Poly Pulse #9: Polygon Ecosystem DAO is launching its Season 1.

Also read about the final KPIs of Liquidity Mining.

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the second week of February’22, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or a knowledge seeker who wants to keep yourself updated, PolyPulse newsletter is the best place to stay ahead of everyone.

The liquidity mining KPIs have been finalized and are ready for distribution. The two parameters which have been considered are:

Total Value Locked (TVL) and

Weekly Average Users (WAU).

As the DeFi ecosystem continues to grow, the TVL indicator is critical to track protocol's health. Similarly, WAU tracking can provide value to a customer's experience by emphasizing the actions or features of an DeFi application that are used frequently.

Talking about the stats, the weekly Daily Active Users (DAU) and Average Transactions per day have seen a slight increase as compared to the past week. DeFi is seeing a major resurgence, led by QuickSwap which reclaimed the most used dApp on Polygon with 73k active addresses. However, there has been a decline in the bridge inflows during the week from $425M to $96M primarily due to the choppy market conditions.

Learn with Polygon

Introducing Polygon Academy, a free online school dedicated to onboard Web2 developers into the Web3 Ecosystem.

The academy has four levels which can be achieved in this journey namely:

Apprentice (Once you run the dApp Starter Kit on your local machine)

Developer (Complete Mid-term Assignment #1)

Warrior (Complete Mid-term Assignment #2)

Wizard (Complete Final Assignment)

Learn right from scratch through a compiled repository and unlock your path to Web3 with Polygon Academy’s 8 modules. These modules include various developer repositories, and activities from setting up a node, to launching your own tokens on Polygon as well as various applications that can be built on top of the blockchain.

To access the school, you can click here.

This past week the DAO has been wrapping up its activities for Season 0 providing grants to over 70 projects and is all set to launch for the Season 1. The past week the DAO approved six grants to various projects which includes:

Gamma Strategies: An active Liquidity Management and Market Making on Uniswap v3.

Avatarverse: An identity avatar metaverse that uses Filecoin to store the underlying identity.

MT Solution: An IP Solution for NFT-licensing that allows users to mint NFTs with proper license terms and set, from inception an IP structure that ensures IP terms throughout NFT life/ecosystem.

Krypto Combat: A first of its kind NFT play-to-earn game on the Polygon network.

ChronoFi: A Play-to-Earn, where anyone can earn tokens through skilled gameplay and contributions to the ecosystem.

Share: A decentralised streaming platform and protocol that reimagines how digital content such as music and video is distributed and consumed using pay-per-view micro-transactions on blockchain.

This week the DAO also launched a bounty board which is going to help the projects building on Polygon to outsource their significant work, so that the projects could focus on their core activities. If you are building on Polygon and want to explore these bounties and learn more about them, feel free to check them out here.

Earn ~14% on on wBTC on Polygon:

Please follow the below steps to earn the rewards:

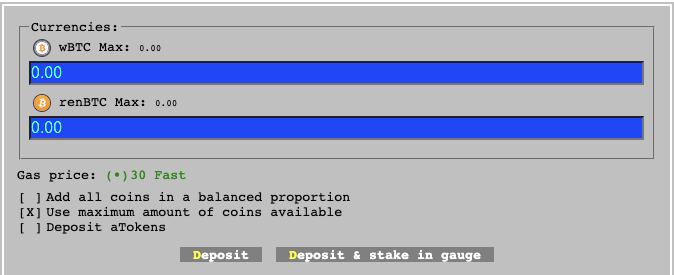

Supply $wBTC to the amWBTC/renBTC pool on Curve Finance

You will get a receipt token called btcCRV.

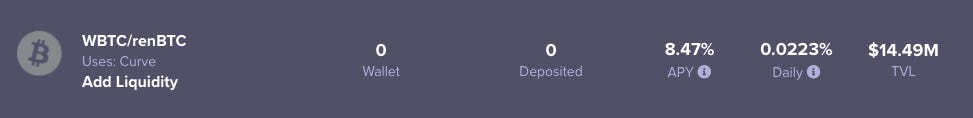

Supply btcCRV to the wBTC/renBTC farm on Beefy Finance.

