PolyPulse #24: Polygon launches 100% KPI-based Liquidity Mining for Active Managers on Uniswap.

Also read about Native USDT going live on Polygon.

Howdy family!

Welcome to Poly Pulse - your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the last week of May 2022.

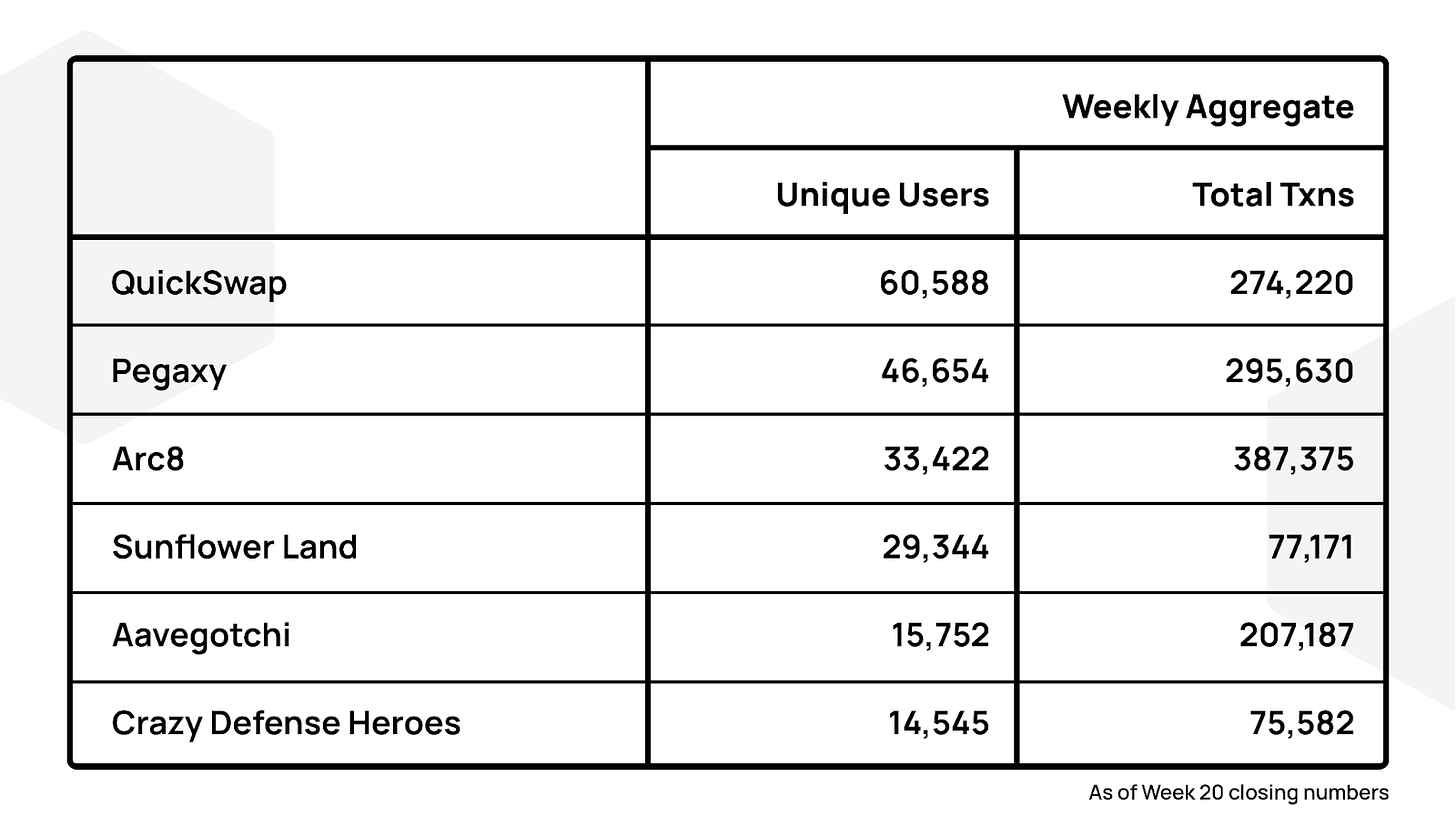

During the last week of May 2022, the bear market effects seem to be kicking in. The daily active users took a dig from 307K in the fourth week of May 2022, to 282K users in the last week of May 2022. The transaction per day also fell from 3.64 Million to 2.82 Million per day.

Quickswap remained the top dApp of the month with around 60K users and a total of around 275K transactions.

Introducing KPI-based Liquidity Mining for Active Managers on Uniswap

Back in April, the Polygon foundation introduced a liquidity mining campaign of $15M for Uniswap v3. It partnered with Arrakis Finance to kickstart the liquidity mining campaign on Uniswap v3 for the first 3 months ending Jun 30, 2022.

