DeFi Pulse Farmer #16

Catch up on a new week in DeFi as we recap a new TVL all-time high, Uniswap, the Farm of the week, the Conservative Farmer, the latest Governance updates, and more!

Welcome to the sixteenth edition of DeFi Pulse Farmer - your guide to staying up on the latest and best trends in yield farming and beyond.

In this newsletter, we break down top stories, developments, and trends from the past week in tandem with two key farming opportunities to keep an eye on.

If you want to access the full DeFi Pulse Farmer experience to receive emerging Yield Farming opportunities sent to you throughout the week as part of our Alpha Tractor Series, and the DeFi Pulse Farmer Protocol Express, which consists of a weekly recap of APYs and new pools on major protocols and a highlight of an emerging opportunity, subscribe today.

Looking to catch up? We’ve got you covered!

If you prefer, you can read today’s edition directly on DeFi Pulse Farmer.

As the cryptoeconomy seemingly ripped into another phase of the bull market this week, an acute frenzy of activity flowed into Ethereum’s decentralized finance arena. This influx helped push the DeFi ecosystem’s total value locked (TVL) to a new record of $14.4B.

Things have been heating up in recent days as an upswell of buy pressure muscled the bitcoin (BTC) price up past $18.5k and the ether (ETH) price up past $500 -- price points that haven’t been seen since Dec. 2017 and July 2018, respectively.

As for why things are turning generally bullish around crypto right now, there are multiple driving factors:

Surging interest from mainstream firms and institutions.

Growing coverage in mainstream media.

Increasingly favorable macro conditions (e.g. growing global embrace of crypto as a hedge against centralized systems).

Improved fundamentals (e.g. powering the DeFi boom) and industry infrastructure.

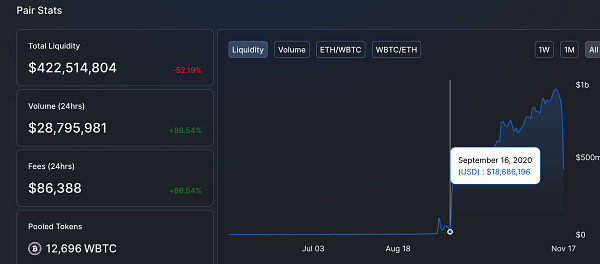

With a flurry of eyes on BTC and ETH currently, we’ve also seen more folks turning to DeFi to put these assets and beyond to productive use (in the case of BTC, through ERC-20 tokens like WBTC). That said, arguably the biggest headline in DeFi this week wasn’t about growth but rather about Uniswap’s acute TVL decline.

After the start of Uniswap’s four UNI farms back in September, the trading protocol dominated DeFi’s charts week after week and ended up becoming the first dapp to reach a +$3B TVL. With the conclusion of those farms on Tuesday, though, Uniswap dropped from DeFi’s largest dapp to its 5th-largest with a current TVL of $1.32B.

Uniswap’s fall paved the way for lending protocol Maker to reclaim DeFi’s top spot once more as the project’s TVL rose to $2.52B. In extension, the projects following up Maker right now are WBTC ($2.32B TVL), Compound ($1.50B TVL), and Aave ($1.40B TVL).

Zooming in on individual tokens, some of the best-performing DeFi assets this week included BZRX (+134.7%), Alpha (88.4%), YFI (+43%), CRV (+21.5%), and AAVE (+16.2%). Moreover, the DeFi Pulse Index (DPI) unsurprisingly climbed from $89.76 to $106.03 (+15.4%) over the last 7 days.

Thank you to our sponsor DEXTF, an asset management protocol that makes managing and investing assets easier through their XTF token funds.

Bundle assets with available 61 supported tokens and mint creative new XTF token funds via DEXTF!

With Uniswap’s first round of UNI rewards over, DeFi farmers are looking for fresh yield pastures. Barnbridge’s new BOND #hodl pool is certainly one to consider.

A first-of-its-kind project, Barnbridge is a tokenized risk protocol that’s been gaining considerable traction since launching this fall. Why? Because the project offers something, many DeFi users want: customizable derivatives that pave the way to advanced hedging strategies around crypto prices and DeFi yields.

