👨🌾️ Farm +190% APR in Premia’s L2 pools & check out Tesseract: Polygon’s version of Yearn!

Also, read about this week’s congressional crypto hearing + more DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

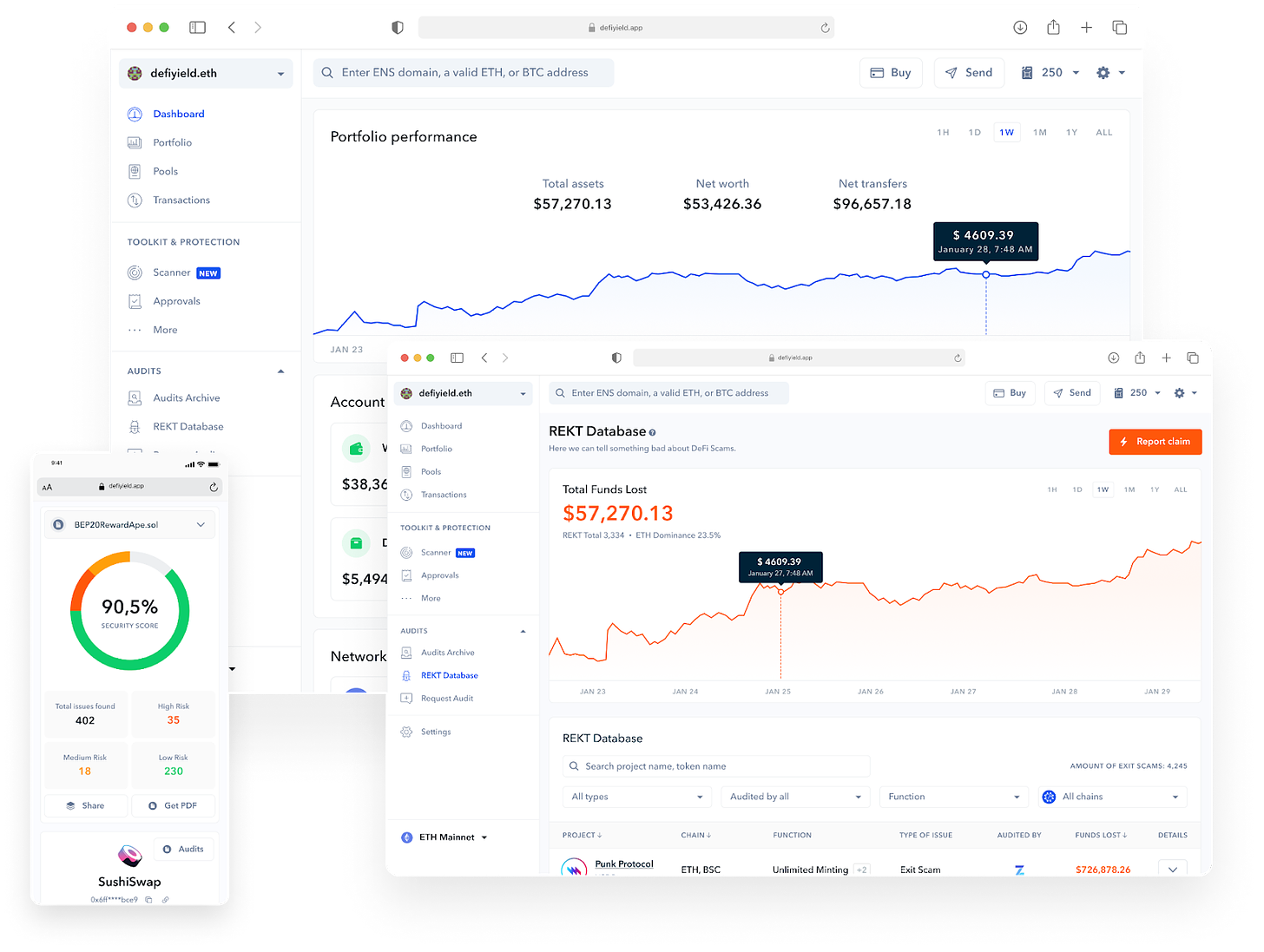

DeFi TVL makes modest climb — Since last weekend, the total value locked (TVL) in Ethereum DeFi climbed from $97.6 to $99.6B. That’s not much by DeFi’s standards, but it is a reversal of the acute freefall we saw from $105.5B to $97.6B last week. For now it’s onward and upward!

