Find out about Instadapp's pools and the new Yearn optimized ETH yVault!

Also, dive into the latest news as we cover Iron Finance's debacle, the Curve and Alchemix drama turned to diplomatic conversations, and more!

Welcome to DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, or the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

Check out “Aave, the global liquidity market,” authored by ChainLinkGod🔥, the latest opinion article published in Alpha Tractor.

The size of DeFi acutely shrunk again this week, with the ecosystem’s total value locked (TVL) declining from $58.79B to $55.25B since our last issue of the Farmer.

That’s not some major drop-off, right, but we’re certainly not in the “up only” environment we were in just a handful of weeks ago!

Instead, we’re now in the chop. Maybe DeFi’s TVL rips down soon, or maybe it rips up soon, but since the start of June the TVL’s been pinging tightly within the $65B to $50B range. Accordingly, perhaps continued chop is the safest bet for the near future!

As for brow-raising DeFi news this week, the ecosystem just experienced two fairly dramatic episodes:

“The world’s first large-scale crypto bank run” — Iron Finance, a partial-collateralized stablecoin project on Polygon, saw the TVLs of its incentivized liquidity pools swell last week. Why? Farming demand for IRON and TITAN tokens created a positive feedback loop in which the APYs for some of Iron’s pools reached astronomical heights. At one point, the TITAN/MATIC pool on Sushi’s Polygon deployment was fetching +4M% APY! Yet when the TITAN price reached $65, whales started cashing out. The selloff turned into an all-out market panic as IRON lost its peg and TITAN quickly crashed to zero.

The Curve and Alchemix kerfuffle — Alchemix’s alUSD allows users to take out a DeFi loan that repays itself overtime via yield farming. But to generate its revenues alUSD’s yield is considerably underpinned by a Yearn Vault strategy that farms and dumps Curve’s CRV token. This week this dynamic boiled over into a Curve governance proposal that, if passed, would cease awarding CRV rewards to Curve’s alUSD pool. The reason? To prevent “leveraged CRV farming.” Things have gotten a bit testy between the Alchemix and Curve communities since, though some ensuing glimmers of diplomacy do suggest there are productive ways forward.

Lastly, let’s finish up this column like we always do by recapping the best-performing DeFi tokens of the week. We just saw compelling 7-day rises from QUICK (+42%), MIR (+24%), KEEP (+20%), DDX (+13%), and BOND (+10%). In this span, the DeFi Pulse Index (DPI) declined 10.91% to reach $276.86.

Thank you to our sponsors DEXTF, an asset management protocol that makes managing and investing assets easier, and O3 Swap, a cross-chain Aggregation Protocol that integrates fragmented liquidity across blockchains.

Accumulate and bundle yield generating assets with your favorite longs on DEXTF today, and access the best trading prices on a one-step platform with O3 Swap.

Farm up to ~985% APR in Instadapp’s new INST-ETH pools

Instadapp is a DeFi dashboard and smart wallet protocol. The project’s risen the ranks in DeFi for making it easy for users of all stripes to manage their activities across top DApps like Aave, Compound, and Maker in a single, one-stop interface.

That’s why heads turned in the ecosystem back in April when the Instadapp team announced plans to decentralize the project’s governance via an INST token distribution, slated for Q2 2021.

Fast forward to this week, and right on schedule Instadapp’s creators kicked off the launch of INST. With a genesis total supply of 100M, INST will be used by holders to steer the parameters of Instadapp’s DeFi Smart Layer (DSL) middleware tech going forward.

With a genesis total supply of 100M, INST will be used by holders to steer the parameters of Instadapp’s DeFi Smart Layer (DSL) middleware tech going forward.

To get INST into the hands of its community members to decentralize governance, Instadapp unveiled it would be allocating INST rewards to what I’d call a “usage mining” program and to two distinct INST-ETH Uniswap V3 price range pools.

