👨🌾️ Farm +90% APR in Premia’s pools & check out Yearn’s new UI!

Also, read about America’s stablecoin fact-finding mission + more DeFi governance updates!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

⚖️ DeFi TVL recovers — After the total value locked (TVL) in Ethereum DeFi dipped below $100B last weekend, it’s since recovered to just shy of $104B. Not bad, especially when you consider how volatile top cryptocurrency markets were over the last week!

💵 U.S. Senate Banking Committee eyes stables — A big thread of note this week? How top U.S. legislators continue to zoom in on stablecoins.

The latest example came a few days ago when Senator Sherrod Brown, who chairs the influential Senate Banking Committee, sent letters to top stablecoin operators. His request? To gain “greater understanding” of how these stablecoin projects work behind the scenes and under the hood.

The move comes at a time when stablecoins are surging in political importance in America. Some argue stables threaten the dollar, while others maintain they’re the best thing that’s ever happened to USD. In any case, it’s clear many regulators will need further fact-finding missions before they can legislate these new technologies in good faith. Indeed, the top U.S. banking regulators plan more such missions throughout 2022.

💸 This week’s best-performing assets — Since last weekend, we’ve seen runs from the following top DeFi tokens:

📈 LRC (+31.6%)

📈 CRV (+29.7%)

📈 REN (+23.5%)

📈 RUNE (+16.4%)

📈 CVX (+14%)

👛 The $DPI pulse — The DeFi Pulse Index ($DPI) is presently trading at $326.83, down 7.21% on the week.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

🌾 Farm up to +90% APR via Premia’s liquidity pools!

Premia is a decentralized options marketplace built on Ethereum. Through its own automated market maker (AMM) infrastructure, Premia offers “pool-to-peer” options.

Accordingly, this style simplifies the trading process for buyers and sellers. Buyers can customize their American-style options through Premia’s asset pools, while sellers serve and earn as underwriters by supplying liquidity.