🏛️ U.S. has crypto-friendly congressional hearing — On Wednesday, the U.S. House's Financial Services Committee heard testimony from the leaders of 6 major cryptocurrency firms regarding the growth of the cryptoeconomy.

Notably, the hearing was educational in nature and showed that crypto’s now a considerable mainstream point of interest for U.S. politicos.

At the session, some legislators expressed skepticism of crypto’s risks, though more than a few others argued America will keep losing ground on innovation if it continues to stifle crypto entrepreneurs. A portion of the discussions even focused on how stablecoins could bolster the U.S. dollar’s world reserve currency status, signalling an evolving view of stables in Washington D.C.

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 SPELL (+16%)

📈 FXS (+15.2%)

📈 ANY (+14.2%)

📈 CVX (+4%)

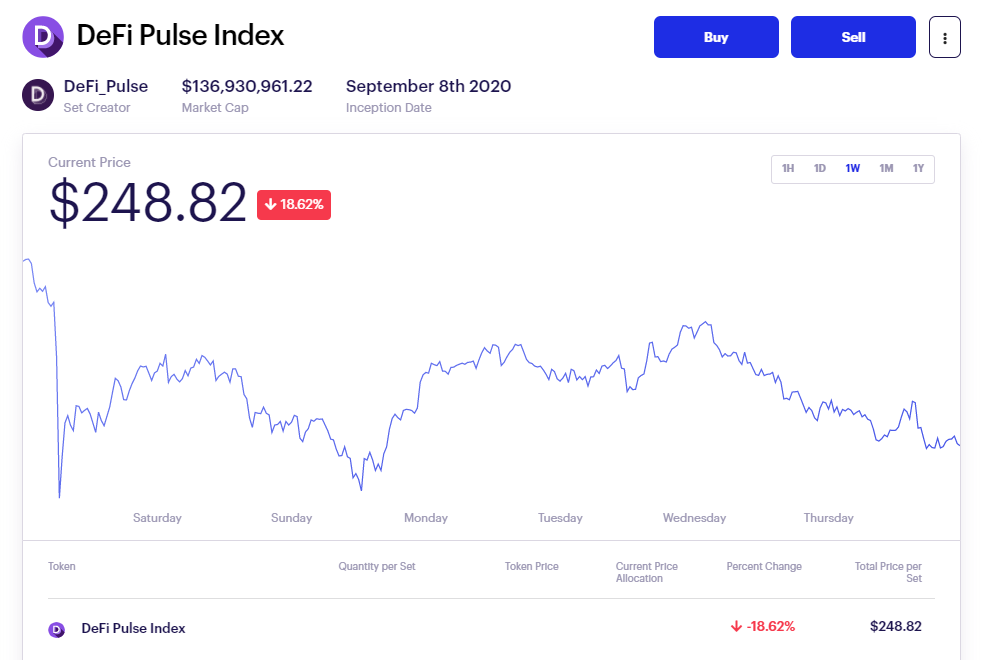

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $248.82, down 18.62% on the week.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

🌾 Farm up to +190% APR in Premia’s Arbitrum yield pastures!

Premia is a decentralized options marketplace live on Ethereum and now Arbitrum.

We’ve covered the protocol in an Alpha Tractor and checked out its Ethereum yield farms for a previous Farm of the Week column. For this current FotW we’re turning our attention back to Premia, yet this time we’re spotlighting the project’s L2 liquidity pools, through which you can earn good yields with low fees!

