🟪PolyPulse #13: Olive DAO, a protocol to provide Liquidity as a Service goes live on Polygon

Also, do not forget to enroll yourself for 'Building Web3 on Polygon' session

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the second week of March 2022, along with a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or a knowledge seeker who wants to keep yourself updated, PolyPulse newsletter is the best place to stay ahead of everyone in the community.

During the second week of March 2022, Polygon saw a rise in the active addresses, which popped a 23.51% week over week increase. Thetanuts, KyberSwap, and OtterClam led the way for such growth, each more than doubling their user base. The primary reason for such an influx was majorly new products being launched on these protocols. Likewise, transactions per day bumped up 9.21%, with OpenSea and DODO making significant moves.

Moving ahead, another thing to highlight this week is the launch of a new platform providing Liquidity as a Service, namely Olive DAO. The Olive DAO is a decentralized protocol inspired by Tokemak, designed to give an everlasting source of sustainable and deep Liquidity to web3 protocols. The best analogy is a decentralized market-making platform that is controlled by the governance token (veOLIVE) holders:

OliveDAO would have veTokenomics and intends to become the primary vessel for liquidity to flow freely and efficiently across networks. Since the DAO governance can decide the flow of liquidity, protocols like DEXes and yield aggregators can be incentivized to pay bribes to influence the veOLIVE holders to redirect liquidity in their favor.

Since OliveDAO takes its inspiration from Tokemak, one can expect the user experience to be something like this:

Liquidity Providers deposit single-sided assets into individual Asset Jars and Genesis Pools (wETH, USDC) and earn yield in the form of OLIVE, OliveDAO's native protocol token. As of now, only the genesis pools are available.

Once the Asset Jars are live, liquidity directors would be able to stake OLIVE into individual Asset Jars and vote how that liquidity gets paired from the Genesis Pools and to what exchange venue it gets directed. The liquidity directors too, earn yield in the form of OLIVE.

OLIVE, similar to TOKE, can be thought of as a tokenized version of liquidity since the veOLIVE holders would be able to generate liquidity on demand.

There are also several measures to mitigate the possibility of impermanent loss risk to ensure that Liquidity Providers can always claim their underlying assets deposited 1:1.

OliveDAO will charge fees for providing liquidity across DeFi and NFT protocols on Polygon and, over time, would allow OliveDAO to build a substantial reserve of various assets in PCA (Protocol Controlled Assets). In the end, the PCA is controlled by veOLIVE holders through decentralized governance.

Stay tuned for more updates on Olive DAO and how one can benefit from its liquidity provision.

