Why SushiSwap is becoming DeFi’s most powerful DEX platform

This article is a part of a new series of opinion articles written by independent researchers that will be published in DeFi Pulse Farmer. The articles will first be shared with the Alpha Tractor subscribers, and will later be made accessible for free subscribers.

Why SushiSwap is becoming DeFi’s most powerful DEX platform

Opinion Article by Christian Murray, in collaboration with Jake Brukhman and the CoinFund team.

Thesis

SushiSwap has undergone significant transformations in leadership and governance structure since its inception as a fork of Uniswap in August 2020.

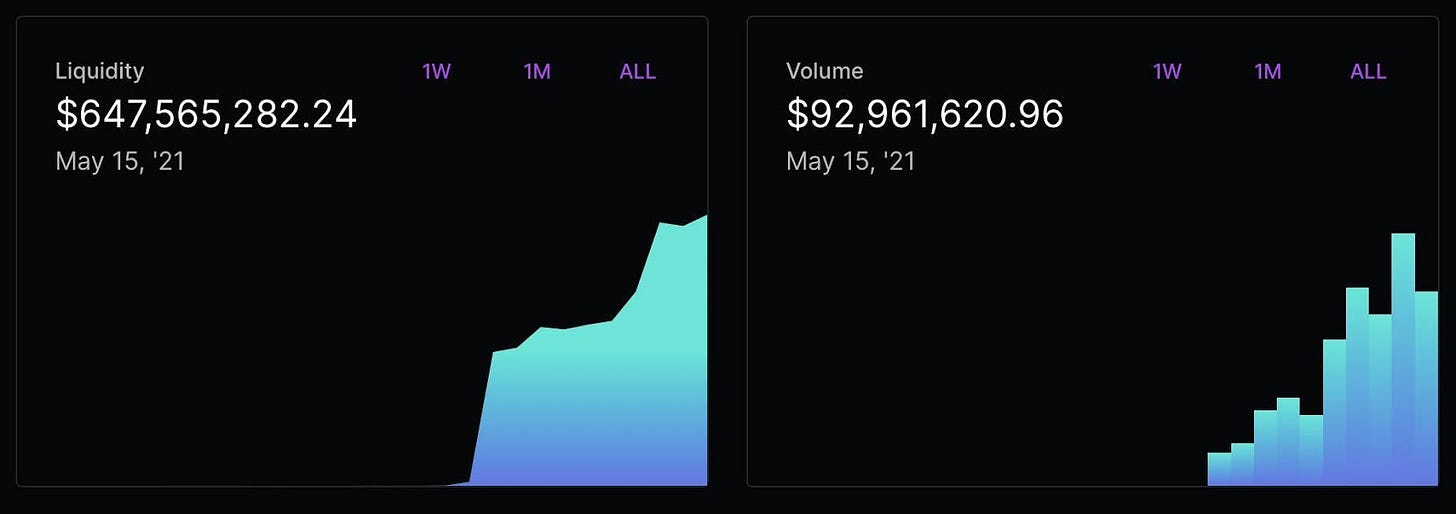

Volumes have steadily increased and now account for 23% of the aggregate volume of Uniswap V2, Uniswap V3, and SushiSwap.

SushiSwap is a fast-moving project that has continued to deliver innovative new features and has deployed across several Layer 2 scaling solutions.

Background

SushiSwap started in August 2020 as a fork of the popular DEX platform Uniswap by an anonymous developer with an additional mechanism meant to incentivize Uniswap volume to migrate to the new platform. SushiSwap’s first innovation was its governance token, SUSHI, which is distributed to liquidity providers as an extra reward for using the platform. Soon after its launch at the end of August, SushiSwap had taken an impressive 37% of Uniswap’s daily volume (source: The Block).

Soon after its launch at the end of August, SushiSwap had taken an impressive 37% of Uniswap’s daily volume.

After the platform’s founder, known as Chef Nomi, attempted to exit with $14 million from the SushiSwap treasury, the price of the SUSHI token and Total Value Locked (TVL) of SushiSwap dropped precipitously. However, Chef Nomi soon returned the funds and then transferred control of the platform to a group of 9 community members. Since then, SushiSwap has proven to be a highly competitive DEX, with strong governance and frequent iterations to the features on the platform. This has led to steady growth, with SushiSwap reclaiming more than one-third of Uniswap’s volume (source: The Block), and surpassing its previous all-time high TVL (It has also created a never before seen competitive strategy for protocols known as the vampire attack).

SushiSwap’s Competitive Advantages

SushiSwap introduced an incentivization scheme via a governance token for liquidity providers before Uniswap, although Uniswap was quick to respond with its own UNI token in early September. However, SushiSwap has already become entrenched as the primary incentivized DEX and has made steady gains against Uniswap during late 2020 and early 2021. Since its restructuring following the Chef Nomi incident, SushiSwap has been innovating at a fast pace, introducing:

Onsen, a rotating menu of incentivized liquidity pools governed by the community at the end of 2020.