If you missed that coverage or just need a refresher, the Premia 101 for liquidity providers (LPs) is as follows:

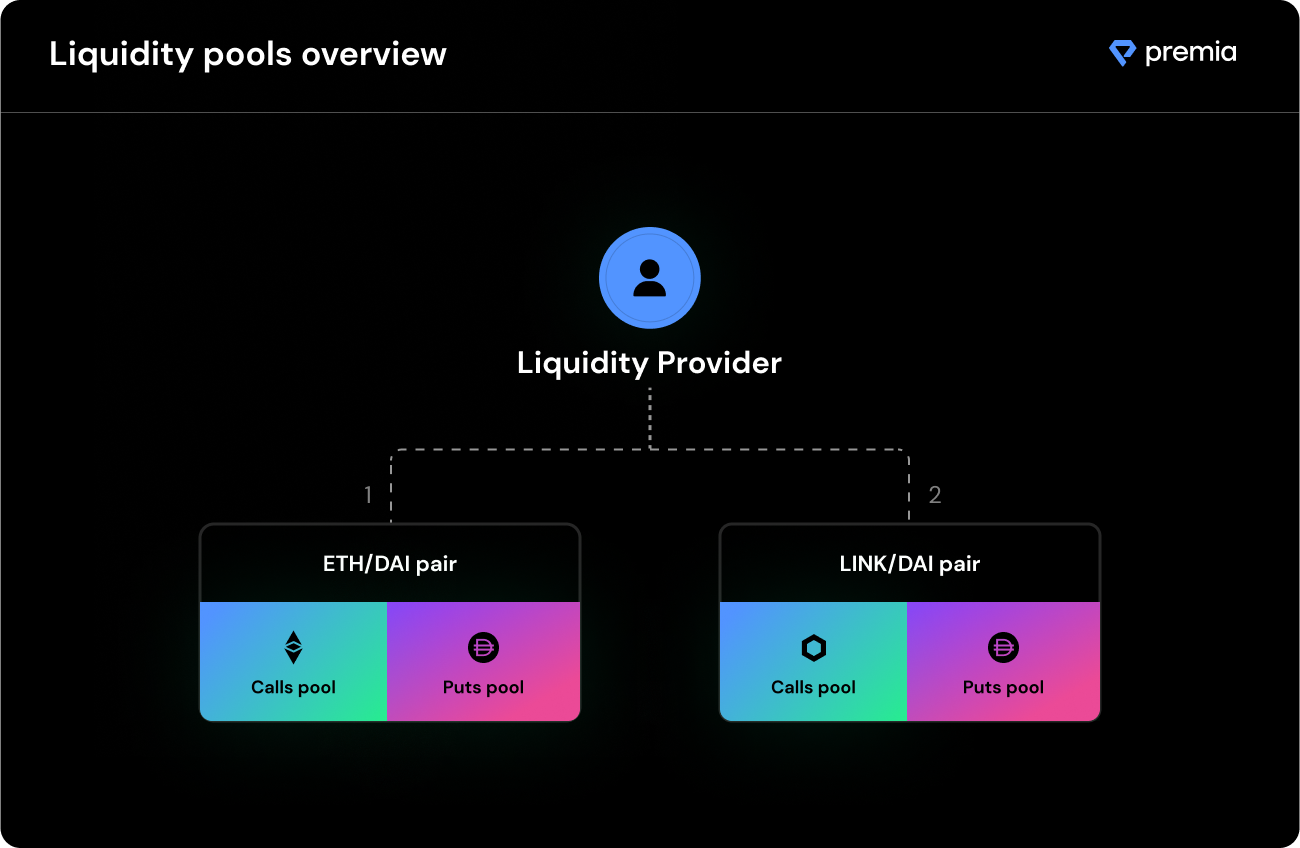

Premia is an automated market maker (AMM) protocol offering pool-to-peer products.

Each asset pair gets its own call pool and put pool, as depicted in the image above.

Users can make single-sided deposits. For example, you can deposit just into the WETH side for the WETH/DAI pool.

📌 Don’t miss our Alpha Tractors!

Not an Alpha Tractor subscriber? Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

How to yield farm Premia’s L2 pools

Premia’s yield pastures on Arbitrum mirror its L1 pastures, with the key difference being that the protocol’s L2 transactions are very fast and very inexpensive gas-wise!

