🟪PolyPulse #14 Liquid Staking is unlocked on Polygon.

Learn more about the details of Liquidity Mining 2.0 in its most democratised way.

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the third week of March 2022 and a farming opportunity.

Whether you are a newbie who has just entered the DeFi ecosystem or a knowledge seeker who wants to keep yourself updated, PolyPulse newsletter is the best place to stay ahead of everyone in the community.

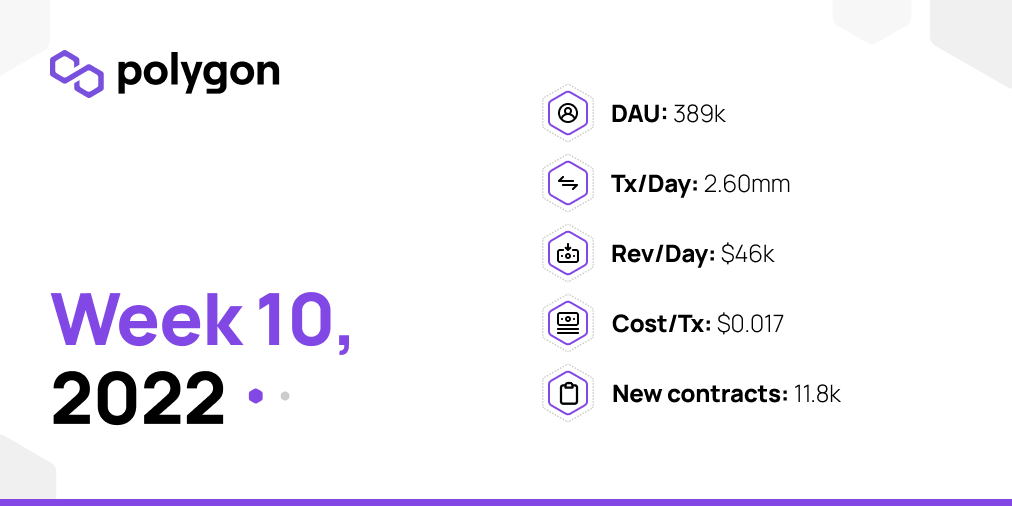

During the third week of March 2022, the active users almost remained the same (388K) on Polygon as compared to the second week. QiDao, and Otterclam topped the charts of most active number of users with respect to the active users due to the Qi wars between Polygon and Fantom chain to maximize the Total Value Locked (TVL) on the chain.

Moving ahead, a new narrative is emerging on Polygon around Liquid staking. Staking in its current form requires users to lock up their assets for a certain period of time, due to which they lose the much-needed liquidity and need to wait for the unbonding period to get over to claim these assets. Liquidity staking protocols enable the issuance of liquid tokens that are used to participate in DeFi and compound their yield. Thus, one gets yield from staking their tokens, but they also get to compound it across DeFi. Compounding means that users must continually reinvest the returns from interest-bearing products like crypto savings or staking to avoid losing out on an exponential amount of returns over time.

Liquid staking is still a novel phenomenon, and only a limited number of users understand it on Polygon. With Lido, Claystack, and Stader this novel phenomenon will be available for the users across the chain and hence will benefit them with better yields for their staked tokens.

Stay tuned as they unveil the benefits for users across the chain.

Liquidity mining (LM) was a concept that was first introduced by Polygon in 2021 when it announced its first Liquidity Mining Program with AAVE. Polygon is planning to do another such campaign of Liquidity Mining for protocols building on its chain.

All the dApps which have previously never received liquidity mining rewards from Polygon and are deployed on Polygon are eligible for the LM 2.0. Even if any dApp wants to move from another chain, if they meet the KPIs for one-month post-deployment of Polygon, they can avail the benefits of LM 2.0. The program is even available for anonymous teams.

The primary KPIs are Total Value Locked (TVL) and Weekly Average Users (WAU). Based on these KPIs, the Tiers could be decided, and the LM rewards could be given in the most decentralized manner.