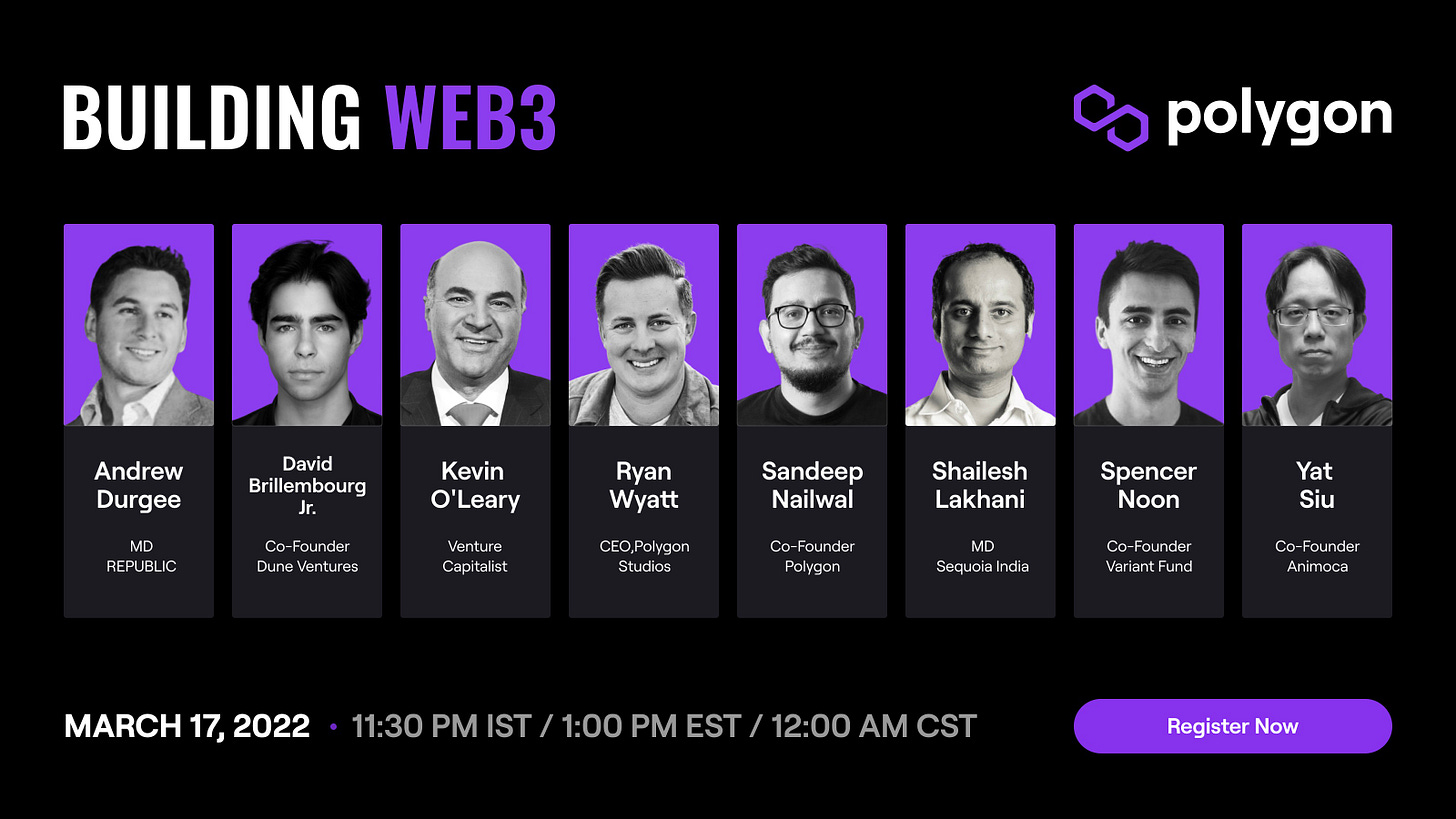

Building Web3 on Polygon:

Building Web3 brings together prime movers in the venture capital industry for a series of talks that brings their unique perspectives on how Web3 may impact financial institutions, social media, gaming/metaverse, governance, and much more.

With speakers like Kevin O'Leary, Investor, Venture Capitalist, Shailesh Lakhani, Managing Director, Sequoia India, Sandeep Nailwal, Co-Founder, Polygon and Ryan Wyatt, CEO, Polygon Studios, there are a lot of experienced talks on display.

The sessions will cover:

Web3/Finance: Financial institutions are warming up to the idea of cryptocurrencies as a new asset class. But blockchain technology promises to transform more than just portfolio allocations. The Cambrian explosion in decentralized finance applications offers an early glimpse of what’s possible. Tune into this round table discussion to learn institutional investors’ outlook for Web3.

Web3/Technology: Every wave of technological change brings with it a new set of values and assumptions about how the world should work. The public debate around Web3 and scrutiny of its promises is in itself a necessary step toward mainstream adoption. Which of the criticisms merit attention, and which ones miss the target? How will the decentralization ethos shape deployment? In this panel, VC heavyweights will share insights from their courtside vantage on the next iteration of the Internet.

Web3/Gaming: From coin-operated arcade machines and home consoles to free-to-play smartphone titles and metaverse, video games have seen a dizzying evolution as a cultural medium during their relatively brief lifespan. Games are a product of close coupling between technology, commercial necessities, and aesthetics, and no part of that equation will be left untouched by Web3. Get ready, Player One; we’re about to snow crash into the diamond age.

If you are interested in registering, please click here.

In the second week of March 2022, Polygon Ecosystem DAO approved five grants to various projects which include:

Tug Finance: A platform working on democratizing access to investment products and education for anyone with internet access.

Satchel: A decentralized application that uplifts unbanked school communities by facilitating locally-governed projects and capital growth.

InsurAce.io: An insurance protocol, which works like a traditional company without KYC and preserving user privacy.

MetaDEX: A DeFi toolkit with a composable SDK.

Glory Games: A play-to-earn model aimed at bringing game-Fi to the masses.

There are major updates that the Polygon Ecosystem DAO will be publishing next week about the grant program. As the new process finalizes, we will publish the same to make you aware of the changes and how you can benefit from the same.

Thank you to our sponsor Tally, the first DeFi wallet owned by a DAO.

Try Tally Swaps before the DAO launches!

vQi by Gotchivault:

QiDao allows users to take out interest-free loans backed by approved cryptocurrency collateral. Since vGHST was recently added, you deposit $130 worth of $vGHST, and can borrow up to $100 worth of Mai (QiDao’s USD-pegged stable coin).

Every two weeks, the QiDao community votes on which collateral-types will continue to receive airdrops. The more votes a collateral gets, the higher their subsequent airdrops will be. This has led to the “QiWars” between Fantom and Polygon projects, with projects on both networks competing to get the lion’s share of new Qi.

Introducing $vQi

vQi is tokenized maximally boosted eQi, based on OpenZeppelin's ERC20 upgradeable smart contract templates. Users deposit Qi into the vQi smart contract, which mints vQi at a rate of 1:1. The deposited Qi is immediately locked up for the maximum 4 year boost. This means that all Qi in the vQi contract receive the maximum airdrops, and the maximum voting power.

Additionally, Gotchivault is also paying out bribes to anyone voting for vGHST at a rate of 300 Qi / 1% of the total votes (or proportional thereof). All profits from the rewards will go to bootstrap Qi/vQi liquidity on either Balancer or Curve.