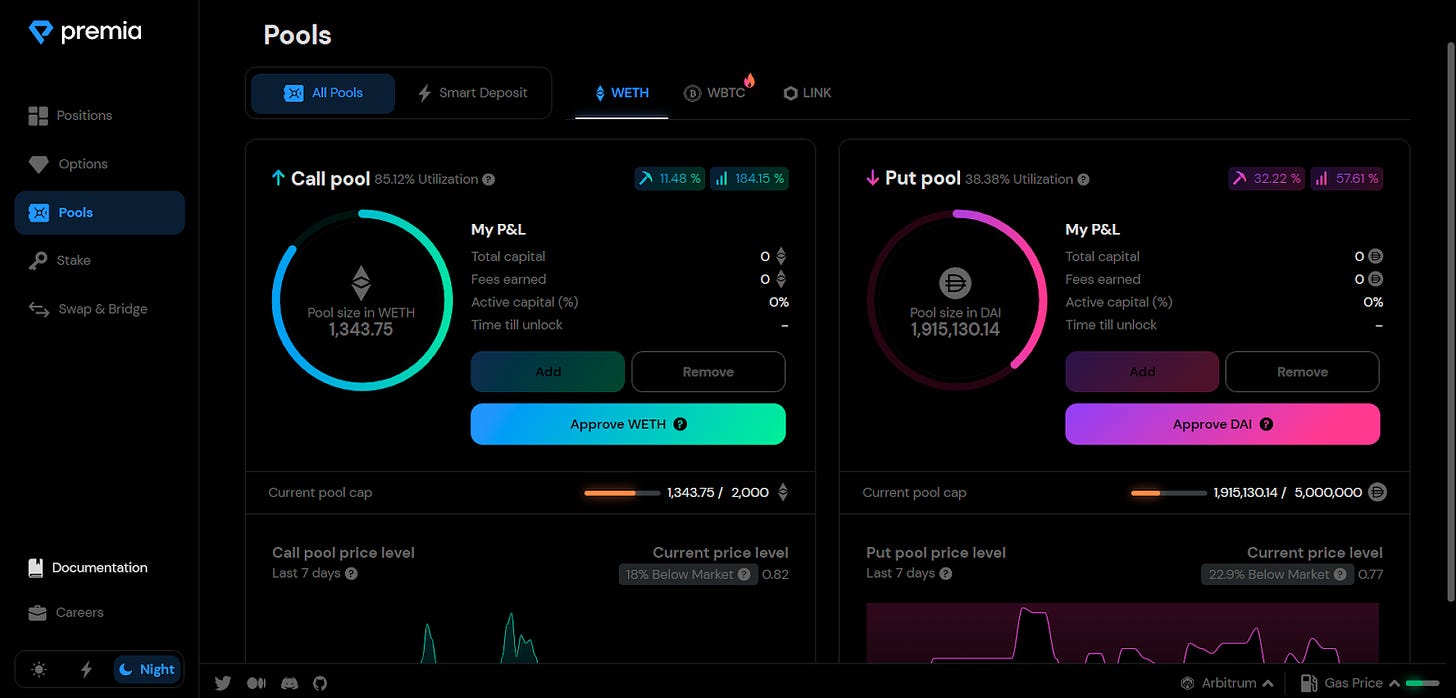

As such, LPs presently have 6 pools they can earn fees and PREMIA rewards through, namely 3 DAI put pools and 1 call pool each for WETH, WBTC, and LINK. If you have some of these assets on Arbitrum and want to join in, you can follow these steps:

Go to Premia’s Pools page, connect your wallet, and switch your wallet over to the Arbitrum network.

Pick your pool of choice; note that the most-performant pool right now is the WETH side of the WETH/DAI trading pair, which is currently yielding +11% APR in PREMIA and +182% APR via selling options.

Select your pool and press the “Approve” button; the ensuing transaction will let Premia accept your deposit.

Press the “Add” button, choose how much liquidity you want to provide, and complete the deposit transaction. After this is done you’ll be earning via options selling and PREMIA rewards.

Keep in mind that you can remove your liquidity through the same interface. You can also later opt to stake your PREMIA to earn through xPREMIA earnings, but note that the staking system is on Ethereum, not Arbitrum, for now.

Premia has been audited, but it’s also a young project. It’s best to treat it as a risky experiment when it comes to putting your crypto into it. Do your own research, and only ever farm with money that you can afford to lose.

