Poly Pulse #8: Polygon Raises $450 Million to scale Ethereum.

Learn more about how the new LM model is democratising the way Liquidity Mining works.

Howdy family!

Welcome to Poly Pulse - your guide to staying up to date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the past week, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or someone who wants to keep yourself updated, this newsletter is the best place to stay ahead of everyone.

The past week has been yet another great week for the Polygon Ecosystem.

Polygon raised about $450 million through a private sale of its native MATIC token in a funding round led by Sequoia Capital India with participation from SoftBank Vision Fund 2, Galaxy Digital, Galaxy Interactive, Tiger Global, Republic Capital and prominent investors like Alan Howard (co-founder, Brevan Howard) and Kevin O’Leary (Mr. Wonderful from ABC's Shark Tank).

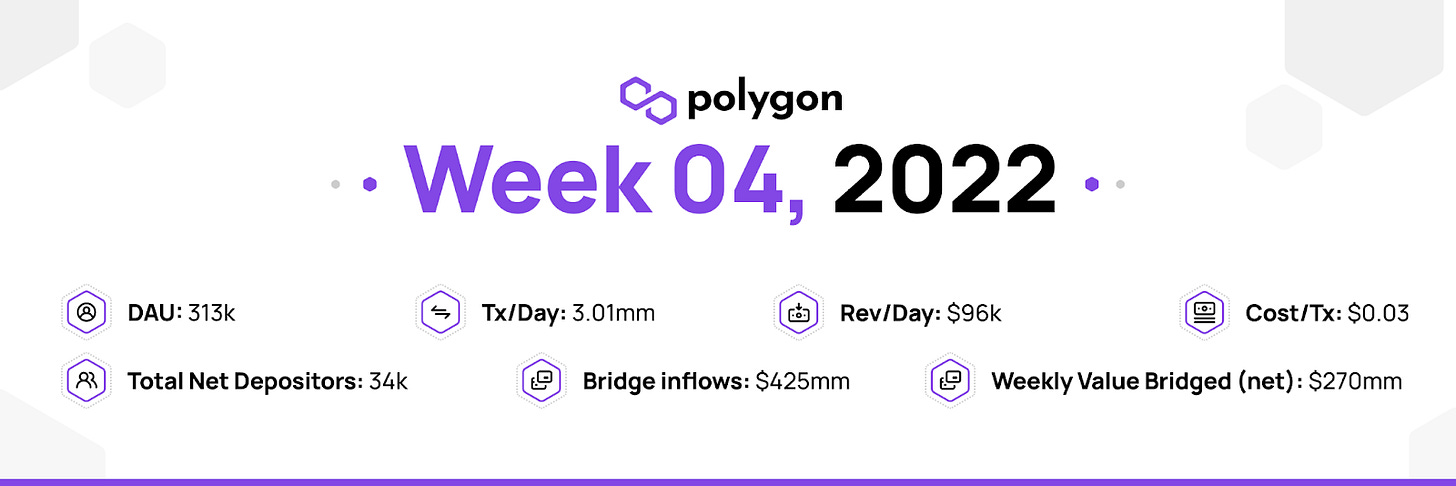

From the statistics perspective as well the week has been great:

Recent statistics from Alchemy confirmed over 7000 dApps have already onboarded the Polygon Ecosystem.

The gas fees which de-stabilised due to EIP-1559 in the past week have come back to normal with average cost of transaction being around $0.03.

The below image shows a summary of all the relevant statistics relating to the polygon ecosystem.

Building on Polygon just became much more lucrative with the announcement of the new LM 2.0 program. The program will support specific liquidity mining (LM) and protocol development efforts and will reward projects based on on-chain metrics. An extension of the belief in #DeFiForAll and bringing it to the next 10s of millions via scalable solutions of Polygon.

How will LM 2.0 mechanism work?

During the first phase (April 2021 - present), the Polygon foundation selected few teams to allocate Liquidity mining and protocol development grants. In spirit of decentralization and public goods - phase 2 will be different. Meritocratic and focussed towards Polygon native protocols.

Firstly, Polygon would take a snapshot for the initial airdrop amount to all those who meet the KPIs. Just to refresh, the key measure is total value locked (TVL) as calculated based on a time-weighted average price (TWAP) and / or weekly active users (WAU). For a complete run-down of these KPIs, refer to our announcement article.

After the snapshot, the dAPPs would get LM Tokens (ERC20) airdropped to a whitelisted multisig wallet. These tokens would then have to be staked in the staking pool, which is a basic staking contract to earn wMATIC rewards. The emission of both LM tokens and wMATIC would be spread linearly across 6 months.

It is important to note that the airdrops to whitelisted addresses would change, i.e., increase, decrease or remain the same. This is based on their respective KPI’s for the previous week. The average of the entire week would be taken in order to prevent TVL from flowing in during the time of the snapshot.

The snapshots would be taken once a week and the emission would change after.

They are collaborating with Vesq Finance team who were very interested to help democratise this innovative and first of a kind Liquidity Mining campaign.

More details here.

The previous week, Polygon Ecosystem DAO approved six grants to various projects which include:

Blocktickets: A transparent and decentralized system for creation and sale of smart tickets using block chain technology.

Axon: One-tap, mobile-first NFT mint and go!! Axon is the slickest no-code NFT generation platform and operating system in the world for college athletes and eventually the influencer ecosystem.

Minty.Art: Minty is designed to drive the passion economy as a user-centric NFT platform.

Grand Fantasy: A simple yet elegant daily fantasy sports platform on Polygon.

DAPAY: DAPAY is a platform enabling the user to request or send invoice in crypto, based on their local FIAT currency.