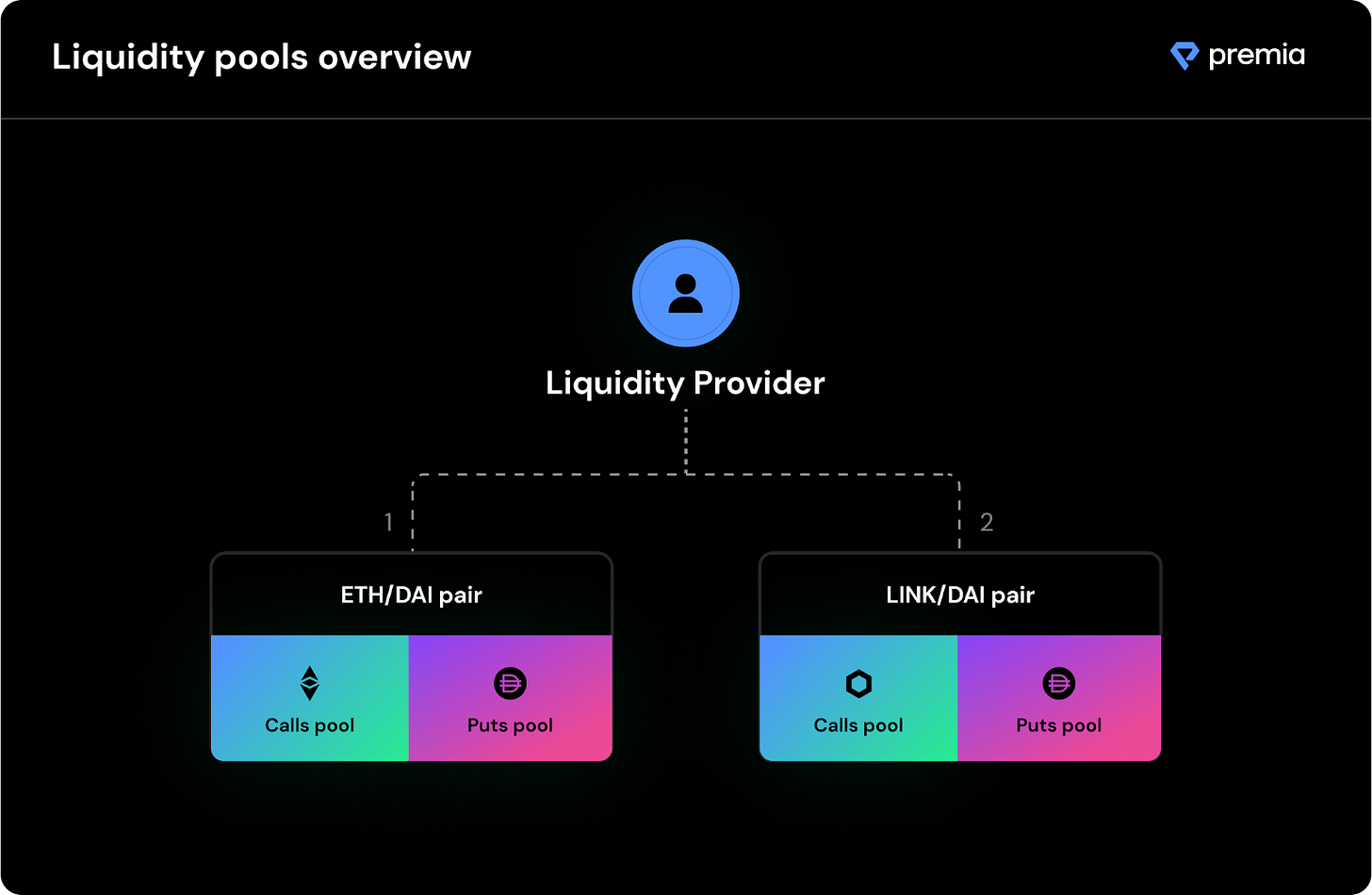

In extension, every Premia asset pair gets its own call pool and put pool.

For the WBTC pair depositors supply WBTC to the call pool and/or supply DAI to the put pool, for example. The project’s first three asset pairs are ETH-DAI, WBTC-DAI, and LINK-DAI.

📌 Don’t miss DeFi Pulse’s previous Premia guide:

Not an Alpha Tractor subscriber? Become a premium subscriber and get access to:

Alpha Tractor Series: giving you intel into the freshest yield for the most honest farmers only.

The Protocol Express: a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity.

Access to the Alpha Tractor Premium Discord channel.

A quick guide to PREMIA farming

Earlier this month Premia kicked off a PREMIA liquidity mining campaign. The gist? Provide liquidity to the project’s activity liquidity pools, of which there are currently 6 (3 DAI put pools and 1 call pool each for ETH, WBTC, and LINK).

These aren’t yield pastures where you’ll have to stake LP tokens, either. Simply supply liquidity and you’ll start accruing PREMIA rewards! To join you could follow these steps:

Navigate to the Premia Pools dashboard and connect your wallet.

Pick the call pool or put pool you want to LP for, then press “Approve” and complete the approval transaction to let Premia use your funds.

Now you’re ready to supply liquidity! Press “Add,” input how much money you want to deposit, and complete the deposit transaction. Once that’s done you’ll start automatically accruing PREMIA rewards.

Keep in mind: you can find how much the pools are currently yielding by looking for the APR next to the pickaxe symbols on their deposit interfaces. The highest-yielding opportunity currently? DAI deposits to the LINK-DAI put pool, which are generating +90% APR at the moment.

Also, note that each of these pools presently have TVL deposit caps of $5M, though these will surely be lifted in the not so distant future.

Premia has been audited, but it’s also a young project. It’s best to treat it as a risky experiment when it comes to putting your crypto into it. Do your own research, and only ever yield farm with money that you can afford to lose.

