🔥Rollups are the Hottest Scaling Solution

Also, read about Maker RWA strategies, post-Merge penalties, dollar-cost-averaging (DCA) approach, and more!

🧶Week in Review: July 11th

StarkWare Confirms Launch of StarkNet Token

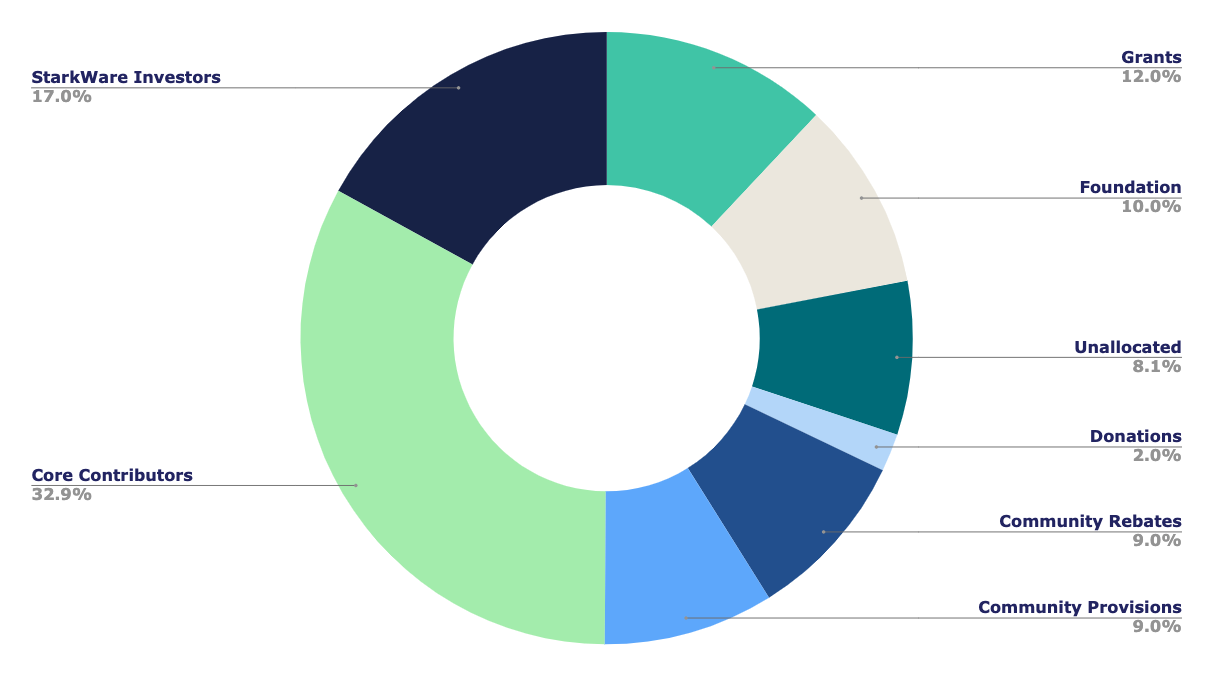

A launch of a token for its StarkNet network has been confirmed by StarkWare. The new token will be used for paying transaction fees on the StarkNet Layer 2 network, compensating operators for executing transactions, and on-chain governance. The StarkWare Foundation will distribute 50.1% of the total token supply via several community-oriented initiatives. The initial allocation of StarkNet tokens is as follows:

Three Arrows Capital co-founder Su Zhu hinted at the company's ambitions for decentralization in a tweet on 12 July, which followed the launch of the StarkNet token. In an email exchange between Zhu's attorneys and counterparty liquidators, it was mentioned that 3AC had received a "StarkWare token purchase offer" after investing in the company earlier this year. This information sparked widespread rumors that StarkWare was developing a token.

However, many members of the community were not pleased with Starkware's decision to distribute half of the tokens to insiders (investors and team) while also creating demand for it (by using it to pay for chain fees), because it results in significant centralization and also buy pressure from team/investors tokens.

