DeFi Pulse Farmer #24

Catch up on a new week in DeFi as we recap the Farm of the Week, the Conservative Farmer, the Governance Watcher, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

The total value locked (TVL) in DeFi is currently $23.85B, $1.85B up since this point last week.

Things have been moving strongly this Saturday, and the ecosystem’s TVL has just surpassed its previous $23B all-time high, which was first reached last Saturday and then once again this Thursday. So $25B is now just around the corner, and with it still only being January a $50B TVL and beyond seems easily in play for 2021.

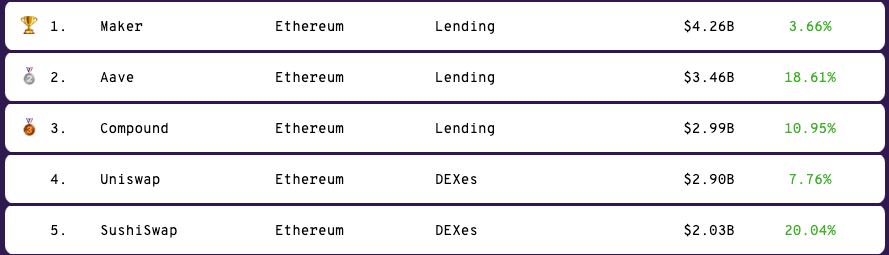

Zooming in on individual dapps, lending protocol Maker is still notably above the $4B TVL mark. It’s the first DeFi project to have achieved that feat as of last week, so let’s see if it can keep up the momentum and similarly be the first project to crack $5B.

Behind Maker, fellow lending protocol Aave currently has a $3.46B TVL and has become the third DeFi protocol to cross the $3B milestone after Uniswap did so last November with Maker following suit promptly after that.

As for noteworthy news, a development that’s gone a bit under the radar recently is the acute boom of DEX trading volume we’re seeing right now.

For example, the previous record for monthly DEX volume was $15.36B as hit in September 2020. Flash forward to the present, where DEXes have already clocked $11.8B in trading volume across the first two weeks of January 2021. Wow! We may see a new monthly record notched above $20B in the coming days if the current DeFi trading frenzy keeps up, then.

Let’s recap the best-performing DeFi assets over the last week per usual. Notable tokens with notable 7-day runs included PERP (+80%), CRV (+70%), SUSHI (+68%), AAVE (+79%), and REN (+50%). The DeFi Pulse Index (DPI) rose 29.83% and is presently trading at $229.8.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today.

Farm 100% to 250% APY via Frax Finance Staking

Collateralized stablecoin efforts like Maker’s Dai grew increasingly popular over the course of 2020, which we can now safely call DeFi’s first boom year.

Starting last summer, though, another stablecoin model rose to the fore: algorithmic stablecoin projects.

Eschewing over-collateralization in favor of price-targeting algorithms, these projects — many of them inspired by the now-defunct Basis stablecoin system — have brought another layer of dynamism to DeFi and captured the imaginations of traders around the world.

Yet these stablecoin models, i.e. collateralized and algorithmic, naturally have their respective pros and cons. Combining the best of both worlds, then, could bring unique advantages. This is the mission and vision of Frax Finance, a new hybrid stablecoin protocol that blends and leans on elements from both collateralized and algorithmic systems.

How to Farm FXS with Frax Staking

FRAX is the stablecoin of Frax Finance. Whenever FRAX trades above $1 the protocol’s collateralization ratio is lowered and its algorithmic mechanics become more pronounced, while this collateralization ratio is increased whenever FRAX trades below $1.

For this system to smooth out and progress toward maturity it’ll be important for Frax Finance to bring in an influx of users and liquidity. To accomplish this bootstrapping, the Frax team has launched a liquidity mining campaign centered around its FXS governance token.

The goal? Incentivizing newcomers to support the project by distributing FXS rewards across Frax’s key Uniswap liquidity pools. These pools, and their current “normal” APYs (as denominated in FXS rewards), are:

FRAX-FXS (243% APY).

FRAX-WETH (221% APY).

FRAX-USDC (108% APY).

You can access these pools through Uniswap.