TLDR: DeFi Pulse’s Flexible Leverage Index methodology is coming to Polygon! You get the same FLI action you love, i.e. going 2x long on ETH with a single fully-collateralized token, without breaking the bank on L1 fees

Endgame

TLDR: Ethereum creator Vitalik Buterin outlines his views on Ethereum’s modular and rollups-centric roadmap in the context of the cryptoeconomy.Polygon Welcomes Mir

TLDR: Ethereum’s “Internet of Blockchains” adds Mir, a zk-rollups scaling solution, to its L2 suite.My Failures in Leadership at Sushi

TLDR: Joseph Delong, who resigned as CTO of Sushiswap this week, details his views of the inner tensions that have seized the DEX project lately.An Optimistic Launch for $LYRA

TLDR: Options protocol Lyra is launching its LYRA token next week as part of a one-month liquidity mining campaign.Integrating with Arbitrum

TLDR: Pods details its multi-network expansion plans, starting with a rollout on the Arbitrum One rollup.Coinbase makes it easy to earn yield with DeFi

TLDR: Coinbase launches a program that lets users earn yield via deposits to the Compound lending protocol.

🌊 DeFi Pulse Power Tool: B.Protocol to the rescue 🌊

In the face of a considerable market dip last weekend, B.Protocol proved once again how its Backstop tech can readily serve both protocols and users in the DeFi ecosystem.

Last Saturday, USDC LPs to B.Protocol's new backstop pool on Hundred Finance's Arbitrum deployment made 7% profits on the day as the system processed over $350k worth of liquidations. Those profits were on top of HND rewards, too!

Yet the Backstop mechanism isn't just good for acute market chop; it also can provide steady gas savings over time. Consider the B.Protocol integration with Liquity, which we covered here a few weeks ago.

Notably, this meld has already saved users ~$50k on gas costs when rebalancing their ETH gains from Liquity liquidations. The auto-compounding of profits lets users optimize their LQTY rewards while Liquity’s Stability Pool stays strong to support the LUSD stablecoin.

These DeFi win-win dynamics are why more projects are embracing B.Protocol lately. For example, Squid DAO just implemented a strategy where it borrows LUSD with ETH and deposits that LUSD into Liquity's Stability Pool via Pickle and B.Protocol. Welcome to DeFi security + DeFi composability at its finest!

Disclosure: This section is part of our paid promotional Partners Program; We’ve partnered with B.Protocol to help educate and inform the community about this new Backstop DeFi primitive. As always, we’re committed to providing the entire community with quality, objective information, and any opinions we express are our own.

🚜 Earn up to 12.5% APY on Tesseract Finance, a new yield aggregator protocol on Polygon!

