SushiSwap Vampire Mining [Alpha Tractor]

Learn why SUSHI is the talk of the town for incentivizing Uniswap Liquidity

THIS STRATEGY IS BRAND NEW AND EXTREMELY RISKY. SUSHISWAP IS UNAUDITED AND SHOULD BE APPROACHED KNOWING YOU MAY LOSE 100% OF YOUR FUNDS.

This is part of the Alpha Tractor series - giving you intel into the freshest yield for the most honest farmers only.

Sushi is served.

The latest in the food coin saga comes as one of the most contentious rollouts (no pun intended) yet.

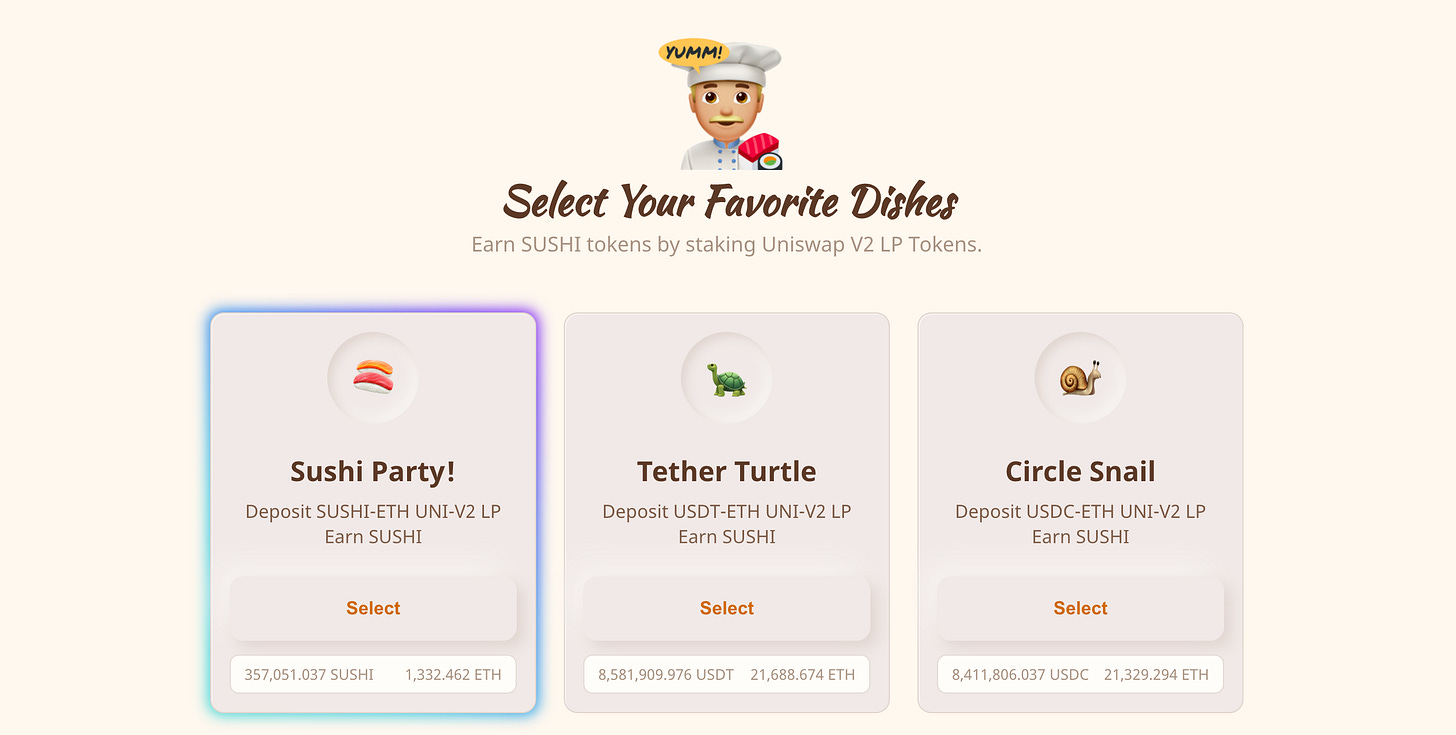

Touting itself as “an evolution of Uniswap with SUSHI tokenomics” farmers earn SUSHI governance tokens for staking the UniswapV2 LP tokens of popular DeFi assets in an appetizing interface inspired by Yam Finance.

100 SUSHI is created per block, distributed across all 13 pools evenly.

For the first two weeks, 1000 SUSHI (10x the base amount) is rewarded per block with the SUSHI/ETH pool receiving an added 2x multiplier.