Yet getting popular fast brought a surge of liquidity into Barnbridge’s first two incentivized pools, the Barnbridge Stable Pool (USDC/DAI/sUSD) and Uniswap’s USDC/BOND pool, as yield farmers piled in to earn BOND rewards. This led to a situation in which stablecoin whales started dominating Pool 1 and smaller farmers couldn’t plow in Pool 2 without considerable risk. That’s where the new #hodl pool comes in!

Enter the #hodl

With the #hodl pool, the Barnbridge team wanted to give community members a way to get more say in the protocol’s governance (via BOND) but “without having to take on unreasonable risks.”

That means this “Pool 3,” which launched on Nov. 16th, is explicitly straightforward in that it lets users farm BOND simply by staking BOND. The gist is clear: hold BOND in the #hodl pool to support the token in the near future and get rewarded by Barnbridge for having strong hands accordingly.

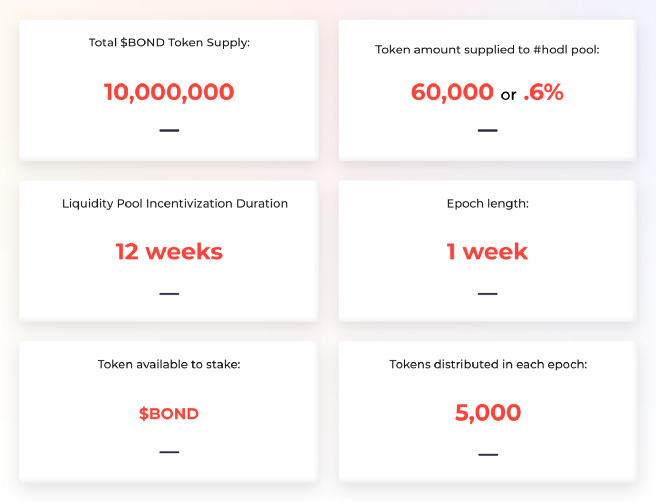

As for how the pool’s incentives will work, they’re going to run for 3 months and distribute 5,000 BOND per week, or “epoch,” on a pro-rata basis to BOND stakers.

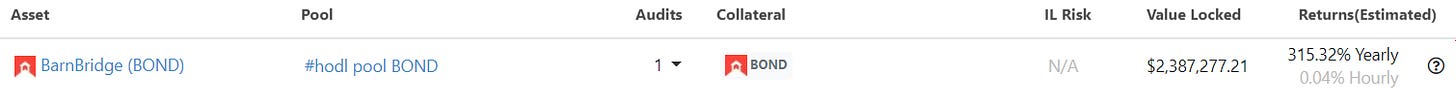

According to CoinGecko, this #hodl pool is notably fetching yearly returns of ~315% right now.

If you’re interested in trying out Pool 3, the steps are simple:

Pick up BOND for staking.

Navigate to the #hold pool and deposit your BOND.

Then just claim your BOND rewards as you please through the deposit dashboard!

That’s it. Farming BOND through this new rewards pool is as simple as that. You won’t have to worry about anything like impermanent loss (IL) since it’s a single-asset pool, though conversely, this means your biggest risk in the #hold pool will be how the BOND price fares.

To be sure, Barnbridge is a really promising project in DeFi, so it’s cool to see its team cater to its wider community with a user-friendly rewards campaign. Farm responsibly anyways if you do. Always do your own research, and never jump into any farm with more money than you can afford to lose!

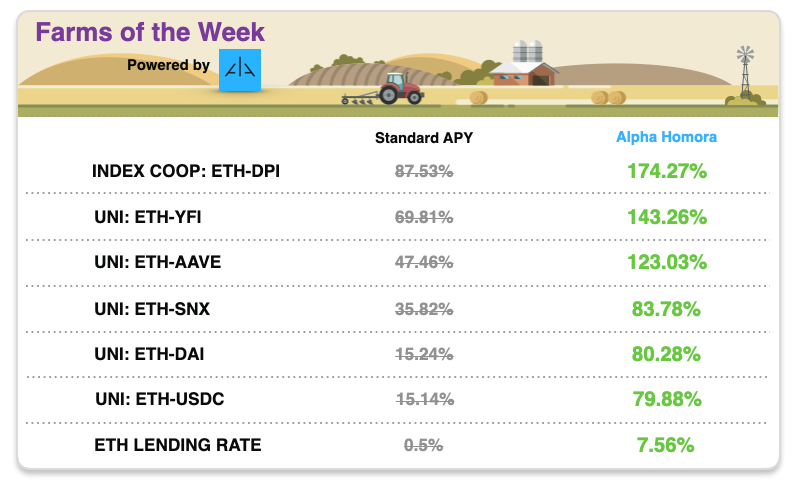

Farmers can enhance this week’s farms with our sponsor Alpha Finance, which is focused on building out an ecosystem of cross-chain innovative and user-friendly DeFi products.