But what about you? 👇

More on zkRollups: The Triple zkEVM Announcements

It was a big week for Ethereum Scaling Solutions! After the above Starkware announcement, we also had not one, but three zkEVM development updates.

ZkSync, which has been working on its solution since 2021, announced today that it will go live on mainnet in 100 days. Polygon, which has become a leader in developing t scaling solutions (specially zkRollups), has announced the new Polygon zkEVM (to be live on testnet soon), while also going open-source! And last but not least, Scroll announced that their zkEVM solution is live on a pre-alpha testnet.

Why zkEVMs? When comparing scaling solutions like Optimistic Rollups (Arbitrum, Optimism) and zkRollups (Starkware, Loopring, and the ones outlined above), we find the latest ones to be safer (by incentivizing decentralization) and also capital efficient.

But Optimistic Rollups are easier to develop, while zkRollups demand high technical knowledge and specific programming language. And that’s where zkEVMs come in: all the advantages from zkRollups but with the simplicity of the Ethereum Machine stack as Vyper and Solidity programming languages.

When looking further ahead, we might see dedicated zkRollups virtual machines being developed in order to fully bootstrap everything a rollup needs, but zkEVMs are definitely a huge step for mid-term Ethereum Scaling development. Exciting times in crypto! - DeFinn

Digitizing real world “analogue” assets

A revolution has been brewing in MakerDAO for a while. It is no secret that the DAI stablecoin issuer has been trying to integrate Real World Assets (RWA) into the mix of collateral backing DAI. This would render the DAI model closer to other custodial stablecoins like USDC. Maker has been planning such a step for a while, and this week’s developments are definitely notable.

2 major proposals (RWA-008 OFH Vault and RWA-009 HVBank Vault) were passed last week, totaling around $130M in Real World Assets collateral soon to be backing DAI.

Behind RWA-009 is HV Bank which is starting with a $100M initial debt ceiling, and targeting $1B in 12 months. The bank is small; according to their website, they hold north of $500M in assets, making the $1B debt ceiling a little on the optimistic side. But it is nonetheless interesting to see such a bank starting to “use” DeFi.

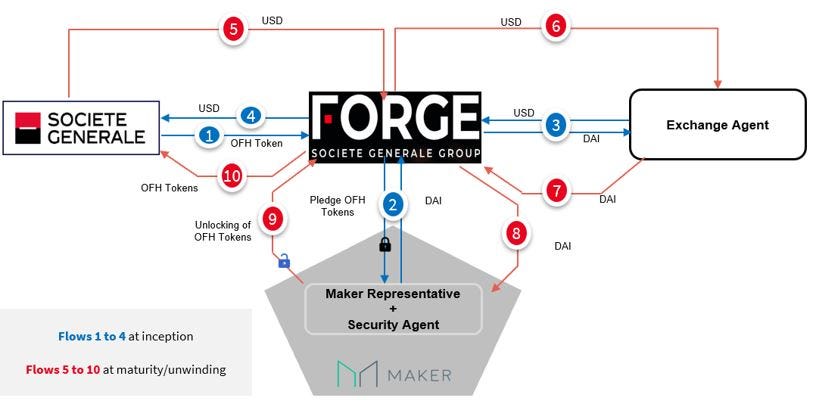

However, it’s the RWA-008 initial proposal that really stands out! This proposal was initially created on behalf of Societe Generale Forge (SG Forge), a subsidiary of the Societe Generale bank. The Societe Generale bank is one of the largest financial institutions in France & Europe (constantly ranked within the top 10 in Europe), with more than 1.7 trillion Euros in assets and a presence in over 62 countries!

The purpose of the transaction is to refinance OFH Tokens, which are security tokens issued on the Ethereum public blockchain and characterized as covered bonds (backed by home loans) issued by Societe Generale.

According to the proposal, the transaction would be structured as follows:

SG Forge would grant a USD loan to Societe Generale (the “USD Loan”);

Societe Generale transfers OFH tokens to SG-Forge;

SG-Forge would borrow DAI from Maker & SG-Forge would pledge the OFH Tokens to the benefit of Maker;

SG-Forge would enter into an agreement with an “exchange agent” (read an exchange) to swap its DAI to US dollars, allowing SG-Forge to make the USD Loan to Societe Generale.