Total Value Locked Tiers:

Tier 1: TVL ≥ $100M gets you ~$1M linearly spread across 6 months

Tier 2: TVL < $100M but > $50M gets you ~$500k linearly spread across 6 months

Tier 3: TVL < $50M but > $15M gets you ~$250k linearly spread across 6 months

Tier 4: TVL < $15M but > $5M gets you ~$100k linearly spread across 6 months

Weekly Active Users Tiers:

Tier 1 [More than 5k WAU]

Tier 2 [3-5k WAU]

Tier 3 [2-3k WAU]

Tier 4 [1-2k WAU]

Last week the audit of the smart contract for the LM 2.0 was completed and is to launch early April 2022.

Learn more about the LM 2.0 checking the FAQ’s here.

Thank you to our sponsor Tally Ho, the first DeFi wallet owned by a DAO.

Try Tally Ho Swaps before the DAO launches!

During the third week of March 2022, Polygon Ecosystem DAO approved multiple grants to various projects which include:

Satchel Finance: Uplifting underbanked school communities by facilitating locally-governed projects & capital growth via DeFi-powered donations & financial primitives.

BattleBrains: An educational initiative working towards onboarding the next billion to Web3 through gamification. Roadmap to a multi-chain DAO.

MetaDex: DeFi at your fingertip, the next generation of Web3.

Swan Finance: A platform which offers an easy to use interface for earning interest. It also provides a decentralized platform for peer to peer lending.

Moopay: No-Code, Non-Custodial Payments for Creators.

If you are building on Polygon you can apply through the new tool here.

Earn 15% on wETH

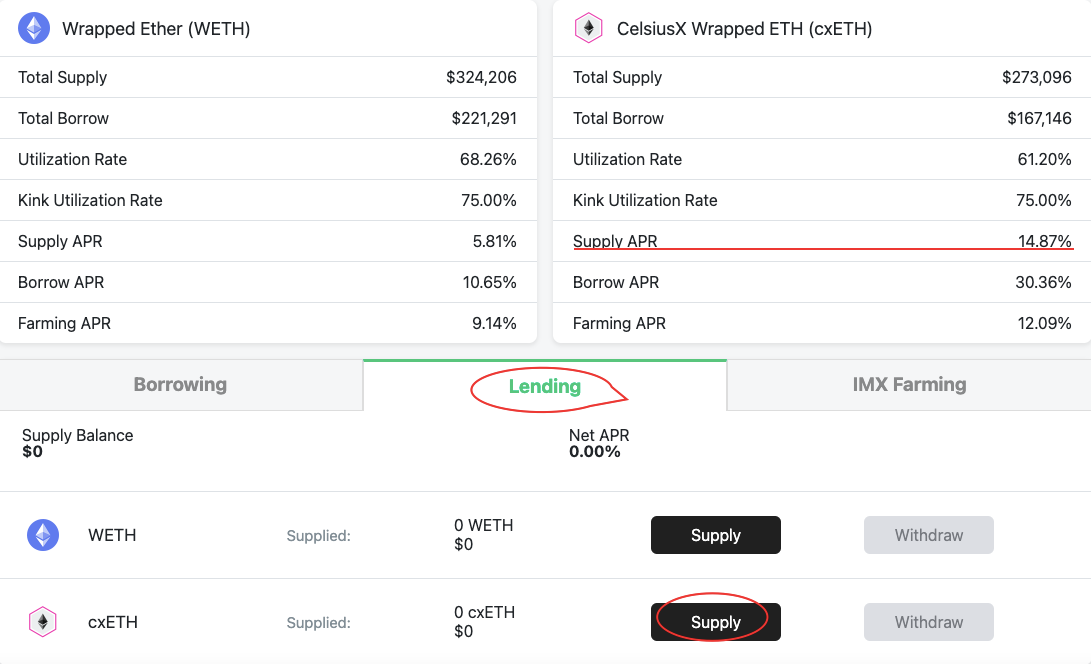

Looking for a nice place to park your wETH, Impermax Finance is a leverage farming protocol for LP tokens for both conservative and risk taking yield farmers. Impermax leverage traders utilize the funds provided by lenders who are less risk averse to multiply their LP rewards.