Over the next 3 months, the aforementioned usage mining program is paying out 3M INST to users who manage their Aave, Compound, or Maker positions through Instadapp’s DSA v2 system. That’s neat for sure, but we’ll be focusing on the two Uniswap V3 price range pools for this “Farm of the Week” as they’re offering some eye-popping APRs right now.

How to farm INST on Uniswap V3

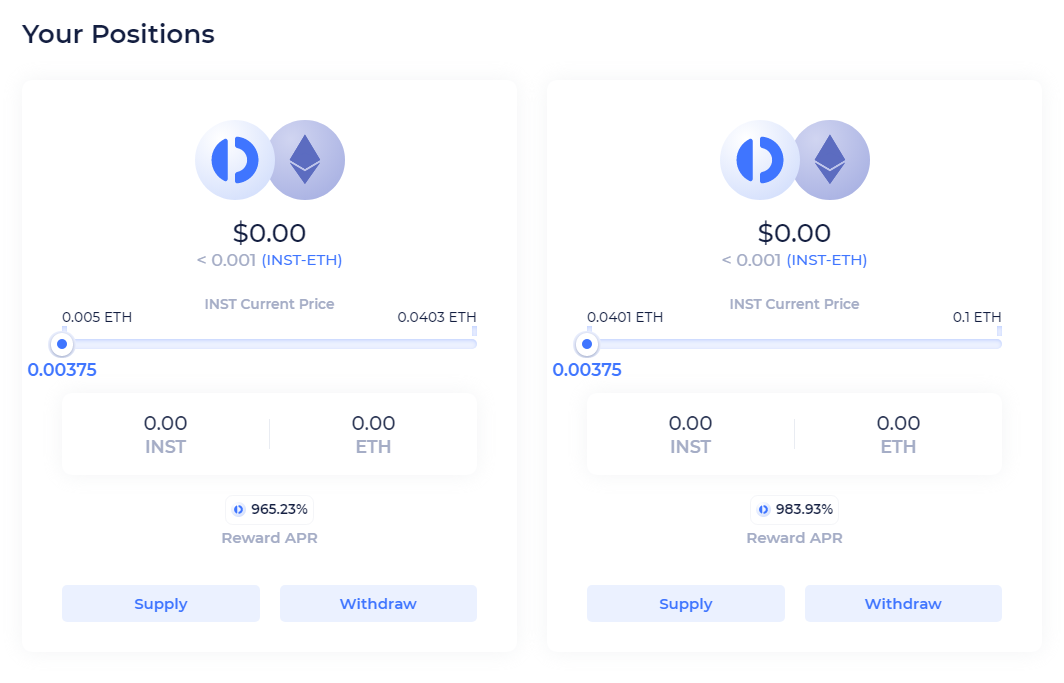

As you can see in the image above, Instadapp is incentivizing two separate Uniswap V3 price range pools.

The first pool, which has been allocated 250k INST in rewards for the next 3 months, provides liquidity within the 0.01-0.04 ETH/INST price range. In-kind, the second pool has been granted a 3-month allocation of 750k INST rewards and supplies liquidity between the 0.04-0.1 ETH/INST price range. The former pool is currently earning ~965% APR, and the latter’s generating ~984% APR.

If you’re interested in harvesting INST through these Uniswap V3 pastures, you can follow these steps:

You’ll need to serve as a liquidity provider, so start by acquiring some INST to LP with. You can buy some on Uniswap V3 here.

Once you have your INST and ETH prepped head over to Instadapp, connect your wallet, and — if you haven’t already — upgrade your Instadapp account to the DSA v2 system. You can do so on the project’s DSA Migration or Import Position portals.

Now navigate to the new INST Pools page and select which pool you want to use. Then click the “Supply” button on that pool. A sidebar will pop up, in which you’ll input how much INST/ETH you want to supply. Note: you can supply a single asset, e.g. just ETH, or both assets.