BentoBox, an integrated token vault.

Kashi, a margin trading system.

Miso, a token launch platform.

While Uniswap focuses on increasing the capital efficiency of spot trading through the V3 protocol upgrade, SushiSwap has brought the margin trading experience available on centralized exchanges to the DEX space.

Additionally, SushiSwap has expanded to multiple layer 2 and side chains, including Polygon (formerly Matic), Fantom, xDAI, Moonbeam, and Binance Smart Chain. The impressive set of new features and presence across many L2’s has positioned SushiSwap as a highly competitive DEX as capital from Ethereum’s layer 1 begins to distribute across chains with lower transaction costs.

BentoBox - Automated lending and yield

SushiSwap’s BentoBox, named after the Japanese lunchbox, is a smart contract system that brings a major upgrade to the gas efficiency, interoperability, and functionality of the entire exchange and will serve as the foundation for a new ecosystem of DeFi applications.

The BentoBox platform can receive user deposits in any ERC-20 token and earn passive yield from flash loans, deposits on external platforms including Yearn and Curve vaults, and from yield opportunities present on SushiSwap. BentoBox also reduces the gas cost for users and developers through its extensive built-in gas optimization and by allowing any app to interact with a user’s tokens with a single token approval.

The BentoBox platform can receive user deposits in any ERC-20 token and earn passive yield from flash loans, deposits on external platforms including Yearn and Curve vaults, and from yield opportunities present on SushiSwap.

Apps built on top of BentoBox will benefit from lower costs to deploy smart contracts and enhanced interoperability with other apps on the platform. Users can deposit their tokens in BentoBox apps while continuing to receive an underlying passive yield on the platform.

Kashi - SushiSwap’s first BentoBox product

The first BentoBox product, Kashi, brings margin trading to the DEX space, allowing users to take leveraged trade positions without using a centralized exchange. While Kashi was developed by the SushiSwap team, BentoBox is a permissionless system, meaning anyone is free to develop apps and deploy them on BentoBox. These apps will be able to interact with user wallets and other apps in a low-cost manner while still being deployed on the Ethereum main chain. BentoBox will become the backbone of a family of SushiSwap-focussed apps, developed by both the SushiSwap team and the community.

Trident - SushiSwap’s second BentoBox product

The next feature to be built using the BentoBox system is Trident, an enhanced liquidity pool system on the exchange. Trident was announced during the Ethereum Community Conference in Paris on July 20, 2021 and will be deployed shortly after. Originally, SushiSwap allowed for only one type of liquidity pool for token swaps: the constant-product pool. Constant-product pools are the most common type of liquidity pool, seen across many DEX platforms including Uniswap’s V2 protocol and others. Constant-product pools require any liquidity deposit to have equal value between the two tokens being deposited. While these pools can be useful, they have a number of limitations; namely that much of the capital in the pool remains unused and liquidity providers are often exposed to impermanent loss.

Trident will initially introduce three additional pool types: hybrid pools, weighted pools, and concentrated liquidity pools.

Hybrid pools: can contain up to 32 similar tokens and allow users to swap between any of the tokens in the pool at a reduced price impact using the stableswap invariant, similar to the system implemented on Curve finance for stablecoin swaps.

Weighted pools: are similar to normal constant-product pools, but can have a ratio between two tokens other than 1:1. This allows liquidity providers to choose the ratio at which they want to deposit funds.

Concentrated liquidity pools: are pools that allow liquidity providers to choose a price range to provide liquidity within, increasing the capital efficiency of the pool. This is similar to Uniswap’s V3 protocol.

In addition to these three new pool types, additional pool types will be possible, as long as they conform to SushiSwap’s interface. Along with the new pool types, Trident also includes a new routing engine, called Tines. Tines will integrate SushiSwap’s many new pool types together by finding the best route for a swap. This will optimize the efficiency of swapping for users, as different assets perform better in different pool types.

Integrations with the Yearn ecosystem

In addition to internal improvements, Sushi has also been integrated into the Yearn Finance ecosystem led by Andre Cronje. The Yearn ecosystem, which also includes CREAM finance, Pickle finance, Yeti, and others, opens up an additional layer of interoperability and support that Sushi can leverage. The popularity and success of the Yearn platform give SushiSwap an even more reliable source of revenue as SushiSwap would be the default exchange system for all other Yearn-related apps. The Yearn ecosystem also includes a collaborative network of developers from other apps that can support the development of SushiSwap.

Incentivizing liquidity with Onsen

Onsen is an incentivized liquidity mining program announced in Sushi Improvement Proposal 2, in December 2020. Projects can apply to the Onsen proposal by paying an application fee and passing a review by SushiSwap developers and selected community members. LPs of tokens that are part of Onsen accrue part of SUSHI issuance on top of the fee cut they already receive from swaps.

LPs of tokens that are part of Onsen accrue part of SUSHI issuance on top of the fee cut they already receive from swaps.