Infinite Privacy: New Anonymity Paradigms with Aztec Network

TLDR: The team behind the Aztec rollup explain how their infrastructure can be used to privately participate in DeFi and NFTs.Compensation on Overcharged Deposits

TLDR: Ribbon Finance executes a compensation plan after a bug in the project’s V2 vaults overcharged depositors on vault fees.Introducing Gasless Deposits

TLDR: Derivatives protocol dYdX launches a gas subsidy campaign that will cover the gas costs of first-time users who deposit at least $1,000.Balancer DAO Commits to DAO Agreement with Fei DAO

TLDR: Balancer outlines some of the highlights of its new and “unprecedented” agreement with Fei DAO.Debt pool synthesis

TLDR: Synthetix outlines the process in which it will merge its L1 and L2 debt pools.Celebrating 1M Monthly Active Users

TLDR: DeFi dashboard project Zapper announces that it’s facilitated over $10B worth of transaction volumes to date and now boasts over 1M MAUs.

🌊 DeFi Pulse Power Tool: The B.Protocol’s Backstop 🌊

Last week we introduced B.Protocol and its Liquity integration. Today, let’s dive deeper by catching up on the project’s new DeFi infrastructure — the Backstop — and the benefits it offers to users and lending platforms alike.

To begin, the B.Protocol team just published a great short explainer vid on how the Backstop works. Start here!