APYs shown above don’t take into account Alpha Homora’s own liquidity mining program. Alpha Homora is conducting its own liquidity mining to those who open leveraged positions (more than 1x) and those who provide liquidity to ibETH/ALPHA pair on Uniswap through Alpha Homora or Uniswap directly. Don't forget to head over to Alpha Homora and check out the 23 total yield farming and liquidity providing pools!

A new look to Oasis.app

TLDR: Maker’s Oasis DEX rolls out its biggest update yet with a variety of new features centered around the Dai stablecoin.All the things!

TLDR: 0x-based DEX Matcha enables trading support for over 1,000 new tokens.OUSD Was Hacked and There Has Been a Loss of Funds

TLDR: Origin Protocol prepares to compensate users after a flash loan attack saw the project drained of $7 million.Instant Cross-L2 Transfers are Now on Testnet!

TLDR: The state channels specialists at Connext unveils their Vector cross-chain routing network for scaling and bridging L1 and L2 chains.

Why YFI Are Not Investment Contracts

TLDR: Attorney Gabriel Shapiro makes a case for why the YFI token might not constitute an investment contract under U.S. federal securities laws.1inch announces stage 2 of liquidity mining program

TLDR: Popular DEX aggregator 1inch launches the second phase of its ongoing 1INCH liquidity mining campaign.Virtual Synths and where to find them

TLDR: Synthetic assets protocol Synthetix publishes a primer on how the project is embracing virtual synths and helping other DeFi projects do the same.Introducing the Umbrella Protocol by Yam

TLDR: Elastic supply project Yam Finance unveils Umbrella Protocol, a new risk management suite for DeFi.

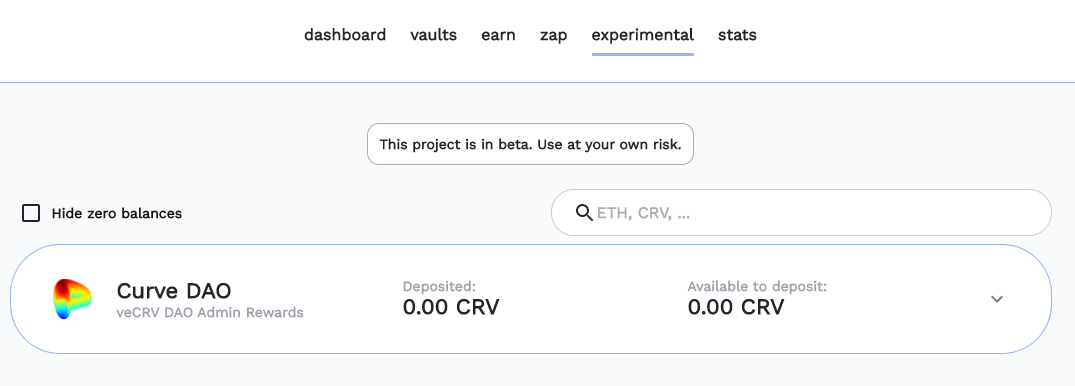

Farm up to 36.75% APY on Yearn Finance’s new vault: Yearn CurveDAO pool.

Yearn Finance has recently launched a new vault that uses a novel strategy by leveraging Curve’s rewards for locked CRV: the Yearn CurveDAO pool.