Interestingly, another stated goal of this transaction structure is to “shape and promote an experiment under the French legal framework [for] security tokens; the pledge on security tokens in a blockchain; the use of a security agent.” Societe Generale is no stranger to public blockchains; in fact, they have experimented before with public blockchains by issuing €100,000,000 worth of bonds on Ethereum back in 2019 - yes, they are OG’s - as well as a security token issuance on Tezos.

Currently, only 0.6% of Maker’s DAI is backed by real world collateral totaling around $40M split through 5 different issuers. Through these 2 proposals, Maker is doubling down on this strategy by an order of magnitude, with hopes that introducing more real world collateral will increase DAI liquidity. It will also ensure that DAI can outgrow the crypto ecosystem and not be bound by liquidity of crypto collateral.

What we are witnessing here is undeniably a great step towards mainstream adoption. Slowly, large banks are becoming comfortable using public blockchains and integrating DeFi protocols into their core business functions. This is another vote of confidence for DeFi and its resilience, especially during the recent tumultuous market conditions. - Nassim

🍇 DeFi Pulse Happenings (Today!)

Join Scalara’s Nathan Howard and Index Coop’s Allan Gulley, for a discussion on how the Merge will impact the ETH supply & the downstream effects on DeFi.

🗓 July 21st ⏰ 6:00 pm UTC/2:00 pm EST

Feel free to connect with us on our Discord channel to discuss anything related to DeFi!

🎯 The Sector Pulse

Crypto market sentiment through Scalara’s indices.

📈DeFi Pulse Index (DPI): $97.64 (13.71%)

📈 ETH 2x Flexible Leverage Index: $12.54 (71.78%)

💲PONY Index (PONY): $1.10

The DeFi Pulse Index hit triple digits again, crossing $100 for the first time on Tuesday since its maximum drawdown in mid-June at just above $50. With very few exceptions, all index constituents finished strong between 20%-40% up. During the seven days ending on Tuesday, all DeFi blue-chips got beaten by ETH though.

News around the timing of the merge (more below) pushed Ethereum back above $1,500. As a result, Scalara’s 2x leverage index ETH2x-FLI almost doubled over the 7-day period.

Increasing activity in DeFi pushes the PONY Index spot yield above 9%. Current constituents are auto-compounding vaults holding stablecoin LP tokens from multiple chains.

👉 Also Read: A short primer on TradFi and DeFi by Scalara’s Christoph Gackstatter.

🐼 Getting Ready for The Merge

What Sort of Ethereum Penalties Can You Expect Post-Merge

Every node taking part in consensus on the Ethereum network must abide by a set of rules. The network rewards what is beneficial to everyone while punishing what is not. These rules have particular objectives. They aim to:

Encourage good conduct.

Disincentivize undesirable behavior.

In our July 7th Pulse Farmer Edition, we have shared some Ethereum REWARDS you can expect after The Merge. So, here are the PENALTIES that you should expect post-merge.

Slashing

Slashing is created when the CASPER commandments are broken by the validator, which means that it goes against what it is voting for. For instance, if you suggest two distinct blocks for the same slot, you have misled the network.! When the offender's evidence is added to a Beacon Chain block, slashing occurs. Once the network has verified the evidence, the offending validator (or validators) are eliminated.

There are three slashing penalties:

Initial Penalty: It is currently charged at 0.5 ETH, but after the merge, it will rise to 1 ETH. The validator is queued for exit and has its withdrawal ability epoch set to about 36 days (or 8192 epochs) in the future, along with the initial penalty.

Inactivity Penalty: Since the validator is not terminated until 8192 epochs (36 days), it is fined for being "offline" during that period. 0.1 to 0.2 ETH are the overall penalty charges if there is no inactivity leak.

Correlation Penalty: If many validators were slashed at once, there is a correlation penalty that is enforced.