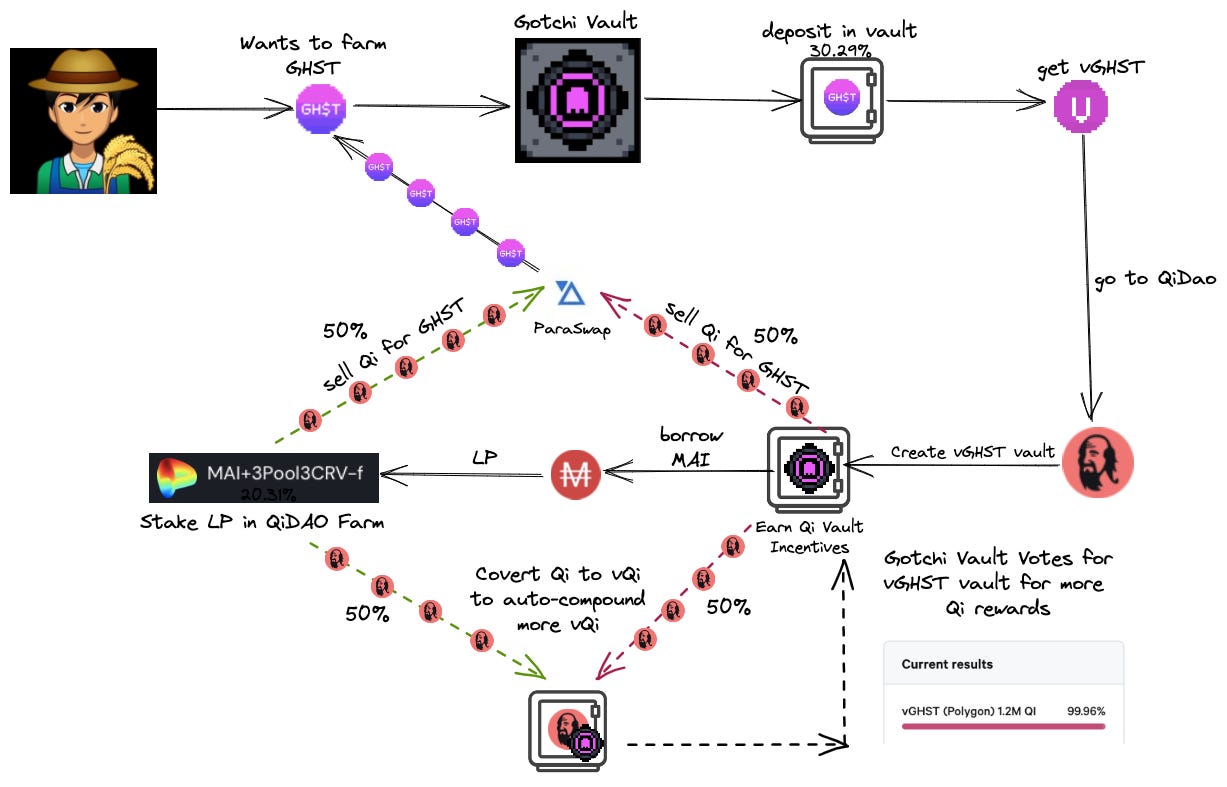

1000 IQ Play to farm both $GHST and $QI:

Steps for farming $GHST and $Qi:

If you have some $GHST, head over to Gotchivault and deposit your $GHST in the vault to receive $vGHST. You need to click on “YOUR PROFILE” to go to the vault section.

Borrow MAI and then supply to the MAI-am3CRV pool on curve finance.

Earn ~22% in $Qi and sell 50% for $GHST and convert the remaining 50% to $vQi to get the best of both worlds.

Since the vQi smart contract retains the voting power (and will be used exclusively to vote for $vGHST vaults), the owners of the vault get boosted rewards in $Qi. 50% of the $Qi earned can again be sold for $GHST and the remaining 50% can be converted to $vQi.

An Alpha worth decoding. Claystack, another liquid staking platform is launching soon!

Tetu forms an alliance to accumulate more eQi and thereby more voting power to vote for more rewards on Polygon chain. OtterClam, Sphere, Universe and Vesq join the alliance.

Euler enabled lending and borrowing for Matic on its platform.

Polysynth has deployed on Polygon Mainnet. With this, they have become the top decentralized perpetual swaps protocol with support for 10X leverage on Polygon.

Will DeFi Summer come back?

Crypto market thrives on innovation and the market tends to move in the same direction. In the last DeFi summer there was tons of innovation and hence the market thrived on it but as innovation moved towards other segments of the Web3 ecosystem, the focus of the market changed.

With respect to Polygon, there is a suite of innovation that is lining up to go live and some of the biggest developments on zero knowledge proofs (ZKPs) are happening on the network. Polygon Hermez, Avail, Edge, Nightfall, Miden and Zero are such innovations and hence I believe that DeFi will resurface sooner than later as enterprises, corporates and protocols line up to build their solution on these chains.

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.