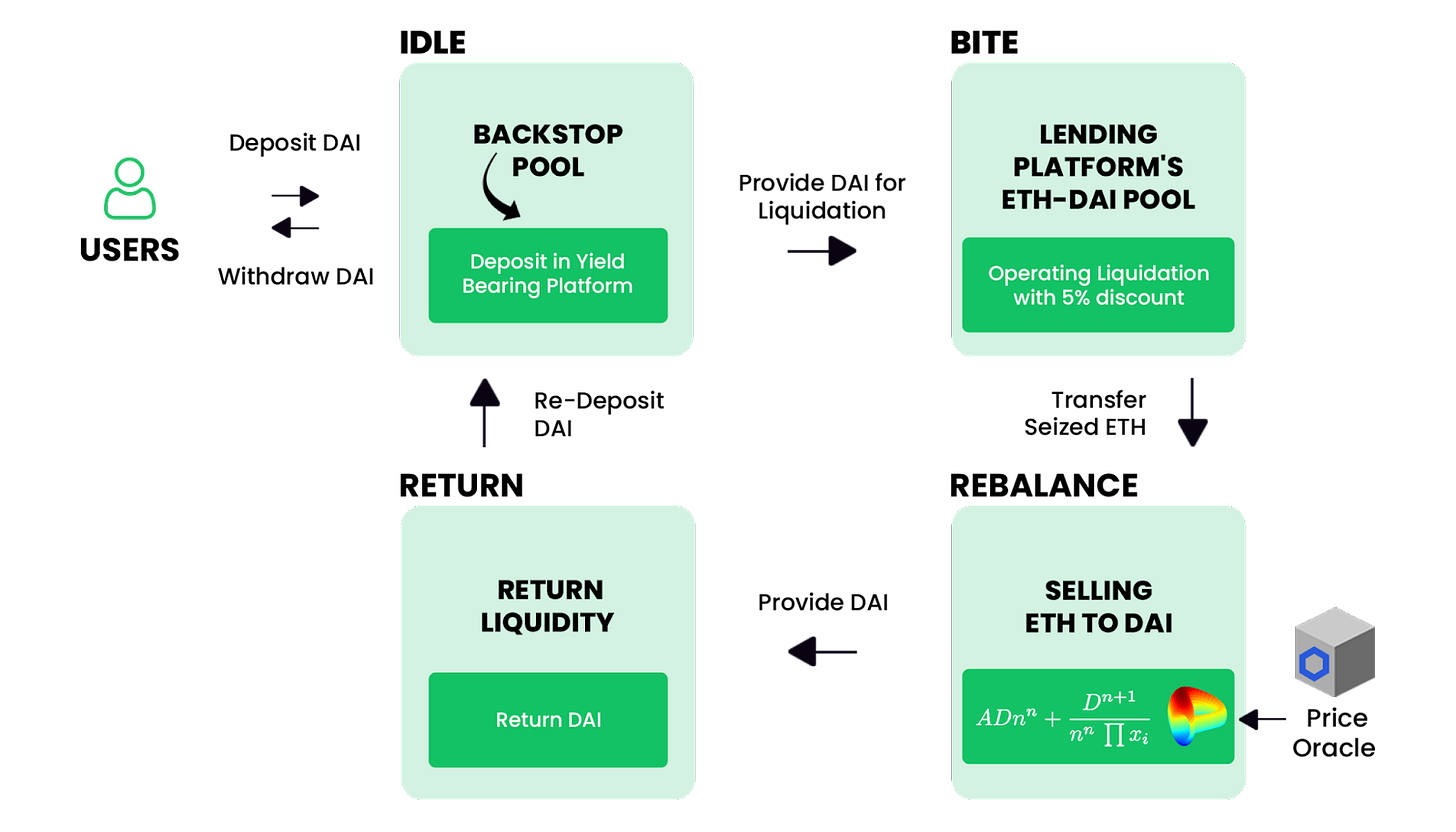

That said, let’s zoom in on the basics. Fundamentally speaking the Backstop liquidation process occurs across four steps:

Depositing — Backstoppers make deposits into the backstop pool.

Biting — Once a liquidation is triggered on the supported lending platform, the backstop funds are automatically used to repay the risky debt in return for its collateral, plus a bonus liquidation penalty.

Rebalancing — The seized collateral is then being automatically sold back to the original asset that was deposited in the backstop pool. This is made using the Backstop AMM (B.AMM), which is designed to handle any size of liquidation with minimal price impact. This is unlike regular liquidation bots that just “dump” on Uniswap or any other AMM!

Redepositing — The rebalanced funds, plus the profits made from the liquidation bonus, are then being redeposited into the backstop pool for any further liquidations to happen.

The advantage of this system? It helps strengthen DeFi protocols while letting anyone easily earn from DeFi liquidations in the process. This is the B.Protocol way!

If you haven’t tried out their integration with Liquity, you can still earn ~20-25% APY on your LUSD, using B.Protocol, Pickle, or Instadapp interfaces.

Disclosure: This section is part of our paid promotional Partners Program; We’ve partnered with B.Protocol to help educate and inform the community about this new Backstop DeFi primitive. As always, we’re committed to providing the entire community with quality, objective information, and any opinions we express are our own.

🚜 Farm though the brand new Yearn UI!

Yearn is the reigning king of yield aggregators in DeFi, and for good reason.

That’s because the dapp’s infrastructure offers the most robust and dependable yield strategies this side of DeFi. And the good news? These strategies just got that much easier to use and navigate.

Indeed, this week Yearn unveiled its newest v3 UI, and it’s got just about everything a humble yield farmer could ask for. Better info on your vault positions, new experimental “Lab” vaults, deeper Iron Bank integrations, transaction simulations, a redesigned mobile UX, you name it!

If you’re interested in trying the new UI, head over to the Vaults dashboard of yearn.finance. Here, you’ll be able to easily browse and select from the highest-yielding vaults or vaults for your top assets!

Yearn is as dependable as projects come in DeFi, but that doesn’t mean you should throw caution to the wind. Always yield farm responsibly, and never deposit more money than you can afford to lose!

Aave considers raising the min. AAVE needed to create a Snapshot proposal to 50.

OlympusDAO votes on diversifying part of its treasury into precious metals.

Balancer approves BeethovenX as a recognized “friendly fork” on Fantom.

Celo grapples with its Optics bridging mechanism being mysteriously sent into recovery mode.

NFT platform Universe.xyz has been whitelisted for the Optimistic Ethereum (OE) L2.

NFT marketplace aggregator Genie broke its previous weekly volume record.

NFT lending protocol JPEG’d is partnering with on-chain options protocol DOPEX.

Multifarm.fi is, simply put, a yield farmer’s dream. The DeFi analytics platform tracks yields and activity across farms, assets, and bridges around many L1s and L2s. If you’re looking for a bird’s eye view of multi-chain DeFi, look no further than this helpful site!

Americans just celebrated Thanksgiving. In extension, what should we be thankful for in DeFi? 🤔

That our dreams are starting to come true.

Indeed, Ethereum DeFi alone is now a +$100B ecosystem that’s surged onto the world stage.

Mainstream institutions and industry giants exploring what we’ve built up here like never before.

We’re no longer the underdogs we once were, so that we’ve come this far thus far is definitely worth being thankful for!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!