Lend cxETH single side and earn 15%

Steps to execute the strategy:

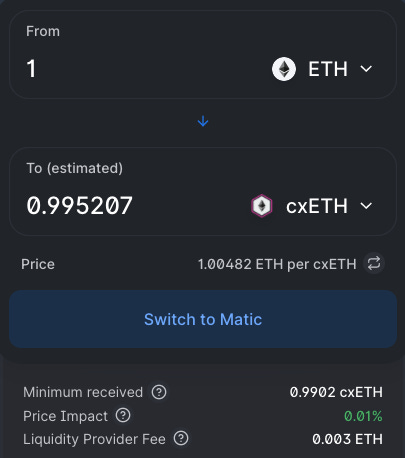

If you have regular wETH you can swap it for cxETH on quickswap. cxETH is custodial ETH of CelsiusX, which is the DeFi arm of Celsius and each cxETH is backed by 1 ETH stored in Enzyme Protocol on Ethereum and chainlinks proof of reserve oracle ensures that it is backed 1:1. Currently there is 19,334 cxETH on Polygon.

Go to Impermax Finance and locate the wETH-cxETH QuickSwap pool.

Click the lending option and select the supply option. Approve the contract to spend your cxETH and deposit all.

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.

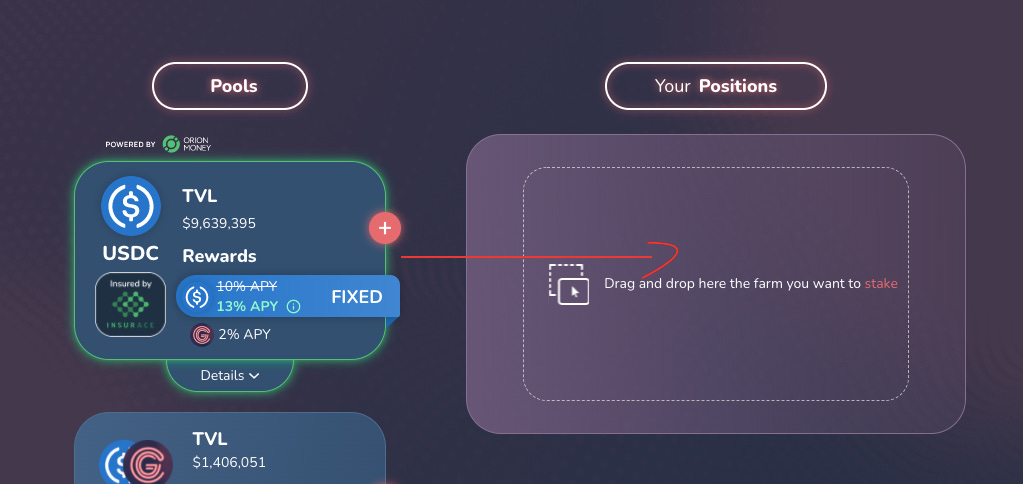

Earn 13% on USDC :

If you have time for only passive DeFi strategies, then the USDC vault of GOGOcoin is an ideal choice. A user has to simply approve and deposit their USDC and they immediately start earning interest.

Simply drag and drop this box in order to approve and deposit your USDC.

How is the 13% APY Generated:

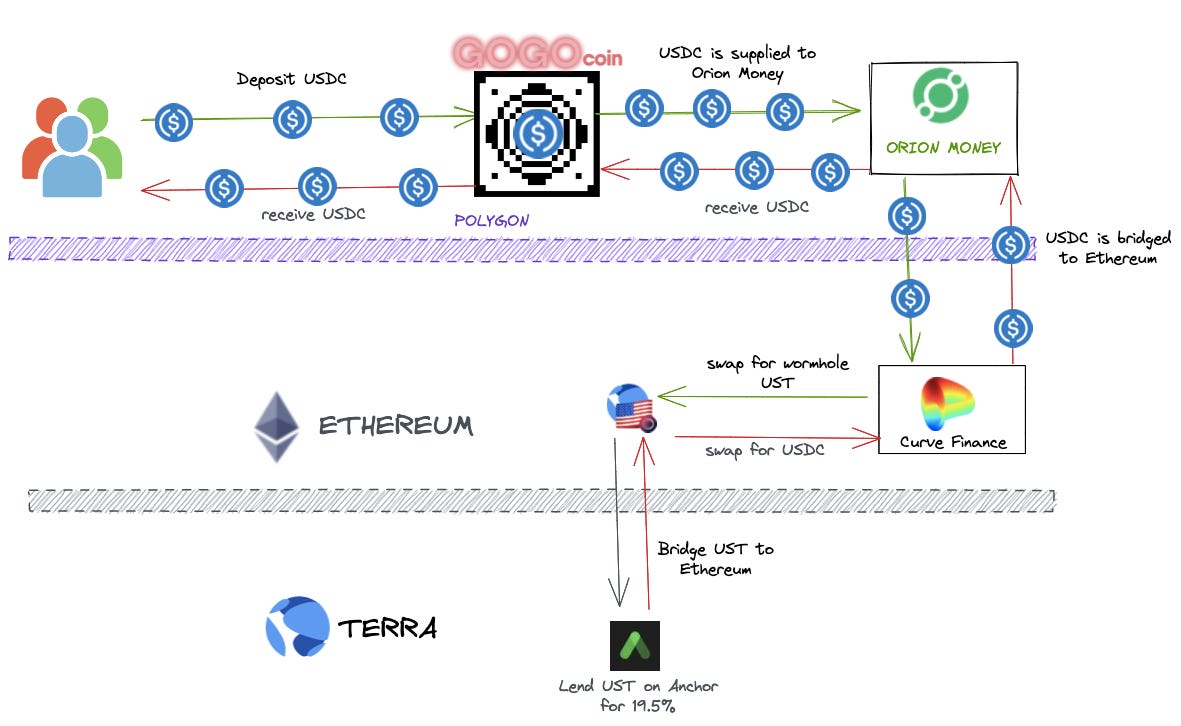

Gogocoin deposits funds to Orion Money who then bridge the USDC back to ethereum. USDC is then swapped for UST on Curve finance and then bridged to Terra via wormhole. The UST is then supplied on anchor protocol to earn interest.

Visual representation of strategy:

Tread cautiously whenever you’re using multiple DeFi protocols, bridges, and L2s. Only ever deposit money you can afford to lose.V3 of Aave's liquidity protocol with a fully revamped UI/UX is live. They deployed across seven blockchains, including Polygon.

V3 of @AaveAave's liquidity protocol boasts a fully revamped UI/UX and deployment across seven blockchains, including #Polygon. Streamlined and optimized #dApps are essential for #DeFi mass adoption and web acceleration. #poweredbyPolygon *Sure it's not Web3 acceleration?*1/ Aave V3 is here! 👻 The most powerful version of the Aave Protocol to date, V3 brings groundbreaking new features than span from increased capital efficiency to enhanced decentralization. Read what's new in V3 in the thread below👇or visit https://t.co/H3jTyKRqNs to dive in! https://t.co/LXzn7660nA

V3 of @AaveAave's liquidity protocol boasts a fully revamped UI/UX and deployment across seven blockchains, including #Polygon. Streamlined and optimized #dApps are essential for #DeFi mass adoption and web acceleration. #poweredbyPolygon *Sure it's not Web3 acceleration?*1/ Aave V3 is here! 👻 The most powerful version of the Aave Protocol to date, V3 brings groundbreaking new features than span from increased capital efficiency to enhanced decentralization. Read what's new in V3 in the thread below👇or visit https://t.co/H3jTyKRqNs to dive in! https://t.co/LXzn7660nA Aave @AaveAave

Aave @AaveAave

What is the biggest thing working in DeFi’s favor right now?

I think it’s the immense talent across the DeFi ecosystem. Incredibly bright people from all walks of life and from around the world are contributing considerable time and effort to advance DeFi. These passionate builders and dreamers are not the type of folks I’d bet against in the years ahead!

And if you found this content useful and want to help us bring more talented builders to this space, share it with your friends.

This newsletter is to help you update yourself in the context of farming opportunities, developer opportunities, and how the ecosystem is evolving. Stay tuned, subscribe, and we will have many updates coming your way!

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.