Inactivity Penalty

Inactive validators will be subject to an increased penalty if the network cannot achieve finality in the most recent four epochs. Goal: to quickly reach finality!

It does not apply to you if you are online. Please note that nothing like this has happened in the mainnet yet.

Sync Committee Penalty

You will forfeit the equivalent amount you would have gained for being right if you are assigned to a sync committee but you don't participate.

Attestation Penalty

Your validator casts a vote for the Casper FFG source and targets every epoch (6 minutes). However, incorrect, late, or absent votes will result in a slight penalty for you.

Don't worry! Missing some votes is common, and even the most adept validators occasionally make mistakes.

To avoid penalties, follow the below guidelines if you are an exchange, sole trader, or operator:

Never use the same validator key more than once.

Maintain software updates.

Watch your validator.

Make sure you have sufficient RAM/CPU/peers/bandwidth.

🙏Thanks to Ethereumpools.info for helping us summarize the penalties post-Merge to help our readers prepare beforehand!

Follow us on Twitter to stay up-to-date with the ongoing happenings in the DeFi space🙌.

What’s Hot Around The Merge🔥

Ethereum's shadow fork 9 goes live in the lead-up to The Merge.

Ethereum devs pencil in the September date for The Merge. The suggested timeline as per the “PoS Implementers’ Call #91 – 2022-07-14” document is listed below:

Goerli/Prater client releases 27th or 28th of July.

Announce 28th/29th.

Prater Bellatrix on Aug 8th

Goerli Merge on the 11th.

ACD Aug 18th plan mainnet Merge:

Bellatrix early September;

Merge two weeks later (week of Sept 19th).

Run a sentry node if you're worried about your validator being DoS'd until Ethereum releases the Single Secret Leader Election (SSLE) to address the issue.

Proposal to support middleware-based distributed validator clients.

Bonus🎁 To prepare your validators for the upcoming Merge, fill out this Google form to attend the EthStaker validator Merge prep workshop on July 29th at 1500 UTC.

🤝 Sharing is Caring

We feel obligated to protect our readers in our capacity as an advocate of the DeFi industry. So, we want to make you aware that Uniswap LPs were duped by a phishing scam, which is too frequent in today's crypto market.

⚠️Please stay vigilant and always check domain names while interacting with any contract.

🗓️ Planning for the Long-term

Dollar-Cost-Averaging (DCA) In and Build Your Position

The crazy price swings in the crypto market, whether they are upward or downward, have overwhelmed us all. Right? Since the market is unpredictable, making peaks and dips hard to see, why not take a small portion of each fluctuation?

Dollar-cost averaging simplifies investing by regularly adding a defined amount of money to an investment portfolio rather than trying to pick the best time to buy and sell an asset. Dollar-cost averaging is particularly helpful in the cryptocurrency market, where prices are incredibly volatile, and timing the market is very challenging.

As a result, this method can reduce investors' risk while increasing their market exposure. Sudden price changes won't hurt investors as much if they stretch out their investments over time because their investment cost will average over time.

“I don’t believe all this nonsense about market timing. Just buy very good value and when the market is ready that value will be recognized.”- Henry Singleton

The DCA approach helps investors with the following:

With the dollar-cost averaging strategy, the pressure to time the market precisely is removed. Instead, you set aside a specific amount to invest in projects with strong fundamentals because you believe that if you do so your investments will grow over time.

You benefit from market dips because they let you purchase more of your preferred cryptocurrencies at a bargain and drive down the average price of the tokens you own.

You remove emotion from your investments through the DCA strategy and as a result, avoid making bad investing decisions.

⚠️Nothing is certain in volatile markets; therefore, always DYOR before implementing any investment strategy. Along with the pros, there are various risks associated with the DCA approach, like the risk of rising markets and the possibility of a better return for lump-sum investments over the long run. Also, you might learn new facts about an asset as the investing environment evolves, prompting you to reconsider your strategy.