Starting in July, it will be giving out $1M in MATIC liquidity mining incentives each month to the best active manager on Polygon that has built on top of Uniswap v3. In order to avoid cherry picking, Polygon has decided to distribute most of the remaining $12M entirely on the basis of individual merit.

Polygon will be partnering with UMA Protocol to launch a 100% KPI-based liquidity mining program for Uniswap v3. Below is a diagrammatic representation of what this would look like:

Polygon will shortlist “n” Uniswap v3 pairs that are eligible for rewards. The pairs selected would be the pairs that generate the most fees in Uniswap v3. Since total monthly rewards are $1M, each pair is eligible to receive “$1M / n” in wMATIC. All active managers are invited to participate and create strategies for however many of the “n” pairs they wish.

The above example shows the “wMATIC/USDC (0.05)”. The manager that has the highest “Fees / Weighted Liquidity over 1 month” for “wMATIC/USDC (0.05)” would be eligible for the entire amount of $1M / n. Since active manager “F” has the highest fees, the entire wMATIC reward goes to manager “F”.

Similarly, rewards for every single one of the “n” pairs are up for grabs by the best performing active manager for that particular pair. By following this approach, it will ensure that the best managers are rewarded for their hard work and the polygon community is able to enjoy the best Uniswap v3 yields.

If you are a dApp which manages liquidity on Uniswap actively and are on Polygon please fill the form here.

👉 Are you a DeFi freelancer writer/researcher? We’re hiring!

With the conclusion of the second month of the Polygon DAO’s initiative “Polygon Village”, it has completed the evaluation of over 150 projects. Out of the projects who applied, 70 projects have been extended support in the form of grants, audit and marketing vouchers as well as other services that the DAO provides through its multiple collaborations and affiliations. The DAO will be working on distributing the support during the week.

In terms of the educational series, the DAO is holding “Village Talks” which bring together the best in the industry to help people build on Polygon. Last week Filecoin was invited to deliberate on decentralized storage services. This week Idle Finance will be joining the village talk to launch their joint grant with Polygon DAO in order to accelerate the growth of more projects on Polygon.

If you are a dApp building on Polygon and want to get support, the Polygon DAO is the best place to get help. You can click here to check their complete suite of services.

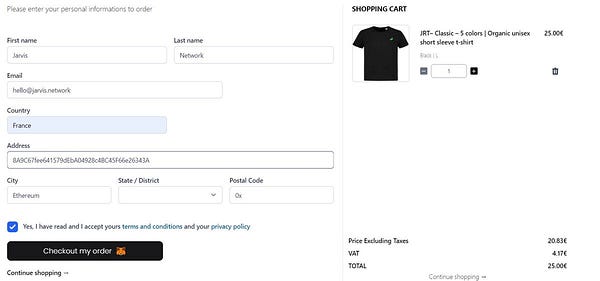

📌 Jarvis Network enables payment for your online shopping via jEUR via Metamask checkouts.

📌 Chainlink VRF v2, the update to Chainlink’s industry-standard RNG solution for smart contracts, is live on Polygon.

📌 Native USDT goes live on Polygon:

📌 Learn how to connect to Polygon through Metamask:

📌 Don’t miss out some great rewards on StaderX through Polygon Liquid Staking

If you are new in Defi and want to dive straight into the wild west, the best way to start your journey is via due diligence. Checking the project's Discord (leading indicator) is usually the first thing to do, and closely looking at the community ethos & how it develops. With time you start to build “A reflexive memory” that will help you analyze projects early on & identify good communities.

This trains your brain to better understand the “DeFi culture” (DeFi subset of crypto is quite different). You start grasping which defi ideas make sense and which ones are just mid-iq waste of time. As an ecosystem, yes we need to foster growth of protocols and more digital assets that get normies onboarded. Closing that loop with the right education materials is also very important.

Once they understand the power of on-chain financial products, you see those start to permeate into use cases traditionally outside our small on-chain bubble. Projects like Teller.finance (and their strong collaboration with Ensuro) is bringing mortgages powered by DeFi and Dimo.zone brings connectivity & data sovereignty to cars. This is the path that leads us to the mass adoption of real life products and utilities on the Blockchain. - Hamzah Khan- Head of DeFi, Polygon.

Disclaimer:

Information provided on this site is for general educational purposes only and is not intended to constitute investment or other advice on financial products. Such information is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any particular digital asset or to use any particular investment strategy. Proveq, LLC and its affiliates (collectively “proveq”) makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this Site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images are the property of Proveq. Proveq is not registered or licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Links provided to third-party sites are for informational purposes. Such sites are not under the control of Proveq, and Proveq is not responsible for the accuracy of the content on such third-party sites.