Tokens considered for Onsen are separated into three categories based on market cap: Mid-cap ($25m-$100m USD), Small-cap ($5m-$25m USD), and Gems ($1m-$5m USD). Each category has a set number of slots available for tokens, and membership in Onsen is reconsidered every 90 days by a community vote. Onsen enables the community to exert greater control over what tokens get the best incentives within the exchange platform.

Miso

SushiSwap’s latest feature was chosen by a governance vote of community members and implemented by the SushiSwap team. Miso, a token creation, and offering platform, brings together SushiSwap’s large user base with founders of all technical backgrounds by creating a streamlined and secure process for creating and launching tokens on SushiSwap’s exchange. Initial DEX Offerings (IDO) have become a popular alternative to airdrops and direct token sales as a way of beginning the distribution of a token. Paring an IDO strategy with a popular DEX platform like SushiSwap allows the token to access a large amount of liquidity and users very quickly compared to other bootstrapping methods while maintaining a transparent and fair sale.

Paring an IDO strategy with a popular DEX platform like SushiSwap allows the token to access a large amount of liquidity and users very quickly compared to other bootstrapping methods while maintaining a transparent and fair sale.

Miso brings additional benefits to teams because it provides a set of standard smart contracts called “ingredients'' that can be stitched together to customize the behavior of the new token.

The ingredients can be combined to create three types of tokens:

Continuous supply tokens,

Fixed supply tokens, and

Tokens with inbuilt governance and yield farming functions.

This can save teams time and money normally spent on designing contracts from scratch, while also giving them access to reliable and audited smart contract code. Miso is the latest addition to SushiSwap’s ever-growing suite of products that enable users to save money, access novel DeFi use cases, and grow their projects using the platform. With the rollout of BentoBox, Kashi, Onsen, and Miso, SushiSwap has taken a sharp departure from Uniswap’s model and has proven itself to be more than a simple fork of a more popular DEX.

Tokenomics

The total supply of Sushi tokens has been capped at 250 million tokens by a community governance proposal, with new token emission decreasing monthly. New SUSHI tokens are emitted through incentivized liquidity pools; pools are voted on by the SushiSwap community to be added to the “menu of the week” and “Onsen” lists - LPs for these pools are rewarded both in transaction fees for the tokens in the pair but also in new Sushi issuance. SushiSwap also contains xSushi, a secondary token that distributes exchange revenue to users who have staked their Sushi tokens on SushiSwap. When traders exchange tokens they are charged a 0.3% fee, of which 0.5% is added to the SushiBar pool and sold for Sushi tokens. Once per day, these rewards are distributed to LPs as compensation for staking their tokens. This mechanism allows liquidity providers to earn additional passive yield along with the typical yield earned from trading fees.

Conclusion

SushiSwap began as a clone of Uniswap and was originally viewed in a negative light by the wider DeFi community. Following leadership changes and months of active development, however, the decentralized exchange’s reputation has been repaired and SushiSwap has since become one of the most popular Ethereum-based DEXes. SushiSwap has also significantly differentiated itself from Uniswap, offering a larger array of functionality including incentivized pools, margin trading, and yield generation that are not present on Uniswap.

SushiSwap has also significantly differentiated itself from Uniswap, offering a larger array of functionality including incentivized pools, margin trading and yield generation that are not present on Uniswap.

SushiSwap has delivered a large suite of new features to users while also expanding to alternate chains and lowering gas costs for users on the Ethereum main chain. SushiSwap is poised to gain further traction as a DEX as users seek a wider array of products to use and lower transaction costs that networks like Fantom and Polygon (Matic) offer. What began as a fork of Uniswap has since evolved into a unique, high-quality DEX that has proven its ability to retain community and stay relevant in the fast-changing DeFi landscape.

Additional Resources

https://boringcrypto.medium.com/bentobox-to-launch-and-beyond-d2d5dc2350bd

https://cointelegraph.com/news/all-you-can-eat-sushiswap-deploys-contracts-on-five-new-networks

https://medium.com/sushiswap-org/miso-cooking-new-tokens-from-scratch-c6be6aad64a

https://medium.com/sushiswap-org/introducing-the-sushi-next-generation-amm-trident-7dea6aa3cbc2

https://medium.com/coinmonks/what-is-a-vampire-attack-in-crypto-fdfc5e1fc5fc

Follow Christian Murray & Jake Brukham on Twitter: @coin_christian_ & @jbrukh 🔥🔥🔥 !

Author’s Disclaimer: The content provided in this post is for informational and discussion purposes only and should not be relied upon in connection with a particular investment decision or be construed as an offer, recommendation or solicitation regarding any investment. The author is not endorsing any company, project, or token discussed in this article. All information is presented here “as is,” without warranty of any kind, whether express or implied, and any forward-looking statements may turn out to be wrong. CoinFund Management LLC and its affiliates may have long or short positions in the tokens or projects discussed in this article.

——-

This article reflects the opinion of its author, who has received no compensation for it (other than from DeFi Pulse). All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information and does not account for specific goals or financial situations. Be careful and keep up the honest work!