📖 Stories of The Week

Lido is launching stETH on Layer 2

TLDR: As Ethereum Layer 2s develop, Lido is dedicated to making its staked-asset tokens publicly accessible by joining hands with Argent and Aztec to make wstETH accessible to zkSync users;Arbitrum AnyTrust mainnet is open for developers

TLDR: Before the imminent introduction of Arbitrum Nova to end customers, developers can now deploy their apps on the mainnet. Apply here to gain developer access;Ethereum jumps 12% as Merge event fast approaches

TLDR: Over the last weekend, Ethereum (ETH) rose by 12.76%, surpassing $1,200. The successful testing of one of the final tests before the Merge by Ethereum core developers on July 14th likely caused ETH's upward price movement;

Vitalik Buterin: The current network state vision leaves people down the socioeconomic ladder in the dust

TLDR: Vitalik looks forward to supporting a vision where network states are modified to promote more democratic governance, constructive interactions with the communities around them, and other ways to assist everyone else;Llama community proposes token swap between Aave & Balancer

TLDR: According to the proposal, Aave would buy 300,000 $BAL, which could then be utilized to generate yield and give new aToken Boosted Pools incentives directly through Balancer's new tokenomics system.

🏆Need a bit more time to prepare your EF Fellowship Program application?

Don’t worry! Ethereum Foundation will be accepting applications through July 24th.

👩💻 Hack The Code

Want to take your due diligence process to a new level, or even start your career at Code4rena as a Warden? Smart contract auditors not only make a lot of money, but also help keep Ethereum ecosystem secure.

Ethernaut is OpenZeppelin’s wargame to learn about Ethereum smart contract security. Each level is a smart contract that needs to be 'hacked', and now it was improved with an enhanced user experience. We recommend it!

💭 Closing Thoughts

Just Being Astrologer 😉

If I were to forecast the state of the financial sector in 2035 based on 2022, I would look at 2009 as a baseline and assess what has transpired in the 13 years following the 2007–2008 financial crisis. Over the past 13 years, new, harsher rules have been enacted for banks, all aimed at making them safer and stabilizing their profitability. We have also seen an economic revolution pushed by Fintechs, blockchain technology, cryptocurrencies, and decentralized finance.

The period that followed was marked by incredibly low-interest rates, which had a significant negative impact on bank profits due to lower revenues, increased competition, and higher costs associated with complying with the recently implemented regulatory laws. However, fintechs had affordable financing from low-interest rates and crypto crowdfunding came to the rescue of DeFi projects.

From 2022 through 2035, we will enter a new macroeconomic period marked by rising interest rates and inflation. While this will benefit conventional banks by increasing their earnings, it will pressure the cost of financing for new businesses. As long as interest rates keep rising, we will see more cryptocurrency businesses collapse, as we already are seeing. To summarize, companies with positive cash flows will do better than their competitors during a recession.

Of course, it's possible that a severe recession coupled with a credit crisis may again hurt people's trust in banks and other centralized institutions, which may help the crypto industry grow and overcome some of its problems. This may be especially true in developing nations with a considerably lower level of trust in central institutions than in the West.

So, I think that in the next 13 years, stablecoins and some DeFi applications will likely be further developed and have some momentum in sectors where decentralization is necessary (like the SWIFT network today, which could be implemented with DeFi technology). I would also see DeFi applications in consortium-based solutions for banks in their back office operations (settlement of securities, for example).

Regardless, we will see what the future may bring; till then, stay optimistic but avoid being over-confident!- @eyeguneet

All info in this newsletter is purely educational and should only be used as research. DeFi Pulse is not offering investment advice, endorsement of any project or approach, or promising any outcome. This post is prepared using public information (which does not account for specific goals or financial situations) and links provided to third-party sites are for informational purposes. Such sites are not under the control of DeFi Pulse, so DeFi Pulse or the author are not responsible for the accuracy of the content on such third-party sites. Be careful and keep up the honest work!

Gm Gm, Really loving this piece and the work you do here. I also run a web3 news substack for underrepresented creators called Facesofweb3. Would you be open to a recommendation exchange? Our subscribers need to be able to find each other!

Great job, once again!