DeFi Pulse Farmer #5

Catch up on a new week in DeFi as we recap Uniswap, Fair Launches, the Nomigate, the Farm of the week, and the second series of our Curve guide for Conservative Farmers.

Welcome to the fifth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

Alpha Tractor Series premium subscription

Next week will mark the last free Alpha Tractors. To protect our alpha, and provide an edge for the most honest farmers only, new opportunities will be reserved for paid subscribers, starting on September 16th.Remember that our Alpha Tractor Series was the first to bring you YAM, BASED & HAKKA, giving you early access to maximize your yields before they went viral. DeFi Pulse Farmer takes serious care of its farmers and will only showcase the best farming opportunities. This is a no hotdog zone!

To get ahead of the curve, subscribe today and enjoy this limited 30% discount for being an Early Farmer.

Next week is on us!

Looking to catch up on the week? We’ve got you covered!

DeFi Recap

Another week is in the books.

Even though Total Value Locked (TVL) now stands at $8B (a weekly decline of around $700M), it surpassed the $9.4B mark on Tuesday. This was driven mainly by Sushiswap’s liquidity mining, which drove more than $1B of TVL to Uniswap.

Today, each of the top four protocols on the DeFi Pulse leaderboard has more than $1B TVL. Who will lead the leaderboard when we get to the 10 billy club?

SushiSwap not only drove Uniswap’s TVL spike more than $1B in a few days, but it also helped the fan-favorite DEX surpass Coinbase’s daily trading volume for the first time in history. No wonder it’s now sitting at the top of the throne on the DeFi Pulse’s leaderboard.

The community was expectant on SushiSwap’s upcoming migration set to go down this Sunday. But Chef Nomi, the anonymous founder behind Sushiswap, cashed out by selling all of his sushi and is facing a backlash by the community, putting the project in turmoil.

In other news, Aave continued its relentless path towards bridging DeFi with traditional finance and announced the creation of its first private market, bringing tokenized real estate to its lending protocol through a partnership with RealT.

Finally, even though most DeFi tokens tanked on Thursday, they’ve slowly started to bounce. UMA is up 27.8%, taking the lead, followed closely behind by YFI, up 21% in the past week.

If there was ever a time to catch up on a train you might have missed, it’s now!

What makes a Fair Launch?

In the midst of a food coin mania, the term ‘fair launch’ is getting lofted around as a get out of jail free card for any and all projects forking sector leaders with a tokenized spin.

Whether it be SushiSwap, Swerve, or the dozens of others in the queue, we’ve reached uncharted territory where ‘community-owned projects’ are challenging the ways in which open-source protocols become sustainable.

Last week, we talked about the aggressive push for projects to tokenize governance. This week, governance is now coming for the whole cake, urging teams to share the vast majority of their upside with its users.

The middle ground is a healthy mix of both. We’re starting to see new teams find a sweet spot for treasury allocations while other DeFi projects look to adapt by putting more power in the hands of their community.

Fair launches help better align token distributions. The days of teams and investors controlling 50%+ of the pie on day one are all but over. But, it’s still unclear just how much of that pie core contributors can confidently request without getting burned by hungry farmers.

What’s emerging is a different path to sustainability. One in which a project launches with a very small group of founders that branches outwards as key contributors demonstrate their worth. We’re seeing it firsthand with yEarn and we’re surely going to see much more of it in the coming months.

If nothing else, DeFi is carving new paradigms right before our eyes.

Take a step back from the token price and marvel in the beauty of the future of work.

Stories of the Week

yETH vault explained

TLDR: Andre Cronje breaks down the yETH vault.bZx Relaunches Torque & Fulcrum

TLDR: bZx relaunch includes yield farming, new UI, and adds BZRX as collateral.Delegated Funding DAO Vaults

TLDR: yEarn new fair launch vault leverages Aave delegated credits to provide funding for DeFi teams.Starkware shares Turing Complete Layer 2 Platform - Cairo

TLDR: StarkWare unveils a generalized platform for privacy-preserving L2 scaling.Lien Launches Generalized ETH-backed options & iDOL stablecoin

TLDR: Lien launches a Uniswap-inspired DEX in tandem with an ETH backed stablecoin.RealT Market Coming to the Aave Protocol

TLDR: Aave launches its private markets bringing tokenized real estate with RealT tokens as collateral.Safety tips for farmers, a tweet

TLDR: 7 tips for Degen Farmers.

Governance Watcher

Maker introduces a proposal to raise the ETH-A debt ceiling to $540M.

Winklevoss twins add proposals to include GUSD in Curve, Aave & Compound.

Yam Finance ends V2 governance with security audit budget allocation for V3 migration.

yEarn passes a proposal to reward YIP creators with $500 for every proposal which is implemented.

Want your company featured here? Fill out this link to be the first DeFi Pulse Farmer sponsor!

Farm of the Week

Earn 300% on USDC Lending with UMA Liquidity Mining

UMA’s generalized synthetic protocol has been eclipsed by the soaring price of the native governance token - UMA.

Despite only launching a handful of synthetic assets since it’s launch three months ago, UMA has proven to be one of the best performing DeFi tokens on the market.

Whether it be the highest ROI pool on SushiSwap or the recent listing on Coinbase, it’s no surprise many are quickly asking more questions about UMA and it’s potential.

For this week’s farm of the week, we wanted to direct farmers to the ongoing UMA liquidity mining campaign for the yUSD ‘Yield Dollar’. Using the Yield Protocol, UMA created a synthetic stablecoin which slowly adjusts to its par value of $1 over the course of a one-month period. Users can mint yUSD by locking ETH as collateral, with the issuance rate fluctuating relative to market demand.