SUSHI tokens offer no utility except for governance of the protocol, with future iterations offering tokenholders a percentage of SushiSwap trading fees.

What’s the Point?

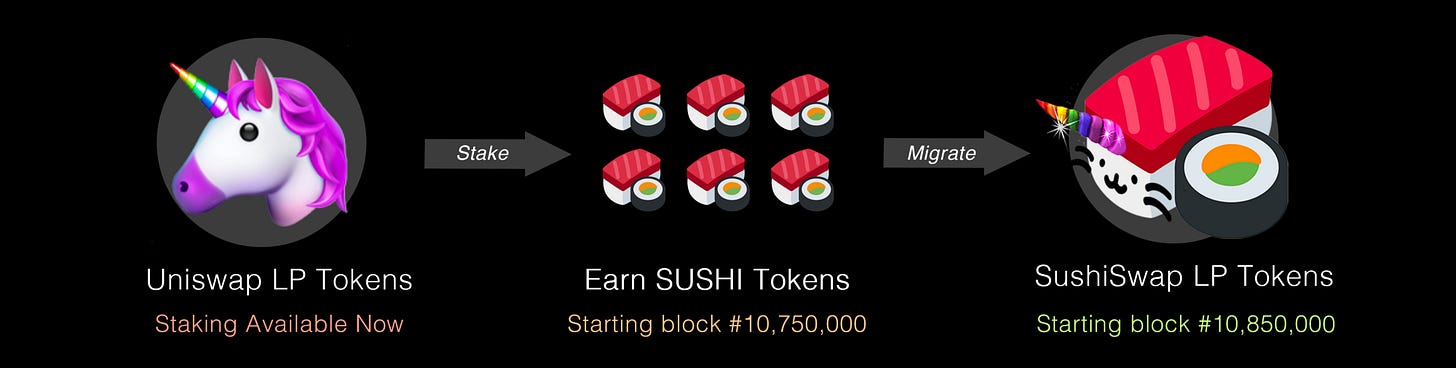

While the first stage of the project is relatively harmless, SushiSwap’s master plan is to take the liquidity staked in their interface and migrate it to a native AMM roughly two weeks after launch.

This tactic - coined ‘Vampire Mining’ by Martina Krung - looks to siphon liquidity from a market leader like Uniswap by offering incentives and revenue-sharing tactics that make capital more profitable on the new AMM. Krung details the steps to do so as:

Copy project A (Uniswap) with all its open-sourced smart contracts and front-end. Project A has no token, but earns a fee on every token flow.

Implement migration mining from project A to project B (SushiSwap), basically giving $X (SUSHI) to people who migrate liquidity from A to B.

Implement governance and start sharing revenue to new tokenholders holding $X.

Project A has no liquidity and loses all revenue.

While the idea of Uniswap being killed by its Japanese clone is quite far fetched, it’s interesting to consider Vampire Mining as a bootstrapping mechanism for new projects.

In the case of SushiSwap, 10% of every SUSHI distribution is set aside for the development & future iterations of the protocol, including security audits.

Upon migration to SushiSwap, a 0.05% trading fee will be shared directly with SUSHI holders, meaning users can capture revenue without having to act as an LP.

Is SushiSwap Safe?

The burning question on everyone’s mind - can I farm this or will I lose all my money?

While the launch of SushiSwap was met with a lot of community backlash, the core team has addressed security concerns around exit scams and rug pulling.

The first red flag - an admin key which would drain funds - is now subject to a timelock. This means that any major admin call will be subject to a 48-hour delay in which LPs can remove their liquidity in the event of a forthcoming crisis.

While the team has suggested that security is an utmost priority, the contracts have yet to be professionally audited. The original post states SushiSwap will “pay 5 ETH of our live-saving for (an) audit immediately after (a leading audit firm) confirms”. This reverse psychology of having an audit firm step up to *want* to audit the contracts is one we’ve only really seen happen with yEarn, a bold claim for the latest meme coin on the block.

The contracts are publicly available here, and so far there have been no glaring holes identified by the community.

Still, there’s an exponential level of unforeseen risk, more so on the smart contract bug side than on the team pulling a quick one.

For any farmer consider keen to harvest SUSHI, please proceed with caution. There is still quite a lot of mystery regarding the project and many of the sector’s top farmers are being very careful with the level of YOLO they’re willing to commit.

To keep an eye on SushiSwap, follow them on Twitter or join the conversation on Discord.

Until the next Alpha Tractor, stay safe out there!

——

All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information and does not account for specific goals or financial situations. Be careful and keep up the honest work!