Deposit all btcCRV and get a receipt token called mooCurveREN.

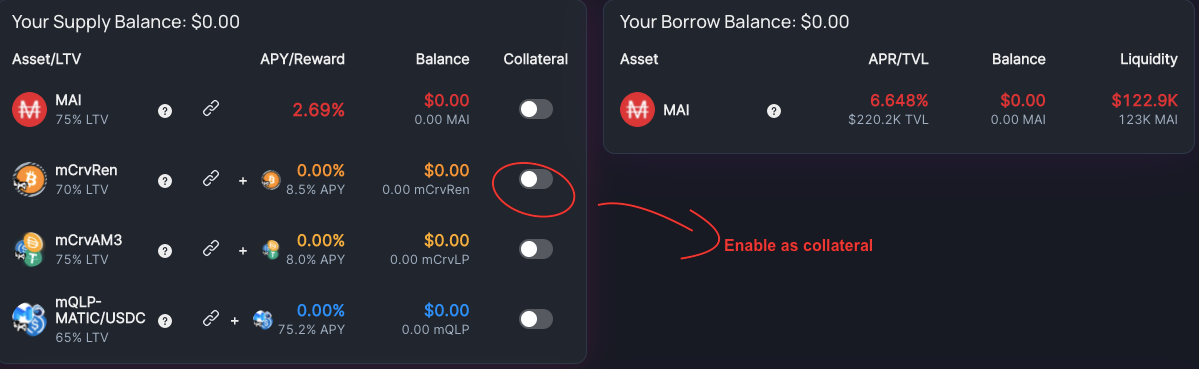

Go to Market.xyz and look for an isolated lending pool called “Mai x Beefy Leverage Locker”. Supply mooCurveREN and borrow MAI.

Sell 50% of the MAI for USDC on Quickswap

Create a MAI-USDC LP on Quickswap

Go back to Beefy Finance and supply the MAI-USDC QLP to the vault

Deposit all MAI-USDC QLP to the vault and get a receipt token called mooMAIUSDC-miMATIC. Please note that there is a 0.5% deposit fee associated with this vault as it deposits the MAI-USDC QLP to the farm on QiDao under the hood.

Under the hood:

A strategy by Yohaan.

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.

WHEN VOLATILITY SPEAKS, MONEY (IN YOUR POCKETS) MAY LEAK!

Unilend, a lending and a borrowing protocol released its contracts for dual assets pools for lending and borrowing with price feed oracles and gas fees optimisation.

Index Coop launches 2x and inverse MATIC leverage indices, an extension of the $FLI suite of products with Scalara.

Earn 15% on $DAI easily using the DAI vaults of Gains Farm

About Gains Farm: Gains Network is a decentralized leverage trading platform on Polygon, “Gains Trade”. Gains is a capital efficient low cost leverage trading platform that allows a wide range of leverage (up to 150x on cryptos and up to 1000x on forex), and any assets/pair (cryptocurrencies, forex, stocks, commodities, indexes).

How to Stake on Gains:Go to the staking section of Gains Farm and supply your $DAI, its as simple as that.

How Does my $DAI earn 15%

Any liquidity provider can supply DAI (single side) to the vault. All the DAI from open trades goes to this vault and is used as settlement to pay out traders that win. Anybody can stake DAI in the vault and earn DAI rewards based on the platform's volume. More volatility = more trading fees for LP’s. The vault will always aim at staying 10% over-collateralized and it achieves this by burning and minting GNS. If the vault is more than 10% over-collateralized because users have opened trades, the vault will use the extra DAI to market buy GNS and burn it. On the other hand if the vault is less than 100% full, because traders have been winning in the short-term, the vault will mint GNS and market sell it in very small amounts over time to refill the vault with DAI

Please note that the staked DAI can only be withdrawn at a max rate of 25% every 24 hours.

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.

Check out the winners of the Road to Web3:

Watch the new episode of Polygon All Stars with Victor at Idex Protocol. A big alpha release by the protocol:

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!