In a nutshell, this is how the new Yearn strategy works:

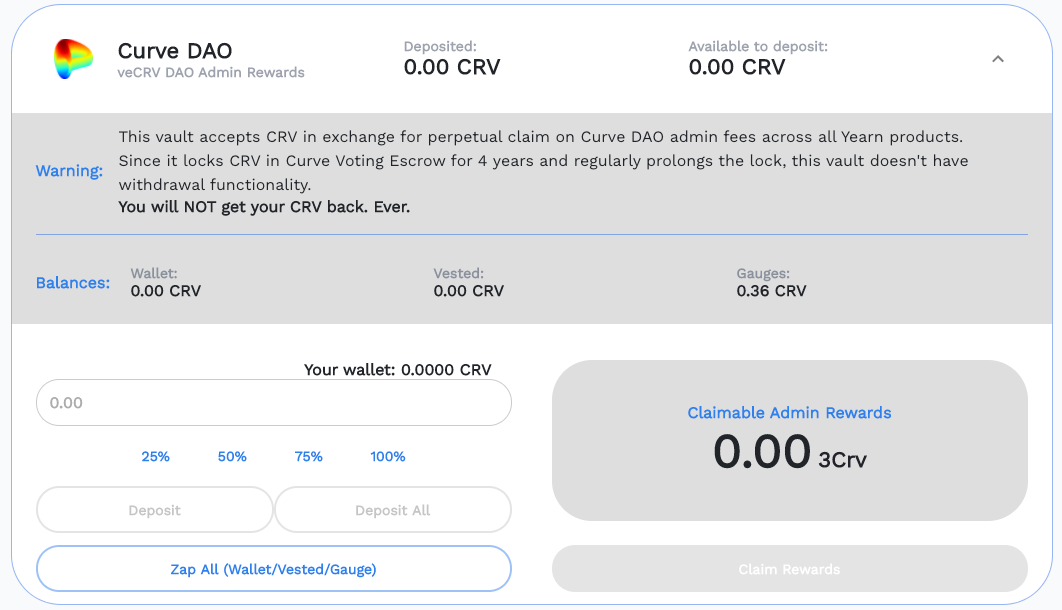

All the CRV allocated to the Yearn CurveDAO pool is locked forever on Curve’s DAO.

The CRV is converted to veCRV by Curve and allocated to Yearn CurveDAO pool and starts generating fee rewards in the form of 3CRV tokens (i.e, half of Curve’s trading fees). In this case, veCRV gets locked perpetually and can never be withdrawn.

By increasing its CRV position Yearn can obtain more voting power on Curve's DAO and can vote for the "Gauge relative weight". So, it can make the rest of the Yearn pools take a larger percentage of Curve's CRV rewards.

The rest of Yearn’s pools share a percentage of their 3CRV rewards with the new Yearn CurveDAO pool in exchange for receiving more CRV rewards. So the new pool receives 3CRV rewards for locking its CRV plus a percentage of the other Yearn vaults 3CRV rewards.

In conclusion, farmers allocate their CRV tokens to Yearn and give their voting power to Yearn by doing so. Afterward, Yearn votes for its own pools and gives farmers more rewards than what they would get by locking CRV themselves.

But how can farmers enjoy their returns if the CRV tokens they allocate to the new Yearn vault are locked forever? Yearn issues a yveCRV token that farmers can trade in the markets.

How to take advantage of the new Yearn vault?

Farmers have to go to the CurveDAO Yearn pool, select the amount of CRV they wish to allocate, and click on deposit.

Source: Yearn After depositing the CRV into the vault, farmers will get yveCRV tokens in exchange, which they will be able to trade, for example on Uniswap. Since this is a brand new strategy, there’s still little liquidity for the yveCRV tokens.

Please remember that if farmers choose to allocate their CRV tokens to this pool, they will be locked forever. This means that they will not be able to withdraw them.And that’s it! Farmers will now own yveCRV tokens.

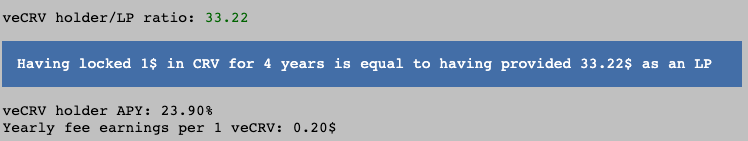

In order to keep an eye on the new vault’s APY, farmers should first head to the Use CRV section on Curve and check the veCRV holder APY, which is currently at 23.9%:

Afterward, they should head to CRV Ape Tax and check out the vault vs solo returns, which are currently at 1.538x, meaning farmers will obtain a 36.75% APY.

As a closing note, please take into consideration that veCRV rewards are not yet being distributed. Rewards are being accumulated and will begin distribution once the following proposal is passed: Vote #40. Even though there are still a few more days left to vote, currently 47% have voted for "Yes", and the minimum approval required is > 30%.