Confirm your deposit transaction, and then it’s all downhill from here as Instadapp uses the Gelato automation network to automatically stake your LP tokens. In other words, you instantly start raking in INST rewards as soon as your deposit goes through.

Closing out, just keep in mind that INST rewards are claimable weekly so it’s normal that you won’t have immediate access to claiming them. Don’t fret about that!

Instadapp is a reputable and proven project, and its smart contracts have been audited. Regardless, you should always approach new farms cautiously and only after you’ve done your own research. Never farm with more money than you can afford to lose.

Alchemix Incident Report

TLDR: The Alchemix team outlines a bug in its alETH system that erroneously allowed some users to withdraw ETH despite their outstanding debts.volmex.finance v1 is live on Ethereum mainnet

TLDR: Tokenized volatility protocol volmex.finance announces the launch of its v1 system on Ethereum.Kyber Partners with Polygon to Enhance DeFi Liquidity *

TLDR: Kyber Network declares its deployment to Polygon’s proof-of-stake (PoS) sidechain scaling solution.TriCrypto CRV rewards begin

TLDR: Curve Finance activates CRV rewards for its new TriCrypto pool, which facilitates trading among ETH, WBTC, and USDT.Pendle is Live

TLDR: Pendle Finance, a new protocol for trading and hedging future DeFi yields, announces its launch on Ethereum. Also, check out our latest Alpha Tractor, featuring Pendle.Treasury Diversification with Range Tokens

TLDR: UMA Protocol unveils range tokens, which are akin to convertible debt and that DAO’s can use to flexibly diversify their treasuries.Metronome 2.0: DeFi’s First, Better

TLDR: Metronome announces the launch of CMET, its governance token, and introduces DAO-based governance for the project.*This is part of our sponsored links series.

Farm yield on ETH with Yearn’s optimized ETH yVault

The brainiacs at on-chain yield aggregator Yearn Finance are at it again, as their developers and strategist just released a souped-up ETH yVault, and it’s a doozy!

That’s because the new vault “incorporates the latest version of Vyper, more robust security, MEV protection, and is more sophisticated overall” according to Yearn, with the composite effect being better and safer yield for users.

As for the yield itself, the updated yVault accrues revenues from four separate DeFi strategies simultaneously. These strategies are:

Aave lending

Alpha Homora lending

Curve sETH pool deposits

Curve StETH pool deposits (single-side)

The vault (which has been merged with the WETH yVault) is easy to join, as you can simply deposit ETH in or the ~1,800 other tokens that Yearn supports via zap deposits. Figure out how much you want to supply, press “Deposit,” confirm the transaction, and boom — you’re in and easily earning albeit in sophisticated on-chain fashion!

The updated ETH yVault is so new that its APY can’t be calculated yet, so don’t go aping in expecting 1,000% yearly returns. But if you’re in the market for a super solid ETH-centric yield farm, this opportunity’s certainly one to consider. Just make sure to do your own research and never invest more than you can afford to lose.

AAVE voters approve AIP-22, which will add support for RAI to Aave.

Compound votes on shifting its oracle system to relying on Chainlink Price Feeds.

The Curve community debates enforcing Curve’s IP rights against alleged copycats like Saddle Finance.

The Curve community discusses removing the alUSD pool’s gauge.

MakerDAO evaluates the risk of onboarding xSUSHI as a supported collateral type.

The PoolTogether community discusses splitting COMP rewards across multiple winners rather than one.

Many farmers had been waiting for this for a few weeks now, and it’s finally here! If you’re farming on Polygon or want an excellent tool to dig into the sidechain’s contracts, you can do it now on Polygonscan, built by the same team behind Etherscan!

DeFi’s been fortunate enough not to have to deal with major intra-ecosystem disputes yet. The Alchemix and Curve kerfuffle this week hardly comes close to that level, but the episode did offer a glimpse into what a shift to DeFi warring could look like. We’re certainly all stronger when we work together, so let’s hope and see to it that cooler heads prevail.

All info in this newsletter is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!