Note: users can earn “max” APYs between ~325% and ~725% right now by locking LP tokens in Frax’s staking dashboard. Normal APYs are earned by simply staking unlocked LP tokens, which can be withdrawn whenever.

If you’re interested in joining any of these DeFi pastures, you’ll follow these steps:

Navigate to Frax Finance’s Staking dashboard.

Select your desired pair from the dropdown menu and then click Add Liquidity.

You’ll be taken to Uniswap, then deposit your chosen assets to receive LP tokens.

Take your LP tokens back to the Staking dashboard and click on the Stake button.

Choose whether you want to stake in an unlocked or locked capacity, confirm the deposit, and you’re in!

Frax is notable because it’s a new, first-of-its-kind project. But that also means it bears more risks than protocols that have been around for a while. Do your own research, and never invest money into any DeFi project that you can’t afford to lose.

Mainnet Soft Launch!

TLDR: The Ethereum Optimism team unveils plans for an incremental soft launch to mainnet, with plans to remove the L2 scaling solution’s “training wheels” once it adequately proves itself in the wild.The Optimistic Ethereum Transition

TLDR: On-chain synthetic assets project Synthetix outlines how its transition to the L2 Optimism solution will take place.Introducing The Iron Bank

TLDR: The CREAM project reveals CREAM v2’s Iron Bank system, which will function as a protocol-to-protocol lending and liquidity backstop for DeFi.Building in Defi sucks (part 2)

TLDR: Yearn creator Andre Cronje publishes a new essay exploring some of the main frustrations that can come with building in contemporary DeFi.Yam 2020 Recap & 2021 Roadmap

TLDR: The Yam Finance project highlights its key accomplishments from last year and its development plans for the next 12 months.Warp Finance Relaunches

TLDR: LP token farming project Warp Finance relaunches with enhanced security measures in the wake of the flash loan attack it was victimized by last month.

Farm Up to 140% APY with Curve’s New EUR pool

It’s no secret that USD-centric stablecoins have dominated in DeFi to date. That’s no surprise, either, since the dollar is the globe’s current reserve currency.

Yet there’s a whole wide world out there and no shortage of other currencies that can be tokenized on Ethereum, not least among them the euro. Indeed, Europe is increasingly becoming a DeFi hub and more European traders are clamoring for EUR stablecoin products accordingly.

The good news? The euro is starting to have its day in DeFi! That’s because the Curve stablecoin exchange just launched a euro pool based around Synthetix’s sEUR token and STASIS’s EURS token.

This sEUR/EURS pair is an interesting opportunity because it gives you an avenue to rack up trading fees, SNX rewards, and CRV rewards all at once. Providing liquidity to this pool on an unboosted basis will fetch you 50% APY right now, while Curve’s boosted APY system can kick that APY up to 124%.

If you’re interested, joining this farm is simple. Head over to Curve’s eurs Deposit page, connect your wallet, and select how much sEUR and EURs you’d like to deposit. Click the “Deposit & stake in gauge” option for CRV rewards. Approve the contract if you haven’t before, and then confirm your deposit and stake. Also, if you want to boost your rewards you can refer to our guide under the conservative former section on DeFi pulse Farmer #5.

This is a trustworthy pool, but you’ll still want to do your own research and farm responsibly. Nothing in DeFi is totally risk-free!

Yearn proposes a YFI buyback program to fund “contributor rewards and Yearn initiatives.”

DefiDollar aims to create an aDai/aSUSD pool on Curve Finance.

Maker is gauging support for onboarding Uniswap ETH-WBTC LP tokens as a supported collateral type.

The Compound community approves recalibrating the ongoing COMP distribution.

This week’s Plow of the Week goes to Sweeposaurus, a cool new tool built by Matt Solomon, who previously built the ETH Dashboard. Sweeposaurus allows you to sweep all your tokens to a new address in a really simple way!

2021 is already shaping up to be another boom year for DeFi. For now, all eyes are on the advance of L2 solutions like Optimism. If Synthetix’s integration with Optimism goes smoothly, look for the novel meld to serve as a blueprint that other DeFi projects can follow as the year proceeds. The stakes are high, but the community’s drive to bring L2’s benefits to life is palpable right now.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!