In order to create a liquid market for yUSD, UMA is currently hosting the second month of its Yield Dollar liquidity mining campaign on this yUSD/USDC 50/50 Balancer pool. More details on this here.

Users who provide liquidity to the yUSD Balancer pool stand to share a weekly allocation of 25k UMA, currently valued at ~$470k. Seeing as the Balancer pool only has ~$8.5M in liquidity, this is a farm flying under the radar for how well UMA has performed in recent weeks. Oh, and did we mention farmers receive BAL rewards as well?

Here’s an example of how a farmer with $10,000 stands to earn from the UMA yUSD farming.

To enter this farm, it’s as easy as heading over to the pool and providing liquidity. The easiest way is to add single-sided liquidity with just USDC. For those looking to take a stab at the UMA tooling, you use this guide to mint yUSD with a 125% minimum collateralization ratio.

Please note that at the time of writing, yUSD is currently above par. This means if you enter with USDC today, upon maturity, you will have slightly less USDC than what you entered. This is due to the price of yUSD stabilizing at $1.

Farmers earn UMA for simply being an LP in the Balancer pool. No staking of LP tokens required. UMA is airdropped to your wallet each week. To keep tabs on the changing APY, head on over to the UMA tooling site and visit the bottom of the “yUSD Yield” tab.

The Conservative Farmer

How to lock your CRV Rewards in Curve to get extra yield

This edition features the second installment of a new tool to make informed decisions while chasing yields across Curve Pools. In the previous edition we touched on how to select pools depending on your risk appetite, and today we’ll show you how to get extra yield by staking your LP positions in a Curve Gauge.

1-Are you willing to stake your CRV rewards for anywhere from six months to four years to boost your yields?

A-Yes

B-No

B-No, I’m not willing to stake my CRV.

If you’re not up to staking your rewards in Curve to boost your yields, please refer to last week’s edition and find out how to invest in stablecoin pools or BTC pools in Curve.

A-I’m willing to stake my CRV rewards to get some of that sweet extra yield.

If you said yes, follow the steps below:

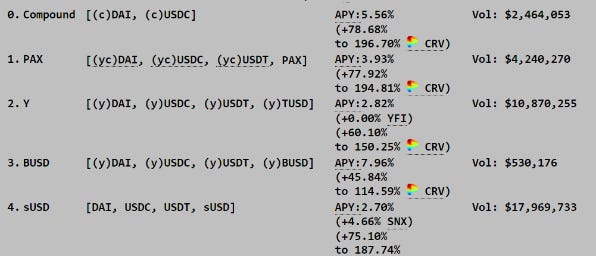

1-Check the different pools APY return on Curve

Note that last week we mentioned that farmers shouldn’t pay attention to the “to”, as it shows APY for the max boost. But, if a farmer is willing to stake, then the “to” becomes the magic word, as it shows the max boost a farmer can get.

Here you can see an example of the stablecoin pools returns:

Source: www.curve.fi

Here’s an example of our estimations for the different stablecoin pools for you to compare:

Here you can see an example of the BTC pools returns:

Source: www.curve.fi

Here’s an example of our estimations for the different BTC pools for you to compare:

2-Find out how expensive it is to get the maximum yield boost

2.1-Go to the DAO Curve Mintr Calculator and check how many CRV needs to be locked to get to the max boost.

2.2- In the examples below, we look at a 10K deposit on stablecoins and a 1 deposit on BTC when locking CRV for 4 years. Here’s how much CRV needs to be locked in each pool in our example.

Stablecoin pools: the best combination of cost to max yield / APY is currently the Y pool

BTC pools: the best combination of cost to max yield / APY is currently the REN pool

Note that both examples use a CRV price of $3,16.

3-Allocate your CRV rewards

3.1- Go to the Curve gauges section in Curve.

3.2- Select the pool where you want to stake your CRV rewards and click on deposit. After depositing you will receive veCRV tokens, which represent your ownership.

Please be advised that staking in any of these gauges has a minimum cost of $100.

Risks: Please note that when staking in a Curve pool you’re exposed to:

The Curve protocol smart contracts risk.

The risk that all the assets in the pools basket carry themselves e.g. insolvent USDT, DAI losing peg, USDC censored, sBTC losing peg, WBTC multisig, etc.

The governance structure is novel and untested.

Ethereum protocol and managing the risk of your own key.

Plow of the Week

Snapshot

Looking to stay up on the latest community governance discussions in one intuitive portal?

Snapshot has aggregated off-chain governance for yEarn, Balancer, Yam Finance, and now SushiSwap in one cheeky page.

What started as an MVP voting tool for Balancer to kickstart BAL governance has quickly evolved into a de facto voting tool due to the ability to vote with an onchain signature, rather than having to submit a transaction that incurs gas costs.

While this is certainly not the end all be all, a bunch of noteworthy governance proposals was implemented using Snapshot, namely by using tokeholders voting weight at the time of a unique snapshot to provide a better means of off-chain voting than a Discord poll.

With a low barrier to entry and easy governance onboarding, expect many forks to embrace Snapshot governance in the coming months!

Alpha Leaker of the Week

Closing Thoughts

While price may be down, ambitions are not.

It’s easy to get lost in the sauce with 10,000%+ APYs.

While farmers are taking the weekend to recollect themselves, next week is set to be one the most thrilling yet.

We’ve got at least two Alpha Tractors on our radar, so go ahead and smash that sub button to have them delivered directly to your inbox within 24 hours of going live ;).

Until next week, stay honest!

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!