Assuming this vote goes through, $2.5M in trading fees collected over the past 60 days will be retroactively distributed to veCRV holders.

yEarn community votes on formalizing the yEarn Improvement Proposal (YIP) process.

Curve votes on distributing $2.5M in trading fees to veCRV holders.

Maker votes to increase the YFI-A debt ceiling and increase dust parameters for all Maker Vaults.

Balancer proposes adding a host of new tokens to the protocol’s BAL distribution whitelist.

Aave proposes adding support for a regulated and insured CrescoFin money market.

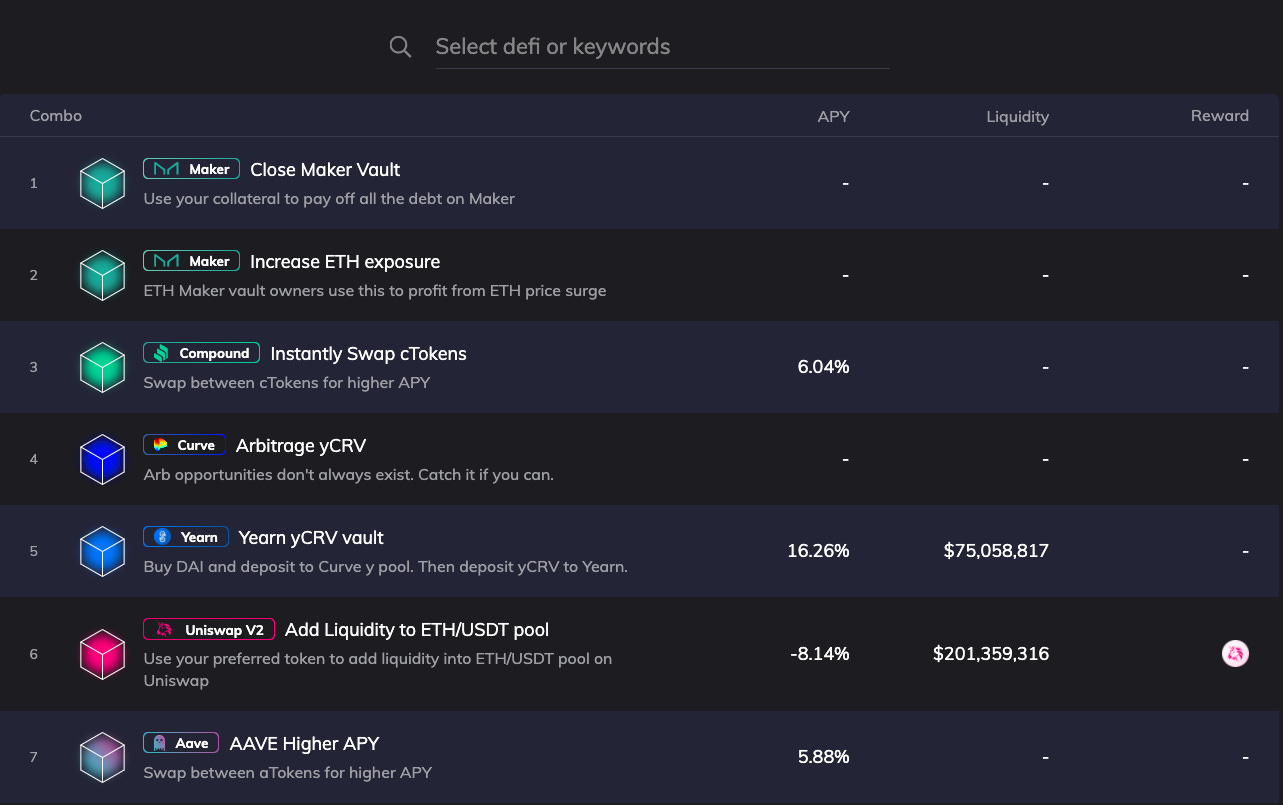

This week’s plow of the week goes to FURUCOMBO, a tool that allows farmers to easily optimize their DeFi strategies by simply drag and drop.

While DeFi keeps on heating up, farmers can expect exciting and intense weeks ahead. So why not be ahead of the curve and take this weekend to rest and get ready to ramble!

Until next week!

All info in this newsletter is purely educational and should only be used to inform your research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome. This is prepared using public information and couldn't possibly account for anyone's specific goals or financial situation. Be careful and keep up the honest work!