The grants are milestone-based and will be released based on the performance of the projects. If you plan to build on Polygon or currently are on Polygon, you can also apply for a grant to the DAO via their application form.

Earn a minimum of 36.86% on your $GHST using Gotchi Vault

Gotchi Vault allows users to deposit their $GHST and Aavegotchi’s into the Vault to passively maximize their yield. The vault takes care of everything from petting, voting for XP and managing Gotchiverse rentals.

New users are often overwhelmed by the mechanics of knowing how much to stake, when to cash in, when to enter into raffles, which raffle to enter, etc.

When a user deposits their $GHST into the contract, they receive a corresponding amount of $vGHST, a new token that represents a share of all the $GHST held by the contract. Once a user deposits their $GHST, everything else is handled by the Vault Managers entirely on-chain, in a way that ensures that no one can compromise your funds.

Below are the current multi-sig holders

Steps:

Go to the Gotchi Vault website.

Go to the “YOUR PROFILE” section on the landing page.

Approve $GHST spend and deposit to earn an easy 36%.

More Alpha: Coming soon…

vGHST to be collateral to borrow MAI?

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.

Delta Neutral Strategy using NASDEX - Increase your chances of making profit regardless of which way the market goes!

Strategy Diagram:

Note:

The current APY is extremely high as there is low liquidity running this strategy so you can expect a drop in APY as more people bring in capital.

Steps:

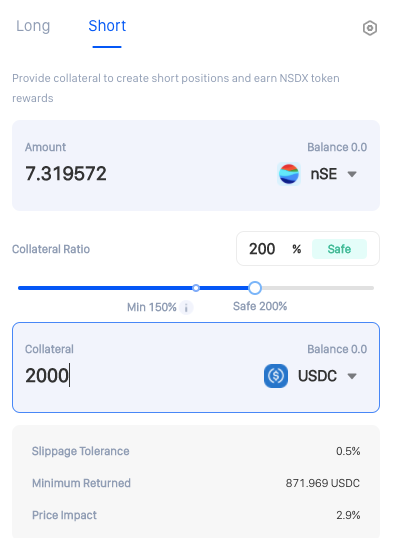

1. Start with 4,000 $USDC or any dollar amount divisible by 4.

2. Use $2,000 to short farm at 200% collateral ratio and mint $1000 worth of $nSE (~1200% APR in $NSDX for short farming). Please note that the APR will reduce as the amount of liquidity increases

3. Hedge your short position by creating a long farming position with the same quantity of nSE that you initially shorted (7.3195) so you can buy back nSE and burn to redeem collateral. (Earn 246% APR in NSDX tokens for providing liquidity)

There are 2 possible scenarios that can occur:

SCENARIO A: The price of $nSE increases.

If the price of $nSE increases, it will cost more to buy back 7.31 $nSE and burn for your 2,000 USDC collateral.

Keep in mind that, we have hedged our position with a long position in the form of a $nSE-USDC LP. The quantity of $nSE will reduce but the quantity of $USDC will increase in the LP, thus allowing you to buy back 7.31 LP using the remaining $nSE shorted and recover your 2,000 $USDC collateral. Since $nSE mirrors the price action of a real life stock the price action will not be very volatile and impermanent loss should be minimum as well.

SCENARIO B: The price of $nSE decreases

In the Long farm position, the quantity of $nSE will increase and the qty of $USDC will decrease. Now you have more $nSE than you shorted and hence you can buy back $nSE to close the short position and redeem the 2,000 USDC collateral. The excess $nSE can be sold for more $USDC.

Note: Since $nSE mirrors the price action of a real life stock (SEA Ltd.) the price action will not be very volatile and impermanent loss should be minimum as well.

Impermanent Loss Calculator for nSE-USDC LP

By joining this strategy, you do take on technical risk (any development flaws that can cause exploitation of the protocol) and impermanent loss risk, as stated in the spreadsheet above. Please farm responsibly, and never do so with money you can’t afford to lose!

A strategy by Yohaan!

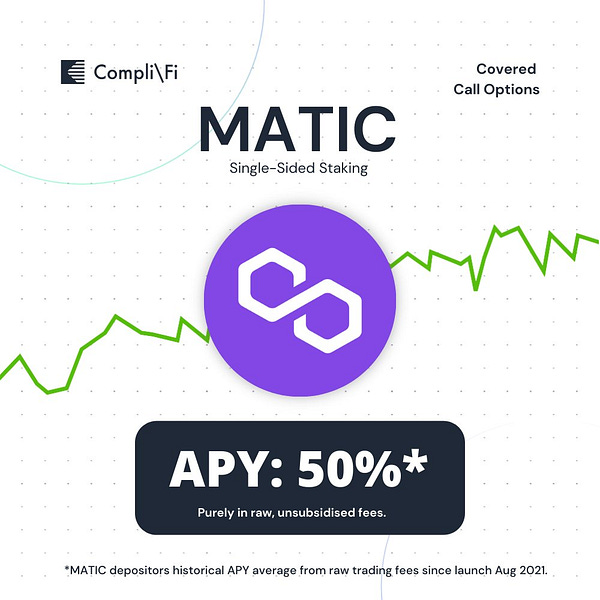

Up to 50% APY from raw, unsubsidized trading fees?

Solace.Fi an insurance protocol launched on Polygon, on the 4th of Feb, 2022.

To tap into more global customers, Celsius Network will now be accepting $Matic, $CEL and $USDC via the Polygon Network.

Watch the new episode of “Polygon All-Star” with Polygon’s grant receiver Entropyfi, a decentralized lossless prediction protocol where DX and the Polygon's team discuss the Project and more.Watch the full video:

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!