polygon pools.

Liquidity providers could be worried that lowering fees from 0.05% to 0.01% would decrease their fee earnings, but the results have been the complete opposite. Take for example, the DAI-USDC pools on UniSwap v3 Ethereum. The 0.01% fee pool has ~$50 M more in TVL compared to the 0.05% pool at $134.25 M vs $85.18 M, and the 0.01% pool has had 7.7x more trading volume in the past 7 days at $635 M compared to $77.15 M. Lower trading fees tend to make up for the lower fees by the large increase in trading volume that occurs as a result of the cheaper fees.

Ship your own domain service on Polygon in a Weekend!

All the cool kids on Twitter have .eth/.sol domains. Here's how you can become cooler than them: by making your own domains!

Maybe you want to make .music so people can share their fav tracks. Anything you want.

Announcing a buidl with Polygon and Builder Space where you’ll be going over things like writing a smart contract in Solidity, deploying to Polygon, and building a React app to let your friends connect their wallets and create their domains.

To register click here. It would take a maximum of 6-12 hours or even less. So what are you waiting for?

The previous week, Polygon Ecosystem DAO approved six grants to various projects which include:

Deefy: A cross-chain loaning, renting for millennials.

Vinland: A MultiChain Defi Metaverse where you can interact with many protocols in a gamified arena.

Sunflower Land: A simple farming & crafting game which went viral over the course of 2 weeks. Players could plant crops, chop wood, mine gold and much more to gather the materials needed to craft NFTs.

Dreamr: A social media platform working on providing a fundamental right to express and create the desires in their heart for everyone.

Edubook: A Full-Stack Customized & Decentralized Skilling Ecosystem which is Globally Scalable using Artificial Intelligence & Blockchain Technology.

Meet with Wallets: An easy way to share your (or your DAO's) calendar and schedule meetings without any hassle or back-and-forth communication.

The grants are milestone-based and will be released based on the performance of the projects. If you plan to build on Polygon or currently are on Polygon, you can also apply for a grant to the DAO via their application form.

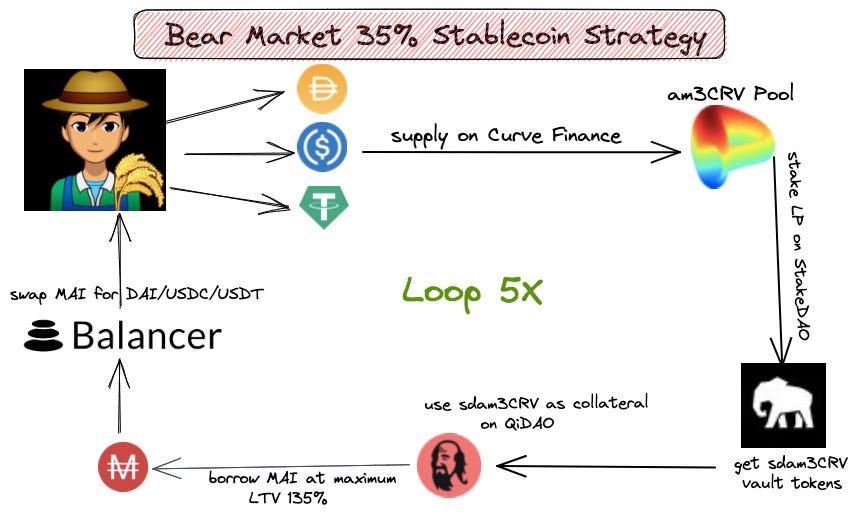

How to earn 35% farming 3CRV using StakeDao and QiDao on Polygon

Deposit your stablecoins $USDC / $USDT / $DAI in the am3CRV pool on Curve Finance.

Deposit the am3CRV LP token in the Stake Dao’s sdam3CRV vault.

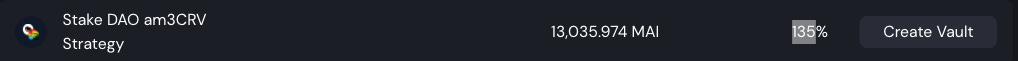

Use the sdam3CRV vault token as collateral and create a vault in QiDao. Please note that the viability of the strategy depends on the debt ceiling of MAI for this particular vault which is a limiting factor.

Borrow $MAI at 135% loan to value (“LTV”) which is the maximum permissible limit. There is no risk of liquidation as it is all stables and the vault is interest bearing as well.

Swap the $MAI for either of $USDC / $USDT / $DAI on Balancer.

Repeat the steps from 1 to 5 five times to leverage your initial capital upto ~200% and get a return of ~35%.

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.

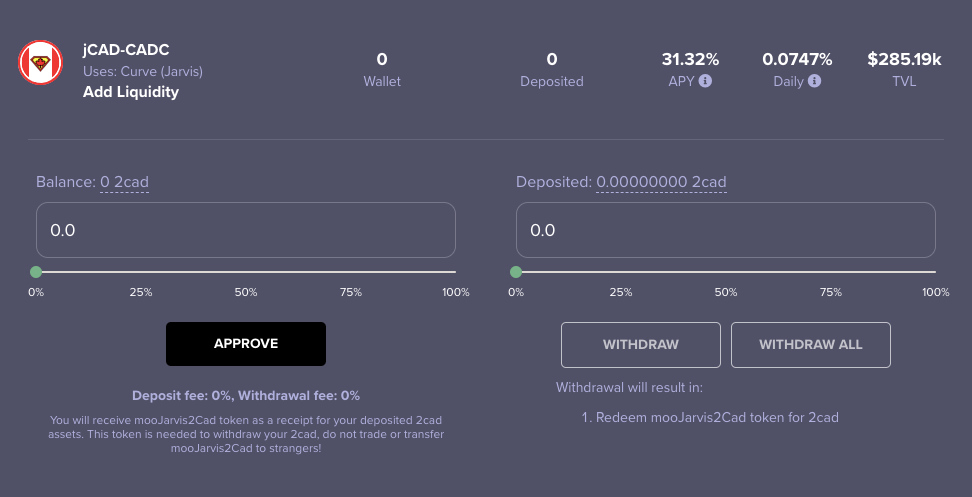

Since the markets are not the greatest here is another ~33% strategy on jCAD (Synthetic Canadian Dollar) with no impermanent loss.

Swap USDC for jCAD on Jarvis

Supply jCAD to the 2CAD pool on Curve Finance

Deposit 2cad LP on Beefy Finance and stake the LP to auto compound for 31% APY

You can earn up to 16% APR by staking in Nexo Wallet.

The Aave V3 protocol has been deployed across 7 testnets which includes Ethereum Rinkeby, Polygon Mumbai, Fantom Testnet, Harmony Testnet, Arbitrum Rinkeby, Optimism Kovan, and Avalanche Fuji!

There is a new series of “Polygon All Stars” that has been started by Polygon and they have started with Vsevolod Grigorovich, the co-founder of Tetu. Don’t forget to lurk around.

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!