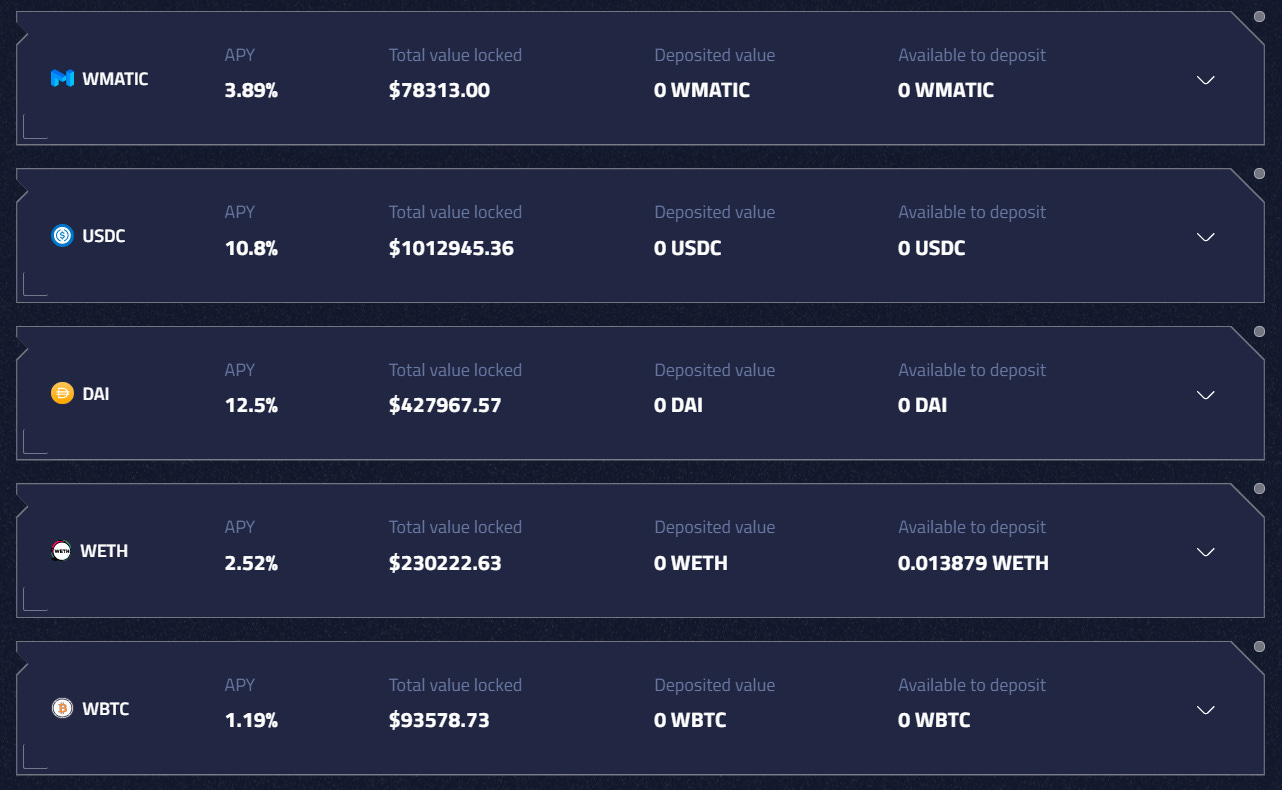

Been searching for a Yearn-like dapp in the Polygon ecosystem? Well search no more, because now you have Tesseract Finance as an option!

Indeed, Tesseract is a multi-chain yield farming aggregator on the Polygon sidechain. Currently, the project offers depositors relatively safe vault strategies for WETH, WBTC, DAI, and USDC.

If you’re interested in trying the protocol out, just keep in mind that the USDC and DAI pools are the highest-yielding right now in offering 10.8% APY and 12.5% APY respectively.

As usual, make sure you have the Polygon network added to your wallet and some of the relevant funds on Polygon’s sidechain before trying to dive in.

Tesseract is a reputable project and the first member of Yearn’s YFI Combinator program. However, you should still approach the young project cautiously. Never yield farm with more money than you can afford to lose!

Tornado introduces Tornado Cash Nova for deposit and withdrawing arbitrary amounts of ETH.

dYdX votes on whether to launch the dYdX Grans Program (DGP).

Fabric Ventures invests $6M into NFT gaming guild BlackPool.

Someone used Genie to sweep the World of Women floor to the tune of 449 ETH.

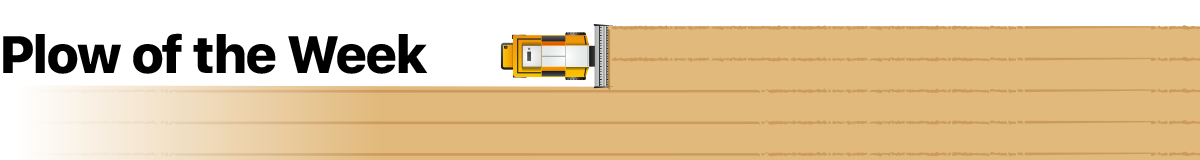

DEFIYIELD is a security-centric Web3 platform that provides a suite of helpful DeFi and NFT resources. If you’re looking to invest and manage your digital assets through a powerful one-stop hub, then look no further!

What will the TVL in Ethereum L2s be at this point in 2022? 🤔

Per L2 analytics website L2Beat, there’s currently over $6B deployed in optimistic rollup and zk-rollup projects.

I think over the next 12 months we’ll see this sum boom as dapps and even rollups themselves increasingly experiment with L2 liquidity mining campaigns.

Alas, it’s impossible to project with any certainty what the TVL in L2s will be circa this time next year, though I’m definitely guessing it will be considerably higher than $6B!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!